Global Feminine Hygiene Products Market Expected to Reach USD 43.7 Billion by 2033 – IMARC Group

Global Feminine Hygiene Products Market Statistics, Outlook and Regional Analysis 2025-2033

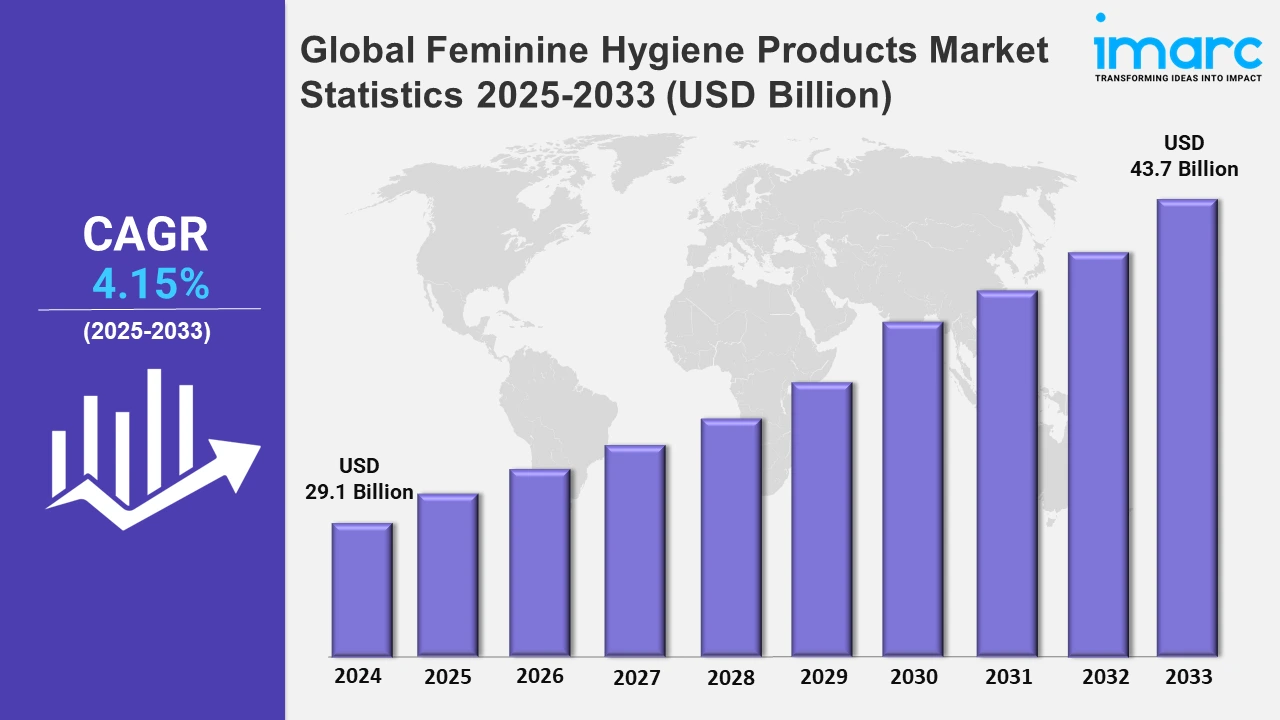

The global feminine hygiene products market size was valued at USD 29.1 Billion in 2024, and it is expected to reach USD 43.7 Billion by 2033, exhibiting a growth rate (CAGR) of 4.15% from 2025 to 2033.

To get more information on this market, Request Sample

The growing awareness among females about their health is encouraging them to prioritize menstrual hygiene and overall well-being. As education on menstrual health and hygiene is improving through media, campaigns, and healthcare providers, women are understanding the importance of using proper hygiene products. This is leading to a rise in the demand for high-quality, effective, and safe feminine hygiene products, such as sanitary pads, tampons, and menstrual cups. In addition, women are openly discussing about their menstruation issues and seeking better solutions for comfort. As women are becoming more conscious of the ingredients used in hygiene products, there is also a noticeable shift towards natural, organic, and chemical-free products, further bolstering the market growth. As per the IMARC Group’s report, the global women’s health market is expected to reach USD 57.9 Billion by 2032.

The expansion of e-commerce platforms is making feminine hygiene products more accessible to a wider range of women. The convenience of shopping from home, especially for personal care items, appeals to individuals who may prefer privacy or find it easier to shop for products in bulk or on a subscription. The variety of online platforms gives women an opportunity to get the essential details of the products, customer reviews, and comparisons, as well as make their choices based on their individual needs. The new approach in online marketing with tailored programs including the use of massively attended influencer events is making it possible for the companies to create different product propositions for the receptive community. Furthermore, women who have busy life schedules are the perfect candidates for e-commerce platforms as they can simply have feminine hygiene products delivered to their homes. The IMARC Group’s report shows that the global e-commerce market is expected to reach USD 214.5 Trillion by 2033.

