Global Freight Management System Market Expected to Reach USD 39.8 Billion by 2033 - IMARC Group

Global Freight Management System Market Statistics, Outlook and Regional Analysis 2025-2033

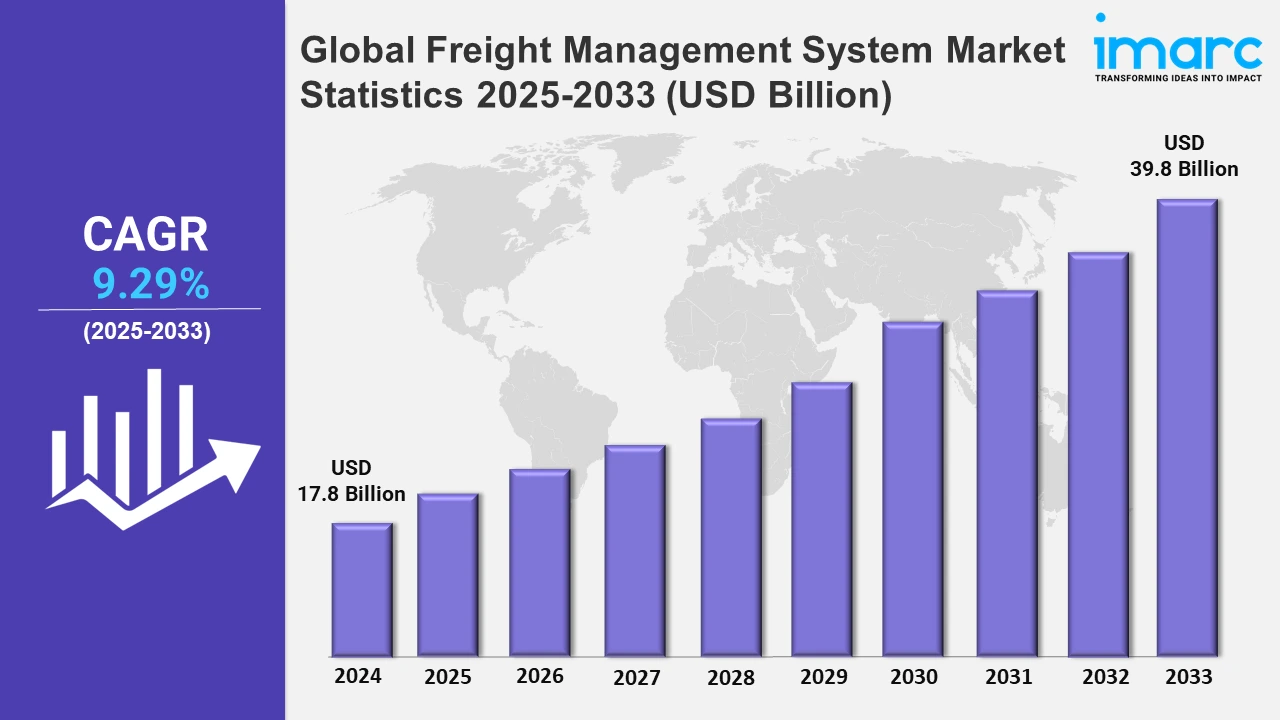

The global freight management system market size was valued at USD 17.8 Billion in 2024, and it is expected to reach USD 39.8 Billion by 2033, exhibiting a growth rate (CAGR) of 9.29% from 2025 to 2033.

To get more information on the this market, Request Sample

The growing demand for freight management systems due to the thriving e-commerce sector is offering a favorable market outlook. People are preferring quick and seamless delivery options, often within the same day or just a few days at most. This shift is putting immense pressure on logistics and supply chain networks to handle high volumes while maintaining precision in delivery timelines. Freight management systems help businesses navigate these challenges by offering tools for efficient route planning, real time tracking, and automated scheduling. These systems optimize fleet operations, reducing delays and enabling on-time deliveries even during peak shopping periods. Additionally, they provide visibility across the supply chain and allow businesses to respond quickly to changing demands or logistical issues. In addition, the push for accurate and timely deliveries also means tighter integration of warehousing, inventory management, and last-mile delivery solutions. Freight management ensures that orders are processed swiftly and correctly. According to Forbes, the e-commerce market is anticipated to reach USD 7.9 trillion by 2027.

The escalating demand for freight management systems due to the rising number of residential and commercial spaces is impelling the market growth. There is an increase in the need for sophisticated coordination systems to ensure that goods reach places on time. Freight management systems aid in offering comprehensive tools for route optimization, real time tracking, and efficient scheduling. Additionally, modern urban areas often have stricter regulations related to noise, emissions, and delivery times to maintain quality of life. Freight management systems help logistics providers adhere to these local rules by optimizing delivery windows and suggesting routes that reduce congestion and emissions. Besides this, the development of smart cities further amplifies the need for advanced freight systems. The research report of the IMARC Group states that the global real estate market size is expected to reach US$ 8,654 Billion by 2032.

Global Freight Management System Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of rising preferences for online shopping, technological advancements, and regulatory compliance.

