Global Food Flavors Market Expected to Reach USD 24.0 Billion by 2033 - IMARC Group

Global Food Flavors Market Statistics, Outlook and Regional Analysis 2025-2033

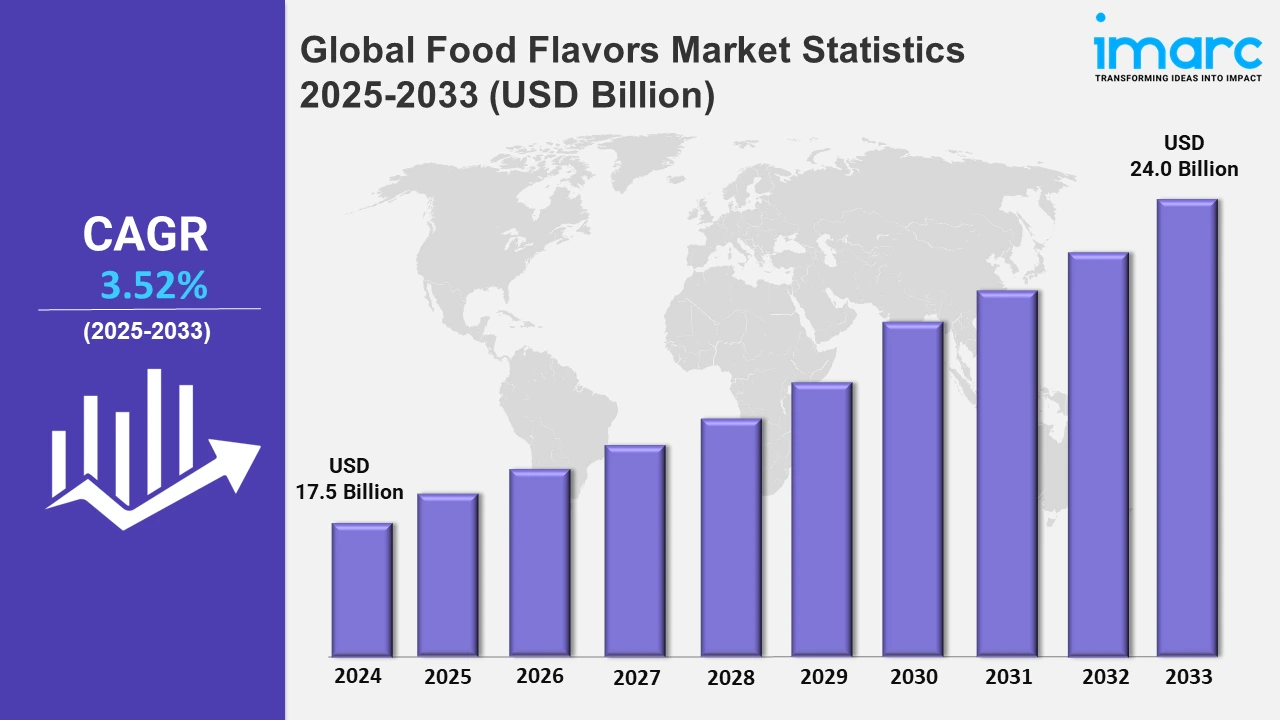

The global food flavors market size was valued at USD 17.5 Billion in 2024, and it is expected to reach USD 24.0 Billion by 2033, exhibiting a growth rate (CAGR) of 3.52% from 2025 to 2033.

To get more information on this market, Request Sample

Advanced encapsulation technology is being used in the food flavor industry to protect product freshness, taste, and aroma. This breakthrough shields delicate taste chemicals from deterioration due to light, heat, and oxygen, thereby resulting in longer shelf life and more realistic sensory experiences. For example, in February 2022, Givaudan launched PrimeLock, which represents a significant development in the food flavors industry. PrimeLock is a product and also a concept aimed at addressing key challenges in the industry, particularly related to the preservation of natural flavors and ingredients. PrimeLock focuses on the preservation of freshness, taste, and aroma in food and beverage products. This technology ensures that the original, authentic taste and aroma of ingredients are retained over an extended shelf life.

Moreover, the industry is expanding due to strategic acquisitions, which allow firms to diversify their flavor and nutrition offerings. These programs increase market presence, improve distribution networks, and offer access to existing customer bases, therefore encouraging innovation and growth. For instance, in July 2021, Symrise AG recently acquired Giraffe Foods Inc. This strategic step assisted the expansion of the flavor and nutrition segment in North America. It allowed Symrise to tap into Giraffe Foods' existing consumer base and distribution network in this region. Furthermore, food flavor manufacturers focus on natural and organic solutions to fulfill increased customer demand for clean-label products. In keeping with this, they are offering new tastes made from sustainable and plant-based ingredients. Additionally, the rise of functional foods and drinks creates several opportunities for tastemakers to develop specialized flavor profiles. Also, customers seek real and robust tastes that reflect their ethnic and regional preferences. For example, the growing demand for exotic fruit tastes in Latin America, fueled by the appeal of tropical ingredients, has prompted firms, such as Kerry Group, to create region-specific flavors, including guava and passion fruit. These tastes are commonly utilized in beverages and desserts, meeting customer demand for regionally inspired and high-quality flavor alternatives that improve the sensory appeal of both traditional recipes and modern food items.

