Global Hardwood Flooring Market Expected to Reach USD 69.8 Billion by 2033 - IMARC Group

Global Hardwood Flooring Market Statistics, Outlook and Regional Analysis 2025-2033

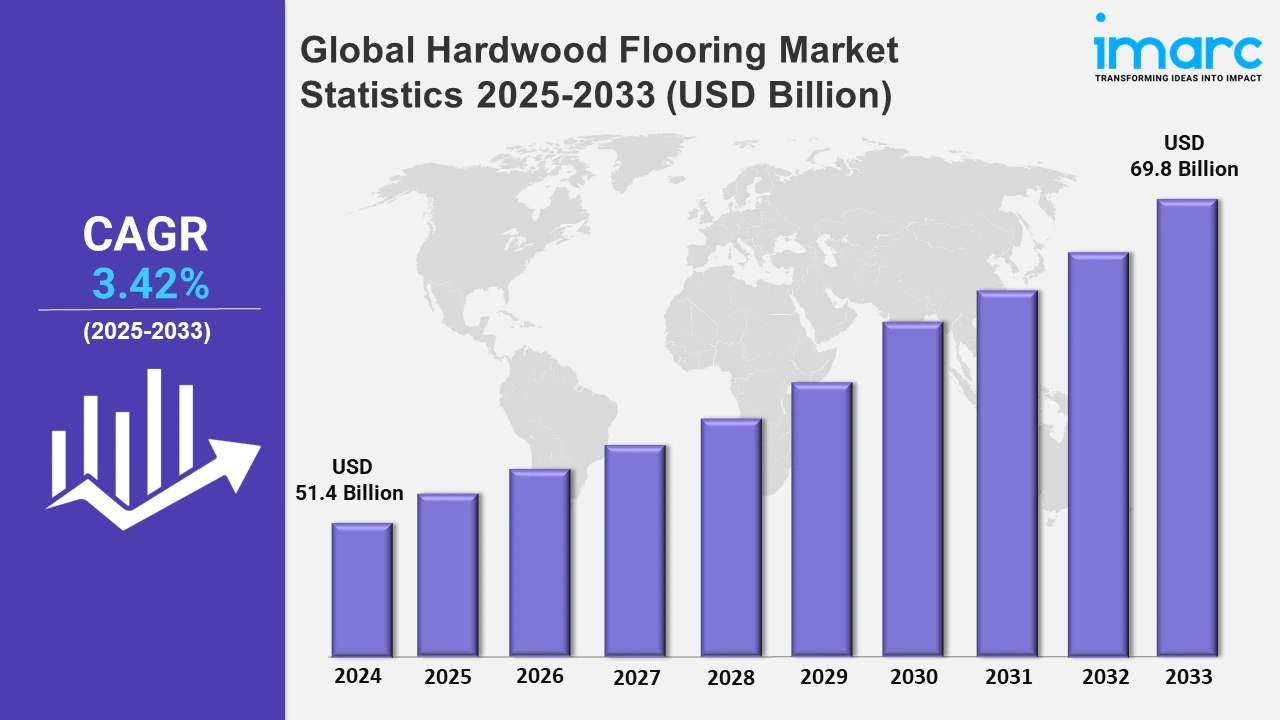

The global hardwood flooring market size was valued at USD 51.4 Billion in 2024, and it is expected to reach USD 69.8 Billion by 2033, exhibiting a growth rate (CAGR) of 3.42% from 2025 to 2033.

To get more information on this market, Request Sample

The market is primarily propelled by the continuous demand for hardwood flooring, which is precisely dependent on the construction and renovation industry. These segments have an increasing affinity for strong and long-lasting floor options by customers and builders in their new works and renovation projects. According to industry reports, homeowners spent $463 billion on renovations in the first quarter of 2024. Hardwood flooring's ageless charm and potential property value increment justify its increasing popularity. Environmental aspects are also being considered as consumers and builders pay tribute to environment sustainability through its natural and renewable characteristics. Most of the hardwood flooring choices have been derived and sourced responsibly from certified forests, making them compatible with green building standards. Available in various finishes and species, hardwood offers versatility in design, enhancing the visual appeal of residential and commercial spaces. Additionally, its durability and ease of maintenance make it a cost-effective long-term solution, appealing to homeowners and businesses alike.

