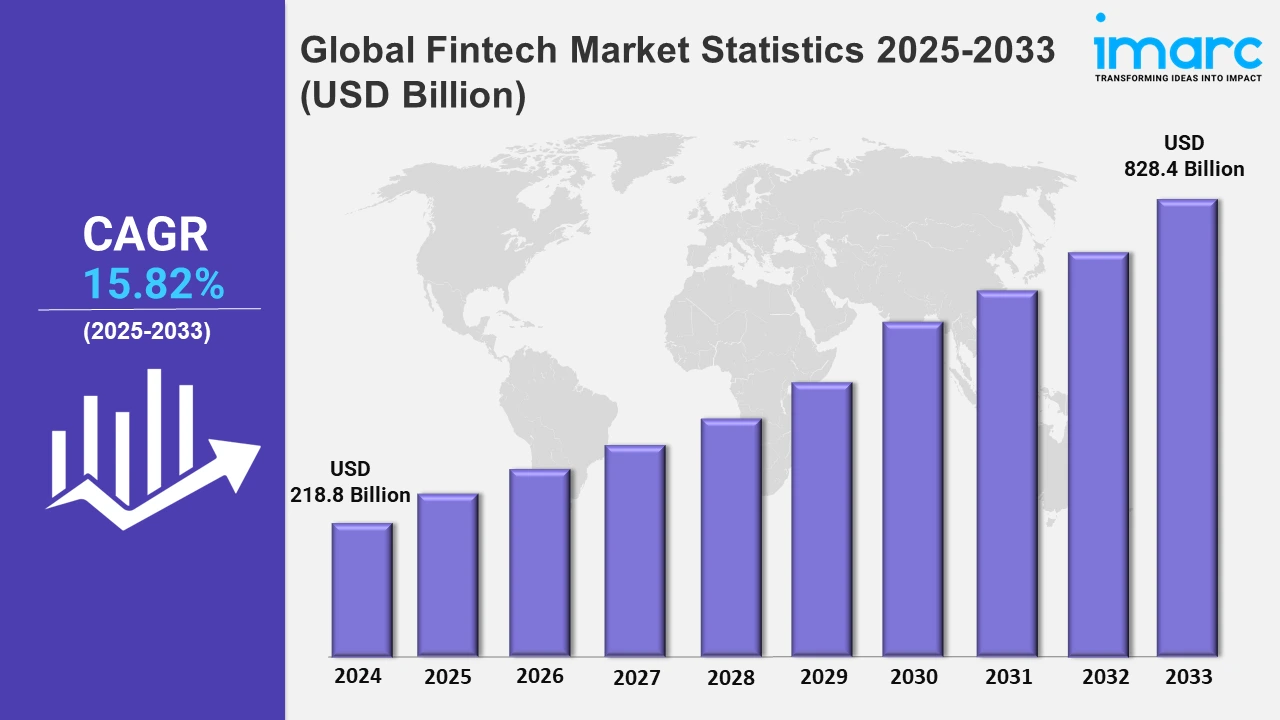

Global Fintech Market Expected to Reach USD 828.4 Billion by 2033 - IMARC Group

The global fintech market size was valued at USD 218.8 Billion in 2024, and it is expected to reach USD 828.4 Billion by 2033, exhibiting a growth rate (CAGR) of 15.82% from 2025 to 2033.

To get more information on this market, Request Sample

The rapid growth of digital technologies is majorly driving the global fintech industry, with numerous advancements in artificial intelligence (AI), blockchain, big data analytics, and cloud computing. The major fintech companies are leveraging AI for improved fraud detection, personalized customer services, and automated decision-making processes. BuzzAR unveiled BuzzPay in November 2024, a state-of-the-art finance solution powered by AI that works in unison with BAE (Buzz AI Experience), their AI travel assistant. With an emphasis on the Asian market, this platform seeks to transform payment procedures for one million tourists. By 2026, it is anticipated to have a USD 3.2 billion impact on Saudi Arabia's economy. Along with this, blockchain technology is revolutionizing secure transactions by ensuring transparency and enhancing security through decentralized ledgers, which is beneficial for financial operations such as cross-border payments and smart contracts. Additionally, big data analytics enable fintech companies to gain deeper insights into consumer behavior, forecast trends, and customize their services to meet client needs more effectively. . Innovation is further enhanced by cloud computing, which allows scalable infrastructure supporting data-heavy applications, thus permitting companies to quickly launch products with light upfront investments. These technological strides are creating an environment for steady growth by ensuring that fintech can be used interchangeably with the systems that are already in existence, thereby disrupting traditional practices, as expected by modern consumers pertaining to speed and convenience. Therefore, this is propelling the growth of the market positively.

