Global Graphite Electrodes Market Expected to Reach USD 11.14 Billion by 2033 – IMARC Group

Global Graphite Electrodes Market Statistics, Outlook, and Regional Analysis 2025-2033

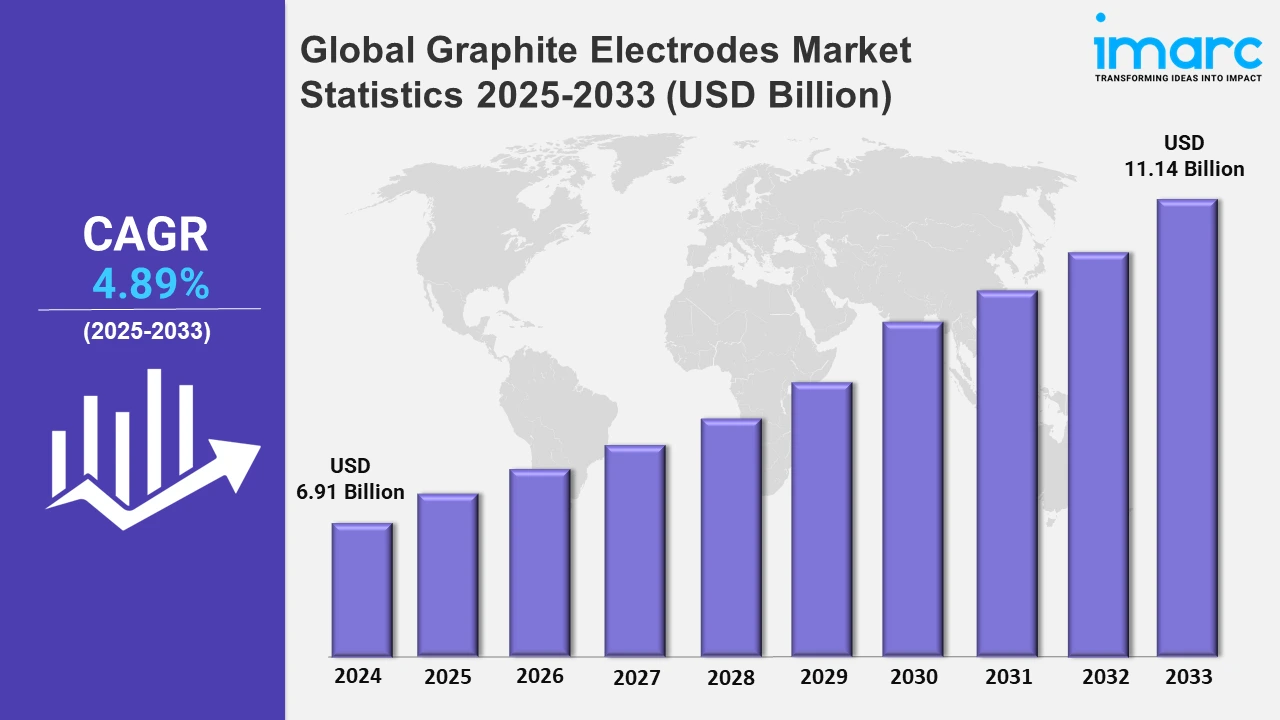

The global graphite electrodes market size was valued at USD 6.91 Billion in 2024, and it is expected to reach USD 11.14 Billion by 2033, exhibiting a growth rate (CAGR) of 4.89% from 2025 to 2033.

To get more information on this market, Request Sample

As an essential component in producing steel, the use of graphite electrode is increasing in electric arc furnaces. As a great conductor of electricity and heat, electric arc furnaces employ it in steel manufacturing. With an increased demand for infrastructure development and urbanization, along with the growth of the automotive industry, the need for efficient steel is rising. A major factor behind the use of graphite electrode in the electric arc furnaces is its durability and energy-efficiency, coupled with the capacity to withstand high temperatures and electrical currents. Electric arc furnaces steelmaking is more carbon efficient than conventional blast furnace steel production, displaying it as an ideal solution in regions with very strict environmental regulations. As per the data published on the website of the IMARC Group, the global steel market size reached USD 974.4 Billion in 2024.

With more electric vehicles (EVs) sold worldwide, the demand for batteries, particularly lithium-ion (Li-ion) batteries, are increasing. Key material used in anode production and compounding is graphite. Graphite is a key component in producing anodes of electric batteries for which high-quality graphite materials are required. Apart from this, the automotive industry's shift to electrification is advancing production coupled with efficient and sustainable manufacturing processes. The growing focus of automakers and manufacturers on sustainability is driving the demand for electric arc furnace-based steelmaking and other energy efficient methods. IMARC Group’s report predicts that the global electric vehicle market will exhibit a growth rate (CAGR) of 22.1% during 2023-2032.

Global Graphite Electrodes Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Asia-Pacific; Europe; North America; Middle East and Africa; and Latin America. According to the report, Asia-Pacific accounts for the largest market share on account of its large steel production industry, significant demand from emerging economies, and increase in infrastructure development activities.

