Global Finished Vehicles Logistics Market Expected to Reach USD 218.8 Billion by 2033 – IMARC Group

Global Finished Vehicles Logistics Market Statistics, Outlook and Regional Analysis 2025-2033

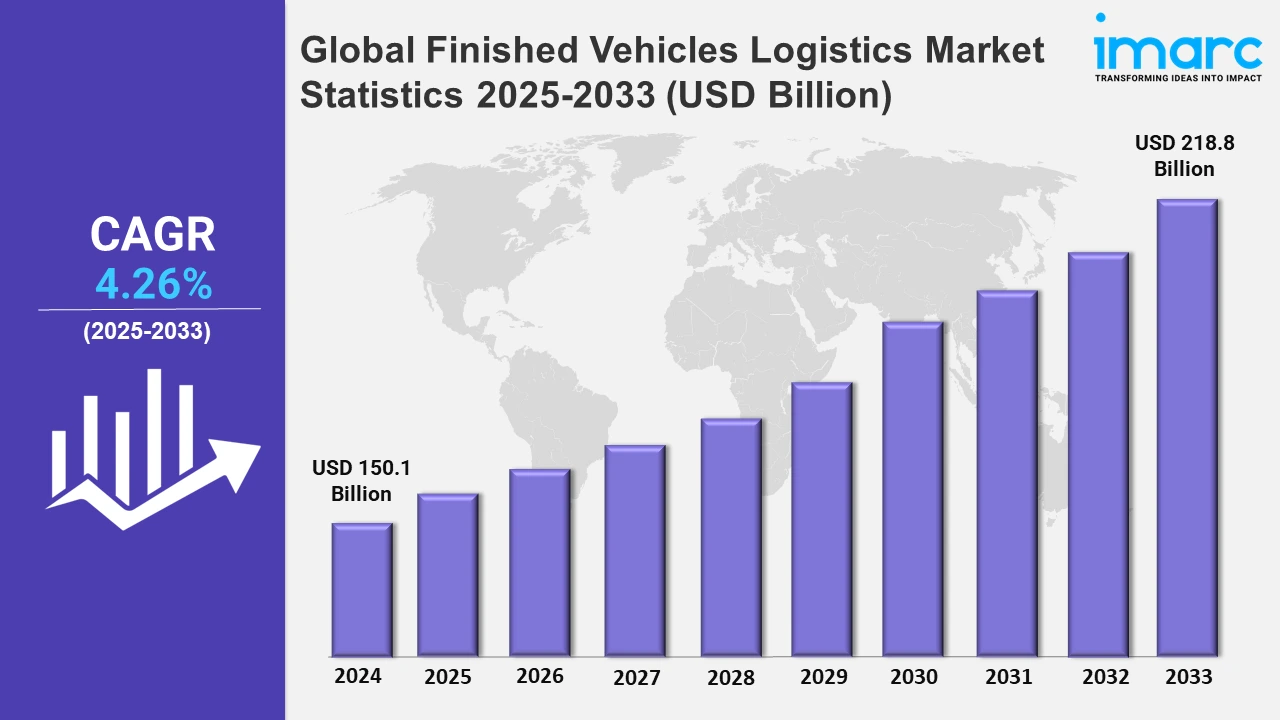

The global finished vehicles logistics market size was valued at USD 150.1 Billion in 2024, and it is expected to reach USD 218.8 Billion by 2033, exhibiting a growth rate (CAGR) of 4.26% from 2025 to 2033.

To get more information on this market, Request Sample

The rising demand for commercial vehicles is creating the need for their efficient transportation, storage, and delivery, which is positively influencing the market. This is encouraging the use of effective finished vehicles logistics solutions, such as vehicle carriers, multi-level transporters, and port handling that help to optimize operational processes. Finished vehicles logistics are employed to ensure that vehicles are properly protected during transit. Furthermore, when commercial vehicles are delivered to a dealer, they may require modifications to meet specific user needs. Finished vehicles logistics providers are responsible for carrying out these tasks before the vehicle reaches the end-user. Efficient finished vehicles logistics assists commercial vehicle manufacturers in reducing lead times and improving user satisfaction. As per the IMARC Group’s report, the global commercial vehicles market is expected to reach USD 1169.0 Billion by 2033.

The integration of the Internet of Things (IoT) in warehouse management is improving efficiency, reducing costs, and enhancing the overall supply chain management process, which is impelling the market growth. IoT-enabled devices like sensors are used to track and monitor vehicles within the warehouse to ensure accurate inventory management. This assists in reducing the risk of misplaced and damaged goods. This real-time tracking provides detailed data on the location, status, and condition of finished vehicles, which allows warehouse managers to make informed decisions and optimize storage space. Apart from this, better predictive maintenance of warehouse equipment, such as conveyors and forklifts, can be ensured through IoT. This assists in lowering downtime and improving operational efficiency. It also facilitates the automation of routine tasks to reduce manual labor and minimize human error. Furthermore, IoT can enhance the safety of vehicle handling within warehouses, as it provides alerts for any unusual activity or potential hazards. The IMARC Group’s report shows that the global IoT in warehouse management market is expected to reach USD 20.5 Billion by 2033.

Global Finished Vehicles Logistics Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-Pacific accounts for the largest market share driven by its large automotive manufacturing base, extensive transportation infrastructure, and increasing investments in logistics technology.

