Global Gummy Vitamins Market Expected to Reach USD 11.0 Billion by 2033 - IMARC Group

Global Gummy Vitamins Market Statistics, Outlook and Regional Analysis 2025-2033

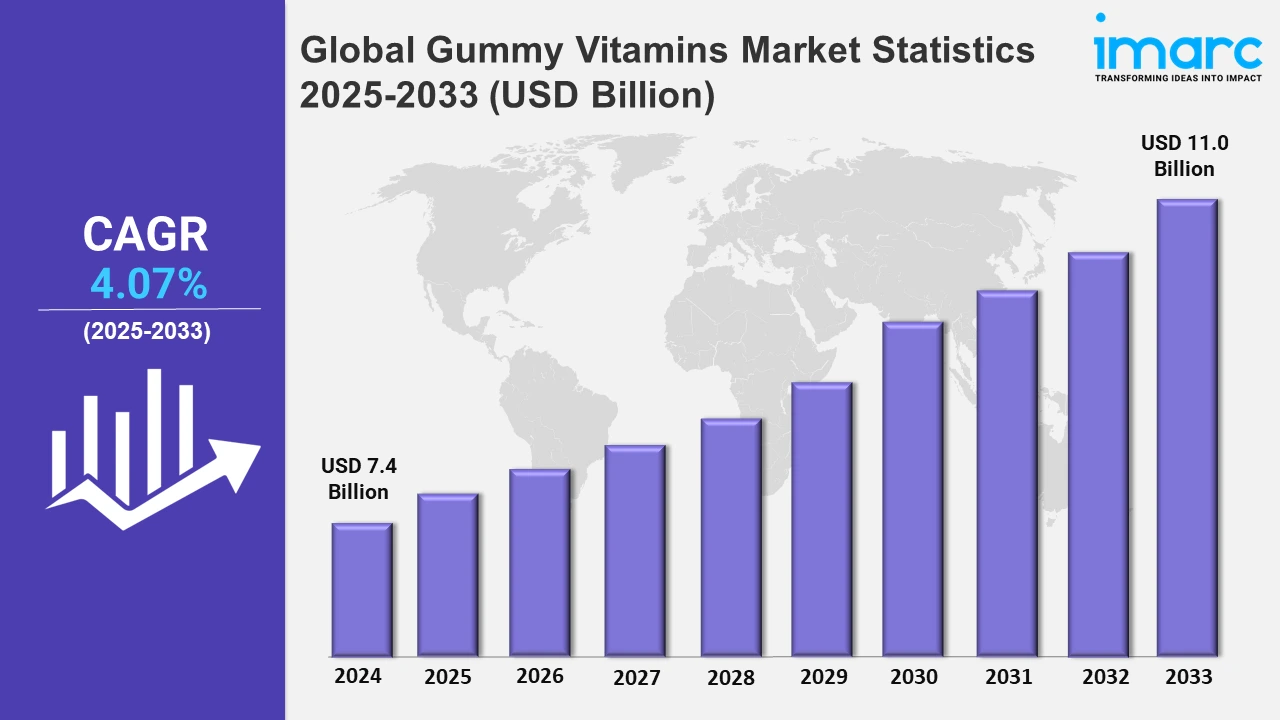

The global gummy vitamins market size was valued at USD 7.4 Billion in 2024, and it is expected to reach USD 11.0 Billion by 2033, exhibiting a growth rate (CAGR) of 4.07% from 2025 to 2033.

To get more information of this market, Request Sample

The shifting preferences of consumers for convenient, palatable, and innovative supplements have propelled the growth of the gummy vitamins market. With the increasing focus on health and well-being and subsequent movement towards preventive measures, the target audience for gums is children and adults who are otherwise averse to taking vitamins in the form of conventional pills. According to Nutrition Business Journal (NBJ), gummy sales are anticipated to reach USD 15.9 Million in 2024, rising to USD 17.4 Million by 2026. Gummies currently hold approximately 25% of the market share, with U.S. sales growing to 75% in 2021 and 12.1% in 2022, despite overall supplement market growth declining to a record low of 1.9% that year. The market is further impelled by the expansion of the market through the development of new product types, such as sugar-free and plant-based proteins, and improved access to markets, such as online retailing. Additionally, with a rising emphasis on natural ingredients for additional health benefits and increasing focus on immunity, the market for gummy vitamins is also expected to gain market attention.

The growing prevalence of nutrient deficiencies is a significant driver of the gummy vitamins market. According to NHANES data, up to 65% of Americans are currently vitamin D deficient, highlighting a critical need for supplementation. Additionally, over 80% of the U.S. population fails to meet adequate omega-3 intake, and four in ten people are magnesium deficient. These statistics underscore a rising demand for targeted nutritional solutions, with gummy vitamins emerging as an appealing option due to their ease of consumption and flavor variety. Manufacturers are responding by developing specialized gummy formulations to address these deficiencies, further supported by increasing consumer education on the health benefits of essential nutrients. This trend continues to drive growth in the gummy vitamins market.

Global Gummy Vitamins Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest gummy vitamins market share, driven by growing health awareness, rising demand for convenient nutritional supplements, and continuous product innovations catering to diverse consumer needs.

North America Gummy Vitamins Market Trends:

The growth of the gummy vitamins market in North America can be attributed to the growing need for health supplements that are fun and easy to swallow amongst the youth as well as adults and children alike. The trend of nutraceuticals and other health products targeted at specific body functions like the immune system, digestive system, and energy is also contributing to the growth of the market. For example, on January 18, 2024, cbdMD, Inc., a leading provider of cannabidiol (CBD) products in America, reported their launch in sprouts farmers market with approximately 175 stores nationwide selling the apple cider vinegar (ACV) and immunity gummy pouches products quite well. Product development and expansion of retail outlets are important features of the market in the region, which is marked by consistently high levels of demand, innovation, and strong consumer distribution.

