Global Fire Fighting Chemicals Market Expected to Reach USD 3.8 Billion by 2033 - IMARC Group

Global Fire Fighting Chemicals Market Statistics, Outlook and Regional Analysis 2025-2033

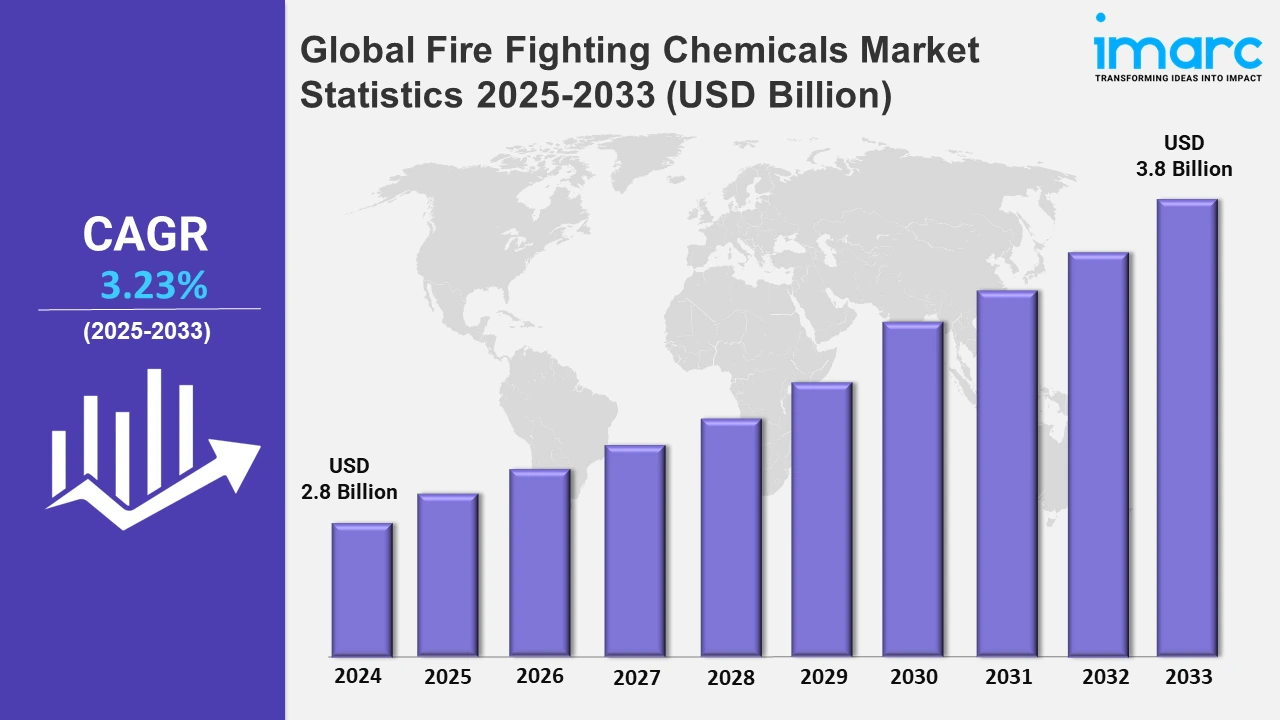

The global fire fighting chemicals market size was valued at USD 2.8 Billion in 2024, and it is expected to reach USD 3.8 Billion by 2033, exhibiting a growth rate (CAGR) of 3.23% from 2025 to 2033.

To get more information on this market, Request Sample

The global fire fighting chemicals market is witnessing a rising demand for environmentally friendly solutions. Growing recognition of ecological consequences and the enforcement of more stringent environmental policies on the use of harmful chemicals, such as per- and polyfluoroalkyl substances (PFAS), have driven the development of sustainable alternatives. For instance, in September 2024, the European Commission introduced REACH Regulation measures to restrict PFHxA and related substances due to their environmental persistence and health risks. The ban covers consumer textiles, food packaging, cosmetics, and fire fighting foams, ensuring balanced protection and innovation. These innovative solutions not only ensure effective fire suppression but also minimize harm to ecosystems and water supplies. The trend is particularly prominent in industries such as aviation, oil and gas, and construction, where compliance with environmental regulations is critical. This shift toward sustainable chemicals reflects growing global efforts to balance safety and environmental responsibility.

Another major driver of the global firefighting chemicals market is the expansion of industries such as oil and gas, aviation, and manufacturing that possesses high risk environments. These sectors require advanced fire suppression solutions to mitigate the risks associated with highly flammable materials and complex operational environments. The need to protect valuable assets, ensure operational safety, and comply with stringent fire safety regulations drives the adoption of efficient and sustainable firefighting chemicals. For instance, in 2024, Cross Plains Solutions unveiled SoyFoam TF 1122, an eco-friendly fire fighting foam supported by U.S. soybean farmers and the United Soybean Board. It is PFAS-free and certified biodegradable, meeting NFPA 18 standards. Moreover, it effectively handles Class A and B fires and works seamlessly with existing firefighting equipment, providing a sustainable and efficient fire suppression solution. Additionally, the increasing infrastructure development in industrial zones and commercial spaces further amplifies demand. Industries are investing in advanced fire retardants and extinguishing agents to address evolving fire safety challenges, making the expansion of high-risk industries a significant driver of market growth.

Global Fire Fighting Chemicals Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of robust technological advancements, rigorous safety standards, and significant investments in fire prevention initiatives.

