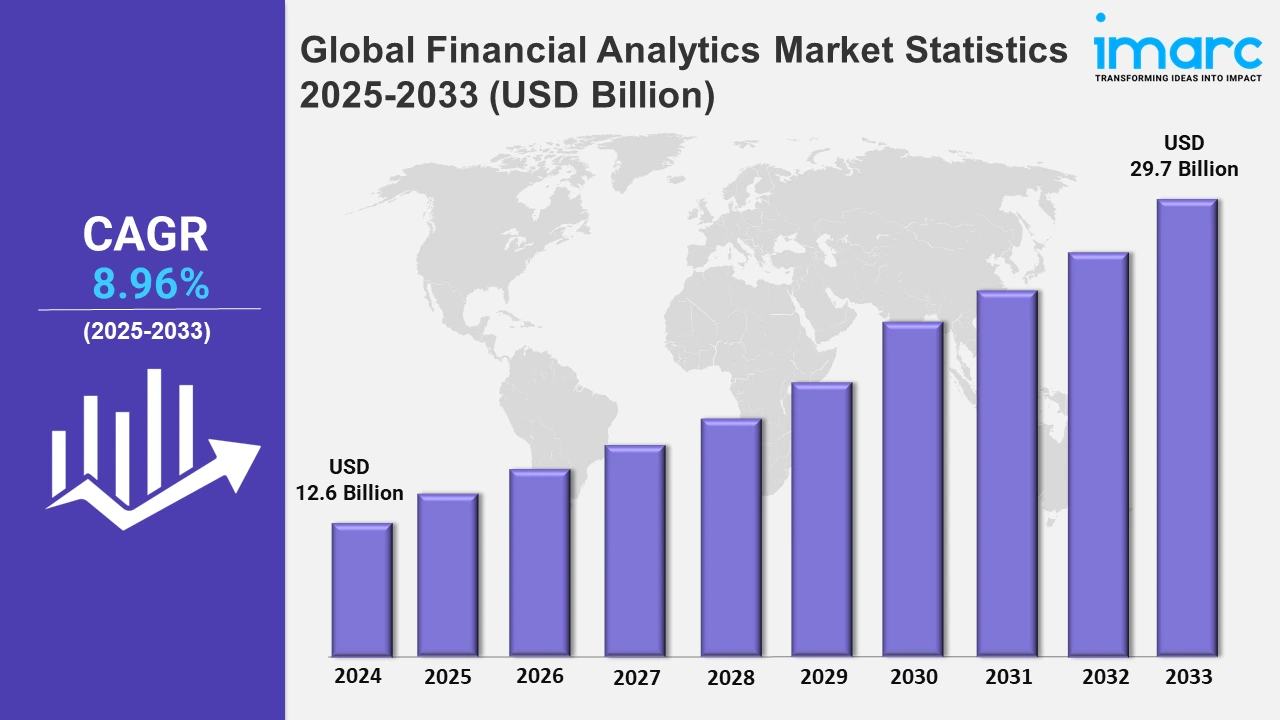

Global Financial Analytics Market is expected to reach USD 29.7 Billion by 2033

Global Financial Analytics Market Statistics, Outlook and Regional Analysis 2025-2033

The global financial analytics market size was valued at USD 12.6 Billion in 2024, and it is expected to reach USD 29.7 Billion by 2033, exhibiting a growth rate (CAGR) of 8.96% from 2025 to 2033.

To get more information on this market, Request Sample

Artificial Intelligence (AI) and machine learning (ML) are reshaping the financial analytics market by enhancing data processing and interpretation capabilities. By enabling predictive and prescriptive analytics, these technologies significantly improve the accuracy in forecasting various market trends as well as identifying investment opportunities. Automation of complex financial analyses reduces manual effort and accelerates decision-making. Machine learning models refine their predictions through historical data, improving precision over time. Notably, Tegus launched AskTegus on April 10, 2024, an AI copilot designed to streamline investment research by summarizing and referencing data from a comprehensive transcript library, improving efficiency, and integrating with Top Investor Questions for deeper analysis. The capabilities of AI are enhancing risk management and enabling tailored financial services, with advanced anomaly detection tools playing a crucial role in preventing fraud and strengthening security, ensuring financial organizations remain resilient and responsive to shifting challenges.

Organizations are increasingly leveraging data for strategic decision-making, resulting in significant growth in financial analytics adoption. The "2024 Data and AI Leadership Executive Survey" published on October 20, 2024, by Wavestone reveals that 87.9% of respondents prioritize investments in data and analytics, with 82.2% increasing these investments. Moreover, 87% of participants reported measurable business value derived from data initiatives, and 77.6% indicated that data is fostering business innovation. This trend is driven by the necessity for precise financial forecasting, risk assessment, and cost efficiency. Advanced data tools enable businesses to extract actionable insights from large datasets, identify trends, predict outcomes, and optimize operations for greater agility. The use of real-time analytics platforms helps firms swiftly adapt to market shifts. Regulatory demands for transparency and compliance further highlight the importance of financial analytics, ensuring competitiveness and adherence to changing standards.

Global Financial Analytics Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of its strong tech industry presence, continuous investments in AI, and widespread adoption of data-driven financial strategies.

North America Financial Analytics Market Trends:

The financial analytics market in North America is growing due to the adoption of advanced analytics technologies and a focus on data-driven strategies for better financial forecasting and decision-making. A notable development occurred on January 22, 2024, when PowerSchool acquired Allovue, enhancing K-12 financial management and analytics. This acquisition bolsters budget planning, real-time analytics, and transparency for U.S. schools, impacting over $50 billion in education spending and improving budget management and funding analysis. The region’s strong tech industry presence and ongoing investments in AI and machine learning are cementing North America's dominance in financial analytics, promoting advancements and wider implementation across diverse end-use industries.

