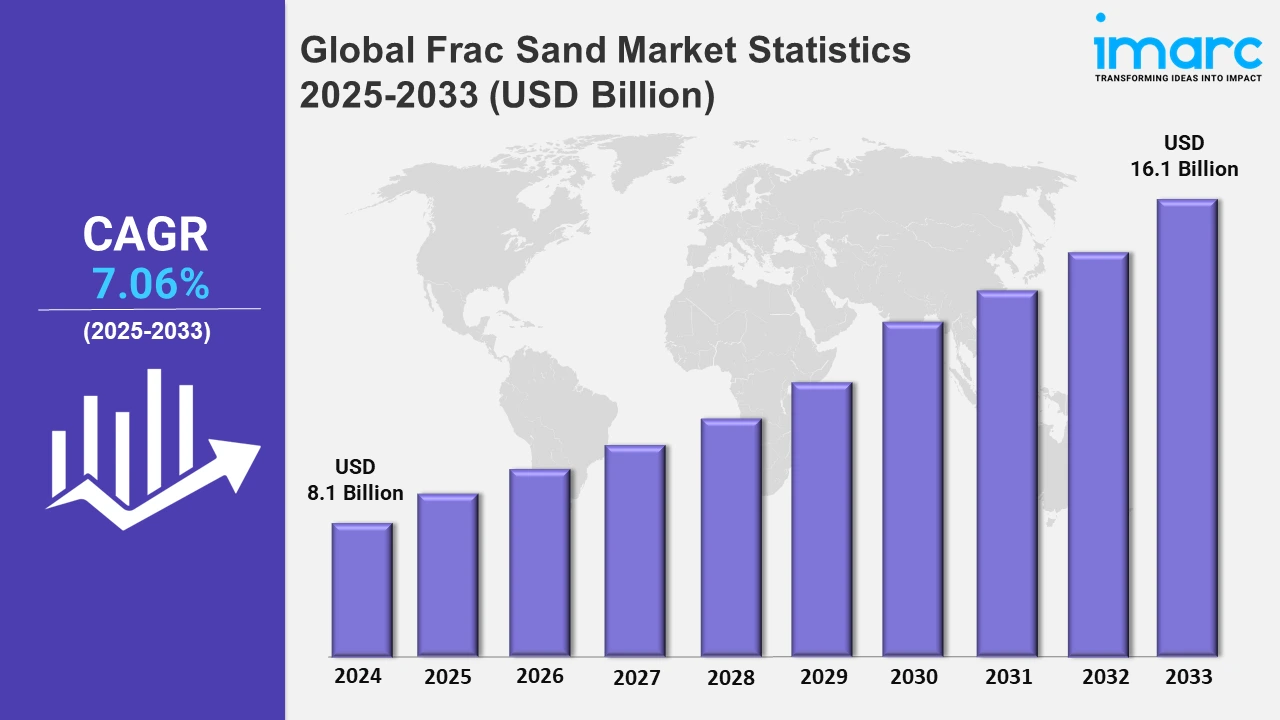

Global Frac Sand Market to Grow at 7.06% During 2025-2033, Reaching USD 16.1 Billion by 2033

Global Frac Sand Market Statistics, Outlook and Regional Analysis 2025-2033

The global frac sand market size was valued at USD 8.1 Billion in 2024, and it is expected to reach USD 16.1 Billion by 2033, exhibiting a growth rate (CAGR) of 7.06% from 2025 to 2033.

To get more information on this market, Request Sample

To produce natural gas and oil from unconventional shale formations, hydraulic fracturing or fracking is necessary. Fracking activity is increasing worldwide due to the rising need for energy worldwide, especially in the United States and other shale-rich countries. Since frac sand is pivotal for this process, there is a rise in the demand for frac sand with each new well and larger drilling project. Significant volumes of frac sand are needed for each well with modern hydraulic fracturing techniques. Even greater amounts of sand are needed for fracking innovations like horizontal drilling and multi-stage fracturing to maintain open cracks and allow hydrocarbons to flow freely. Frac sand is the favored proppant in many shale formations because hydraulic fracturing businesses use it to maximize production while controlling expenses. As per the IMARC Group’s report, the global hydraulic fracturing market is expected to reach US$ 77.7 Billion by 2032.

Water filtration systems can make use of frac sand, which is renowned for its durability and high silica content. High-quality frac sand is an efficient filtration medium, particularly for eliminating contaminants in industrial and municipal water treatment facilities, because of its robust granular structure and resistance to chemical breakdown. Strong filtration technologies are in greater demand as concerns about water safety and quality are increasing around the world. Sand-based filtration is frequently used to filter water in industrial facilities, agricultural operations, and municipal water sources. Frac sand is perfect for these systems, especially because of its uniform grain size and high silica purity, which helps meet the increasing need for clean water. The IMARC Group’s report shows that the global water purifier market is expected to reach US$ 108.3 Billion by 2032.

