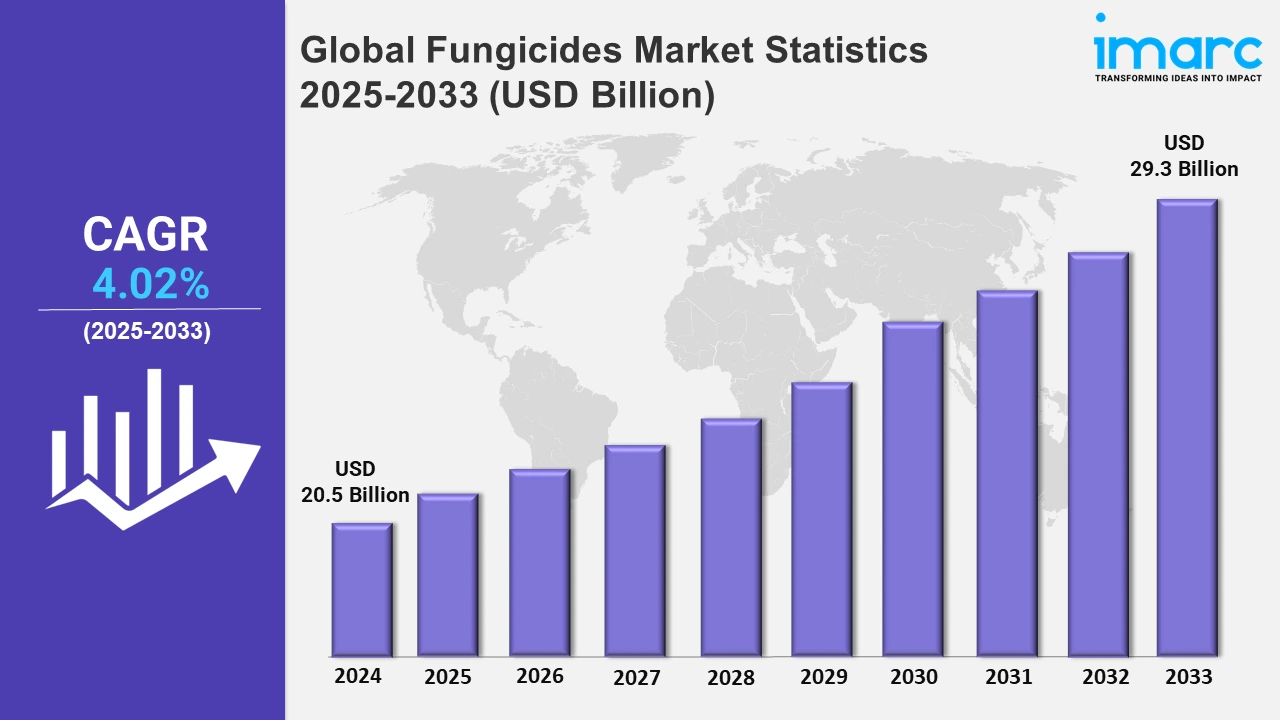

Global Fungicides Market Expected to Reach USD 29.3 Billion by 2033 - IMARC Group

Global Fungicides Market Statistics, Outlook and Regional Analysis 2025-2033

The global fungicides market size was valued at USD 20.5 Billion in 2024, and it is expected to reach USD 29.3 Billion by 2033, exhibiting a growth rate (CAGR) of 4.02% from 2025 to 2033.

To get more information on this market, Request Sample

The global fungicides market is driven by the rising need to safeguard crops from fungal diseases that threaten agricultural output and food safety. Plant pathogens and pests are predicted to cause up to 40% yield losses in major crops, such as maize, rice, and wheat, leading to annual worldwide economic losses of approximately USD 220 billion, according to the APS Journals. Climate variability, characterized by increased temperatures and irregular rainfall distribution, has amplified the risk of fungal outbreaks, leading to an even greater demand for effective crop protection measures. High-value crops, especially cereals, fruits, vegetables, and oilseeds, are most sensitive to such attacks, prompting farmers to adopt fungicides to ensure healthy yields and reduce economic losses.

Technological advancements in agricultural sector are also propelling the market growth. Precision farming techniques allow for the efficient application of fungicides, waste and environmental impact reduced, and effectiveness improved. Innovations in fungicide formulations, such as systemic and bio-based ones, address concerns about resistance and sustainability. Bio fungicides, which are derived from natural microorganisms, are gaining popularity due to consumers and regulators pushing for environmentally friendly and residue-free solutions. Stringent regulations, especially in the Europe and North America region, are shaping market dynamics. Even though such regulations help minimize the environmental impact of chemical fungicides, they promote the development and adoption of safer alternatives. Rising disposable incomes and government initiatives that support modern farming practices in the Asia-Pacific and Latin America regions are driving demand for fungicides. E-commerce and increasing retail networks further improve accessibility even in distant areas, facilitating the fungicides market's growth. Moreover, IPM systems incorporating fungicides also increase their widespread utilization as a part of balanced crop protection measures. Owing to the rising trend for sustainability and global food demands, the fungicides market is likely to experience excellent growth as innovation, adherence to regulatory requirements, and effective disease management solutions continue to become increasingly essential.

