Global Heparin Market Expected to Reach USD 9.0 Billion by 2033 - IMARC Group

Global Heparin Market Statistics, Outlook and Regional Analysis 2025-2033

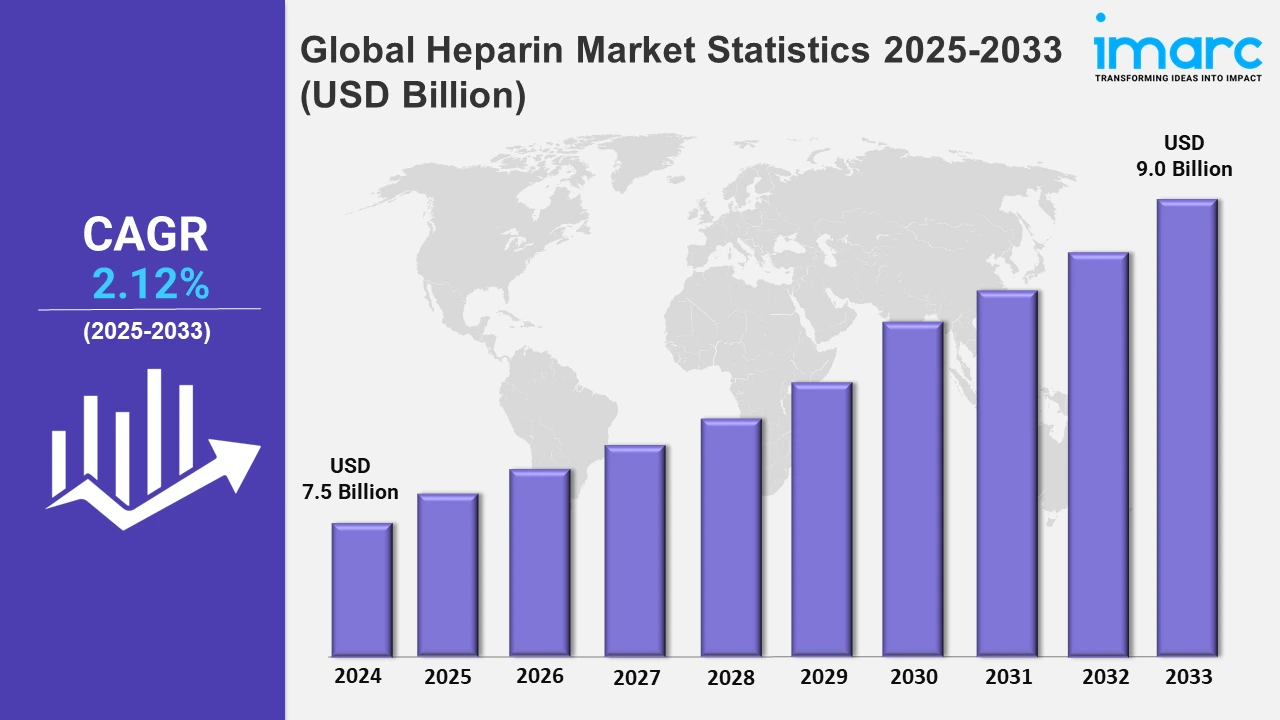

The global heparin market size was valued at USD 7.5 Billion in 2024, and it is expected to reach USD 9.0 Billion by 2033, exhibiting a growth rate (CAGR) of 2.12% from 2025 to 2033.

To get more information on this market, Request Sample

The increasing incidence of chronic conditions, such as cardiovascular diseases (CVDs), cancer, and diabetes, has led to a higher demand for anticoagulant therapies like heparin. For instance, according to the World Health Organization (WHO), in 2022, there were nearly 20 million new cancer diagnoses and 9.7 million fatalities. Cancer affects around one in every five persons in their lifetime, with one in every nine men and one in every twelve women dying from it. Over 35 million more cancer cases are expected in 2050, up 77% over the estimated 20 million in 2022.

Moreover, the global demographic shift towards an older population has escalated the need for medical interventions that often require anticoagulation. For instance, according to the World Health Organization (WHO), by 2030, one in every six people in the world will be 60 or older. At this time, the share of the population aged 60 and up will rise from 1 billion in 2020 to 1.4 billion. By 2050, the global population of persons aged 60 and up will double (2.1 billion). The number of people aged 80 and older is anticipated to treble between 2020 and 2050, reaching 426 million, increasing the demand for heparin in managing age-related health issues. Besides this, the growing healthcare infrastructure and increased understanding of anticoagulant medicines are driving the widespread use of heparin in developing scenarios. Moreover, countries in Latin America and Asia-Pacific are witnessing the growing adoption of heparin for numerous medical conditions, which is supported by local production and distribution initiatives. For example, India's Bharat Serums and Vaccines Ltd. has been actively distributing and producing heparin to suit domestic and regional demand. The increased availability and cost of heparin in these locations are critical for managing surgical procedures and cardiovascular disorders, consequently expanding the heparin industry's size. Apart from this, the growing prevalence of kidney disorders has led to an increase in dialysis procedures, where heparin is used to prevent clotting during treatment. Additionally, the demand for blood transfusions has surged, with heparin playing a crucial role in maintaining the patency of catheters and ensuring the success of these procedures.

Global Heparin Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Europe, North America, Asia-Pacific, Middle East and Africa, and Latin America. According to the report, North America accounted for the largest market share owing to the rising incidence of chronic diseases and advanced healthcare infrastructure.

