Global Feed Premix Market Expected to Reach USD 31.6 Billion by 2033 - IMARC Group

Global Feed Premix Market Statistics, Outlook and Regional Analysis 2025-2033

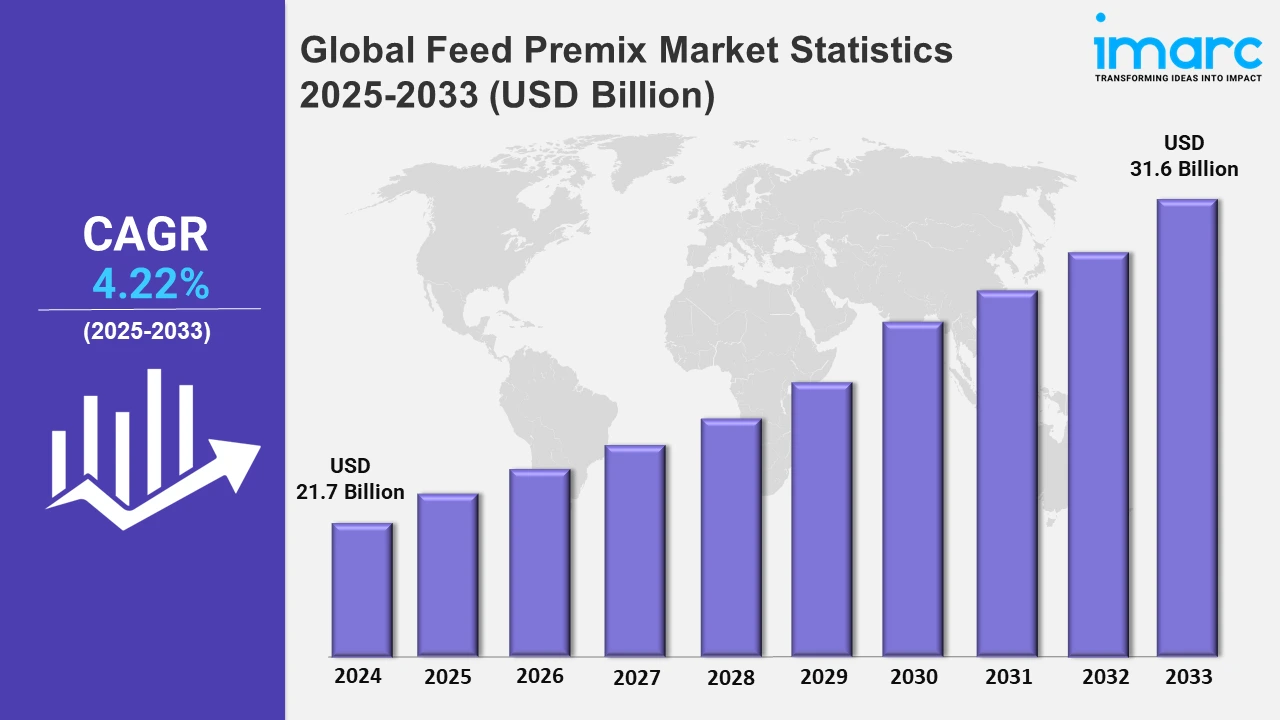

The global feed premix market size was valued at USD 21.7 Billion in 2024 and it is expected to reach USD 31.6 Billion by 2033 exhibiting a growth rate (CAGR) of 4.22% from 2025 to 2033.

To get more information on this market, Request Sample

The demand for high quality animal products, which include meat, milk, and eggs, is also raising the demand for feed premix as consumers are concerned about protein-rich diets. Increased adoption of feed premixes is also backed by the need for optimized nutrition for livestock to increase productivity and enhance health. Other regulations concerning animal welfare and food safety further promote the consumption of fortified feeds with a balance of nutrients. Advances in precision nutrition that allows formulating premixes according to the specific needs of specific animals are increasing demand. Changes in the preference toward more sustainable and organic modes of farming are creating awareness in non-GMO and more environment-friendly premixes. The awareness of benefits related to feed premixes, such as efficient feeds and cost reduction among the farmers, is driving further market growth. For example, in September 2024, dsm-firmenich launched a new Animal Nutrition and Health facility in Egypt, which will help improve the production of specialized feed premixes and additives. This 10000-square-meter plant with state-of-the-art technology will enhance supply reliability and support sustainable farming while creating local jobs and economic growth.

