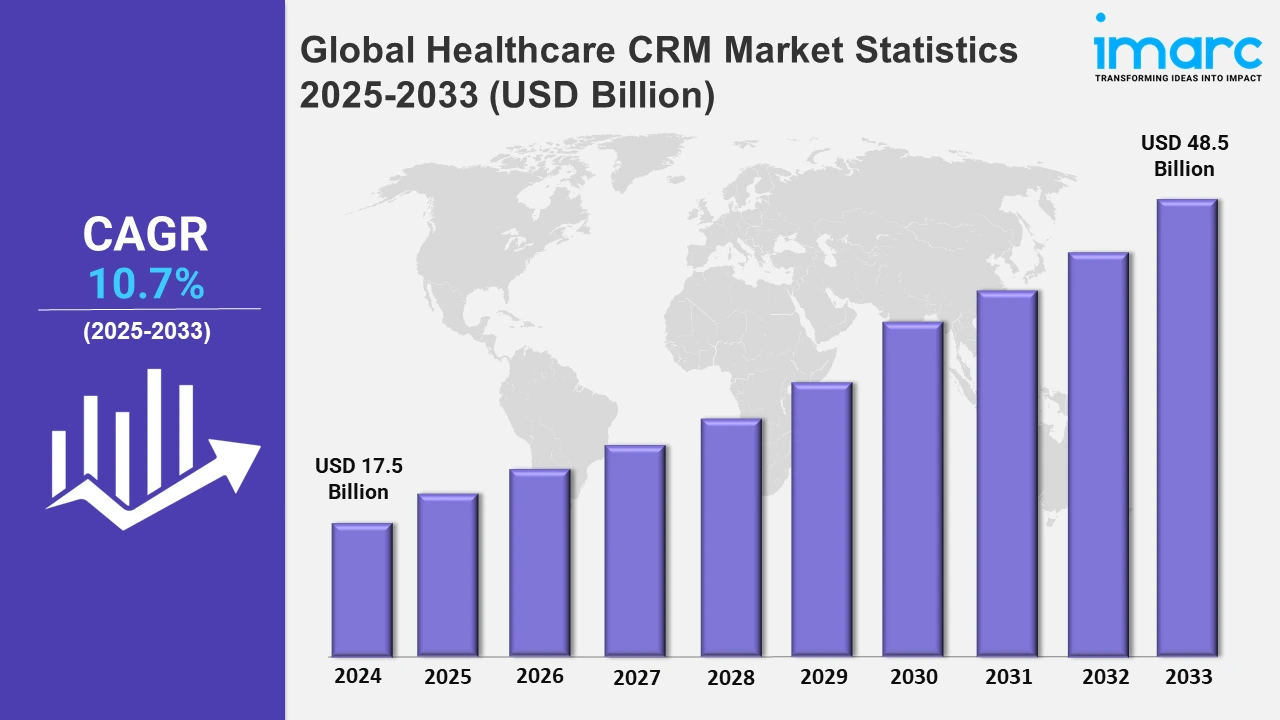

Global Healthcare CRM Market is Expected to Reach USD 48.5 Billion by 2033 - IMARC Group

Global Healthcare CRM Market Statistics, Outlook and Regional Analysis 2025-2033

The global healthcare CRM market size was valued at USD 17.5 Billion in 2024, and it is expected to reach USD 48.5 Billion by 2033, exhibiting a growth rate (CAGR) of 10.7% from 2025 to 2033.

To get more information of this market, Request Sample

Rising healthcare costs are driving providers to adopt CRM systems to enhance efficiency and reduce expenses. As per a report by Flywire Corporation, 89% of Americans are concerned about increasing medical expenses, with 75% stating that bills are overly complicated, up from 65% in 2021. Additionally, 60% cannot afford unexpected medical costs in a single payment, a rise from 46% in 2021. Patients demand clearer billing, with 95% agreeing that medical statements need simplification. Healthcare CRM platforms address these challenges by optimizing appointment schedules, reducing no-shows, and automating administrative tasks. These systems streamline patient data management, minimizing redundant tests and improving care coordination. CRM tools also enhance communication, marketing efforts, and targeted outreach, ensuring higher ROI. By improving resource allocation and patient engagement, CRMs are essential for mitigating financial stress and maintaining care quality in an increasingly cost-sensitive environment.

Continual advancements in healthcare technology are accelerating the adoption of CRM systems. Tools such as artificial intelligence (AI), machine learning, and predictive analytics enable providers to analyze patient data, enhancing decision-making and efficiency. Talkdesk’s September 24, 2024 launch of the Healthcare Experience Cloud for Payers exemplifies this shift. This AI-powered solution integrates CRM and EHR systems for personalized interactions, reduces costs with self-service capabilities, and improves health outcomes through tailored member engagement. Its features ensure compliance, security, and seamless implementation, making it a vital tool for healthcare insurers. Automate appointment reminders, telemedicine integration, and chatbot support that enhance operational efficiency and engagement of patients. Cloud-based CRM platforms also provide for scalability and the direct real-time availability of data needed to care for large populations. Mobile health apps further complete these systems by providing update and remote interaction capabilities. Collectively, these innovations streamline workflow, allowing healthcare providers to deliver enhanced services and adjust to modern demands for care efficiently.

Global Healthcare CRM Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of its advanced healthcare infrastructure, high adoption of digital technologies, robust funding, and a strong focus on personalized patient care.

