GCC Ice Cream Market Expected to Reach USD 3.3 Million by 2033 - IMARC Group

GCC Ice Cream Market Statistics, Outlook and Regional Analysis 2025-2033

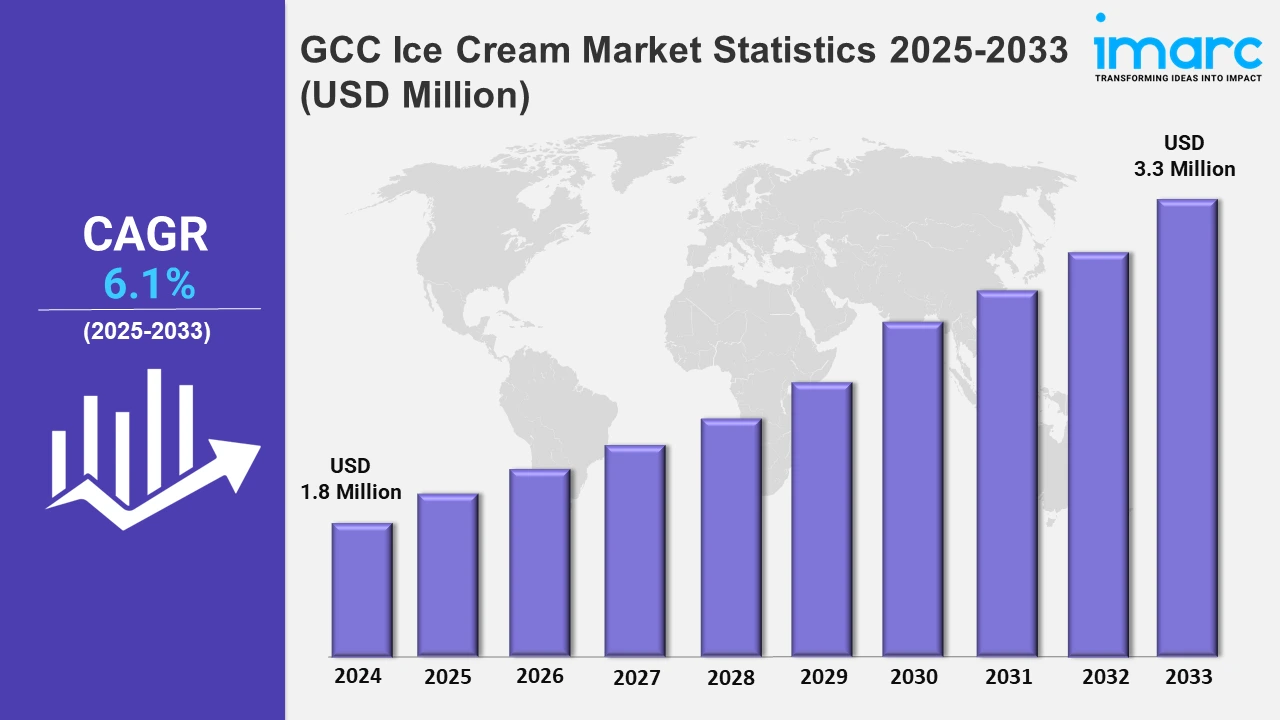

The GCC ice cream market size was valued at USD 1.8 Million in 2024, and it is expected to reach USD 3.3 Million by 2033, exhibiting a growth rate (CAGR) of 6.1% from 2025 to 2033.

To get more information on this market, Request Sample

The ice cream businesses in GCC are rising, driven by the introduction of new franchising models and innovative distribution partnerships. These methods enable organizations to enter new markets, especially in Saudi Arabia and Bahrain. For example, in June 2023, House of Pops, one of the Dubai-based ice cream brands, aimed to secure the top spot in the GCC’s healthy frozen dessert sector through franchising and distribution partnerships. The firm also established a franchising model, which it used to expand its presence in Saudi Arabia and Bahrain.

Moreover, there are elevating investments in new manufacturing facilities, boosting growth across the region. These initiatives not only increase industrial capacity but also help to create employment. For instance, in October 2024, Pure Ice Cream, the owner of the Kwality brand, announced its plan to invest in a new factory in Dubai in a project expected to create around 300 jobs. Furthermore, premium and artisanal ice creams are becoming increasingly popular in the GCC, owing to consumers' willingness to spend more for distinctive tastes and high-quality ingredients. According to the Gulf Cooperation Council's Food and Beverage Sector study, premium ice cream sales have grown at a consistent 8% per year over the previous five years. This is due to the emergence of distinct flavors by companies such as Baskin-Robbins and Froneri. Local craftsmen are gaining popularity, providing handcrafted ice creams that appeal to preferences. As disposable incomes rise, people want more lavish experiences, which drives the expansion of this market.

GCC Ice Cream Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, the UAE, Qatar, Bahrain, Kuwait, and Oman. According to the report, these regions are bolstering due to the expanding expatriate population willing to try new flavors and offerings.

