Global GMP Testing Service Market Expected to Reach USD 2.5 Billion by 2033 - IMARC Group

Global GMP Testing Service Market Statistics, Outlook and Regional Analysis 2025-2033

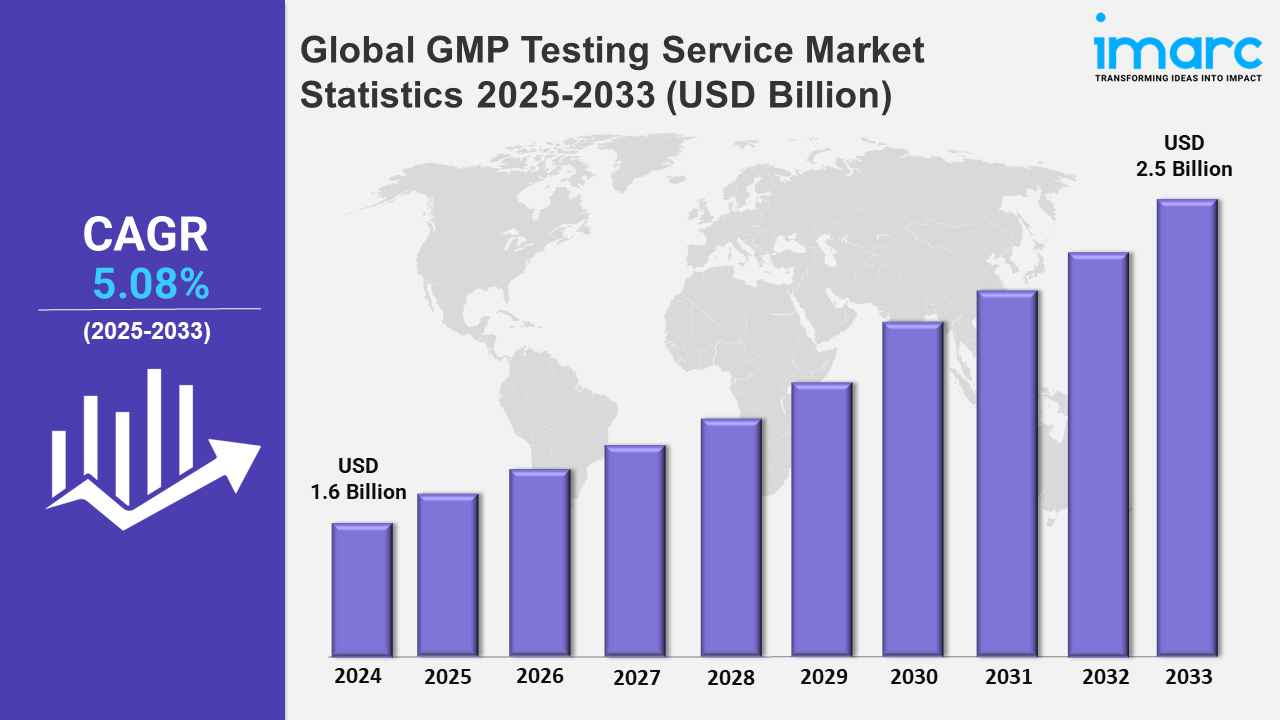

The global GMP testing service market size was valued at USD 1.6 Billion in 2024, and it is expected to reach USD 2.5 Billion by 2033, exhibiting a growth rate (CAGR) of 5.08% from 2025 to 2033.

To get more information on this market, Request Sample

The global pharmaceutical sector is expanding significantly, with increased drug development efforts and the introduction of novel medications. This expansion necessitates rigorous GMP testing to ensure product integrity and regulatory compliance. For example, according to the Indian Brand Equity Foundation Report 2022, India ranks as the world's 12th largest supplier of medical goods. Indian pharmaceuticals are exported to over 200 nations globally, with the United States being the primary market. Furthermore, generic drugs account for 20% of global export volume, making the country the world's leading provider of generic medicines.

Moreover, the rapid technological advancements in analytical methods and equipment as highlighted in the GMP testing service market research report are another major driver in the market. In addition, the introduction of cutting-edge technologies, such as high-performance liquid chromatography (HPLC), mass spectrometry, and next-generation sequencing, allows for more accurate, efficient, and comprehensive testing procedures. For instance, in April 2024, Waters Corporation launched the Alliance iS Bio HPLC System, which has new features that solve operational and analytical difficulties in biopharma quality control (QC) laboratories. The new HPLC system combines superior bio-separation technology with built-in instrument intelligence features. It is intended to help biopharma QC analysts improve efficiency and remove up to 40% of frequent errors, saving time spent investigating the source of failed runs and out-of-spec results. Also, in October 2024, Thermo Fisher Scientific Inc. launched the Thermo Scientific™ iCAP™ MX series ICP-MS, which simplifies trace element analysis using inductively coupled plasma mass spectrometry (ICP-MS). The launch includes a new single quadrupole Thermo Scientific iCAP MSX ICP-MS and a triple quadrupole Thermo Scientific iCAP MTX ICP-MS developed for environmental, food, industrial, and research labs to analyze routine and difficult trace elements in order to detect and mitigate hazardous compounds.