North America Healthcare CRM Market Trends:

Advanced healthcare systems and rapid adoption of digital solutions in North America have triggered the growth of the North American Healthcare CRM market. Demand for patient-centric services and tools for chronic diseases management is also boosting this implementation of CRM. Well-established regulatory frameworks in this region and improved data integration capabilities are further fueling its growth. On April 17, 2024, Veeva Systems, American cloud-computing company focused on pharmaceutical and life sciences industry applications, introduced the Veeva Vault CRM Campaign Manager, designed to optimize non-personal promotions for healthcare professionals. Integrated with Veeva Vault CRM, it offers features including campaign actions, dynamic target lists, mass email capabilities, and customizable landing pages. Scheduled for release in late 2024, it fosters collaboration between sales and marketing, enhancing customer engagement in life sciences.

Europe Healthcare CRM Market Trends:

Europe's healthcare CRM market is growing as the importance of personalized care and more stringent data protection laws, like GDPR, are increasingly coming into the spotlight. Governments and health care institutions are focusing on integrated solutions to enhance the efficiency of care and outcome for the patients. This is a growing aging population and adoption of telemedicine. Another is the improvement in AI-driven CRM platforms that enhance the operational workflow and engage the patient in a better way across the region.

Asia-Pacific Healthcare CRM Market Trends:

In Asia-Pacific, the market is witnessing rapid growth, fueled by increasing healthcare investments and rising awareness about digital health solutions. Expanding telehealth services and a growing middle-class population demanding better healthcare experiences are driving CRM adoption. The region’s fragmented healthcare systems also create opportunities for CRM platforms to streamline operations. Additionally, government initiatives promoting health digitization and mobile app usage are further augmenting the market's growth.

Latin America Healthcare CRM Market Trends:

The healthcare CRM market in Latin America is growing as healthcare providers seek to enhance patient engagement and operational efficiency. Limited resources and infrastructure challenges is making CRM solutions valuable for streamlining processes and improving care delivery. The adoption of mobile health technologies and increasing investments in healthcare IT infrastructure are also driving demand. Countries such as Brazil and Mexico are at the forefront of this regional market growth.

Middle East and Africa Healthcare CRM Market Trends:

In the Middle East and Africa, the market is gaining traction due to increased focus on healthcare modernization and improving access to medical services. Governments and private sector players are investing in digital infrastructure to address regional healthcare disparities. Rising medical tourism and growing adoption of AI-powered tools in CRM systems are also contributing to market expansion. Efforts to integrate CRM with telemedicine and EHR systems are further fueling growth.

Top Companies Leading in the Healthcare CRM Industry

Some of the leading healthcare CRM market companies include Accenture Plc, AllScripts Healthcare Solutions Inc, Amdocs, Aspect Software Inc, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, Salesforce.com inc, SAP SE, Siemens Healthineers AG (Siemens AG), among many others. On August 27, 2024, Accenture agreed to acquire consus.health, a German healthcare consultancy specializing in strategy, patient management, and infrastructure optimization, enhancing its healthcare CRM capabilities. Serving over 600 providers, consus.health offers expertise in cost management, logistics, and operational efficiency. This acquisition strengthens Accenture’s ability to drive digital transformation, improve care quality, and support healthcare organizations across Germany, Austria, and Switzerland. It also expands Accenture's healthcare CRM offerings through integrated strategies and managed services.

Global Healthcare CRM Market Segmentation Coverage

- On the basis of the product, the market has been categorized into individual, referral, and individual and referral, wherein individual and referral represents the leading segment. This is due to its critical role in the building of personalized relationships and trust in healthcare. Most patients depend on referrals from trusted sources, such as physicians, friends, or family, which increases engagement and retention. This model resonates with patient-centric care models where individualized attention and word-of-mouth recommendations significantly impact healthcare decisions, thereby pushing the adoption of CRM systems tailored to manage and optimize such interactions effectively.

- Based on application, the market is classified into community outreach, case coordination, case management, and relationship management, amongst which community outreach dominates the market as it fosters direct engagement with patients, enhancing awareness and access to healthcare services. By addressing public health needs through educational campaigns, free screenings, and wellness programs, healthcare organizations build trust and strengthen their community presence. This approach aligns with preventive care strategies, driving patient loyalty and expanding access to underserved populations, making it a critical focus area in healthcare CRM adoption.

- On the basis of technology, the market has been divided into cloud-based, mobile, social, collaborative, and predictive. Cloud-based solutions lead the market due to their scalability, cost-effectiveness, and accessibility. They enable real-time data sharing and integration across devices, enhancing patient management and care coordination. With minimal infrastructure requirements, healthcare providers can adopt cloud-based CRM systems quickly, reducing upfront costs. Advanced security features ensure data protection and compliance, while seamless updates and remote access render these solutions ideal for modern, digitally driven healthcare environments.

- On the basis of end use, the market is divided into payers, providers, and life science companies. Among these, payers hold the largest share of the market as they focus on efficient member management, cost control, and personalized engagement. Healthcare CRM solutions help payers to process claims efficiently, optimize resource allocation, and improve member satisfaction through customized communication and support. With the growing demand for transparency and preventive care, payers are using CRM systems to provide seamless interactions and improve health outcomes while also maintaining a competitive advantage in an increasingly value-driven healthcare landscape.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 17.5 Billion |

| Market Forecast in 2033 | USD 48.5 Billion |

| Market Growth Rate 2025-2033 | 10.7% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Individual, Referral, Individual and Referral |

| Applications Covered | Community Outreach, Case Coordination, Case Management, Relationship Management |

| Technologies Covered | Cloud-Based, Mobile, Social, Collaborative, Predictive |

| End Uses Covered | Payers, Providers, Life Science Companies |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture Plc, AllScripts Healthcare Solutions Inc, Amdocs, Aspect Software Inc, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, Salesforce.com inc, SAP SE, Siemens Healthineers AG (Siemens AG), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Healthcare CRM Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)