Asia Pacific Gummy Vitamins Market Trends:

The Asia Pacific gummy vitamins market is expanding with an increasing awareness of health conditions and rising disposable incomes in some of the countries comprising China, India, and Japan. The expanding middle-class population within this region stimulates demand for nutrition supplements in the form of convenient and flavorsome action. In addition, there is a growing incidence of lifestyle-related diseases like diabetes and obesity, which motivates preventive practices in healthcare. Urbanization and booming e-commerce platforms furthermore have increased the availability of gummy vitamins. Local languages and formulations localized by regional manufacturers are also being introduced for culture-based flavors to reach consumers, hence continuing the growth of the market.

Europe Gummy Vitamins Market Trends:

The expanding market in Europe is due to the growing trend for clean and wholesome products. Consumers are more often looking for gummies that are sugar-free, have no allergens, and are plant-based. Countries with older populations such as Germany or the UK tend to have high appeal for supplements that focus on bone and joint health or boosting the immune system. Different regulatory compliance processes and plant certifications are key aspects in the market that are encouraging new market innovations in product development. In addition, the growth of gummy vitamins has been further supported by the trend for wellness and preventive care, as well as well-developed retail outlets.

Latin America Gummy Vitamins Market Trends:

The market in the region of Latin America is currently expanding in a more modest manner. Countries like Brazil Mexico and Argentina have been seeing increased focus by their younger urban populations on health and wellness, this has assisted the demand for easier gummies. The increase of online retail presence has made chewy vitamins easier to obtain while local suppliers have been introducing formulations that suit the tastes of their regions. Furthermore, the use of nutrition education and the advocacy of fortified foods by the government has also facilitated the use of gummy vitamins.

Middle East and Africa Gummy Vitamins Market Trends:

The market in the Middle East and Africa is growing with increased awareness of health supplements and vitamin deficiencies being rampant. Growth in the middle-class population, especially in countries like Saudi Arabia, South Africa, and the UAE, is driving demand for easy-to-take and better-tasting vitamin options. Domestic players are concentrating on halal certification for their products to better suit local tastes. International brands have taken the advantage of developing their presence by signing partnerships and further localizing their marketing. The increased use of the internet in e-commerce or preventive care adoption is increasingly growing with leaps and bounds, thereby making the region among the growing potential markets of gummy vitamins.

Top Companies Leading in the Gummy Vitamins Industry

Some of the leading gummy vitamins market companies include Bayer AG, Bettera Wellness LLC, Church & Dwight Co. Inc., Hero Nutritionals, Ion Labs Inc. (DCC plc), Nature's Way Products LLC. (Dr. Willmar Schwabe GmbH & Co. KG), Pfizer Inc., Pharmavite (Otsuka Pharmaceutical Co. Ltd), Santa Cruz Nutritionals, SmartyPants Vitamins (Unilever plc), The Honest Company Inc., Vitakem Nutraceutical Inc., etc. On June 9, 2024, Bayer AG’s multivitamin and supplement brand, One A Day®, announced the launch of One A Day® Age Factor™ Cell Defense, a dietary supplement focused on supporting cellular health—where the aging process begins. This product is specially formulated with key ingredients such as olive polyphenols derived from olive fruit extract, which act as antioxidants to combat oxidative stress, a major contributor to cellular aging. It also contains Omega-3 fatty acids, Resveratrol, Astaxanthin, Vitamin C, Vitamin D, and Niacin to enhance cell resilience, supporting consumers on their healthy aging journey. This innovative offering highlights the growing consumer demand for supplements that address age-related health concerns, thereby driving the gummy vitamins and dietary supplements market.

Global Gummy Vitamins Market Segmentation Coverage

- On the basis of the type, the market has been divided into single vitamin, multi vitamin, and prebiotics and probiotics, among which the multi vitamin is the most preferred type as it deals with wide nutritional deficiencies under one cover. The trend of this segment is continued by preventive healthcare awareness, along with the increasing need for a product that has multiple health benefits in one dose.

- Based on the demographics, the market is categorized into children and adult, with adult representing the largest segment. This is majorly due to the increased health-consciousness among adults as they try to keep themselves healthy despite their busy lives by adopting easy-to-consume supplements. Additionally, lifestyle disorders such as stress and fatigue have increased, hence a rise in gummy vitamins that are adult-specific.

- On the basis of the sales channel, the market has been divided into supermarkets and hypermarkets, speciality stores, retail pharmacies, and online stores. Among these, it is seen that the segment of supermarkets and hypermarkets holds the greatest value due to the higher product offering, promotional discount schemes, and easy availability, among other factors. Additionally, in-store variety checking between several brands and flavors tends to attract most customers toward this sales channel, ensuring the dominance of the supermarkets and hypermarkets over others.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 7.4 Billion |

| Market Forecast in 2033 | USD 11.0 Billion |

| Market Growth Rate 2025-2033 | 4.07% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Single Vitamin, Multi Vitamin, Prebiotics and Probiotics |

| Demographics Covered | Children, Adult |

| Sales Channels Covered | Supermarkets and Hypermarkets, Speciality Stores, Retail Pharmacies, Online Stores |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bayer AG, Bettera Wellness LLC, Church & Dwight Co. Inc., Hero Nutritionals, Ion Labs Inc. (DCC plc), Nature's Way Products LLC. (Dr. Willmar Schwabe GmbH & Co. KG), Pfizer Inc., Pharmavite (Otsuka Pharmaceutical Co. Ltd), Santa Cruz Nutritionals, SmartyPants Vitamins (Unilever plc), The Honest Company Inc., Vitakem Nutraceutical Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Gummy Vitamins Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)