Global Generic Injectables Market Expected to Reach USD 99.2 Billion by 2033 - IMARC Group

Global Generic Injectables Market Statistics, Outlook and Regional Analysis 2025-2033

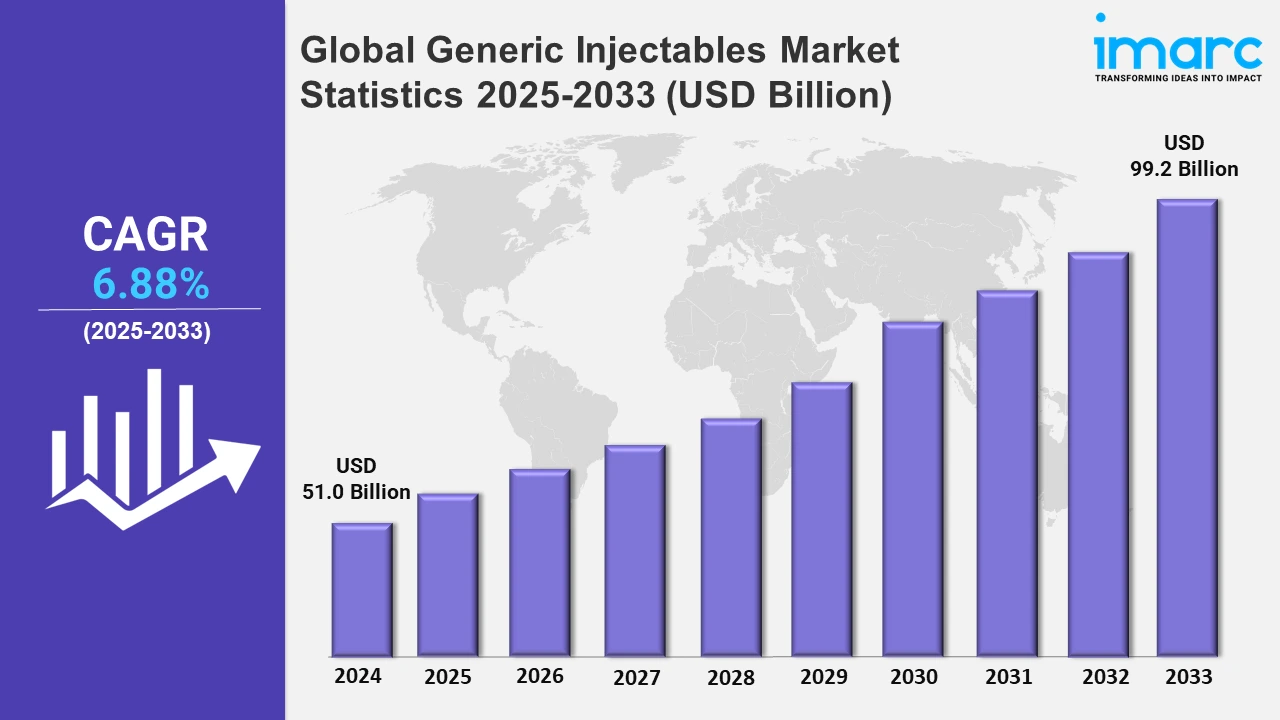

The global generic injectables market size was valued at USD 51.0 Billion in 2024, and it is expected to reach USD 99.2 Billion by 2033, exhibiting a growth rate (CAGR) of 6.88% from 2025 to 2033.

To get more information on this market, Request Sample

The market is witnessing substantial growth for injectable devices, which is driven by technological advancements, rising investment in healthcare innovations, and increased demand for generic formulations. In contrast, companies are focusing on expanding their portfolios to address a broader range of medical needs, thereby emphasizing affordability and accessibility. On the contrary, manufacturers are innovating with new concentrations and formulations to meet varied therapeutic requirements. For instance, in January 2024, Piramal Critical Care (PCC) launched a 10mg/10mL (1 mg/mL) concentration of zinc sulfate, which is enhancing its generic injectables lineup. Therefore, these developments underscore the commitment to diversifying injectable solutions, enabling healthcare providers to offer tailored treatments for better patient outcomes. Meanwhile, the trend towards the commercialization of generic injectable solutions is gaining traction, thereby reinforcing the competitive landscape. For example, in January 2024, Milla Pharmaceuticals Inc. took a significant step by commercializing its Supplemental Abbreviated New Drug Application (sANDA) for a generic version of sodium acetate injection. This product is fundamental for formulating specific intravenous fluids when conventional electrolyte or nutrient solutions are inadequate. Hence, these advancements are important as they facilitate cost-effective treatment alternatives and strengthen the global supply chain of essential drugs, supporting healthcare institutions in managing patient care more efficiently.

