Global High-Speed Camera Market Expected to Reach USD 1,002.4 Million by 2033 - IMARC Group

Global High-Speed Camera Market Statistics, Outlook and Regional Analysis 2025-2033

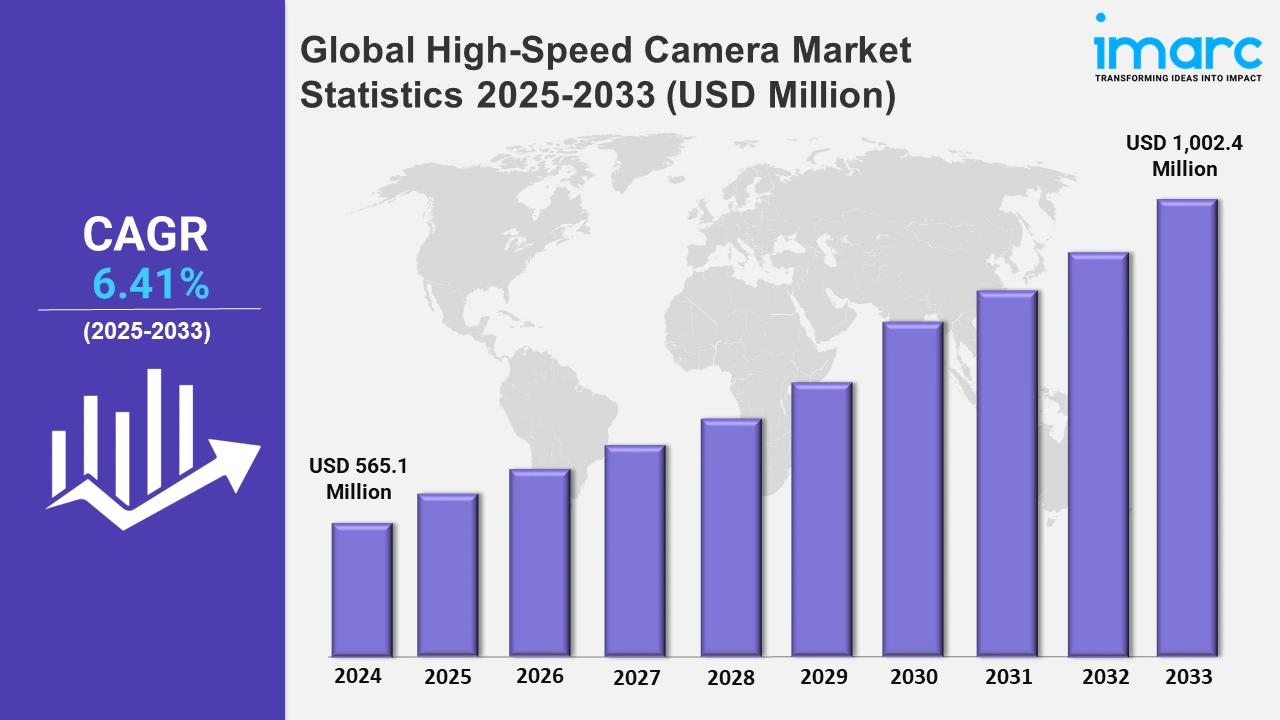

The global high-speed camera market size was valued at USD 565.1 Million in 2024, and it is expected to reach USD 1,002.4 Million by 2033, exhibiting a growth rate (CAGR) of 6.41% from 2025 to 2033.

To get more information on this market, Request Sample

Innovative cooling techniques are strengthening industrial imaging systems, allowing for more precise picture capture and increased efficiency. Advanced camera designs with integrated cooling systems are setting new standards in industrial image processing, demonstrating the market's expanding focus on performance optimization and time-saving capabilities. For example, in July 2023, Baumer Holding AG announced that its cameras featuring a patented cooling concept were nominated for the Inspect Award. As a pioneer in industrial image processing, Baumer creates measurable added value with innovative solutions. A notable example is the CX.XC industrial cameras, which provide high-precision image capture and significant time savings, owing to their unique integrated cooling pipe design.

Moreover, high-speed imaging technology is evolving with the introduction of new camera types that provide improved performance and increased capabilities. These unique solutions serve a wide range of sectors, including scientific research and engineering, solving difficult needs with accuracy and dependability for professional applications. For instance, in June 2023, iX Cameras, a leading developer and manufacturer of high-speed imaging technology, introduced the new i-SPEED 5 Series of high-speed cameras. The three new models in the series offer class-leading features that elevate their performance and expand their capabilities across various industries and applications, making them invaluable for professionals in scientific research and engineering. Furthermore, high-speed camera manufacturers are concentrating on enhancing image technology to fulfill the needs of modern industrial and scientific applications. These initiatives are consistent with the necessity to capture exact data in high-stakes scenarios, assuring improved performance and dependability. Additionally, the increased usage of specialized high-speed cameras in specialist applications such as ballistics testing and material analysis opens up new opportunities for market growth. Businesses choose high-performance cameras over ordinary ones because of their higher resolution and endurance. For example, the aerospace and defense sectors are driving the rise in the requirements for high-performance and high-speed cameras in North America, with organizations such as NASA using cameras with frame rates surpassing 50,000 FPS for rocket propulsion studies and spacecraft testing. These improvements address crucial precision requirements, allowing innovation and safety in high-demand industries while establishing the area as a leader in cutting-edge imaging technology.

Global High-Speed Camera Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest high-speed camera market share, on account of the presence of a robust infrastructure and a growing entertainment industry.