North America Freight Management System Market Trends:

As per the Statsup, in the first quarter of 2024, United States retail e-commerce sales were around USD 289.2 billion. The burgeoning e-commerce sector in the North American region is catalyzing the demand for efficient logistics and supply chain solutions. Additionally, people are increasingly preferring fast and reliable deliveries that is prompting companies to invest in freight management systems to optimize delivery schedules and improve user satisfaction. Furthermore, the market is expanding in North America because of the integration of cutting-edge technologies like cloud computing, the Internet of Things, and artificial intelligence (AI). Data-driven decision-making and real-time tracking are made possible due to these technologies.

Asia-Pacific Freight Management System Market Trends:

The market is expanding rapidly, driven by the thriving e-commerce industry in countries like China and India. This necessitates advanced freight management solutions to manage high-order volumes, ensure timely deliveries, and optimize routes and costs. Moreover, governing agencies in the region are investing in policies and initiatives to promote logistics and transportation.

Europe Freight Management System Market Trends:

Europe has strict environmental laws designed to lower carbon emissions and encourage sustainable practices. Through route optimization and fuel consumption reduction, freight management systems assist businesses in adhering to these laws. Companies in the region are constantly looking for ways to enhance cost-efficiency within their logistics operations due to various economic pressures.

Latin America Freight Management System Market Trends:

Increasing trade activities in the Latin America region is catalyzing the demand for efficient freight management systems. These systems help businesses handle complex logistics operations associated with cross-border and international trade. Additionally, these systems play a crucial role in meeting user expectations for quick and reliable deliveries in this expanding e-commerce landscape.

Middle East and Africa Freight Management System Market Trends:

Countries in the Middle East and Africa region such as the United Arab Emirates (UAE) and Saudi Arabia are aiming to become global logistics hubs and adopting freight management technologies to enhance efficiency and competitiveness. In addition, the rising adoption of technologies like artificial intelligence (AI) and blockchain in logistics to improve operational transparency is impelling the market growth.

Top Companies Leading in the Freight Management System Industry

Some of the leading freight management system market companies include Blue Yonder Group Inc. (Panasonic Holdings Corporation), C.H. Robinson Worldwide Inc., Ceva Logistics (CMA CGM Group), DB Schenker (Deutsche Bahn AG), e2open LLC (E2open Parent Holdings Inc.), Kuehne + Nagel International AG, McLeod Software, MercuryGate International Inc., Oracle Corporation, SAP SE, The Descartes Systems Group Inc., United Parcel Service of America Inc., and Werner Enterprises Inc., among many others. Key players in the market are focusing on engaging in partnerships, integrating advanced technologies, and introducing products that offer enhanced convenience. For instance, on 30 September 2024, CEVA Logistics announced that it would take over CMA CGM’s freight management as part of a new agreement to strengthen their partnership. The deal allows CEVA to expand its service and improve operational efficiency by managing CMA CGM’s freight management.

Global Freight Management System Market Segmentation Coverage

- On the basis of the component, the market has been categorized into solution (planning, execution and operations, and control and monitoring) and service (consulting, system integration and deployment, and support and maintenance), wherein solution represents the leading segment. Solution offers advanced functionalities like route optimization, real time tracking, fleet management, and data analytics. These capabilities offer significant value to logistics companies looking to streamline operations and improve efficiency. Companies are preferring comprehensive solutions that integrate seamlessly with their existing infrastructure such as enterprise resource planning (ERP) and warehouse management systems. This integration allows for enhanced communication across departments and improved decision-making.

- Based on the transportation mode, the market is classified into rail freight, road freight, ocean freight, and air freight, amongst which road freight dominates the market. The rising focus on road freight, as it offers direct door-to-door delivery as compared to other forms of transportation, is impelling the market growth. This feature is particularly advantageous for industries that rely on timely deliveries. For shorter distances, road freight is often more economical compared to air or ocean freight.

- On the basis of the end user, the market has been divided into third-party logistics, forwarders, brokers, shippers, and carriers. Among these, third-party logistics accounts for the majority of the market share. Third-party logistics (3PL) help in handling large volumes of shipments that benefit in improving efficiency while ensuring timely deliveries. 3PL providers cater to businesses of different sizes and industries, requiring scalable solutions that can adapt to varying demands. Freight management systems offer this flexibility, supporting the growth and diversification of 3PL services.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 17.8 Billion |

| Market Forecast in 2033 | USD 39.8 Billion |

| Market Growth Rate 2025-2033 | 9.29% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered |

|

| Transportation Modes Covered | Rail Freight, Road Freight, Ocean Freight, Air Freight |

| End Users Covered | Third-party Logistics, Forwarders, Brokers, Shippers, Carriers |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Blue Yonder Group Inc. (Panasonic Holdings Corporation), C.H. Robinson Worldwide Inc., Ceva Logistics (CMA CGM Group), DB Schenker (Deutsche Bahn AG), e2open LLC (E2open Parent Holdings Inc.), Kuehne + Nagel International AG, McLeod Software, MercuryGate International Inc., Oracle Corporation, SAP SE, The Descartes Systems Group Inc., United Parcel Service of America Inc., Werner Enterprises Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)