Global Feminine Hygiene Products Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Asia-Pacific, North America, Europe, the Middle East and Africa, and Latin America. According to the report, Asia-Pacific accounts for the largest market share due to the growing female population, increasing awareness about menstrual health and rapid urbanization.

Asia-Pacific Feminine Hygiene Products Market Trends:

The Asia-Pacific region is at the top position in the market due to its massive female population and increasing adoption of premium female hygiene products. Increasing disposable incomes in countries, such as China, India, and Japan encourage women to utilize sanitary products. Government agencies in these regions actively promote menstrual hygiene through educational campaigns. Efforts are being made here to ensure that all women have access to necessary hygiene products. Also, a diverse variety of products, from very inexpensive to expensive, and organic, covers cover a wide range of individual needs. Rapid e-commerce growth and duty-free retail expansion assist in making menstrual products more easily reachable across the region. According to the IMARC Group’s report, the Asia-Pacific duty-free retailing market is projected to exhibit a growth rate (CAGR) of 6.6% during 2024-2032.

North America Feminine Hygiene Products Market Trends:

North America’s feminine hygiene products share a large part of the sector due to its much-developed infrastructure. Locally, women have a preference for high-end, sustainable, and environment friendly products. Regional brands are regularly offering biodegradable pads, organic tampons, and reusable menstrual cups. Government and private initiatives that promote menstrual health and access to free and subsidized products also contribute to the market growth.

Europe Feminine Hygiene Products Market Trends:

The market for feminine hygiene products is expanding gradually in Europe, which can be attributed to a large buyer base that prioritizes quality, comfort, and sustainability. In Germany, the UK, and France, females prefer organic and eco-friendly menstrual products. Government policies to promote menstrual equity are further supporting the market growth. Moreover, in this region, women choose reusable products, such as menstrual cups and period underwear, which highlights a shift toward sustainable consumption.

Middle East and Africa Feminine Hygiene Products Market Trends:

The market for feminine hygiene products in the Middle East and Africa region is distinguished by rising awareness about menstrual health and hygiene education. Initiatives by non-governmental organizations are addressing barriers of period stigma. People are shifting here to urban areas, which is also driving the demand for effective hygiene products.

Latin America Feminine Hygiene Products Market Trends:

On account of the improving access to menstrual hygiene solutions, Latin America is enjoying feminine hygiene products market expansion. Economic development and rapid urbanization, particularly in Brazil, Mexico, and Argentina, contribute to increased purchasing power, which allows more women to buy branded products. Furthermore, government agencies are investing in these products to promote menstrual health education.

Top Companies Leading in the Feminine Hygiene Products Industry

Some of the leading Feminine Hygiene Products market companies include Procter & Gamble, Edgewell Personal Care, Unicharm, Kimberly-Clark Corporation, Kao Corporation, among many others. In October 2024, Sofy, a prominent feminine hygiene brand by Unicharm, unveiled the launch of the improved Sofy Anti-Bacteria range to provide high-quality hygiene solutions to young women. A period tracking app, SOFY CLUB APP was also introduced in India to enable females to monitor their cycles with ease.

Global Feminine Hygiene Products Market Segmentation Coverage

- On the basis of the product type, the market has been categorized into sanitary pads, panty liners, tampons, spray and internal cleaners, and others, wherein sanitary pads represent the leading segment. Sanitary pads are easy to use and widely available. They are comfortable for use by all age groups of women and come in different sizes. They have different levels of absorbency based on the needs of the person. Many brands also provide ultra-thin and scented versions for modern buyers. Women do not feel hindered during daily activities, as pads are lightweight and comfortable.

- Based on the distribution channel, the market has been classified into supermarkets and hypermarkets, specialty stores, beauty stores and pharmacies, online stores, and others. Among these, supermarkets and hypermarkets dominate the market because they are super convenient and accessible for shoppers. These stores provide a variety of products and brands from which the customer can simply compare and choose what they need. They often have some discounts and promotions, which attract more customers. Since most people already visit these places for groceries and essentials, picking up hygiene products becomes part of their routine. They also provide a trust factor, as customers feel confident about the quality and authenticity of the products sold there.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 29.1 Billion |

| Market Forecast in 2033 | USD 43.7 Billion |

| Market Growth Rate 2025-2033 | 4.15% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Sanitary Pads, Panty Liners, Tampons, Spray and Internal Cleaners, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Beauty Stores and Pharmacies, Online Stores, Others |

| Regions Covered | Asia Pacific, North America, Europe, Middle East and Africa, Latin America |

| Companies Covered | Procter & Gamble, Edgewell Personal Care, Unicharm, Kimberly-Clark Corporation, Kao Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Feminine Hygiene Products Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)