Global Herbicides Market Expected to Reach USD 46.6 Billion by 2033 - IMARC Group

Global Herbicides Market Statistics, Outlook and Regional Analysis 2025-2033

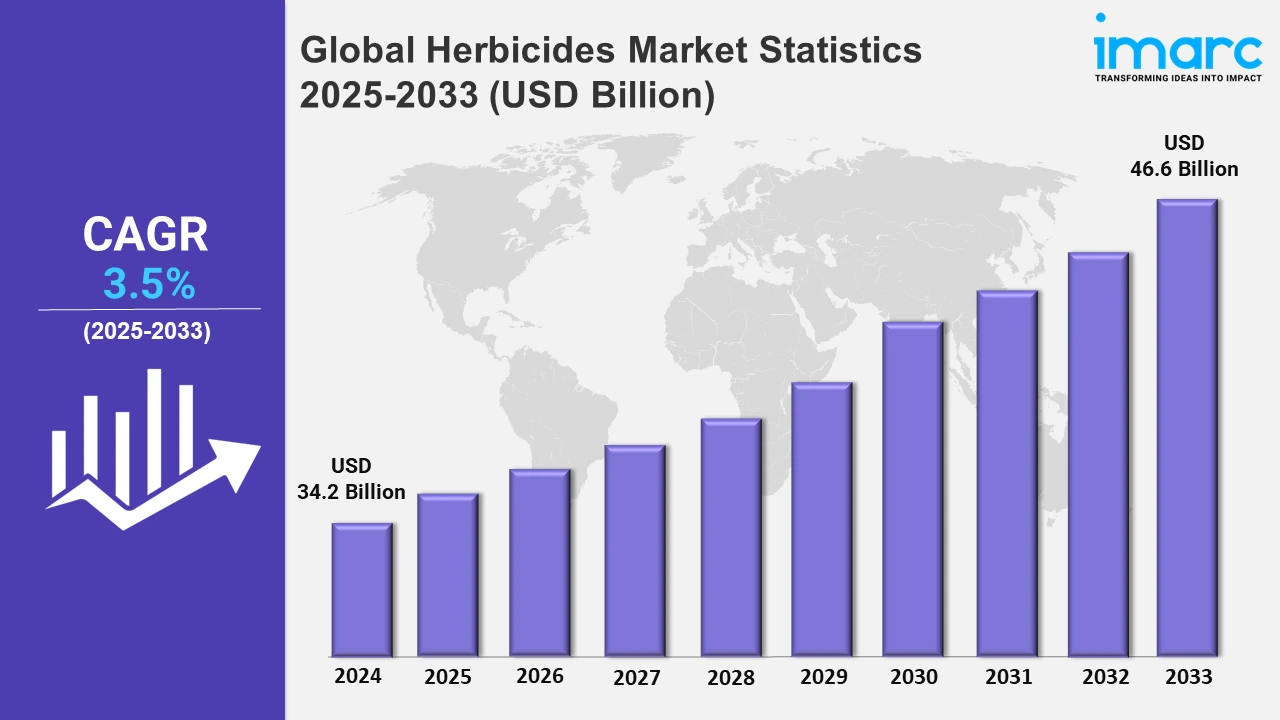

The global herbicides market size was valued at USD 34.2 Billion in 2024, and it is expected to reach USD 46.6 Billion by 2033, exhibiting a growth rate (CAGR) of 3.5% from 2025 to 2033.

To get more information on this market, Request Sample

The global trend of consumption for herbicides is gradually changing to bio-herbicides owing to the increasing consciousness for environmental hazards and health issues related to chemical products. According to the National library of Medicine, biopesticides are in double digit growth and constitutes nearly 10% of the global pesticides market. Bio-herbicides based on biologically active substances from plant and microbial origin are growing in use as they are selective and have less impact on beneficial flora, fauna and environment. Bureaus globally are encouraging the use of organic farming amenities through banning more synthetic herbicides to the limited non-organic ones in operation. This shift is supported also by increasing consumer preference for organic food, which will push farmers to practice more sustainable approach to weed removal. Improvements in the field of biotechnology and research are gradually leading to the formulation of very effective bio-herbicides which can selectively control weeds for particular species without having any ill effects on crops.

The adoption of precision agriculture techniques is transforming the herbicides market by enhancing efficiency and minimizing waste. Farmers are increasingly utilizing advanced technologies such as GPS mapping, drones, and sensors to identify weed-infested areas and apply herbicides with pinpoint accuracy. This targeted application reduces the amount of herbicide used and minimizes environmental impact and lowers costs for farmers. Precision agriculture also supports the integration of herbicide application data with broader farm management systems, enabling better decision-making and resource allocation. For instance, sensor data can be used to track patterns of weed resistance so that a farmer can change herbicide combinations, or the amount used in the field for better efficiency. This kind of precision is immensely important as herbicide-resistant weeds get more serious and challenge conventional means of controlling weeds. Furthermore, governments and agricultural bodies are encouraging the use of precision farming by offering subsidies and training programs.