North America High-Speed Camera Market Trends:

North America leads the market for high-speed cameras in the aerospace and defense sector. For instance, NASA uses cameras with speeds of more than 50,000 frames per second to monitor rocket engine and spacecraft dynamics, assuring safety and innovation. The region's emphasis on cutting-edge R&D and government financing encourages adoption in vital industries, including aviation, space exploration, and military applications, underlining the need for precision imaging in fulfilling performance and safety standards.

Europe High-Speed Camera Market Trends:

To comply with strict safety rules, Europe uses high-speed cameras in vehicle accident testing. For example, manufacturers, such as BMW and Volvo, use 1,001-10,000 FPS cameras in simulations to enhance car safety concepts. This emphasis is consistent with the European Union's stringent car safety requirements, pushing technical improvements and demand for dependable imaging solutions throughout the region's automotive and transportation industries.

Asia-Pacific High-Speed Camera Market Trends:

Asia-Pacific focuses on high-speed cameras in both production and consumer gadgets. For example, semiconductor companies in South Korea and Japan use 250-1,000 FPS cameras for quality control during microchip fabrication. Rapid industrialization and technical innovation in countries, such as China, along with investments in precision manufacturing, have considerably increased the usage of advanced imaging systems across several industries.

Latin America High-Speed Camera Market Trends:

Latin America is implementing high-speed cameras for sports performance analysis and broadcasting advancements. For example, Brazil uses 10,001 to 30,000 FPS cameras to evaluate player motions and enhance soccer training regimens. The rising emphasis on integrating technology into sports development and increasing fan engagement is driving the deployment of advanced imaging systems throughout the region.

Middle East and Africa High-Speed Camera Market Trends:

High-speed cameras are used in surveillance and security systems in the Middle East and Africa. For example, the UAE uses cameras with a frame rate of more than 30,001 FPS to monitor critical areas such as airports and oil refineries. The region's emphasis on infrastructure security and technical modernization supports the rising need for advanced imaging solutions in high-stakes scenarios.

Top Companies Leading in the High-Speed Camera Industry

Some of the leading high-speed camera market companies include AOS Technologies AG, Baumer Holding AG, DEL Imaging, Excelitas Technologies Corp., Fastec Imaging (RDI Technologies, Inc.), iX Cameras Inc., Motion Capture Technologies, NAC Image Technology, Optronis GmbH, Photron (Imagica Group Inc), SVS-Vistek GmbH, Vision Research Inc, and Weisscam GmbH, among many others. For example, in June 2024, AOS Technologies announced the launch of the PROMON 2000 high-speed streaming camera system in a new bundle package, revolutionizing high-speed recording. The PROMON 2000 features an advanced light-sensitive sensor capable of streaming Full-HD 1920 x 1080-pixel video at 1000 frames per second (fps) in 8-bit mode or at 300 fps in high dynamic range 12-bit mode.

Global High-Speed Camera Market Segmentation Coverage

- On the basis of the component, the market has been bifurcated into image sensors, processors, lens, memory systems, fan and cooling systems, and others. Image sensors capture high-resolution images, processors process data quickly, lenses optimize focus, memory systems store large amounts of data, and fan and cooling systems ensure consistent performance, all of which improve operational efficiency across a wide range of industrial, scientific, and entertainment applications.

- Based on the spectrum, the market is categorized into visible RGB, infrared, and x-ray, amongst which visible RGB dominates the market. Visible RGB high-speed cameras provide high-quality color representation and accuracy, making them excellent for applications that need precise color analysis and thorough visual inspection, such as product quality control and medical imaging.

- On the basis of the frame rate, the market has been divided into 250-1,000 FPS, 1,001-10,000 FPS, 10,001-30,000 FPS, 30,001-50,000 FPS, and above 50,000 FPS. High-speed cameras with 250-1,000 FPS are useful for industrial inspections and quality control. 1,001-10,000 FPS cameras are used for automobile testing and material analysis. 10,001-30,000 FPS models are used to help biomechanics and fluid dynamics research. Explosive testing uses devices with 30,001-50,000 FPS, while cameras above 50,000 FPS excel in advanced scientific and defense applications.

- Based on the application, the market is bifurcated into automotive and transportation, consumer electronics, aerospace and defense, healthcare, media and entertainment, and others, wherein automotive and transportation dominate the market. The automotive and transportation industry makes extensive use of high-speed cameras for safety testing, collision simulation, and impact analysis.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 565.1 Million |

| Market Forecast in 2033 | USD 1,002.4 Million |

| Market Growth Rate 2025-2033 | 6.41% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Image Sensors, Processors, Lens, Memory Systems, Fan and Cooling Systems, Others |

| Spectrums Covered | Visible RGB, Infrared, X-Ray |

| Frame Rates Covered | 250-1,000 FPS, 1,001-10,000 FPS, 10,001-30,000 FPS, 30,001-50,000 FPS, Above 50,000 FPS |

| Applications Covered | Automotive and Transportation, Consumer Electronics, Aerospace and Defense, Healthcare, Media and Entertainment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AOS Technologies AG, Baumer Holding AG, DEL Imaging, Excelitas Technologies Corp., Fastec Imaging (RDI Technologies, Inc.), iX Cameras Inc., Motion Capture Technologies, NAC Image Technology, Optronis GmbH, Photron (Imagica Group Inc), SVS-Vistek GmbH, Vision Research Inc, Weisscam GmbH, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)