Global Fertilizer Additives Market Expected to Reach USD 3.64 Billion by 2033 - IMARC Group

Global Fertilizer Additives Market Statistics, Outlook and Regional Analysis 2025-2033

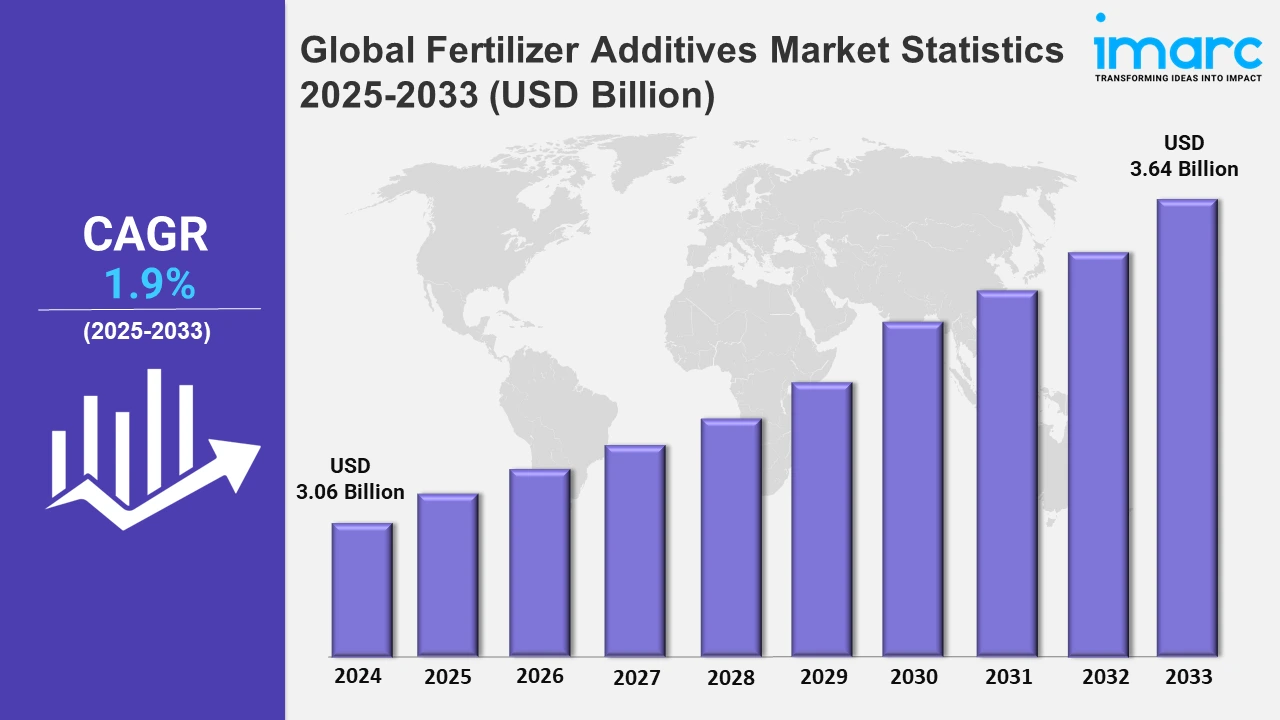

The global fertilizer additives market size was valued at USD 3.06 Billion in 2024, and it is expected to reach USD 3.64 Billion by 2033, exhibiting a growth rate (CAGR) of 1.9% from 2025 to 2033.

To get more information on this market, Request Sample

Driving factors in the market are an ever-growing global population, thereby intensifying a demand for greater agricultural outputs to sustain food security levels. Besides this, surging implementation of precision farming techniques pushes the market forth as the increasing adoption is seen on the part of farmers with regard to usage of additives that make their fertilizers more tailored up to soil and crop's specific demands for optimizing nutrients delivery to crops and wastage less. Sustainable agricultural practices are reducing environmental impacts. Emerging investments in research to reduce methane emissions from livestock and advances in biological solutions are indicating that the industry is focusing on creating eco-friendly innovations, further propelling the growth of sustainable agriculture markets. On July 19, 2024, Agriculture Dive reported that PepsiCo and Yara have partnered to supply up to 165,000 tons of low-carbon fertilizers annually, aiming to reduce food production emissions across 1,000 EU and UK farms. Cargill invested USD 1 Million in Colorado State University's AgNext program to research methane reduction in cattle. Syngenta and Ginkgo Bioworks are collaborating to expedite the development of sustainable biologicals.

Furthermore, governments across the globe have initiated policies that encourage usage of environmentally friendly additives to alleviate soil degradation and water contamination associated with conventional fertilizers. Increasing awareness of deficiencies in soil micronutrient content has also driven interest in additives specifically formulated for supplementing soil with minerals such as zinc, boron, and manganese. Further, the growing bio-agriculture industry focusing on organic and non-toxic inputs integrates additives that comply with the standards of organic farming. The increasing attention to enhancing nutrient use efficiency and minimizing greenhouse gas emissions is further fueling the growth in the fertilizer additives market. Strategic expansion in emerging markets such as Japan highlights the need for innovative solutions that ensure optimal crop productivity while reducing adverse impacts on the environment. Collaborative efforts within these regions further accelerate advancements in sustainable agricultural practices, bolstering market expansion. On September 18, 2024, the Japan external trade organization (JETRO) announced that Innovar Ag, a U.S.-based developer of chemical fertilizer additives, established a representative office in Tokyo's Toshima-ku. This strategic move aims to enhance nutrient use efficiency in crops, reduce agricultural greenhouse gas emissions, and foster collaborations within the Japanese market.

