Global Healthcare IT Outsourcing Market Expected to Reach USD 103.3 Billion by 2033 - IMARC Group

Global Healthcare IT Outsourcing Market Statistics, Outlook and Regional Analysis 2025-2033

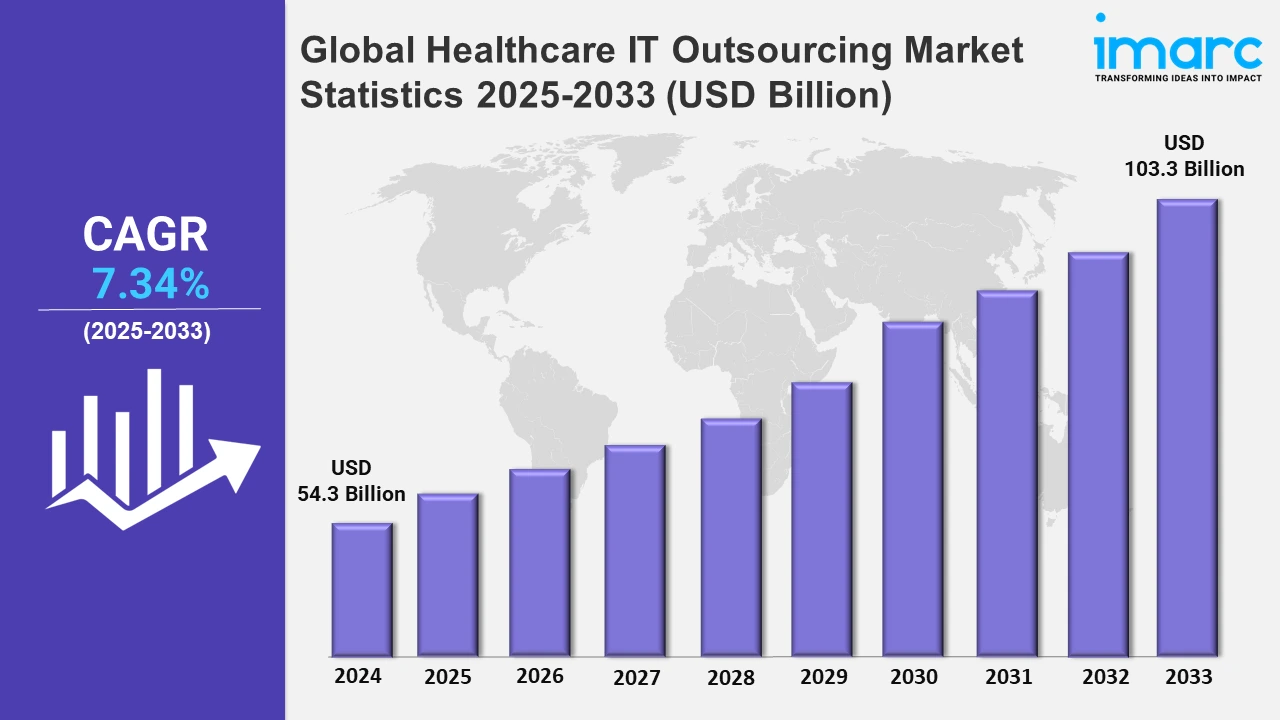

The global healthcare IT outsourcing market size was valued at USD 54.3 Billion in 2024, and it is expected to reach USD 103.3 Billion by 2033, exhibiting a growth rate (CAGR) of 7.34% from 2025 to 2033.

To get more information on the this market, Request Sample

Healthcare organizations are under constant pressure to reduce operational costs while maintaining high-quality services, which is acting as a major growth-inducing factor in the market. By partnering with specialized IT vendors, healthcare providers can access skilled professionals and advanced technologies without the overhead of in-house staffing and training. For instance, in August 2024, Sonata Software announced that it had been chosen as a strategic IT outsourcing partner by a US-based premier healthcare and wellness company. As part of the collaboration, Sonata Software will support the client in achieving dual objectives, i.e., optimizing IT budgets and cost efficiencies through systemic improvements and engineering levers and modernizing their technology landscape by leveraging enterprise data, artificial intelligence, and hyper-automation across patient-facing systems, and back-office operations. This cost-saving aspect is a significant driver of outsourcing in the healthcare sector.

The rapid evolution of healthcare technologies, such as electronic health records (EHRs), telemedicine, cloud computing, and artificial intelligence, is creating a growing demand for specialized IT services. For instance, in October 2024, GE HealthCare launched the new Versana Premier, the latest release within the Versana ultrasound family of reliable, affordable, easy-to-use, and versatile ultrasound systems. The Versana Premier is designed to meet the multi-purpose needs of healthcare professionals across diverse clinical specialties and care areas, including general practice, OBGYN, musculoskeletal (MSK), and cardiology. Versana Premier offers automation and AI-enabled productivity tools to improve workflow and clinical features designed to enhance clinical efficiency and accuracy. Healthcare providers need to stay competitive by integrating the latest technologies into their operations. Outsourcing allows them to leverage the expertise of IT service providers who are at the forefront of innovation.

