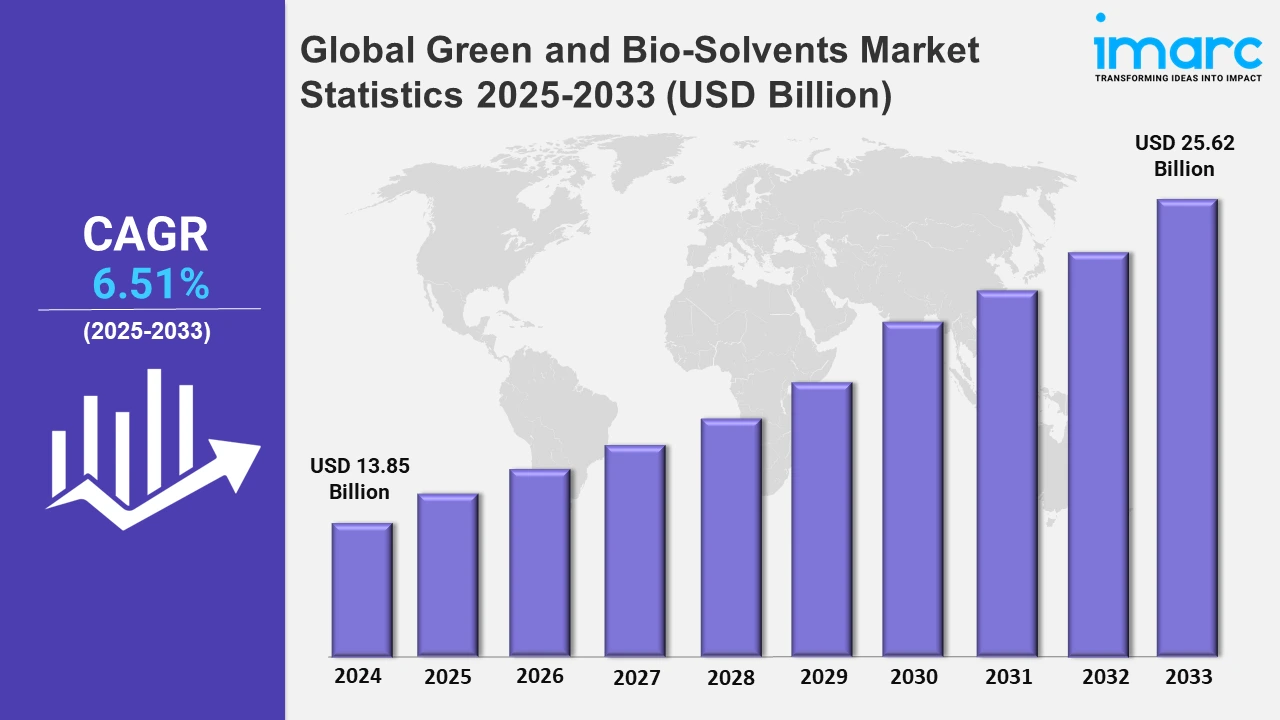

Global Green and Bio-Solvents Market Expected to Reach USD 25.62 Billion by 2033 - IMARC Group

Global Green and Bio-Solvents Market Statistics, Outlook and Regional Analysis 2025-2033

The global green and bio-solvents market size was valued at USD 13.85 Billion in 2024, and it is expected to reach USD 25.62 Billion by 2033, exhibiting a growth rate (CAGR) of 6.51% from 2025 to 2033.

To get more information on this market, Request Sample

The market for green and bio-solvents is expanding because of the growing environmental consciousness and the urgent need to reduce the negative effects of industrial chemicals. Conventional solvents frequently release volatile organic compounds (VOCs), which are linked to both health issues and air pollution. To lower VOC emissions and encourage sustainable behaviors, governments, and environmental organizations throughout the world have intervened with stringent laws. To further the region's objective of developing a cleaner and greener chemical sector over time, the European Union (EU) implemented the Ecodesign for Sustainable Products Regulation (ESPR) as a new framework law. Bio-solvents provide an ideal solution to the demand on industries to embrace environmentally friendly substitutes. These solvents are produced from renewable sources such as corn, soy, and sugarcane, which are biodegradable and much less harmful than other solvents.

Consumers are increasingly concerned about the environment and their principles, which include sustainability and a low environmental effect, are reflected in the items they choose. This has pushed manufacturers to innovate and provide greener alternatives in a variety of items, such as paints, adhesives, cosmetics, and cleaning supplies. For instance, Covestro replaced petroleum with plant biomass in February 2024 when it set up an aniline pilot plant at its Leverkusen location. Because they are made from renewable resources, green and bio-solvents are ideal for this environmentally conscious narrative. They also provide producers a competitive edge in a market that is becoming more environmentally conscious by allowing them to promote their goods as natural or green. This tendency is further supported by the rising demand for eco-labels and certifications as customers actively search for companies that showcase their commitment to sustainability.