North America Heparin Market Trends:

North America dominates the overall market. The increasing incidence of CVDs, such as heart attacks and strokes, has led to a higher demand for anticoagulant therapies like heparin. For instance, according to the U.S. Centers for Disease Control and Prevention, in 2022, 702,880 individuals died of heart disease in the United States. That is the equivalent of one out of every five deaths, resulting in significant utilization of heparin for treatment and prevention.

Europe Heparin Market Trends:

In Europe, the heparin market is shaped by the adoption of biosimilar heparins. Countries like Germany and the U.K. have seen growing acceptance of biosimilars, such as Inhixa, to reduce healthcare costs. The aging population in the European Union, with higher risks of thromboembolic diseases, boosts the market demand.

Asia-Pacific Heparin Market Trends:

In Asia-Pacific, rapid urbanization and increasing prevalence of chronic diseases, including diabetes and cancer, drive heparin demand. China and India dominate the production of raw heparin due to extensive pig farming, which is critical for heparin extraction. For instance, China contributes over 80% of the world’s crude heparin supply. Rising medical tourism in countries like Thailand and Singapore further supports regional market expansion.

Latin America Heparin Market Trends:

The Latin American heparin market is expanding due to the increasing prevalence of cardiovascular diseases (CVDs), such as deep vein thrombosis and venous thromboembolism, notably in Brazil and Argentina, where CVD rates are high. Aging populations in countries like Mexico contribute to higher demand for anticoagulants. The rise in surgeries, including orthopedic and cardiac procedures, has also boosted heparin use for clot prevention.

Middle East and Africa Heparin Market Trends:

In the Middle East and Africa, the heparin market is driven by the expanding healthcare access and a rise in chronic diseases such as diabetes. The UAE and South Africa see increasing use of heparin for dialysis and surgical procedures. Local partnerships, such as Saudi Arabia’s deals with international pharmaceutical firms, ensure steady supply chains.

Top Companies Leading in the Heparin Industry

Some of the leading heparin market companies include GlaxoSmithKline Plc, Shenzhen Hepalink Pharmaceutical Co., Ltd, Pfizer Inc., LEO Pharma A/S, Sanofi S.A., Dr. Reddy’s Laboratories Ltd., Teva Pharmaceutical Industries Ltd., Aspen Holdings, Baxter International Inc., Hebei Changshan Biochemical Pharmaceutical Co. Ltd., Sandoz International GmbH, Opocrin S.p.A., Sichuan Deebio Pharmaceutical Co., Ltd., and Dongying Tiandong Pharmaceutical Co. Ltd., among many others. For instance, in November 2024, Pfizer Limited planned to expand its manufacturing capacity while focusing on R&D activities.

Global Heparin Market Segmentation Coverage

- On the basis of the product, the market has been bifurcated into unfractionated heparin, low molecular weight heparin (LMWH), and ultra-low molecular weight heparin (ULMWH), wherein low molecular weight heparin (LMWH) represented the largest market segmentation. Low molecular weight heparin (LMWH) is a refined form of heparin used widely for its anticoagulant properties, offering advantages, such as a more predictable response, longer half-life, and lower risk of osteoporosis and heparin-induced thrombocytopenia compared to unfractionated heparin, further driving the segment growth.

- Based on the source, the market is categorized into bovine and porcine, amongst which porcine represented the largest market segmentation. Porcine-derived heparin, extracted from pig intestines, remains a crucial anticoagulant in medical practice due to its effectiveness in preventing and treating blood clots.

- On the basis of the mode of administration, the market has been divided into oral and parenteral. Among these, oral represented the largest market segmentation owing to the increasing research and developments. A notable product launch is Rivaroxaban, marketed as Xarelto by Bayer and Janssen Pharmaceuticals, which represents a significant breakthrough in anticoagulant therapy.

- Based on the application, the market is bifurcated into atrial fibrillation & heart attack, stroke, deep vein thrombosis (DVT), pulmonary embolism (PE), and others, wherein atrial fibrillation & heart attack represented the largest market segmentation due to the high prevalence and significant clinical need for effective anticoagulation therapy in these conditions.

- On the basis of the end-user, the market is segmented into hospitals, clinics, homecare settings, ambulatory surgical centers, and others. Currently, hospitals represented the largest market segmentation due to their critical role in administering acute and intensive care, where heparin is extensively used.

- Based on the distribution channel, the market is bifurcated into hospital pharmacies, retail pharmacies, drug stores, online stores, and others, wherein hospital pharmacies represented the largest market segmentation due to their pivotal role in managing and dispensing medications for acute care and surgical interventions.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Market Growth Rate 2025-2033 | 2.12% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Unfractionated Heparin, Low Molecular Weight Heparin (LMWH), Ultra-Low Molecular Weight Heparin (ULMWH) |

| Sources Covered | Bovine, Porcine |

| Mode of Administrations Covered | Oral, Parenteral |

| Applications Covered | Atrial Fibrillation & Heart Attack, Stroke, Deep Vein Thrombosis (DVT), Pulmonary Embolism (PE), Others |

| End-users Covered | Hospitals, Clinics, Homecare Settings, Ambulatory Surgical Centers, Others |

| Distribution Channels Covered | Hospital Pharmacies, Retail Pharmacies, Drug Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | GlaxoSmithKline Plc, Shenzhen Hepalink Pharmaceutical Co., Ltd, Pfizer Inc., LEO Pharma A/S, Sanofi S.A., Dr. Reddy’s Laboratories Ltd., Teva Pharmaceutical Industries Ltd., Aspen Holdings, Baxter International Inc., Hebei Changshan Biochemical Pharmaceutical Co. Ltd., Sandoz International GmbH, Opocrin S.p.A., Sichuan Deebio Pharmaceutical Co., Ltd., Dongying Tiandong Pharmaceutical Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Heparin Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)