Global Healthcare IT Outsourcing Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share owing to factors such as significant technological innovations, increasing regulatory compliance, and the rising demand for digital healthcare solutions.

North America Healthcare IT Outsourcing Market Trends:

In North America, the market is driven by the need for cost reduction, access to specialized expertise, and the adoption of advanced technologies like cloud computing, AI, and telemedicine. For instance, in July 2024, DIGITAL, Canada's Global Innovation Cluster for digital technologies, announced its largest investment with innovative Canadian health tech companies and researchers to advance the development and deployment of AI-powered technologies to better support healthcare providers and enhance patient outcomes. Led by ORX in collaboration with a pan-Canadian team of Tali AI, HEALWELL AI, Phelix AI, WELL Health Technologies, and Simon Fraser University (SFU); DIGITAL's investment in the Health Compass II project will introduce an innovative suite of four AI-driven modules to increase patient engagement, reduce administrative burnout, assist healthcare providers with documentation and enhance clinical decision-making. Additionally, regulatory compliance requirements, such as HIPAA, and the growing demand for digital health solutions fuel outsourcing trends across the region.

Asia-Pacific Healthcare IT Outsourcing Market Trends:

In the Asia Pacific region, the market is driven by cost efficiency, access to skilled IT professionals, and the increasing adoption of digital healthcare technologies. Additionally, the rising demand for telemedicine, electronic health records (EHR), and cloud-based solutions, along with improving healthcare infrastructure, contribute to market growth.

Europe Healthcare IT Outsourcing Market Trends:

In Europe, the market is driven by the need for cost efficiency, regulatory compliance (such as GDPR), and the adoption of advanced technologies like AI and electronic health records (EHRs). Additionally, the region's focus on improving healthcare accessibility, data security, and innovation further boosts the outsourcing demand.

Latin America Healthcare IT Outsourcing Market Trends:

In Latin America, the market is driven by cost advantages, access to a skilled IT workforce, and the growing demand for digital health solutions like telemedicine and electronic health records (EHRs). Additionally, improving healthcare infrastructure, regulatory changes, and a shift toward modernization fuel the outsourcing trend.

Middle East and Africa Healthcare IT Outsourcing Market Trends:

In the Middle East and Africa, the market is driven by cost efficiency, the growing adoption of digital health solutions, and the need for advanced technologies like telemedicine and electronic health records (EHRs). Additionally, regulatory pressures, improving healthcare infrastructure, and a shortage of skilled IT professionals drive outsourcing.

Top Companies Leading in the Healthcare IT Outsourcing Industry

Some of the leading healthcare IT outsourcing market companies include Accenture, Cognizant, Dell Inc., HCL Technologies Limited, Infosys Limited, NTT DATA Group Corporation, Optum, Inc, Oracle Corporation, Siemens Healthineers AG, TATA Consultancy Services Limited, Wipro Limited, among many others.

In November 2023, Accenture and Salesforce announced that they are investing in the development of Salesforce Life Sciences Cloud including new innovations, assets and accelerators, powered by data and artificial intelligence (AI). This endeavor is undertaken with the aim to help life sciences companies create sustainable value and drive growth

Global Healthcare IT Outsourcing Market Segmentation Coverage

- On the basis of the type, the market has been categorized into payers HCIT outsourcing (hospital information system (HIS), laboratory information system (LIS), radiology information system (RIS), electronic medical records (EMR), and others) and providers HCIT outsourcing (revenue cycle management (RCM) system and healthcare analytics), wherein payers HCIT outsourcing represent the leading segment. Payers' healthcare IT outsourcing holds the largest share due to the growing need for efficient claims processing, fraud detection, data analytics, and regulatory compliance. Outsourcing these IT functions allows payers to reduce operational costs, improve customer service, and adopt innovative technologies, enhancing their competitive edge and operational efficiency.

- Based on the end user, the market is classified into healthcare provider system, biopharmaceutical industry, clinical research organization, and others, amongst which healthcare provider system dominates the market. Healthcare provider systems hold the largest share of the market due to the increasing demand for efficient patient management, electronic health records (EHR), telemedicine, and data security. Outsourcing allows providers to reduce costs, access advanced technologies, improve operational efficiency, and focus on delivering quality patient care.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 54.3 Billion |

| Market Forecast in 2033 | USD 103.3 Billion |

| Market Growth Rate (2025-2033) | 7.34% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered |

|

| End Users Covered | Healthcare Provider System, Biopharmaceutical Industry, Clinical Research Organization, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, the Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture, Cognizant, Dell Inc., HCL Technologies Limited, Infosys Limited, NTT DATA Group Corporation, Optum, Inc, Oracle Corporation, Siemens Healthineers AG, TATA Consultancy Services Limited, Wipro Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)