Global Flight Management Systems Market Expected to Reach USD 4.5 Billion by 2033 Driven by the Increasing Air Traffic

Global Flight Management Systems Market Statistics, Outlook and Regional Analysis 2025-2033

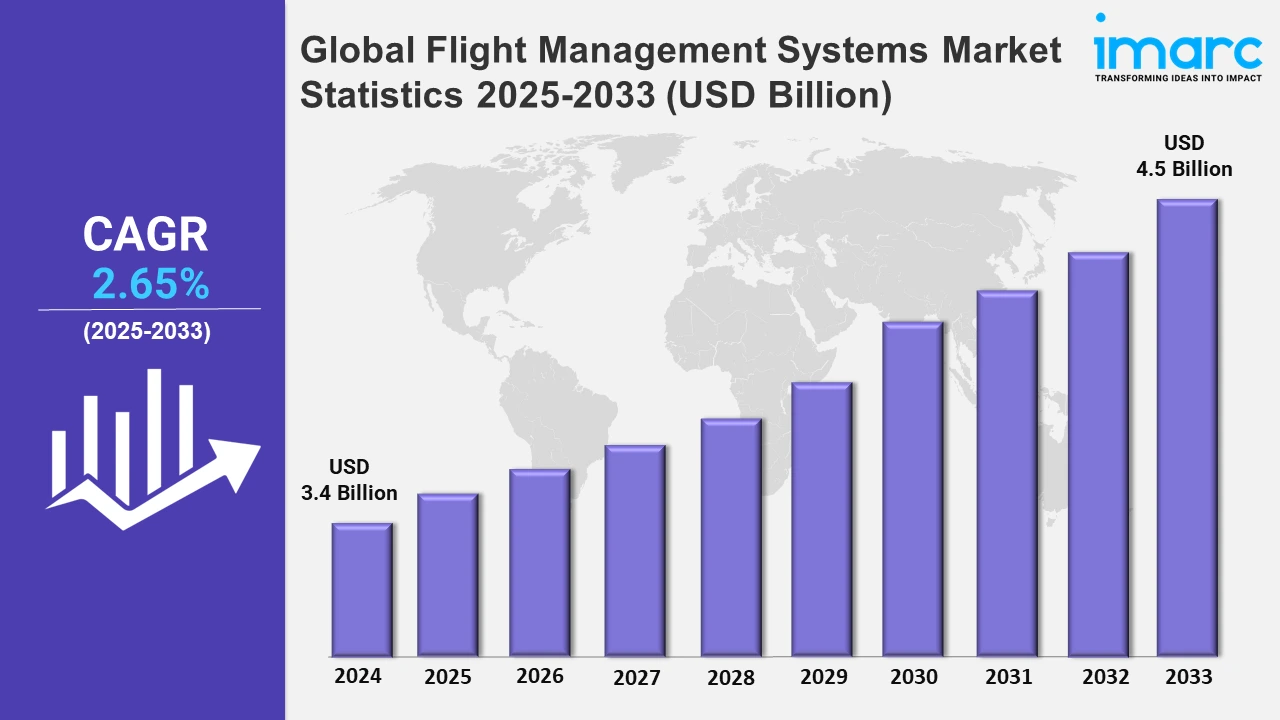

The global flight management systems market size was valued at USD 3.4 Billion in 2024, and it is expected to reach USD 4.5 Billion by 2033, exhibiting a growth rate (CAGR) of 2.65% from 2025 to 2033.

To get more information on this market, Request Sample

The flight management systems (FMS) market is primarily driven by the growing focus on operational efficiency in aviation. Airlines are increasingly adopting advanced FMS solutions to optimize fuel consumption, reduce flight times, and minimize operational costs. With rising fuel prices and the push for environmentally sustainable practices, FMS technology offers significant benefits by enhancing route optimization, enabling precise flight planning, and supporting real-time decision-making capabilities. Along with this, these systems use predictive analytics and performance data to adjust flight paths dynamically, accounting for factors like weather conditions and traffic. This efficiency is particularly important for airlines operating on narrow profit margins, as it enables cost savings while meeting regulatory requirements for reduced emissions. As both commercial and cargo airlines invest in systems that facilitate efficient and environmentally friendly operations, the need for improved FMS capabilities is growing, reflecting a larger industry trend toward technology-driven efficiency.

Another major driver strengthening the market growth is the modernization of air traffic management (ATM) systems worldwide, which requires enhanced FMS compatibility. As air traffic continues to grow, regulatory bodies like the Federal Aviation Administration (FAA) and European Union Aviation Safety Agency (EASA) are implementing NextGen and Single European Sky ATM Research (SESAR) programs to improve airspace management. These initiatives are designed to handle higher traffic volumes by introducing advanced communication, navigation, and surveillance systems, necessitating upgraded FMS technologies that support complex procedures such as Required Navigation Performance (RNP) and Area Navigation (RNAV). This modernization aims to enhance airspace efficiency and safety by facilitating seamless communication between aircraft and ground systems. FMS solutions that integrate with modern ATM systems offer airlines a competitive advantage, as they ensure compliance with evolving air traffic protocols. Furthermore, the increasing traffic across airspaces in Europe, North America, and parts of Asia-Pacific is propelling the market forward, as enhanced FMS capabilities align with regional ATM modernization goals, supporting both commercial aviation growth and regulatory compliance.