Asia-Pacific Finished Vehicles Logistics Market Trends:

The Asia-Pacific region is enjoying the leading position in the market due to its high number of automotive production hubs, such as China, Japan, India, and South Korea. The region has efficient manufacturing capabilities, which creates the need for finished vehicles logistics to transit goods. The region is noted for high imports and exports, which require efficient logistics solutions. Apart from this, innovations in logistics infrastructure, such as seaports, rail networks, and highways, encourage companies to employ capable logistics systems. In India, specialized transport vehicles are used to handle autonomous vehicles with the minimum risk. According to the IMARC Group’s report, the India autonomous vehicle market is projected to exhibit a growth rate (CAGR) of 19.4% during 2024-2032.

North America Finished Vehicles Logistics Market Trends:

North America accounts for a sizeable portion of the finished vehicles logistics industry owing to the increasing production of vehicles, particularly in the US, Mexico, and Canada. The integration of advanced logistics technologies, such as radio-frequency identification (RFID) tracking and IoT, is improving the supply chain visibility and operational efficiency. Here, automakers collaborate with third-party logistics providers to manage vehicle transportation and distribution.

Europe Finished Vehicles Logistics Market Trends:

The market for finished vehicles logistics is expanding gradually in Europe, which can be attributed to key automotive producers, such as Germany, France, the UK, and Spain. The region is famous for high vehicle production and exports, which create the need for innovative logistics solutions, including green logistics practices and multimodal transport systems. Continental suppliers, on the other hand, emphasize environmental sustainability and energy efficiency in logistics operations.

Latin America Finished Vehicles Logistics Market Trends:

On account of the increasing vehicle production, particularly in Brazil, Mexico, and Argentina, Latin America is experiencing finished vehicles logistics market expansion. The export of vehicles from Latin American nations encourages the use of modern logistics strategies to facilitate effective transportation. In addition to this, upgraded road infrastructure, along with investments in rail and port systems, is improving the logistics capabilities throughout the region.

Middle East and Africa Finished Vehicles Logistics Market Trends:

The market for finished vehicles logistics in the Middle East and Africa region is distinguished by the rising demand for automobiles, particularly in the GCC countries like Qatar and Bahrain as well as South Africa. Additionally, the region has a well-setup logistics infrastructure, including seaports and distribution centers to enable efficient vehicle transportation. Furthermore, high international trading activities across the region promote the use of finished vehicle logistics.

Top Companies Leading in the Finished Vehicles Logistics Industry

Some of the leading finished vehicles logistics market companies include CargoTel Inc., CEVA Logistics (CMA CGM), DHL (Deutsche Post AG), DSV A/S, Hellmann Worldwide Logistics SE & Co. KG, Kuehne + Nagel International AG, Omsan Logistics, and Pound Gates, among many others. In December 2024, CEVA Logistics (CMA CGM), a major finished vehicles logistics solutions provider, made the announcement to broaden its special vehicle transport offerings across Europe. The initiative promises to offer effective handling of scheduled vehicle deliveries for users.

Global Finished Vehicles Logistics Market Segmentation Coverage

- On the basis of the activity, the market has been segmented into transport (rail, road, air, sea), warehouse, and value-added services, wherein transport (rail, road, air, sea) represents the leading segment. It is very important for the efficient movement of vehicles from manufacturers to people. Road transport is widely used for short-distance deliveries, rail for bulk transport over long distances, and sea and air transport for international shipping. Finished vehicles logistic ensures that vehicles are transported efficiently and securely to dealerships, distributors, and buyers worldwide so that the risk of damage can be minimized. This system is essential for automotive trade around the world and the distribution of vehicles across various regions.

- Based on the vehicle type, the market has been classified into passenger vehicle, commercial vehicle, hybrid electric vehicle, and battery electric vehicle, amongst which commercial vehicle dominates the market. Commercial vehicles are critical for businesses that require large-scale operations and logistics services, such as trucks, buses, and delivery vans. Finished vehicle logistics is important for transporting large numbers of commercial vehicles from manufacturing plants to dealerships, fleet operators, and rental services. This logistics process ensures that vehicles are delivered on time, in optimal condition, and at the right locations. It involves coordinating various transportation modes to handle the large size and weight of commercial vehicles.

- On the basis of the distribution channel, the market has been bifurcated into OEMs (original equipment manufacturers) and aftermarket. Among these, OEMs (original equipment manufacturers) account for the majority of the market share, as they are the primary producers of vehicles and are responsible for the large-scale distribution of finished vehicles to dealerships and customers. They have long-term contracts with logistics providers, which enables them to streamline transportation processes and maintain control over distribution. Finished vehicle logistics for OEMs helps to improve their production schedules and manage inventory effectively. This assists in enhancing operational efficiency and customer satisfaction.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 150.1 Billion |

| Market Forecast in 2033 | USD 218.8 Billion |

| Market Growth Rate 2025-2033 | 4.26% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Activities Covered | Transport (Rail, Road, Air, Sea), Warehouse, Value-added Services |

| Vehicle Types Covered | Passenger Vehicle, Commercial Vehicle, Hybrid Electric Vehicle, Battery Electric Vehicle |

| Distribution Channels Covered | OEMS (Original Equipment Manufacturers), Aftermarket |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | CargoTel Inc., CEVA Logistics (CMA CGM), DHL (Deutsche Post AG), DSV A/S, Hellmann Worldwide Logistics SE & Co. KG, Kuehne + Nagel International AG, Omsan Logistics, Pound Gates, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)