Global Gas Turbine Market Expected to Reach USD 35.2 Billion by 2033 - IMARC Group

Global Gas Turbine Market Statistics, Outlook and Regional Analysis 2025-2033

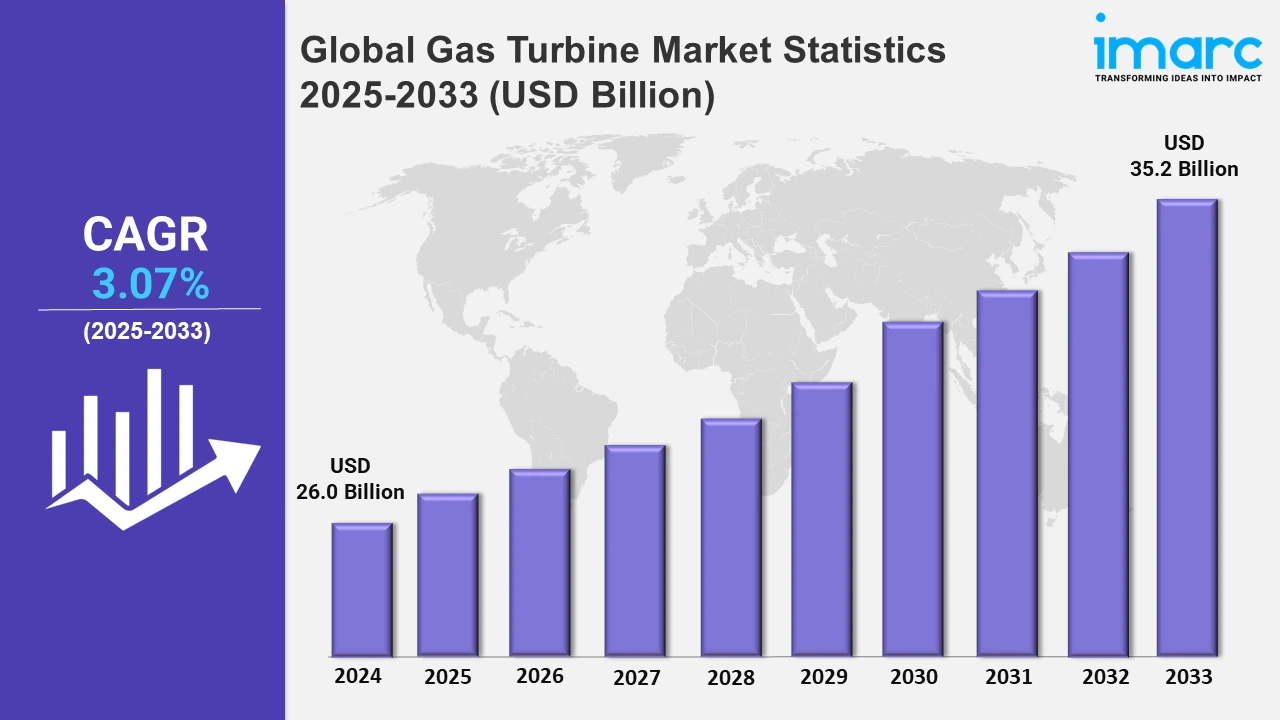

The global gas turbine market size was valued at USD 26.0 Billion in 2024, and it is expected to reach USD 35.2 Billion by 2033, exhibiting a growth rate (CAGR) of 3.07% from 2025 to 2033.

To get more information on this market, Request Sample

The advancements in lightweight materials, energy efficiency, and propulsion systems are driving significant growth in the global gas turbine market. In parallel to this, manufacturers are focusing on innovative designs to improve fuel efficiency, reduce emissions, and enhance performance for various applications, including aviation, power generation, and hydrogen projects. On the contrary, the integration of hybrid propulsion systems is a major factor supporting market growth. For instance, in April 2024, NSK Ltd. launched gas turbine generator bearings for electric vertical takeoff and landing (eVTOL) aircraft, featuring a novel lubrication mechanism that reduces lubricant supply by 80% and power loss by 30%. These bearings enable lightweight designs, extend flight range, and improve high-speed performance, aligning with the industry's growing emphasis on sustainable and efficient aviation technologies.

Meanwhile, the market is experiencing growth due to the increasing investments in domestic manufacturing capabilities and energy independence. For example, in October 2024, Russia commissioned its first domestically produced high-capacity gas turbine, the GTD-110M, at the Udarnaya power station. This turbine was developed by Rostec, which enhances technological self-reliance, providing a capacity of 560 MW and fulfilling 10% of the Krasnodar region's electricity needs. Moreover, the growing adoption of hydrogen-ready technologies is shaping the market dynamics. GE Vernova secured its first customer for its 100% hydrogen-ready aeroderivative gas turbine, the LM6000VELOX, in November 2024. Four units are set to power the 200-MW Whyalla hydrogen plant in South Australia, with commissioning expected by early 2026. This milestone underscores the increasing shift toward hydrogen combustion technology, driven by the global transition to clean energy solutions. Collectively, these advancements are bolstering the market, as manufacturers focus on efficiency, sustainability, and regional development to meet future energy needs.