Global Frac Sand Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Asia-Pacific, Europe, the Middle East and Africa, and Latin America. According to the report, North America accounts for the largest market share due to its extensive shale reserves and high reliance on hydraulic fracturing for oil and gas extraction, particularly in major shale regions like the Permian Basin, Bakken, and Eagle Ford.

North America Frac Sand Market Trends:

Because of the vast shale reserves in the United States and Canada, as well as the considerable usage of hydraulic fracturing in oil and gas extraction, North America leads the market. Fracking activity is increasing significantly in key areas, including the Permian Basin, Eagle Ford, and Bakken, which is driving the demand for frac sand. This demand is further enhanced by technological developments in multi-stage fracturing and horizontal drilling, which are raising the amount of frac sand required per well. With many of its mines situated near significant shale basins, the United States, in particular, has a well-established network of frac sand mining and processing facilities, which lowers transportation costs and promotes market expansion. North America is the top geographical category due to its thriving energy sector and plenty of shale resources. According to the IMARC Group’s report, the North America frac sand market is expected to reach US$ 2,947.7 Million by 2032.

Asia-Pacific Frac Sand Market Trends:

As nations like China and Australia are exploring their shale reserves, there is a rise in the demand for hydraulic fracturing technology throughout the Asia Pacific area. With its vast shale reserves, China is attempting to increase its own energy production, which is driving an increase in hydraulic fracturing projects and, consequently, the need for frac sand. Particularly in areas like the Cooper Basin, where fracking is utilized to access shale and tight gas deposits, Australia's unconventional oil and gas industry is expanding.

Europe Frac Sand Market Trends:

Compared to North America, Europe has a smaller frac sand business because of more stringent environmental laws and less shale resources. However, region's emphasis on energy security, several European nations like Poland and the United Kingdom, are investigating shale gas production as a way to lessen their need on imported energy. Although on a lower scale, the few hydraulic fracturing projects in these locations are catalyzing the demand for frac sand.

Middle East and Africa Frac Sand Market Trends:

Due to the dominance of traditional oil extraction techniques in the Middle East and Africa, the frac sand market is still in its infancy. To diversify their energy supplies, certain nations, such as South Africa and Algeria, are starting to investigate hydraulic fracturing to produce shale gas. The limited demand for frac sand, mostly for shale drilling projects, is driven by these initiatives.

Latin America Frac Sand Market Trends:

Argentina, which has the biggest shale oil and gas deposits in the region, is the main driver of the growing frac sand business in Latin America. One of the world's most potential shale plays is Argentina's Vaca Muerta shale formation, and the nation is aggressively growing its fracking industry, which is driving the demand for frac sand.

Top Companies Leading in the Frac Sand Industry

Some of the leading frac sand market companies include CARBO Ceramics, Emerge Energy Services, Covia Holdings, Hi Crush, Source Energy Services, U.S Silica, Preferred Sands, Badger Mining Corporation, Mammoth Energy Service, Inc, Smart Sand Inc., Chongqing Changjiang, among many others. In November 2024, Covia Holdings and Black Mountain Sand Holdings LLC announced the completion of a final agreement to merge in an all-stock transaction. The combined firm, now known as Iron Oak Energy Solutions LLC, is North America's top diversified proppant supplier, with an active annual production capacity of around 30 million tons of sand.

Global Frac Sand Market Segmentation Coverage

- On the basis of the type, the market has been categorized into white sand, brown sand, and others. Brown sand represents the leading segment. Brown sand is plentiful, particularly in areas like Texas, and is primarily extracted from open-pit mining, which lowers logistical and shipping costs. Brown sand is the preferred option for many fracking operations, particularly in the early phases of oil and gas well development, due to its affordability, even though it has a somewhat lower silica content and durability than white sand. It is also very viable for large-scale hydraulic fracturing operations because of its close proximity to important shale basins in North America, which lowers supply chain costs.

- Based on the application, the market is classified into oil exploitation, natural gas exploration, and others. Natural gas exploration currently dominates the market. The need for natural gas is increasing due to the shift to cleaner-burning fuels and rising global energy demand, particularly in North America, which has a wealth of shale supplies. Frac sand plays a crucial role in the fracking process by supporting open fractures to maximize gas flow. Additionally, as businesses are striving to meet both domestic and foreign natural gas needs, the demand for frac sand is increasing due to the acceleration of natural gas production.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 8.1 billion |

| Market Forecast in 2033 | USD 16.1 billion |

| Market Growth Rate 2025-2033 | 7.06% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | White Sand, Brown Sand, Others |

| Applications Covered | Oil Exploitation, Natural Gas Exploration, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | CARBO Ceramics, Emerge Energy Services, Covia Holdings, Hi Crush, Source Energy Services, U.S Silica, Preferred Sands, Badger Mining Corporation, Mammoth Energy Service, Inc, Smart Sand Inc., Chongqing Changjiang, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Frac Sand Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)