North America Fire Fighting Chemicals Market Trends:

North America holds a leading position in the global fire fighting chemicals market due to stringent fire safety regulations, advanced infrastructure, and a strong focus on public safety. The region’s industrial and commercial sectors, particularly in the United States and Canada, demand efficient fire suppression solutions, driving the adoption of advanced fire fighting chemicals. For instance, in March 2024, Carrier Global Corporation, a U.S. based fire and security equipment company, announced an agreement to sell its Industrial Fire business to Sentinel Capital Partners for USD 1.425 billion. This move aligns with Carrier's focused strategy to provide advanced fire detection and suppression solutions for high-hazard sectors such as oil and gas, marine, and critical infrastructure. High investment in research and development has led to innovative formulations, such as environmentally friendly and fluorine-free foam agents, which comply with global environmental standards. Additionally, the rising prevalence of wildfires in region has significantly increased the demand for fire retardants and suppressants. The region’s robust distribution networks, coupled with the presence of key market players, further strengthen North America’s dominance in the fire fighting chemicals market.

Asia-Pacific Fire Fighting Chemicals Market Trends:

Asia-Pacific is emerging as a key region in the global fire fighting chemicals market, driven by rapid industrialization, urbanization, and increasing fire safety regulations. Rising investments in infrastructure and awareness of fire prevention measures are boosting demand for advanced fire fighting chemicals, particularly in countries with expanding industrial bases.

Europe Fire Fighting Chemicals Market Trends:

Europe is a prominent region in the global fire fighting chemicals market, supported by strict fire safety regulations and advanced infrastructure. Growing investments in sustainable and fluorine-free chemicals, combined with increasing awareness of environmental compliance, drive demand for innovative fire suppression solutions across industrial, commercial, and residential sectors.

Latin America Fire Fighting Chemicals Market Trends:

Latin America is a growing region in the global fire fighting chemicals market, fueled by growing urban development, expanding industries, and heightened awareness of fire prevention measures. Demand for advanced fire suppression solutions is supported by government initiatives and stricter regulations, particularly in key sectors like manufacturing, oil and gas, and construction.

Middle East and Africa Fire Fighting Chemicals Market Trends:

The Middle East and Africa are emerging regions in the global fire fighting chemicals market, driven by infrastructure development, industrial growth, and increasing fire safety awareness. Rising investments in oil and gas, construction, and urban projects further boost demand for advanced fire suppression solutions tailored to regional requirements.

Top Companies Leading in the Fire Fighting Chemicals Industry

Some of the leading fire fighting chemicals market companies include Angus Fire, DIC Corporation, Fire Safety Devices Pvt. Ltd., Foamtech Antifire Company, Johnson Controls International plc, Linde plc, Orchidee Europe, Perimeter Solutions, Safequip Pty Ltd, Solvay S.A, among many others. In October 2024, Angus Fire introduced Respondol ATF 1x3%, a synthetic fluorine-free foam concentrate tailored for high-hazard flammable liquid and Class A fires. It delivers effective fire suppression, is fully biodegradable, and functions with fresh and salt water, making it a reliable solution for industries such as oil and chemical manufacturing in critical firefighting situations.

Global Fire Fighting Chemicals Market Segmentation Coverage

- On the basis of the type, the market has been categorized into dry chemicals, wet chemicals, dry powder, and foam based, wherein dry chemicals represent the leading segment, primarily due to their effectiveness in suppressing various types of fires, including those involving flammable liquids and gases. These agents offer rapid extinguishing capabilities and are widely used in both commercial and industrial applications. The growing emphasis on fire safety regulations and the need for efficient firefighting solutions further bolster the demand for dry chemical agents.

- Based on the chemicals, the market is classified into monoammonium phosphate, halon, carbon dioxide, potassium bicarbonate, potassium citrate, sodium chloride, and others. Monoammonium phosphate can be used to fight Class A, B, and C fires, making it appropriate to use in multi-purpose fire protection facilities. However, halon is restricted due to environmental impact, but its effectiveness in controlling class B and C fires makes it a preferred choice, particularly in the aerospace industry. Carbon dioxide is another most common suppressant, which is not conductive of heat or electricity and leaves no residue behind and is commonly used in electrical and liquid fires. Potassium bicarbonate, also known as Purple-K, is famous for rapid fire extinguishing outcomes and is suitable for flammable liquid and electrical fires. Furthermore, potassium citrate is used in extinguishing grease fires in kitchens through cooling and forming a layer over the fire origin, thus preventing reignition. Additionally, sodium chloride is used in the extinguishing of combustible metal fires because, upon application of the compound, it forms a heat resistant layer that creates a barrier between the metal fuel and oxygen, therefore safely operating industrial facilities with reactive metal.

- On the basis of the application, the market has been divided into portable fire extinguishers, automatic fire sprinklers, fire retardant bulkhead, fire dampers, and others. Among these, portable fire extinguishers account for the majority of the market share as they are easy and convenient to use in residential, commercial, and industrial applications. These devices give fast and adequate responses to numerous classes of fire, such as A, B, C, and K. They have become popular due to meeting regulatory standards and raising awareness of fire precautionary measures across the world.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 2.8 Billion |

| Market Forecast in 2033 | USD 3.8 Billion |

| Market Growth Rate 2025-2033 | 3.23% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Dry Chemicals, Wet Chemicals, Dry Powder, Foam Based |

| Chemicals Covered | Monoammonium Phosphate, Halon, Carbon Dioxide, Potassium Bicarbonate, Potassium Citrate, Sodium Chloride, Others |

| Applications Covered | Portable Fire Extinguishers, Automatic Fire Sprinklers, Fire Retardant Bulkhead, Fire Dampers, Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Angus Fire, DIC Corporation, Fire Safety Devices Pvt. Ltd., Foamtech Antifire Company, Johnson Controls International plc, Linde plc, Orchidee Europe, Perimeter Solutions, Safequip Pty Ltd, Solvay S.A, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)