Global Gas Turbine Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, Europe, North America, the Middle East and Africa, and Latin America. According to the report, Asia-Pacific dominates the gas turbine market due to the rapid industrialization and urbanization in countries like China, India, and Southeast Asia, driving energy demand.

North America Gas Turbine Market Trends:

In North America, the market is experiencing growth due to the shift toward cleaner energy and the integration of combined-cycle gas turbine (CCGT) systems. In line with this, the United States is investing in gas-fired power plants, particularly in Texas, to reduce coal dependency. For example, projects like the Cricket Valley Energy Center showcase the region’s commitment to advancing gas turbine technology for efficient power generation.

Europe Gas Turbine Market Trends:

Europe is focusing on upgrading older power plants with more efficient gas turbines to meet stringent emission standards. Germany, for instance, is leading in adopting hydrogen-ready turbines to transition toward renewable energy. Companies like Siemens Energy are setting benchmarks with hydrogen-compatible turbines, ensuring sustainable energy production while complying with environmental policies in the region.

Asia-Pacific Gas Turbine Market Trends:

Asia-Pacific is leading in the market, driven by the region's focus on transitioning to cleaner energy sources. This is propelling the adoption of advanced gas turbines, particularly in hybrid and hydrogen-compatible configurations. Furthermore, in November 2024, Keppel installed a gas turbine at Singapore's first hydrogen-compatible cogeneration plant, the 600-MW Keppel Sakra Cogen Plant, which is currently 80% complete. This facility, set to begin operations in 2026, will significantly reduce carbon emissions by over 6 million tons. Such initiatives underline Asia Pacific's leadership in integrating cutting-edge gas turbine technologies to meet sustainability goals and address the region's growing energy requirements.

Latin America Gas Turbine Market Trends:

Latin America is expanding its gas turbine market through investments in natural gas infrastructure, driven by abundant reserves in countries like Brazil. In contrast, projects, such as the Sergipe Power Plant, Latin America’s largest gas-fired power facility, underline the focus on meeting rising electricity demand while transitioning toward cleaner energy sources across the region.

Middle East and Africa Gas Turbine Market Trends:

In the Middle East and Africa, demand is rising for gas turbines to power industrial growth and meet energy demands. Furthermore, Saudi Arabia is prioritizing initiatives like the Jazan Integrated Gasification Combined Cycle Plant, showcasing a push for high-efficiency turbines. These efforts aim to balance economic growth with sustainability by optimizing gas turbine technology in power generation.

Top Companies Leading in the Gas Turbine Industry

Some of the leading gas turbine market companies include Kawasaki Heavy Industries, Siemens, GE, MHPS, Ansaldo, Harbin Electric, OPRA, MAN Diesel, Solar Turbines, Vericor Power, BHEL, Centrax, Zorya, Caterpillar, General Electric, and Mitsubishi Heavy Industries, among many others. In November 2023, Kawasaki Heavy Industries announced that it had established a framework for all types of sustainable finance.

Global Gas Turbine Market Segmentation Coverage

- On the basis of the technology, the market has been bifurcated into combined cycle gas turbine and open cycle gas turbine, wherein combined cycle gas turbine represents the most preferred segment. This technology integrates both gas and steam turbines, optimizing energy efficiency by utilizing the waste heat from the gas turbine to produce additional electricity through the steam turbine.

- Based on the design type, the market is categorized into heavy duty (frame) type and aeroderivative type, amongst which heavy duty (frame) type dominates the market. Heavy-duty gas turbines are robust, large-scale machines designed for high-power applications, such as utility and industrial power plants.

- On the basis of the rated capacity, the market has been divided into above 300 MW, 120-300 MW, 40-120 MW, and less than 40 MW. Among these, above 300 MW exhibits a clear dominance in the market. These turbines are integral to meeting the substantial electricity demands of urban centres and industrial complexes.

- Based on the end user, the market is bifurcated into power generation, mobility, oil and gas, and others, wherein power generation dominates the market. Gas turbines play a pivotal role in the power generation sector, where they are employed in a variety of applications, from large utility-scale power plants to distributed energy systems.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 26.0 Billion |

| Market Forecast in 2033 | USD 35.2 Billion |

| Market Growth Rate 2025-2033 | 3.07% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Combined Cycle Gas Turbine, Open Cycle Gas Turbine |

| Design Types Covered | Heavy Duty (Frame) Type, Aeroderivative Type |

| Rated Capacities Covered | Above 300 MW, 120-300 MW, 40-120 MW, Less Than 40 MW |

| End Users Covered | Power Generation, Mobility, Oil and Gas, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Kawasaki Heavy Industries, Siemens, GE, MHPS, Ansaldo, Harbin Electric, OPRA, MAN Diesel, Solar Turbines, Vericor Power, BHEL, Centrax, Zorya, Caterpillar, General Electric, Mitsubishi Heavy Industries, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Gas Turbine Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)