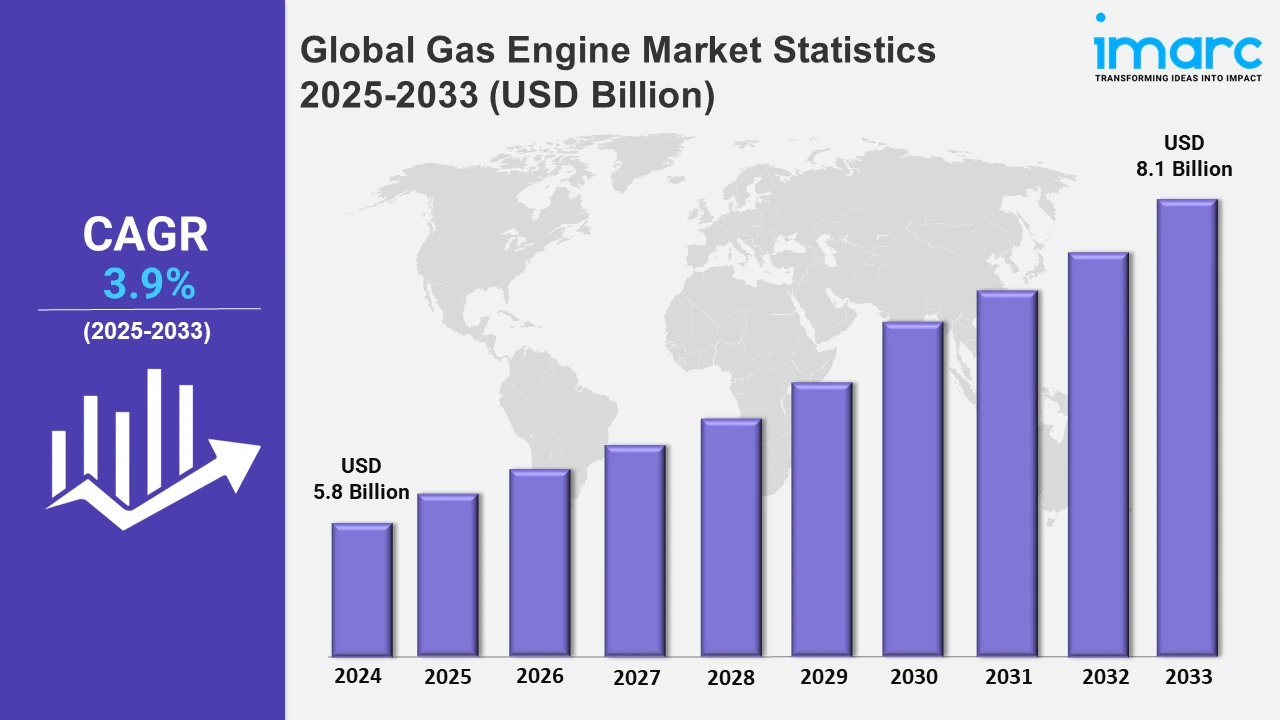

Global Gas Engine Market Expected to Reach USD 8.1 Billion by 2033 - IMARC Group

Global Gas Engine Market Statistics, Outlook and Regional Analysis 2025-2033

The global gas engine market size was valued at USD 5.8 Billion in 2024, and it is expected to reach USD 8.1 Billion by 2033, exhibiting a growth rate (CAGR) of 3.9% from 2025 to 2033.

To get more information on this market, Request Sample

The growing emphasis on lessening greenhouse gas emissions is driving the demand for gas engines, as they produce notably lower footprints in comparison to coal or oil-based power systems. Governing bodies and industries are prioritizing cleaner energy sources, making gas engines a preferred option for power generation. Furthermore, the adoption of gas engines in cutting-edge vehicle designs highlights their role in achieving higher fuel efficiency and reduced emissions. These engines, when paired with innovative technologies like aerodynamic enhancements and low-resistance components, demonstrate their ability to meet stringent environmental standards while maintaining operational efficiency. This trend is driving the demand for gas engines in commercial and heavy-duty vehicle applications. In 2024, Shell introduced the Starship 3.0, a Class 8 concept truck powered by a Cummins X15N natural gas engine. It achieved significant efficiency gains, including 9 mpg, and reduced carbon emissions by 15% while maintaining practicality for fleets. The truck combines aerodynamic design and low-resistance tires for enhanced performance.

Additionally, the rising popularity of decentralized energy systems because of their reliable and effective power supply closer to where it is needed is supporting the market growth. Gas engines are crucial in such environment, particularly in remote and off-grid areas, guaranteeing dependable and adaptable energy. Besides this, the development of hydrogen-ready gas engines is revolutionizing the market by offering future-proof solutions aligned with net-zero energy goals. These engines provide the flexibility to operate on natural gas while being capable of transitioning to hydrogen as it becomes more accessible. In 2024, Wärtsilä released the first-ever large-scale power plant utilizing a 100% hydrogen-ready engine, built on the Wärtsilä 31 platform, as a way to aid net-zero energy systems. This adaptable solution, certified by TÜV SÜD, currently operates on natural gas but can switch to hydrogen in the future. Orders can be placed for it in 2025, and deliveries will begin in 2026.

Global Gas Engine Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of an advanced infrastructure, abundant natural gas availability, and increasing adoption of cleaner energy technologies across industries and utility sectors.