Global GMP Testing Service Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America exhibited the largest segment, owing to the ongoing technological advancements.

North America GMP Testing Service Market Trends:

The GMP testing service market in North America is exhibiting dominance due to increased awareness and demand for high-quality, safe products. The North American market is distinguished by well-informed customers who want transparency and assurance that the products that they use satisfy the highest safety and efficacy requirements. Technological innovation is another important component. The availability of improved testing technology and procedures allows for more accurate and efficient quality control operations, which benefits the GMP testing industry. Besides this, the growing number of chronic diseases has led to an increased demand for novel drugs. For instance, according to CDC estimates for 2022, almost six out of ten people in the United States suffer from chronic diseases.

Europe GMP Testing Service Market Trends:

The continuous growth of the pharmaceutical sector in Europe necessitates rigorous quality assurance measures. For instance, according to IMARC, the Italy pharmaceutical market size reached USD 4.64 Billion in 2023. Looking forward, IMARC Group expects the market to reach USD 6.82 Billion by 2032, exhibiting a growth rate (CAGR) of 4.25% during 2024-2032. This expansion fuels the demand for GMP testing services to ensure compliance with stringent regulatory standards.

Asia Pacific GMP Testing Service Market Trends:

Countries like China and India have seen substantial growth in their pharmaceutical sectors. China's increase in pharmaceutical companies and their R&D activities is a major contributor to the expansion of GMP testing service market.

Latin America GMP Testing Service Market Trends:

Latin American countries are increasingly aligning their regulatory frameworks with international standards, necessitating rigorous GMP compliance. For example, Brazil's regulatory agency, ANVISA, implemented RDC 751/2022 in March 2023, consolidating legislation related to medical device regulatory and registration processes, thereby emphasizing the importance of GMP adherence.

Middle East and Africa GMP Testing Service Market Trends:

The MEA region has seen significant growth in its pharmaceutical and biopharmaceutical sectors. This expansion necessitates rigorous GMP testing to ensure product quality and compliance with international standards. For instance, the establishment of new manufacturing facilities in countries like Saudi Arabia and the UAE has increased the demand for GMP testing services.

Top Companies Leading in the GMP Testing Service Industry

Some of the leading GMP testing service market companies include Almac Group, Charles River Laboratories International Inc., Eurofins Scientific SE, ICON plc, Intertek Group plc, Merck KgaA, Nelson Laboratories LLC (Sotera Health Company), North American Science Associates LLC, Pace Analytical Services LLC, PPD Inc. (Thermo Fisher Scientific Inc.), Sartorius AG, and Wuxi Apptec Co. Ltd., among many others. For instance, in August 2023, Charles River Laboratories International Inc. and Fondazione Telethon collaborated to develop High Quality (HQ) plasmids. Moreover, in September 2020, Almac Group expanded its analytical services portfolio by adding biologics testing solutions. In order to aid customers' drug substance and drug product programs for both new biologics and biosimilars, the company announced that its services would include GMP lot release and stability services.

Global GMP Testing Service Market Segmentation Coverage

- On the basis of the service type, the market has been bifurcated into packaging and shelf-life testing, product validation testing, bioanalytical services, and others, wherein product validation testing represented the largest segment driven by the stringent regulatory requirements across sectors, such as pharmaceuticals, food, and medical devices necessitating rigorous validation testing to ensure products meet established safety and efficacy benchmarks.

- Based on the end user, the market is categorized into pharmaceutical and biopharmaceutical companies and medical device companies, amongst which pharmaceutical and biopharmaceutical companies accounted for the largest market share fueled by stringent guidelines laid out by authorities, such as the FDA and EMA, which necessitate comprehensive GMP testing to ensure product safety and efficacy.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1.6 Billion |

| Market Forecast in 2033 | USD 2.5 Billion |

| Market Growth Rate 2025-2033 | 5.08% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Service Types Covered | Packaging and Shelf-life Testing, Product Validation Testing, Bioanalytical Services, Others |

| End Users Covered | Pharmaceutical and Biopharmaceutical Companies, Medical Device Companies |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Almac Group, Charles River Laboratories International Inc., Eurofins Scientific SE, ICON plc, Intertek Group plc, Merck KgaA, Nelson Laboratories LLC (Sotera Health Company), North American Science Associates LLC, Pace Analytical Services LLC, PPD Inc. (Thermo Fisher Scientific Inc.), Sartorius AG, Wuxi Apptec Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)