Global Fungicides Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share due to its diverse agricultural activities and growing population, driving demand for increased productivity and food security.

Asia Pacific Fungicides Market Trends:

The Asia-Pacific fungicides market is growing at a fast pace, driven by the growth of the agricultural sector in the region. According to the Economic Trends and Prospects in Developing Asia: Southeast Asia report released by the Asian Development Bank (ADB), agriculture in Southeast Asia increased by 4.5% in the first half of 2024. With major agricultural producers like China, India, and Indonesia focusing more on the protection of high-value crops such as rice, wheat, and fruits, the demand for fungicides is increasing. These crops, especially those that grow in water-rich areas with temperatures that favor the growth of fungi, need more protection and, therefore, are associated with the increased use of fungicides. This is in line with the move toward more sustainable practices in agriculture, such as the use of advanced fungicides based on biotechnology. Some of these fungicides are widely used, especially in crop protection for reducing environmental impact. Government policies, including subsidies on crop protection chemicals and incentives to enhance agricultural productivity, have further pushed the fungicides market in the region. Retail and e-commerce platforms have also emerged, increasing the availability of crop protection products even in rural areas. The rise in disposable incomes in the region also enhances the ability of farmers to get high-quality, premium-grade fungicides, which further helps improve the Asia-Pacific region to be a key growth driver in the fungicides industry market.

North America Fungicides Market Trends:

The North America fungicides market is propelled by advanced agricultural practices and a high emphasis on crop protection to ensure high yields. With an increase in fungal infestations owing to climate variability, the demand for fungicides has been enhanced. Farmers are opting for novel formulations like systemic and bio-based fungicides to overcome disease resistance and environmental issues. Stringent regulation also pushes safer, eco-friendly product use while high-value crop growth through fruits and vegetables expands further for the industry. Increasing precision agriculture is also found to increase the use efficiency of fungicides.

Europe Fungicides Market Trends:

Regulation and regulatory compliance push higher sales of fungicides across Europe due to adherence to sustainable agriculture and safer eco-friendly product use in this region. The growing demand for organic and bio-based fungicides is a reflection of the region's emphasis on reducing environmental impacts. Increasing fungal outbreaks, especially in cereals and vineyards, call for advanced fungicide formulations. Disease management is of prime importance for farmers to ensure quality export standards. Government subsidies and initiatives to support sustainable agriculture also boost fungicide usage. Precision farming practices and developments in crop protection technologies further promote fungicide usage in Europe.

Latin America Fungicides Market Trends:

Latin America fungicides market is dominated by large-scale cultivation of export-oriented crops such as soybeans, corn, and coffee, which are all highly susceptible to fungal diseases. Farmers are increasingly using fungicides to manage outbreaks and optimize yield. High-value fruit and vegetable farming expansions also support demand for targeted fungicide applications. Rising adoption of integrated pest management practices encourages the use of bio-based and systemic fungicides. Additionally, improving access to agricultural inputs through government programs and private investments is expanding fungicide usage in rural and emerging markets.

Middle East and Africa Fungicides Market Trends:

The fungicides market in the Middle East and Africa is driven by increasing agricultural activities to meet the rising food demand. Climatic conditions favorable to the growth of fungi, including high temperature and humidity, are driving fungicide adoption. Farmers are concerned with maximizing crop yields and minimizing post-harvest losses, which increases demand for fungicides. Government initiatives supporting modern farming techniques and the shift toward bio-based products are also boosting market growth. Increased access to agricultural inputs through better distribution networks is also promoting the adoption of fungicides.

Top Companies Leading in the Fungicides Industry

Some of the leading fungicides market companies include American Vanguard Corporation, Atticus, Nufarm Limited, Sumitomo Chemical Co., Ltd., LLC, BASF SE, Bayer AG, Botano Health, Corteva Inc., FMC Corporation, Isagro SpA (Gowan Company LLC), Marrone Bio Innovations Inc, Syngenta AG, Terramera Inc, UPL Limited, etc.

- On 28 May 2024, BASF launched Aramax Intrinsic branded fungicide, a new dual-active solution for the long-lasting control of 26 turf diseases on golf fairways. It contained long-lasting control of up to 28 days through blending pyraclostrobin with triticonazole while improving stress tolerance and efficient growth in turf, respectively.