North America Gas Engine Market Trends:

North America dominates the gas engine market, driven by widespread adoption of cleaner energy technologies and abundant natural gas reserves. Strong government policies supporting emission reduction and the growth of combined heat and power (CHP) systems further drive the demand. The region also benefits from advanced infrastructure and consistent investments in energy-efficient solutions, making it a hub for technological advancements in gas engine development. Additionally, the presence of major manufacturers ensures a steady supply of innovative products tailored to meet diverse energy requirements across sectors, solidifying North America’s leading position in the market. In 2024, Daimler Truck North America introduced the fifth version of the Freightliner Cascadia, showcasing enhanced safety features, upgraded aerodynamics, and Detroit DD13 and DD15 engines. Starting in 2026, the product range will feature Cummins X15 diesel and X15N natural gas engines.

Asia-Pacific Gas Engine Market Trends:

Asia Pacific is emerging as a key market for gas engines due to its increasing focus on sustainable energy solutions and expanding investments in renewable energy projects. Countries in the region are leveraging gas engines for their efficiency in power generation and adaptability to various fuel types, including biogas and natural gas.

Europe Gas Engine Market Trends:

Europe holds a considerable market share attributed to the growing focus on lessening carbon emissions and achieving energy sustainability goals. The region benefits from the growing employment natural gas and biogas for generating power and cogenerations applications. Strong regulatory frameworks supporting renewable energy integration, coupled with ongoing technological innovations, enhance the market growth. European manufacturers are also at the forefront of delivering advanced gas engines with high efficiency and environmental compliance.

Latin America Gas Engine Market Trends:

Latin America showcases promising growth in the gas engine market due to increasing adoption of cost-effective and environment-friendly energy systems. The region leverages its abundant natural gas reserves to meet rising energy demands efficiently. Governments are actively encouraging the transition to cleaner fuels, which boosts gas engine deployment in power generation and industrial applications.

Middle East and Africa Gas Engine Market Trends:

The Middle East and Africa is a growing segment in the market, primarily supported by their substantial natural gas reserves and increasing energy diversification initiatives. Governments and industries in the region are prioritizing investments in cleaner and more sustainable energy sources, which enhances the adoption of gas engines across various applications.

Top Companies Leading in the Gas Engine Industry

Some of the leading gas engine market companies include Caterpillar Inc., China Yuchai International Limited, Cummins Inc., Doosan Corporation, General Electric Company, Hyundai Heavy Industries Co. Ltd., JFE Holdings Inc., Kawasaki Heavy Industries Ltd., Mitsubishi Heavy Industries Ltd., Rolls-Royce plc, Siemens AG, Volkswagen AG, and Wärtsilä Oyj Abp, among many others. In 2024, Cummins Inc. announced the launch of the X15N big bore natural gas engine, offering 500 HP and improved fuel efficiency. Certified to meet CARB 2024 emissions regulations, it supports renewable natural gas for reduced carbon intensity.

Global Gas Engine Market Segmentation Coverage

- On the basis of the fuel type, the market has been categorized into natural gas, special gas, and others, wherein natural gas represents the leading segment. Natural gas dominates the market because it is readily available, affordable, and produces fewer carbon emissions in comparison to other fuels. It clean-burning nature and adherence to strict environment mandates make it an ideal option for various sectors. Furthermore, improvements in methods of extracting natural gas, like hydraulic fracturing and horizontal drilling, are increasing its availability.

- Based on the power output, the market is classified into 0.5-1 MW, 1-2 MW, 2-5 MW, 5-10 MW, and 10-20 MW, amongst which 1-2 MW dominates the market. 1-2 MW is the largest segment attributed to its optimal mix of power and efficiency, which is crucial for industrial and commercial use. These power output engines are commonly employed in manufacturing, power generation, and small-scale utilities, where there is a need for moderate power. Their versatility, cost-effectiveness, and ability to integrate with combined heat and power (CHP) systems contribute significantly to their market leadership.

- On the basis of the application, the market has been divided into mechanical drive, power generation, cogeneration, and others. Among these, power generation accounts for the majority of the market share. Power generation dominates the market accredited to the growing need for dependable and efficient energy solutions. Gas engines are commonly employed for power generation owing to their capacity to offer stable power while producing lesser emission than traditional fossil fuels. Their ability to function with renewable gases further improves their appeal, positioning them an ideal option for utilities, industries, and decentralized energy systems striving to meet environmental regulations.

- Based on the industry vertical, the market is segregated into utilities, manufacturing, oil and gas, mining, and others, wherein utilities hold the biggest market share. Utilities leads the market owing to the growing demand for decentralized energy solutions and efficient power generation systems. Gas engines are employed in utility applications for various purposes, including grid stabilization, management of peak load, and power backup. The ability of these engines to offer cleaner energy, coupled with their adaptability to work with renewable fuels, aligns with the objective of the industry of lowering carbon footprints and fulfilling increasing energy demands in a sustainable manner.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 8.1 Billion |

| Market Growth Rate 2025-2033 | 3.9% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | Natural Gas, Special Gas, Others |

| Power Outputs Covered | 0.5-1 MW, 1-2 MW, 2-5 MW, 5-10 MW, 10-20 MW |

| Applications Covered | Mechanical Drive, Power Generation, Cogeneration, Others |

| Industry Verticals Covered | Utilities, Manufacturing, Oil and Gas, Mining, Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Caterpillar Inc., China Yuchai International Limited, Cummins Inc., Doosan Corporation, General Electric Company, Hyundai Heavy Industries Co. Ltd., JFE Holdings Inc., Kawasaki Heavy Industries Ltd., Mitsubishi Heavy Industries Ltd., Rolls-Royce plc, Siemens AG, Volkswagen AG, Wärtsilä Oyj Abp, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)