Asia-Pacific Graphite Electrodes Market Trends:

Because of an increase in infrastructure development, requirement for steel in the construction and the manufacturing sectors of Asia Pacific is rising. Major contributors include nations like China and India, wherein China, backed by its vast industrial base, is a major producer and user. The market’s potential in this area is further enhanced by the availability of raw materials at an affordable rate. Apart from this, the region has a strong need for graphite electrodes in production of steel due to its expanding manufacturing base, technological advancements, and investment in green technologies. The market is further strengthened by the growing adoption of electric vehicles (EVs), catalyzing the demand for graphite electrodes, particularly in battery production. IMARC Group’s report predicts that the China electric vehicle battery market side will exhibit a growth rate (CAGR) of 31.50% during 2024-2032.

Europe Graphite Electrodes Market Trends:

The market for graphite electrode in Europe is distinguished by its sophisticated manufacturing sector requiring high quality electrodes for steel production. The region’s demand is further supported by the programs initiated by the governing agencies in the region promoting sustainable manufacturing practices. European countries with their well-established automotive and EV industry are driving the demand for graphite electrodes in battery production.

North America Graphite Electrodes Market Trends:

Due to the high demand from steel producing units, North America accounts for a sizeable portion of the graphite electrode market. Owing to established automative industry and construction sector, the United States further propels the demand for graphite electrode. The availability of clean and energy-efficient methods of producing steel and the demand for graphite electrode is further catalyzed in sustainable industrial processes.

Middle East and Africa Graphite Electrodes Market Trends:

Major contributing nations including Saudi Arabia, the UAE, and South Africa, with their heavy demand for graphite electrodes in the steel production are driving the market. Infrastructure development in the region, characterized by large-scale construction and industrial projects is propelling the demand for graphite electrodes. Due to lower carbon emission compared to conventional blast furnace, the region is shifting to electric arc furnace, creating the demand for high-quality electrodes.

Latin America Graphite Electrodes Market Trends:

The growing steel and automotive base in Latin America, is what propels the market for graphite electrodes. Brazil dominates the regional market as the largest producer of steel because of its expanding electric arc furnace steelmaking sector. Market expansion is aided by the region’s growing infrastructure projects and urbanization coupled with the expansion of construction and manufacturing industries.

Top Companies Leading in the Graphite Electrodes Industry

Some of the leading graphite electrode market companies include Fangda Carbon New Materials Technology Co., Ltd., GrafTech International Ltd., Graphite India Limited, HEG Limited, Nantong Yangzi Carbon Co. Ltd, Nippon Carbon Co. Ltd, Resonac Graphite Japan Corporation, Sangraf International, SEC Carbon Limited, Sigri New Material Technology (Tianjin) Co., Ltd., Tokai Carbon Co. Ltd, among many others. In October 2024, HEG Limited acquired 8.23% stake in GrafTech International, which is a graphite electrode manufacturing brand, for ₹248.62 crore, intensifying its global market presence.

Global Graphite Electrodes Market Segmentation Coverage

- On the basis of product type, the market has been categorized into ultra-high power (UHP), high power (HP), and regular power (RP), wherein ultra-high power (UHP) represents the leading segment. Due to their superior performance in industrial applications and electric arc furnace for steel production, ultra-high power (UHP) dominates the graphite electrode market. UHP electrodes can sustain much higher current and temperatures, allowing them to serve in large operations requiring high-quality steel. UHP electrodes offer better durability, resulting in lower operational costs and less frequent replacements. They are a preferred choice across various industries as they enhance steel quality and efficiency.

- Based on the application, the market has been classified into electric arc furnace, ladle furnace, and non-steel application, amongst which electric arc furnace dominates the market. Electric arc furnaces (EAFs) consume much less energy compared to the conventional blast furnaces as they use electrical energy directly for melting scrap or raw materials. This efficiency lowers operational costs. They can accommodate a wide range of input materials, from steel scrap, direct reduced iron (DRI), and pig iron. Such flexibility supports production according to resources and market needs. The ability to quickly start up and shut down makes EAF operation easier for producers to quickly respond to changes in demand.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 6.91 Billion |

| Market Forecast in 2033 | USD 11.14 Billion |

| Market Growth Rate 2025-2033 | 4.89% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Ultra-high Power (UHP), High Power (HP), Regular Power (RP) |

| Applications Covered | Electric Arc Furnace, Ladle Furnace, Non-Steel Application |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Fangda Carbon New Materials Technology Co., Ltd., GrafTech International Ltd., Graphite India Limited, HEG Limited, Nantong Yangzi Carbon Co. Ltd, Nippon Carbon Co. Ltd, Resonac Graphite Japan Corporation, Sangraf International, SEC Carbon Limited, Sigri New Material Technology (Tianjin) Co., Ltd., Tokai Carbon Co. Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Graphite Electrodes Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)