Global Flight Management Systems Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America; Europe; Asia-Pacific; Latin America; and the Middle East and Africa. According to the report, North America accounted for the largest market share due to high consumer demand, advanced infrastructure, and technological innovation, supporting rapid adoption across various industries.

North America Flight Management Systems Market Trends:

The North American Flight Management Systems (FMS) market is experiencing growth driven by technological advancements and increased demand for efficient navigation solutions. Airlines are increasingly adopting advanced FMS to improve fuel efficiency and streamline flight operations, reducing operational costs. Integration of next-generation FMS with satellite-based navigation and enhanced data analytics is enhancing flight accuracy and safety. Moreover, the rise in air traffic, coupled with stringent regulatory standards for aviation safety, supports the need for innovative flight management solutions. As the industry shifts towards sustainable aviation, FMS technology focuses on optimizing routes to minimize carbon emissions, aligning with environmental goals. In December 2023, Universal Avionics completed flight tests of its NexGen i-FMS on a Bell 212 helicopter, enhancing flight management with GNSS-based navigation, and supporting RNAV, RNP, and VNAV for civilian airspace operations.

Asia-Pacific Flight Management Systems Market Trends:

The Asia-Pacific flight management systems market is growing rapidly due to rising air traffic, expanding low-cost carriers, and government investments in aviation infrastructure. Enhanced navigation and fuel efficiency needs are pushing airlines to adopt advanced FMS solutions, while emerging markets like India and China drive demand through fleet expansions.

Europe Flight Management Systems Market Trends:

In Europe, strict environmental regulations and a focus on sustainable aviation fuel efficiency boost the adoption of advanced FMS. Key players emphasize integrating eco-friendly technologies to reduce carbon footprints. High air traffic and the presence of established aerospace manufacturers foster continuous innovation in FMS, supporting market growth.

Latin America Flight Management Systems Market Trends:

Latin America’s FMS market growth is driven by increasing passenger demand and regional connectivity projects. Airlines are adopting modernized FMS to enhance operational efficiency and meet safety standards. As infrastructure expands, particularly in Brazil and Mexico, the need for efficient navigation solutions supports a steady market expansion across the region.

Middle East and Africa Flight Management Systems Market Trends:

The MEA region sees growing FMS demand due to increased international air travel and significant investments in aviation hubs, especially in the UAE and Saudi Arabia. Airlines prioritize advanced FMS for optimized flight operations amid harsh desert conditions, while regional government initiatives also support the modernization of aviation infrastructure.

Top Companies Leading in the Flight Management Systems Industry

Some of the leading flight management systems market companies include Honeywell International Inc., Thales Group, General Electric Company, Rockwell Collins, Esterline Technologies Corporation, Garmin Ltd., Universal Avionics Systems Corporation, Jeppesen Sanderson, Inc., Navtech, Inc., Lufthansa Systems GmbH & Co. Kg, Leonardo-Finmeccanica Spa, among many others.

- In June 2024, Airbus partnered with Honeywell to develop a new flight management system (FMS) for its A320, A330, and A350 aircraft. This system combines existing FMS models into a standardized platform, offering enhanced modularity, advanced functionality, and multi-core processing. The new FMS will simplify fleet support by providing primary navigation, flight planning, and optimized route guidance.

Global Flight Management Systems Market Segmentation Coverage

- On the basis of the fit, the market has been bifurcated into line fit and retrofit, wherein line fit represents the leading segment as it allows the integration of advanced systems directly during aircraft manufacturing, meeting airline preferences for pre-installed, customized solutions. This approach streamlines installation, enhances compatibility, and reduces operational downtime compared to retrofits. With increasing aircraft production to meet global air travel demand, line fit remains the preferred choice for manufacturers and airlines.

- Based on the aircraft type, the market is classified into narrow body aircraft, wide body aircraft, very large aircraft, and regional transport aircraft, amongst which very large aircraft dominate the market due to their extensive range, higher passenger capacity, and suitability for long-haul flights. These aircraft require advanced navigation and fuel management systems to optimize performance and safety, making them ideal for major airlines prioritizing efficiency in international travel routes.

- On the basis of the hardware, the market has been divided into visual display unit, a control display unit, and flight management computers. Among these, flight management computers account for the majority of the market share due to their central role in processing flight data, optimizing route planning, and ensuring efficient navigation. These systems integrate various functions, enhancing cockpit automation, fuel efficiency, and safety, making them essential for modern aircraft operations and the preferred choice for airlines worldwide.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 3.4 Billion |

| Market Forecast in 2033 | USD 4.5 Billion |

| Market Growth Rate (2025-2033) | 2.65% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Fits Covered | Line Fit, Retrofit |

| Aircraft Types Covered | Narrow Body Aircraft, Wide Body Aircraft, Very Large Aircraft, Regional Transport Aircraft |

| Hardwares Covered | Visual Display Unit, Control Display Unit, Flight Management Computers |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Honeywell International Inc., Thales Group, General Electric Company, Rockwell Collins, Esterline Technologies Corporation, Garmin Ltd., Universal Avionics Systems Corporation, Jeppesen Sanderson, Inc., Navtech, Inc., Lufthansa Systems GmbH & Co. Kg, Leonardo-Finmeccanica Spa, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)