Apart from this, consumer behavior is rapidly changing due to the increasing reliance on digital solutions. This shift is driven by the rising smartphone penetration, widespread internet access, and growing preference for seamless financial interactions on-the-go. This is augmenting the demand for user-friendly, accessible fintech services to make banking, payment, investing, and insurance smoother. Mobile banking apps, digital wallets, and peer-to-peer payment systems are becoming part of daily life for many, particularly among younger, tech-savvy demographics. On 12th November 2024, Thunes, a global financial technology company specializing in cross-border payment solutions, announced a new partnership with GCash, Philippine’s largest and most prominent digital wallet. This landmark transaction will allow GCash customers to top up their balances directly through the application using funds sitting in their UK or European bank accounts. This partnership makes cross-border top-up real-time and cost-efficient and gives GCash users in Europe greater ease and control in handling their finances. Apart from this, the growing consumer preference for fintech services over traditional banking systems due to their frictionless, secure, and personalized financial services is also propelling the market growth. Fintech solutions cater directly to these needs, with features such as real-time payment tracking, easy fund transfers, and personalized financial advice delivered through user-friendly interfaces. This shift in consumer behavior continues is driving fintech innovation and adoption, creating a positive market outlook.

Global Fintech Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of robust technological infrastructure, high consumer adoption rates, and strong support from financial institutions.

North America Fintech Market Trends:

The North American fintech market is experiencing robust growth, propelled by widespread digitalization and increasing mobile banking usage. A significant driver is the consumer demand for convenient and rapid financial transactions. Moreover, advancements in blockchain and artificial intelligence technology are enabling enhanced security and personalization, attracting more users. Regulatory changes are also playing a critical role in fostering a favorable environment for fintech innovations.

The region also benefits from an ecosystem where traditional banks, tech giants, and startups collaborate to deliver advanced financial solutions. In May 2024, Chilean paytech Koywe acquired Facto for an undisclosed sum, to target the North American market. Koywe aims to capitalize on the experience of Facto's founder, Mickle Foretic, in the U.S. Federal Reserve's Business Payments Coalition to launch a new invoicing standard in the United States. Cross-border payments with crypto are offered by Koywe. Facto supports SMBs in integrating its online sales tech stack with a standardized payment and invoicing solution. This synergy fosters rapid innovation, leading to a broad range of services, including digital payments, blockchain applications, and personalized financial planning tools.

Asia Pacific Fintech Market Trends:

Asia Pacific is witnessing rapid fintech growth, fueled by increasing smartphone penetration, digital payment adoption, and favorable government initiatives. The significant market growth in countries including China, India, and Southeast Asian nations is driven by a large unbanked population and tech-savvy consumers. Innovations such as mobile wallets and super apps are increasing demand for financial services, enhancing financial inclusion. Strong venture capital investment and partnerships between fintech startups and traditional banks further bolster the region’s market expansion.

Europe Fintech Market Trends:

Europe maintains a strong foothold in the global fintech market due to advanced regulatory frameworks and progressive financial policies. The region’s emphasis on open banking and data-sharing standards enables collaboration between fintech companies and established financial institutions. Key hubs such as the United Kingdom, Germany, and the Nordic countries foster fintech innovation through supportive regulations and a well-connected digital infrastructure. Europe’s focus on transparency and consumer protection is driving the widespread adoption of fintech services.

Latin America Fintech Market Trends:

Latin America’s fintech market is expanding rapidly due to rising financial inclusion needs and an underbanked population. Countries including Brazil and Mexico lead this growth, leveraging mobile banking and digital payment solutions to bridge the gap in traditional financial services. The region's youthful population and increasing internet access encourage rapid adoption of innovative financial tools. Startups and partnerships are thriving, supported by a changing regulatory landscape that aims to balance innovation with financial stability and security.