Saudi Arabia Ice Cream Market Trends:

The rising consumer preferences toward high-quality and artisanal ice cream are propelling the market in Saudi Arabia. For example, Baskin-Robbins and Häagen-Dazs have expanded their offers in key cities like Riyadh and Jeddah. The premium segment's growth reflects Saudi Arabia's growing emphasis on diversified and luxury eating experiences, particularly among the younger generation.

UAE Ice Cream Market Trends:

The UAE is experiencing a huge increase in demand for health-conscious ice cream choices, such as low-calorie, dairy-free, and sugar-free options. House of Pops caters to Dubai and Abu Dhabi residents who want to enjoy themselves without compromising their health goals. This development corresponds with the UAE's emphasis on wellness and fitness, as the ice cream invention keeps up with changing eating habits.

Qatar Ice Cream Market Trends:

The market in Qatar continues to see an increase in locally manufactured brands that combine traditional flavors with contemporary processes. Gelato Mondo is gaining success in Doha by selling one-of-a-kind ice cream flavors like saffron and rose. This emphasis on native companies reflects Qatar's larger cultural pride and attempts to encourage local entrepreneurship.

Bahrain Ice Cream Market Trends:

In Bahrain, ice cream sales are heavily impacted by seasonal and event-based consumption, notably around holidays such as Eid and the Bahrain Grand Prix. During these periods, ice cream parlors like Dairy Queen and Cold Stone Creamery observe increased demand, demonstrating Bahrain's active social scene and its influence on dessert trends.

Kuwait Ice Cream Market Trends:

The industry is expanding with gourmet and specialized ice cream concepts, which are frequently inspired by overseas trends. Sloan's Ice Cream in Kuwait City serves elaborate sundaes with social media-worthy themes, appealing to affluent customers. This trend reflects Kuwait's preference for distinctive eating experiences.

Oman Ice Cream Market Trends:

In Oman, there is a growing interest in ice cream with traditional and ethnic tastes like frankincense or cardamom. Local and foreign brands appeal to the market in Muscat by introducing tastes based on Oman's cultural history. This trend demonstrates Oman's admiration for retaining its culinary heritage while also embracing current dessert innovations.

Top Companies Leading in the GCC Ice Cream Industry

Some of the leading GCC ice cream market companies have been provided in the report. They are particularly focusing on pricing strategies, brand recognition, distribution networks, etc. These local players are further catering to the preferences of consumers across the country. Baskin Robbins elevated its presence in GCC via a franchise model.

GCC Ice Cream Market Segmentation Coverage

- Based on the flavor, the market has been classified into chocolate, fruit, vanilla, and others. Chocolate is widely consumed because of its rich flavor and countless variants. Fruit-flavored ice creams, such as mango, strawberry, and mixed berry, are popular among health-conscious consumers and those looking for a refreshing treat. Vanilla, with its universal and adaptable appeal, frequently serves as the base for other desserts. Other flavors, including pistachio and rose, are gaining popularity, reflecting cultural preferences and expanding the market.

- Based on the category, the market has been categorized into impulse ice cream, take-home ice cream, and artisanal ice cream. Impulse ice cream, which comprises single-serve ice cream bars and cones, is handy and appealing to impulse buyers, particularly in high-traffic places like malls and sightseeing spots. Take-home ice cream, available in bigger containers such as tubs and blocks, is aimed at families and people who want to enjoy ice cream at home. Artisanal ice cream is popular among discriminating consumers looking for an exquisite experience due to its premium quality, distinctive flavors, and handmade appeal.

- Based on the product, the market has been divided into cup, stick, cone, brick, tub, and others. Cups provide feasible single-serve solutions that are popular due to their portability and portion control. Stick ice cream is favored for the ease of eating, particularly among youngsters. Cones offer a classic experience that appeals to traditionalists. Bricks are suitable for families and home usage, while tubs provide big quantities for parties and gatherings. Other creative forms, such as mochi or ice cream sandwiches, provide diversity and appeal to certain consumers.

- Based on the distribution channel, the market is classified into supermarkets/hypermarkets, convenience stores, ice cream parlours, online stores, and others. Supermarkets and hypermarkets offer various products and regular promotions, which draw many shoppers. Convenience stores help by providing rapid access to popular ice cream brands, which appeal to impulsive buyers. Ice cream parlors provide value by offering distinctive and freshly created flavors and an engaging purchase experience. Online retailers have grown in popularity because of their ease and wider variety. Other channels, such as kiosks and specialized stores, increase market diversity by focusing on certain sectors and unique consumer preferences.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1.8 Million |

| Market Forecast in 2033 | USD 3.3 Million |

| Market Growth Rate 2025-2033 | 6.1% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Flavors Covered | Chocolate, Fruit, Vanilla, Others |

| Categories Covered | Impulse Ice Cream, Take-Home Ice Cream, Artisanal Ice Cream |

| Products Covered | Cup, Stick, Cone, Brick, Tub, Others |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Ice Cream Parlours, Online Stores, Others |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Ice Cream Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)