Asia-Pacific Financial Analytics Market Trends:

The financial analytics market in the Asia Pacific region is growing quickly due to increasing digital adoption and an expanding fintech ecosystem. Governments and companies are investing in data analysis for improved financial effectiveness and decision-making. The drive for digital advancement in the region, along with a rise in cloud computing usage, is driving the need for real-time financial insights.

Europe Financial Analytics Market Trends:

The market in Europe for financial analytics is characterized by significant regulatory emphasis and a growing focus on data transparency. Financial institutions are integrating advanced analytics for better compliance and risk management. The region's commitment to digital transformation, coupled with robust investments in artificial intelligence (AI) and cloud-based solutions, is providing an impetus to the analytics capabilities across various financial sectors.

Latin America Financial Analytics Market Trends:

The financial analytics market in Latin America is rapidly changing as organizations seek improved financial strategies amidst economic fluctuations. Increasing investments in digital transformation and cloud technologies are facilitating analytics adoption. While challenges remain, such as infrastructural limitations, the demand for actionable financial insights is propelling the market forward, supported by regional economic development and expanding fintech sectors.

Middle East and Africa Financial Analytics Market Trends:

In the Middle East and Africa, the financial analytics market is growing as financial institutions and enterprises embrace digital solutions for improved operational efficiency. The region’s gradual shift towards technological modernization and smart financial strategies is stimulating interest in data-driven analytics, with cloud adoption and regulatory reforms playing supportive roles in accelerating the market penetration.

Top Companies Leading in the Financial Analytics Industry

Some of the leading financial analytics market companies include Alteryx, Birst, Domo, Fair Isaac Corporation (FICO), Hitachi Vantara, IBM, Information Builders, Microsoft Corporation, Oracle Corporation, QlikTech International A.B, Rosslyn Data Technologies, SAP SE, SAS Institute, Teradata Corporation, Tibco Software, Zoho Corporation, among many others. On November 13, 2024, Alteryx announced its Fall 2024 release, enhancing its platform to support hybrid analytics with new data connectors, including support for Google Cloud Storage and SingleStore, cloud execution for Analytic Apps, improved user management, and API upgrades. Key financial analytics updates include Magic Reports for automated insight generation and streamlined reporting, and LiveQuery for direct cloud data warehouse integration, enhancing data privacy and cost efficiency.

Global Financial Analytics Market Segmentation Coverage

- Based on the type, the market is classified into database management system (DBMS), data integration tools, query, reporting and analysis, analytics solutions, and others. Database management systems account for majority of the market share due to their essential role in storing, organizing, and retrieving vast amounts of financial data efficiently. They support complex data analytics, ensuring accuracy and speed, which is critical for financial forecasting and decision-making. The need for scalable, secure, and reliable data solutions further drives their adoption in the financial analytics sector.

- On the basis of the component, the market has been categorized into solutions (financial function analytics and financial market analytics) and services (managed services and professional services), wherein services represent the leading segment. This can be attributed to the high demand for consultancy, implementation, and ongoing support that organizations need when adopting financial analytics. Firms seek expert guidance for seamless integration, customization, and training, which drives growth in service offerings. Additionally, managed services are popular as businesses prefer outsourcing analytics operations to optimize performance and focus on core activities.

- Based on the application, the market is classified into wealth management, governance, risk and compliance management, financial forecasting and budgeting, customer management, transaction monitoring, stock management, and others, amongst which wealth management dominates the market. This can be attributed to its emphasis on personalized client services and tailored financial solutions, which demand advanced analytics for better decision-making. The need to manage diverse portfolios, monitor investment performance, and adapt strategies in real-time drives the adoption of sophisticated financial analytics tools. This focus ensures clients receive precise insights, enhancing trust and long-term client relationships.

- Based on the organization size, the market has been divided into large enterprises and, small and medium enterprises. Among these, large enterprises account for the majority of the market share due to their substantial resources and capacity to invest in advanced data-driven solutions. Their focus on optimizing complex financial operations, forecasting, and risk management drives demand for robust analytics tools. Additionally, large enterprises prioritize integrating AI and real-time analytics to maintain competitive advantages, enhancing their strategic decision-making capabilities and market influence.

- Based on the vertical, the market is segregated into BFSI, telecom and IT, manufacturing, government, education, and others. The BFSI sector dominates the market due to its need for precise financial forecasting, risk management, and regulatory compliance. The industry's growing focus on leveraging advanced data analytics to enhance decision-making and improve customer experiences drives adoption. Continuous investments in AI and real-time analytics solutions further bolster BFSI's leading position in the global financial analytics landscape.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 12.6 Billion |

| Market Forecast in 2033 | USD 29.7 Billion |

| Market Growth Rate 2025-2033 | 8.96% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Database Management System (DBMS), Data Integration Tools, Query, Reporting and Analysis, Analytics Solutions, Others |

| Components Covered |

|

| Applications Covered | Wealth Management, Governance, Risk and Compliance Management, Financial Forecasting and Budgeting, Customer Management, Transaction Monitoring, Stock Management, Others |

| Organization Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| Verticals Covered | BFSI, Telecom and IT, Manufacturing, Government, Education, Others |

| Regions Covered | North America, Asia Pacific, Europe Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Alteryx, Birst, Domo, Fair Isaac Corporation (FICO), Hitachi Vantara, IBM, Information Builders, Microsoft Corporation, Oracle Corporation, QlikTech International A.B, Rosslyn Data Technologies, SAP SE, SAS Institute, Teradata Corporation, Tibco Software, Zoho Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)