Middle East and Africa Fintech Market Trends:

The Middle East and Africa are witnessing significant growth in the fintech sector, driven by an increasing need for accessible financial services and mobile technology penetration. Governments and private sectors are promoting fintech solutions to enhance financial inclusion and drive economic growth. Key countries including the UAE and South Africa are leading with supportive policies and investment in digital banking infrastructure. The region’s focus on addressing underserved communities is fostering the adoption of payment solutions, microfinancing, and mobile banking services.

Top Companies Leading in the Fintech Industry

Some of the leading fintech market companies include Adyen, Avant, LLC, Fidelity National Information Services, Inc., Fiserv, Inc., Klarna Bank AB, Mastercard Inc., Nubank, PayPal Holdings, Inc., Revolut Ltd, Robinhood Markets, Inc., SoFi Technologies, Inc., and Stripe, Inc., among many others. Paypal Holdings, Inc. announced on September 2024 that it is allowing its U.S. merchants to buy, hold and sell cryptocurrency directly from their PayPal business account. Upon launch, this feature for business accounts will not be available in New York State. The announcement represents PayPal's latest step toward increasing cryptocurrency's utility by making increased functionality available to millions of merchants in the U.S.

Global Fintech Market Segmentation Coverage

- On the basis of the deployment mode, the market has been categorized into on-premises and cloud-based, wherein on-premises represents the leading segment. Organizations favor on-premises solutions for their ability to customize and manage infrastructure according to specific business needs, ensuring greater data protection and meeting stringent regulatory requirements. This mode is majorly preferred by large enterprises that prioritize full ownership of their IT environment and need robust, customizable solutions. On-premises deployment continues to lead as companies value the reliability, privacy, and tailored performance capabilities offered by on-premises deployment.

- Based on the technology, the market is classified into application programming interface, artificial intelligence, blockchain, robotic process automation, data analytics, and others. Application programming interfaces (APIs) are integral, enabling seamless integration and communication between diverse financial services. Artificial intelligence (AI) is facilitating personalized customer experiences and improved decision-making processes. Blockchain technology ensures secure, transparent, and decentralized transactions, enhancing trust and efficiency. Robotic process automation (RPA) streamlines repetitive tasks, boosting operational productivity. Data analytics provides deep insights into strategic planning and customer behavior analysis. These technologies are propelling the market, enriching fintech solutions, and fostering adoption.

- On the basis of the application, the market has been divided into payment and fund transfer, loans, insurance and personal finance, wealth management, and others. Among these, payment and fund transfer account for the majority of the market share. This can be attributed to the rise in digital transactions and the demand for seamless, real-time financial services. This segment also benefits from increasing smartphone usage, secure digital platforms, and user-friendly mobile payment apps. Consumers and businesses prioritize quick, cost-effective, and convenient transaction methods, propelling the growth of this application. The continuous development of secure technologies and widespread adoption of contactless payments further solidify payment and fund transfer as the market's leading application.

- Based on the end user, the market is segregated into banking, insurance, securities, and others. Banking stands as the largest end user in the market, driven by the sector's early adoption of financial technologies to enhance customer experience and streamline operations. Banks leverage fintech solutions to offer digital banking, mobile payments, and improved lending services, meeting modern consumer expectations for convenience and efficiency. In addition, the integration of AI, blockchain, and data analytics allows for personalized services, better risk management, and secure transactions. This push for innovation is also contributing to the growth of the market.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 218.8 Billion |

| Market Forecast in 2033 | USD 828.4 Billion |

| Market Growth Rate 2025-2033 | 15.82% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Technologies Covered | Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, Others |

| Applications Covered | Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, Others |

| End Users Covered | Banking, Insurance, Securities, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adyen, Avant, LLC, Fidelity National Information Services, Inc., Fiserv, Inc., Klarna Bank AB, Mastercard Inc., Nubank, PayPal Holdings, Inc., Revolut Ltd, Robinhood Markets, Inc., SoFi Technologies, Inc., Stripe, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Fintech Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)