Global Fertilizer Additives Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of due to expanding agricultural sector, government-backed farming advancements, industrial capabilities, and growing awareness of sustainable practices, meeting the food demands of its large population.

Asia-Pacific Fertilizer Additives Market Trends:

The Asia Pacific fertilizer additives market is driven by the region's vast agricultural base and increasing demand for high-yield crops. Rapid adoption of modern farming techniques, government support, and awareness of soil health contribute to the market growth. Emerging economies, including India and China are key players, focusing on sustainable solutions to meet the growing food demand.

North America Fertilizer Additives Market Trends:

North America dominates the fertilizer additives market due to advanced agricultural practices, widespread adoption of precision farming, and significant investment in research and development. The region's focus on sustainable agriculture, coupled with favorable government policies and robust infrastructure, supports market growth. High awareness among farmers regarding soil health and nutrient efficiency further drives demand. Moreover, the fertilizer additives market is being propelled by strategic acquisitions that integrate advanced soil health technologies and sustainable agricultural solutions. Companies are leveraging partnerships to reduce chemical dependency and improve nutrient management, aligning with industry demand for eco-friendly innovations. On July 1, 2024, Sustainable Green Team, Ltd. (SGTM) acquired Regen Hubs North America, Inc., Regen Hubs International, Inc., and HumiRock, LLC. This strategic move aims to enhance SGTM's sustainable agricultural practices by leveraging Regen Hubs' expertise in soil health and reducing chemical usage. The acquisition includes established connections with major retail networks, facilitating growth in the Fertilizer Additives market.

Europe Fertilizer Additives Market Trends:

Fertile ground for the growth of Europe's fertilizer additives market is created by strong environmental regulations and sustainable agriculture. Advanced agricultural technologies along with an emphasis on the reduction of greenhouse gases increase the demand. A considerable R&D investment in the region also boosts the organic farming initiative and hence the market for environmentally friendly fertilizer additives.

Latin America Fertilizer Additives Market Trends:

The Latin American fertilizer additives market is expanding due to the growth of agricultural exports and awareness in soil fertility management. The countries, such as Brazil and Argentina, are adopting precision farming and advanced additives that meet the global food demand as well as improve the overall productivity. Government policies supporting sustainable farming further propel the market.

Middle East and Africa Fertilizer Additives Market Trends:

The Middle East and Africa fertilizer additives market is growing due to the need for efficient farming in arid conditions. The challenges of water scarcity have driven the adoption of additives that improve nutrient utilization and crop yield. Increased investments in agricultural technologies and partnerships with global players also drive regional market growth.

Top Companies Leading in the Fertilizer Additives Industry

Some of the leading fertilizer additives market companies include Amit Trading Ltd, ArrMaz (Arkema S.A.), BASF SE, Clariant AG, Corteva Inc., Dorf-Ketal Chemicals India Private Limited, Holland Novochem B.V., Hubei Forbon Technology Co Ltd, KAO Corporation, Michelman Inc., Solvay S.A., and Tolsa SA, among many others. On May 8, 2024, BASF announced plans to expand its additives plant in Nanjing, China, by introducing a state-of-the-art production line for high-performance Controlled Free Radical Polymerization dispersants. This initiative aims to meet the growing demand in Asia and enhance environmental standards by reducing CO₂ emissions. The new line is expected to commence operations by the end of 2025.

Global Fertilizer Additives Market Segmentation Coverage

- On the basis of the function, the market has been categorized into dust control agent, anticaking agent, antifoaming agent, hydrophobing agent, corrosion inhibitor, and others, wherein anticaking agent represents the leading segment. Anticaking agents drive the demand due to their critical role in maintaining fertilizer quality by preventing clumping during storage and transportation. Additives ensure uniform application, ease of handling, and increase efficiency for farmers. Demand for high-performance fertilizers in agriculture enhances the adoption of anticaking agents across various fertilizer types.

- Based on the form, the market is classified into granular, prilled, and powdered, amongst which granular dominates the market. Granular fertilizers dominated the market as they provide better handling, uniform nutrient distribution, and reduced application loss. Their compatibility with modern agricultural machinery makes them highly preferred for large-scale farming operations. Moreover, granular fertilizers ensure slow and controlled nutrient release, meeting the growing need for efficient, long-lasting fertilization solutions in diverse farming practices.

- On the basis of the application, the market has been divided into urea, monoammonium phosphate, triple super phosphate, diammonium phosphate, ammonium nitrate, and others. Among these, urea accounts for the majority of the market share. The high nitrogen content and cost-effectiveness of urea have dominated the application segment in global agriculture. Fertilizer additives play a crucial role in enhancing the stability of urea, reducing volatilization, and improving nutrient efficiency. The growing use of urea in intensive farming practices also fuels the demand for additives specifically designed for this critical fertilizer.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 3.06 Billion |

| Market Forecast in 2033 | USD 3.64 Billion |

| Market Growth Rate 2025-2033 | 1.9% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Functions Covered | Dust Control Agent, Anticaking Agent, Antifoaming Agent, Hydrophobing Agent, Corrosion Inhibitor, Others |

| Forms Covered | Granular, Prilled, Powdered |

| Applications Covered | Urea, Monoammonium Phosphate, Triple Super Phosphate, Diammonium Phosphate, Ammonium Nitrate, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amit Trading Ltd, ArrMaz (Arkema S.A.), BASF SE, Clariant AG, Corteva Inc., Dorf-Ketal Chemicals India Private Limited, Holland Novochem B.V., Hubei Forbon Technology Co Ltd, KAO Corporation, Michelman Inc., Solvay S.A., Tolsa SA, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)