Technological advancements, such as engineered hardwood, have made hardwood flooring much more versatile and accessible. Engineered hardwood, with its property of high stability and resistance to moisture, is becoming popular in places that experience variable humidity levels. This innovation also widens the scope of hardwood flooring even in regions that were not very favorable for solid hardwood installation. For instance, in July 2024, AHF Products announced the launch of its latest breakthrough in flooring solutions: Ingenious Plank, which is a hybrid resilient flooring. The product is getting launched across several AHF brands including Robbins, Armstrong Flooring, and Bruce. In addition to this, the rising disposable income, which is most prominent in some emerging economies, makes consumers more inclined to purchase quality, durable products such as hardwood flooring and boosts market demand.

Global Hardwood Flooring Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, North America, Europe, Latin America, and the Middle East and Africa. According to the report, North America held the largest market because of rising levels of home renovation activity, high disposable income, better preference for durable and eco-friendly materials, and advancements in engineered hardwood technology providing added versatility and stability.

North America Hardwood Flooring Market Trends:

In North America, the hardwood flooring market is driven by increasing home renovation projects, high disposable incomes, and the preference for durable, eco-friendly materials. The region’s emphasis on premium quality and aesthetic appeal, along with technological advancements in engineered hardwood, further boosts demand across residential and commercial sectors. For instance, in November 2024, Fame Hardwood, a custom hardwood flooring company based in Hollywood, California, announced the launch of the American Heart Pine collection at the WestEdge Design Show during 14th-16th November 2025, in Los Angeles, California.

Asia Pacific Hardwood Flooring Market Trends:

The Asia Pacific market witnessed the rise primarily due to increasing urbanization, disposable incomes, and residential construction. The expanding middle-class population seeks high-quality and durable flooring for homes. The widespread adoption of engineered hardwood along with government initiatives constituting the promotion of sustainable housing boosts growth prospects in the market across this region.

Europe Hardwood Flooring Market Trends:

Europe's market benefits from strict environmental regulations and the demand for sustainable building materials. Consumers prefer premium, stylish flooring that aligns with modern design trends. Renovation activities in historic structures and the popularity of engineered wood flooring drive growth across residential and commercial applications.

Latin America Hardwood Flooring Market Trends:

In Latin America, growing construction work, rapid urbanization, and high-end interests are factors driving demand for hardwood flooring. Locally sourced hardwoods are available for sustainable and cost-friendly benefits. The market in the region is also propelled by rising tourism and investments in the hospitality and retail industry.

Middle East and Africa Hardwood Flooring Market Trends:

The Middle East and Africa see growth in hardwood flooring due to increasing infrastructure projects, luxury housing developments, and commercial construction. Rising disposable incomes and an inclination toward premium interiors contribute to demand. Engineered hardwood’s adaptability to extreme climatic conditions further drives market adoption in this region.

Top Companies Leading in the Hardwood Flooring Industry

Some of the important hardwood flooring market companies include FRITZ EGGER GmBH & Co. OG, Formica Group, AHF, LLC, UNILIN, and Beaulieu International Group, Classen, among many others.

In July 2024, AHF Products, a leading hard surface flooring manufacturer for the residential and commercial markets, announced a new partnership with HGTV’s “Fixer to Fabulous” stars and hardwood flooring aficionados – Dave and Jenny Marrs – for its new national “Wood Wow” campaign. This aims to endorse the benefits and value of hardwood flooring to help consumers differentiate between real wood and wood-look flooring products and to give retail sales associates (RSAs) the essential tools to aid customers make informed purchasing choices.

Global Hardwood Flooring Market Segmentation Coverage

- On the basis of the end-use sector, the market has been categorized into the residential sector and commercial sector, wherein the commercial sector represents the leading segment. The commercial sector holds the largest share in the hardwood flooring market due to its demand for durable, high-quality flooring in spaces like offices, retail stores, and hospitality venues. Hardwood's aesthetic appeal, longevity, and ease of maintenance make it a preferred choice for creating sophisticated, professional, and high-traffic environments.

- Based on the raw material, the market is classified into red oak, white oak, maple, and others, amongst which red oak dominates the market. Red oak holds the largest share of the hardwood flooring market due to its widespread availability, affordability, and excellent durability. It has an attractive graining pattern and has a great ability to take stains hence apt for use in almost all interior styles. The aforementioned plus features of red oak being resistant to wear and scratches and easy to install and maintain have raised the status of this wood even greater among homeowners and builders.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 51.4 Billion |

| Market Forecast in 2033 | USD 69.8 Billion |

| Market Growth Rate 2025-2033 | 3.42% |

| Units | Billion USD, Million Sq. Meters |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End-Use Sectors Covered | Residential Sector, Commercial Sector |

| Raw Materials Covered | Red Oak, White Oak, Maple, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | AHF, LLC, UNILIN, Beaulieu International Group, Classen, FRITZ EGGER GmBH & Co. OG, Formica Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)