Global Green and Bio-Solvents Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounts the largest share of the market due to severe environmental legislation, an established industrial base, and significant awareness and implementation of sustainable practices.

North America Green and Bio-Solvents Market Trends:

North America has established itself as the largest region in green and bio-solvents market. This domination can be ascribed to strict environmental regulations, which enhance the usage of environmentally friendly solvents. The demand for sustainable development has been gaining ground across different industries, and in the U.S., this movement has seen enhanced initiatives. This has led to several programs by the United States Green Building Council (USGBC) and Leadership in Energy and Environmental Design (LEED) to facilitate the adoption of low VOC paints and green solvents. Other significant growth sectors are pharmaceuticals, paints and coatings, and adhesives. The presence of key market players and advanced research capabilities also contribute to North America's leading position in this market.

Asia-Pacific Green and Bio-Solvents Market Trends:

Rapid industrial and infrastructure growth, especially in nations like China and India, is the major reason for the Asia-Pacific region's expanding demand for bio-solvents and green solvents. The growing building and construction industry, together with the demand for paints and coatings, is another factor driving the need for environmentally friendly solvents. The construction of new airports and national roads, among other massive infrastructure projects, and India's extremely ambitious economic goals all serve to boost market expansion. Notably, one of the fastest-growing packaging industries in the region, India represents a sizable market for green solvents.

Europe Green and Bio-Solvents Market Trends:

In Europe, the green and bio-solvents market has a considerable share, which is primarily driven by stringent environmental regulations and high commitment toward sustainable practices. Germany, France, and the U.K. are pioneers of policies promoting reduced VOC emissions and eco-friendly products. The Renovation Wave campaign launched by the European Commission, which pursues improved energy performance of buildings around the EU, also escalates the demand for green solvents in paints, coatings, and other applications. A major attracting factor for green and bio-solvents is the region's commitment toward a circular economy and resource efficiency targets.

Latin America Green and Bio-Solvents Market Trends:

In Latin America, a growing trend of green and bio-solvent acceptance is observed owing to the increased automotive industry and its usage in sustainable practices. The automotive industry in the region is developing at a substantial pace. The growth consequently necessitates the demand for paints, coatings, and adhesives and drives the market for green solvents. Major market contributors such as Brazil and Mexico are moving toward continued environmentally friendly product adoption across their industries to meet regulatory standards and consumer preferences.

Middle East and Africa Green and Bio-Solvents Market Trends:

The expanding construction industry and steady advancements in sustainable development is propelling the market for green and bio-solvents in the Middle East and Africa. Green solvents are becoming an effective alternative as the rising construction sector increases the demand for paints and coatings. Because the market is still quite nascent compared to other areas, the growth momentum for the future stems from ever-increasing awareness regarding environmental issues and high benefits of green products.

Top Companies Leading in the Green and Bio-Solvents Industry

Some of the leading green and bio-solvents market companies include Archer Daniels Midland Company, Cargill, Incorporated, Circa Group, Dow Inc., Florachem Corporation, Solvay, Vertec Biosolvents Inc., among many others.

In October 2024, BASF and AM Green B.V. signed a memorandum of understanding (MoU) to evaluate and develop business opportunities together for low-carbon chemicals produced exclusively with renewable energy, and for the offtake of 100,000 tons of green ammonia annually.

Global Green and Bio-Solvents Market Segmentation Coverage

- On the basis of the type, the market has been categorized into lactate esters, methyl soyate solvents, bio-alcohols, bio-diols and bio-glycols, D-limonene, and others, wherein bio-alcohols, bio-diols and bio-glycols represent the leading segment. Bio-alcohols, bio-diols, and bio-glycols are capturing the market share due to their increased use in the construction, automotive, and pharmaceutical industries as well as higher solvency and environmental benefits. They are also utilized in industrial processes and are a better option than conventional solvents like petrochemicals because they are derived from renewable resources.

- Based on the application, the market is classified into paints and coatings, printing inks, cleaning products, adhesives and sealants, and others, amongst which paints and coatings segment dominates the market. Since the paint and coatings sector uses a number of solvents to achieve the required uniformity, drying time, and performance, it represents the largest application category. The change toward low-VOC and eco-friendly formulations in architectural and industrial coatings has also led to a huge hike in the demand for green and bio-solvents.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 13.85 Billion |

| Market Forecast in 2033 | USD 25.62 Billion |

| Market Growth Rate 2025-2033 | 6.51% |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Lactate Esters, Methyl Soyate Solvents, Bio-Alcohols, Bio-Diols and Bio-Glycols, D-Limonene, Others |

| Applications Covered | Paints and Coatings, Printing Inks, Cleaning Products, Adhesives and Sealants, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Archer Daniels Midland Company, Cargill, Incorporated, Circa Group, Dow Inc., Florachem Corporation, Solvay, Vertec Biosolvents Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)