Global Herbicides Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of robust technological advances and environmental consciousness.

Asia-Pacific Herbicides Market Trends:

The Asia Pacific herbicides market is growing rapidly, driven by growing agricultural activities, rising demand for food, and higher crop yields. As per IFAD, by 2050, the demand for food is anticipated to grow in Asia Pacific, requiring a 70% increase in production. Shrinking arable land and rapid urbanization encourage farmers to adopt herbicides for effective weed management. Advances in agrochemical technology and a growing demand for bio-based and selective herbicides are the key factors shaping the market dynamics. Major contributors from the list are India and China, mainly on account of their large agricultural sectors and growing population. Additionally, government initiatives supporting modern farming techniques and sustainable practices are encouraging herbicide usage. The trend toward eco-friendly solutions further fuels market expansion in the region.

North America Herbicides Market Trends:

The adoption of advanced herbicides supports weed control, enhances crop yield, and ensures sustainable farming practices. This widespread use demonstrates the reliance on herbicides to maintain food security and meet the rising demand for agricultural products across North America.

Europe Herbicides Market Trends:

The Europe herbicides market is advancing due to increasing adoption of sustainable farming practices and eco-friendly herbicides. Demand for bio-based solutions is rising, driven by stringent environmental regulations and consumer preference for organic produce. Technological innovations in crop protection and precision agriculture are enhancing efficiency. Key markets like France and Germany are leading the shift toward sustainable herbicide solutions.

Latin America Herbicides Market Trends:

The Latin America herbicides market is expanding as agriculture remains a key economic driver in the region. Rising demand for high-yield crops and efficient weed management solutions is boosting herbicide adoption. Brazil and Argentina lead the market, supported by large-scale farming practices. Increasing focus on bio-based and selective herbicides aligns with growing sustainability initiatives across the region.

Middle East and Africa Herbicides Market Trends:

The Middle East and Africa herbicides market is growing as agriculture modernizes to meet rising food demand. Governments are promoting advanced farming methods, driving herbicide adoption. Increased focus on sustainable and bio-based solutions is shaping the market, especially in South Africa and Egypt. Limited arable land and climate challenges further emphasize the need for effective weed control solutions.

Top Companies Leading in the Herbicides Industry

Some of the leading herbicides market companies include BASF SE, Bayer AG, Corteva Inc., Drexel Chemical Co. Inc., FMC Corporation, Heranba Industries Ltd., Nissan Chemical Corporation, Nufarm, Sumitomo Chemical Co. Ltd., Syngenta Group, UPL Limited, and Wilbur-Ellis Company LLC, among many others.

- In February 2024, Corteva Agriscience launched its new Enversa herbicide at the 2024 Commodity Classic in Houston, Texas, following EPA clearance in December 2023. Corteva anticipates that the product will be ready for use on a variety of crops during the 2025 growing season, pending state registrations.

Global Herbicides Market Segmentation Coverage

- The market has been segmented based on the type as synthetic (glyphosate, atrazine, 2,4-dichlorophenoxyacetic acid, acetochlor, paraquat, and others) and bio-herbicides, wherein synthetic represent the leading segment. The majority of the farmers extensively use synthetic herbicides due to their cost-effectiveness and efficacy. They provide reliable solutions for large-scale agricultural operations and can manage a wide range of weed species.

- Based on the mode of action, the market is segmented into selective herbicides and non-selective herbicides. Among those, selective herbicides have a larger market share. Due to its precision and efficiency, the herbicide market is led by the selective herbicides, which kills specific weeds but lets the desired crop remain unharmed and survive.

- Based on the application, the market has been categorized into grains and cereals, pulses and oil seeds, commercial crops, fruits and vegetables, turf and ornamentals. Among these, grains and cereals hold the largest share of the market as these crops are cultivated on vast expanses of farmland globally, necessitating substantial herbicide use to manage weed growth effectively.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 34.2 Billion |

| Market Forecast in 2033 | USD 46.6 Billion |

| Market Growth Rate 2025-2033 | 3.5% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Mode of Actions Covered | Selective Herbicides, Non-Selective Herbicides |

| Applications Covered | Grains And Cereals, Pulses and Oilseeds, Commercial Crops, Fruits and Vegetables, Turf and Ornamentals |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BASF SE, Bayer AG, Corteva Inc., Drexel Chemical Co. Inc., FMC Corporation, Heranba Industries Ltd., Nissan Chemical Corporation, Nufarm, Sumitomo Chemical Co. Ltd., Syngenta Group, UPL Limited, Wilbur-Ellis Company LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)