Moreover, the introduction of novel injectable products is also accompanied by increased regulatory approvals, facilitating market penetration across various regions. In contrast, companies are leveraging these opportunities to enhance their product reach and support treatment accessibility. The global focus on generic injectables aligns with the aim to provide safe, affordable healthcare solutions in the face of rising chronic disease prevalence and an aging population. In July 2024, Sandoz made headlines by launching Pyzchiva (ustekinumab) across Europe, a significant development in the generic injectables sector. Pyzchiva, developed as a biosimilar by Samsung Bioepis, marks the first ustekinumab biosimilar in the region. This milestone not only broadens Sandoz's immunology portfolio but also promotes wider access to effective treatments for chronic inflammatory diseases. Overall, such region-specific launches underline the strategic efforts by key players to cater to localized market demands and set a precedent for future innovations in the injectable drugs industry.

Global Generic Injectables Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Europe, North America, Asia, Latin America, and the Middle East and Africa. According to the report, North America dominates the generic injectables market due to its advanced healthcare infrastructure, robust regulatory framework, and significant investments in research and development.

North America Generic Injectables Market Trends:

North America is the dominating region in the market due to its advanced healthcare infrastructure and significant investments in research and development. In January 2024, Accord BioPharma, Inc., the U.S. specialty division of Intas Pharmaceuticals Ltd. focused on developing immunology, oncology, and critical care therapies, announced that its Biologics License Application (BLA) for DMB-3115, a proposed biosimilar to the blockbuster drug STELARA, had been accepted by the U.S. FDA. Thus, presence of leading pharmaceutical companies and initiatives promoting affordable healthcare solutions further bolster North America’s dominant position in the market.

Europe Generic Injectables Market Trends:

Europe is seeing growth in the generic injectables market due to increasing healthcare cost-containment efforts and favorable government policies. In addition, Germany, known for its robust pharmaceutical sector, exemplifies this with initiatives promoting the use of generics. This trend is supported by strong healthcare infrastructure and collaborations between pharmaceutical companies to develop biosimilars, thereby enhancing the accessibility of critical injectable treatments across the region.

Asia Generic Injectables Market Trends:

The region is experiencing rapid expansion in the generic injectables market, which is driven by rising healthcare demands and cost-effective manufacturing. India, as a major player, continues to lead with its large-scale production capabilities and extensive R&D investments. Furthermore, the region’s focus on affordable healthcare solutions and export opportunities contributes to its growth, thereby appealing to global and local markets with competitive pricing.

Latin America Generic Injectables Market Trends:

In Latin America, the injectables market is advancing due to the increasing need for accessible treatment options amidst economic constraints. In contrast, Brazil exemplifies this trend with government-backed initiatives to support local production and reduce reliance on imported medicines. The region's investments in local manufacturing facilities and growing partnerships with international pharmaceutical firms ensure the availability of generic injectables to meet public health needs.

Middle East and Africa Generic Injectables Market Trends:

The Middle East and Africa are witnessing gradual growth in the generic injectables industry as countries like South Africa invest in expanding healthcare services and improving affordability. Also, the trend is fueled by regional efforts to boost local pharmaceutical production and adapt to rising chronic disease rates. International collaborations and supportive regulations are enhancing the distribution and development of cost-effective injectables in these markets.

Top Companies Leading in the Generic Injectables Industry

Some of the leading generic injectables market companies include AstraZeneca plc, Baxter International, Inc., Fresenius SE & Co. KGaA, Hikma Pharmaceuticals plc, Lupin Ltd., Pfizer, Inc., Sandoz AG, Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., and Viatris Inc., among many others. In April 2024, Baxter International introduced five novel generic injectables that feature ready-to-use formulations to help support patient safety. Apart from this, these advancements enhance patient compliance and provide a competitive edge to manufacturers.

Global Generic Injectables Market Segmentation Coverage

- On the basis of the therapeutic area, the market has been bifurcated into oncology, anaesthesia, anti-infectives, parenteral nutrition, and cardiovascular, wherein oncology represents the most preferred segment. Oncology represents a significant segment in the market due to the high prevalence and the increasing incidence of cancer worldwide, which drives the demand for cost-effective treatment options.

- Based on the container, the market is categorized into vials, ampoules, premix, and prefilled syringes, amongst which vials dominate the market. Vials are a preferred packaging format for a wide range of injectable medications, including antibiotics, vaccines, and oncology drugs, because they offer a stable and secure means of storing and administering these drugs.

- On the basis of the distribution channel, the market has been divided into hospitals and retail pharmacy, wherein hospitals represent the most preferred segment. Hospitals rely heavily on injectable medications for their rapid onset of action and high bioavailability, making them essential for emergency care, anesthesia, oncology, and critical care.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 51.0 Billion |

| Market Forecast in 2033 | USD 99.2 Billion |

| Market Growth Rate 2025-2033 | 6.88% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Therapeutic Areas Covered | Oncology, Anaesthesia, Anti-infectives, Parenteral Nutrition, Cardiovascular |

| Containers Covered | Vials, Ampoules, Premix, Prefilled Syringes |

| Distribution Channels Covered | Hospitals, Retail Pharmacy |

| Regions Covered | Europe, North America, Asia, Latin America, Middle East and Africa |

| Companies Covered | AstraZeneca plc, Baxter International, Inc., Fresenius SE & Co. KGaA, Hikma Pharmaceuticals plc, Lupin Ltd., Pfizer, Inc., Sandoz AG, Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Viatris Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Generic Injectables Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)