Global Fungicides Market Segmentation Coverage

- Based on the type, the market is divided into chemical (triazoles, strobilurins, dithiocarbamates, chloronitriles, phenylamides, and others) and biological (microbials, microchemical, and macrobials) fungicides. Chemical fungicides contribute the majority of market share as they have proved to be more effective in managing a vast range of fungal diseases of diversified crops. These fungicides under the subcategories Triazoles, Strobilurins, and Dithiocarbamates are highly preferred due to their robust activity against major fungal pathogens and their compatibility with various crop protection programs. Chemical fungicides have wide adaptation in intensive farming as these can be used cost-efficiently, have a long shelf life, and give dependable results. Despite this shift in the direction of sustainability, the adoption rate of biological fungicides is slower compared to chemicals due to increased cost, limited awareness, and region-specific challenges. Global farm operations primarily rely on chemical fungicides, developing countries depend significantly on chemical fungicides as high crop yields are critical there.

- On the basis of the form, the market is segmented into liquid ((suspension concentrates (SC), emulsifiable concentrates (EC), and soluble liquid flowables (SLC)), and dry ((water dispersible granules (WDG) and wettable powder (WP)) fungicides, while the liquid formulations hold a majority share in the industry. They are easy to spray, provide better coverage, and exhibit fewer problems of compatibility with modern spray plant liquid fungicides that have better usage. These are segmented under Liquid fungicide Suspension Concentrates (SC), Emulsifiable Concentrates (EC), and Soluble Liquid Flowables (SLC). Their ability to deliver consistent results in a wide variety of agricultural settings makes them indispensable for large-scale farming operations. Additionally, liquid formulations are easier to dilute and mix with other agricultural inputs, providing added convenience for farmers. Though formulations in dry form, like Water Dispersible Granules and Wettable Powders, are also used on occasions, their demand is minimal due to problems in their application, like uneven dispersal and dissolution problems, so liquid forms lead the market.

- Based on the crop type, the market is categorized into fruits and vegetables (apple, pears, cucumber, potatoes, grapes, and others), cereals and grains (corn, wheat, rice, and others), and oilseeds and pulses (soybean, cotton, and others), in which cereals and grains represent the leading segment. Cereals, corn, wheat, and rice produce the highest proportion of agricultural output in the world and show the maximum vulnerability to fungal infestations, including rusts, blights, and smuts. The economic importance of these crops as a means of food security and providing for the world's demand translates into heavy use of fungicides. Farmers prefer to protect their cereals and grains first by applying fungicides to save yield and quality, where applicable, for export. Oilseed, pulse, and fruit productivity are also affected by pathogens, but the sheer volume of cereal crop production places these crops at the top of this list. Moreover, government policies encouraging the preservation of staple crops drive fungicide consumption in this segment.

- On the basis of the mode of action, the market is classified into contact and systemic fungicides. Contact fungicides are leading the market, as they act immediately upon application, forming a protective coating on the plant surface that prevents fungal spores from germinating. Their rapid action and low cost make them very popular among farmers, especially for crops that are easily affected by sudden fungal attacks. The broad-spectrum activity of contact fungicides against a variety of pathogens also makes them very attractive. Although Systemic fungicides provide long-term protection as they penetrate the plant tissues, their higher cost and complicated application methods limit their extensive use. Contact fungicides remain the favorite for speedy and affordable disease control management, especially in developing countries with no easy access to high technology in agriculture.

- Based on the application, the market has been segmented into seed treatment, soil treatment, foliar spray, chemigation, and post-harvest, out of which seed treatment holds the highest share in the market. Seed treatment fungicides are integral to modern agriculture as they protect crops from fungal infections at the earliest stages of growth. By targeting pathogens before they can impact germination and seedling health, seed treatments significantly improve crop yield and resilience. Their targeted nature ensures minimal wastage and reduces the environmental impact compared to other application methods. It also has a cost-effective advantage as seed treatment helps avoid multiple fungicide applications over the crop cycle. Other methods, such as foliar spraying, are reactive and used for controlling existing infections, while seed treatments are the most proactive and efficient approach and, with high-value crops like cereals and grains.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 20.5 Billion |

| Market Forecast in 2033 | USD 29.3 Billion |

| Market Growth Rate 2025-2033 | 4.02% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Forms Covered |

|

| Crop Types Covered |

|

| Mode of Actions Covered | Contact, Systemic |

| Applications Covered | Seed Treatment, Soil Treatment, Foliar Spray, Chemigation, Post-Harvest |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American Vanguard Corporation, Atticus, LLC, BASF SE, Bayer AG, Botano Health, Corteva Inc., FMC corporation, Isagro SpA (Gowan Company LLC), Marrone Bio Innovations Inc, Nufarm Limited, Sumitomo Chemical Co., Ltd., Syngenta AG, Terramera Inc, UPL Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)