Global Food Flavors Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-Pacific accounted for the largest food flavors market share on account of the growing population, the inflating levels of urbanization, and the shifting nutritional choices.

North America Food Flavors Market Trends:

In North America, the demand for clean-label and natural flavoring solutions is driving growth in the food flavors industry. Consumers value transparency and sustainability, which encourages companies to choose plant-based and organic alternatives. For example, in 2021, McCormick & Company extended its natural flavor offering to meet the region's rising interest in minimally processed and environmentally friendly goods, which matches shifting customer tastes across the region.

Europe Food Flavors Market Trends:

In Europe, plant-based food innovation is boosting demand for customized taste solutions. Vegan diets and substitute proteins necessitate real and attractive tastes. Firmenich debuted dairy-free taste profiles in 2020, focusing on plant-based dairy alternatives. Germany and the U.K. are at the forefront of this trend, as consumer demand for sustainable and cruelty-free diets grows. The market responds to changing consumer preferences through innovation and localization.

Asia-Pacific Food Flavors Market Trends:

Asia-Pacific holds the largest share of the market, owing to the shifting preference for distinct tastes influenced by local cuisines. Asia-Pacific is a leader in generating distinct taste preferences influenced by local cuisines. With an increasing middle-class population, there is a need for innovative and culturally relevant dishes. Givaudan introduced flavors adapted to regional meals and beverages in 2022, including pandan and matcha. This reflects the region's combination of traditional and modern culinary interests, which is driving growth in the industry.

Latin America Food Flavors Market Trends:

Tropical and exotic fruits dominate the market in Latin America due to cultural preferences and culinary history. Popular tastes, such as guava and passion fruit, are more prevalent in drinks and pastries. Kerry Group launched customized taste solutions in 2021, focusing on Brazil and Mexico. This trend demonstrates the region's dependence on real, local tastes to improve traditional recipes and drive market expansion.

Middle East and Africa Food Flavors Market Trends:

Halal-certified flavors thrive in the food flavor industry in the Middle East and Africa, meeting cultural and religious demands. Countries, such as Saudi Arabia and South Africa, are experiencing increased demand for halal-compliant solutions. Symrise launched halal-certified taste solutions in 2020, allowing companies to meet customer expectations for authenticity and quality, which are critical for success in this region.

Top Companies Leading in the Food Flavors Industry

Some of the leading food flavors market companies include Archer-Daniels-Midland Company, BASF SE, Corbion, dsm-firmenich, Givaudan, International Flavors & Fragrances Inc., Kerry Group plc, Robertet Group, Sensient Technologies Corporation, Symrise AG, and Takasago International Corporation, among many others. For example, in July 2019, Kerry Group Plc opened its production facility in India. This strategic expansion reflects Kerry's commitment to tapping into the growing food and beverage market in the Indian subcontinent. The population of India, which is one of the largest in the world, presents a substantial consumer base for food and beverage products.

Global Food Flavors Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into natural and artificial, wherein artificial represents the most preferred segment. Artificial flavors are becoming increasingly popular, owing to their ability to reproduce a wide range of sensations, from typical fruit and dessert flavors to more complex and exotic ones.

- Based on the form, the market is categorized into dry and liquid. Dry flavors are often offered in powder or granulated form, and they provide various benefits to both manufacturers and consumers. Liquid flavors are easily and consistently dispersed throughout a wide range of items, including drinks, confectionery, dairy, and sauces.

- On the basis of the end user, the market has been divided into beverages, dairy and frozen products, bakery and confectionery, savory and snacks, and animal and pet food. Among these, beverages exhibit a clear dominance in the market. The beverage sector elevates demand for food flavors by enhancing the taste and aroma of soft drinks, fruit juices, sports drinks, and alcoholic beverages, hence bolstering the growth of the market.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 17.5 Billion |

| Market Forecast in 2033 | USD 24.0 Billion |

| Market Growth Rate 2025-2033 | 3.52% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Natural, Artificial |

| Forms Covered | Dry, Liquid |

| End Users Covered | Beverages, Dairy and Frozen Products, Bakery and Confectionery, Savory and Snacks, Animal and Pet Food |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Archer-Daniels-Midland Company, BASF SE, Corbion, dsm-firmenich, Givaudan, International Flavors & Fragrances Inc., Kerry Group plc, Robertet Group, Sensient Technologies Corporation, Symrise AG, Takasago International Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Food Flavors Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)