The feed premix market is evolving with trends centering on sustainability, precision nutrition, and regulatory compliance. Organic and non-GMO premixes are in increased demand due to consumer desire for environmentally friendly and responsible livestock farming practices. Innovation in precision nutrition supported by advances in data analytics and livestock health monitoring are driving the possibility of tailoring feed formulation to optimize performance and reduce waste. For example, in April 2024, Intraco and trinamiX GmbH announced a collaboration to provide mobile feed analysis using trinamiX handheld NIR spectroscopy technology. The collaboration will improve real-time nutrient assessment for livestock, enabling farmers to optimize feed formulations and improve dietary quality while reducing dependence on traditional lab testing methods. Functional additives such as probiotics and enzymes are increasingly being added to improve gut health and immunity. Tightening rules in terms of feed quality and safety drive the development of traceable, compliant premixes. These trends together express a market shift toward efficient, sustainable, and healthy feed solutions.

Global Feed Premix Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share due to its high livestock population and expanding poultry sector.

Asia-Pacific Feed Premix Market Trends:

In the Asia Pacific region, the feed premix market is experiencing an increase in demand for customized nutritional solution mainly due to the rapid growth of livestock sector across the region. Gradual increase in meat consumption mainly in developing countries like China and India is further driving the necessity for nutrient dense feed premixes. According to industry reports, in 2024, India's milk production increased by 3.78% to 239.30 million tons in 2023-24 with Uttar Pradesh leading at 16.21%. Egg production increased to 142.77 billion with Andhra Pradesh at 17.85%. Meat output reached 10.25 million tons primarily from West Bengal at 12.62% and poultry (48.96%). There is a growing emphasis in sustainable farming practices with manufacturers across the region prioritizing ecofriendly formulations and minimizing antibiotic use. The inclusion of enzymes, probiotics and prebiotics in feed premixes is becoming increasingly common to improve animal health and productivity.

North America Feed Premix Market Trends:

In North America feed premix market several key trends are shaping the landscape. There is a growing emphasis on enhancing animal health and nutrition driving demand for specialized premixes enriched with vitamins, minerals, and probiotics. Sustainability is a significant focus with manufacturers adopting ecofriendly ingredients and processes to meet regulatory standards and consumer preferences.

Europe Feed Premix Market Trends:

The feed premix market in Europe is evolving with a strong focus on animal health, productivity, and sustainable farming practices. There is an increasing demand for personalized premixes that contain essential vitamins, minerals, amino acids, and other nutrients aimed at enhancing livestock performance. Consumers are gravitating toward natural and organic ingredients driving the market towards cleaner label options for meat and dairy products. Additionally, as regulations around antibiotic use tighten there is a rise in innovation for alternative feed additives. Furthermore, advancements in precision nutrition are offering tailored solutions that meet the specific needs of animals enabling farmers to achieve greater efficiency and sustainability in their operations across Europe.

Latin America Feed Premix Market Trends:

The Latin American feed premix market is experiencing several key trends driving its growth and evolution. Increasing demand for high quality animal protein particularly in Brazil and Argentina fuels the need for advanced premix formulations that enhance livestock health and productivity. Technological advancements such as precision nutrition and automation in feed manufacturing are improving efficiency and consistency. Sustainability is becoming paramount with a shift towards ecofriendly ingredients and practices to meet regulatory standards and consumer expectations. These trends collectively are shaping a robust and dynamic feed premix landscape in the region.

Middle East and Africa Feed Premix Market Trends:

The Middle East and Africa feed premix market is experiencing significant growth driven by several key trends. A rising demand for animal protein and an expanding livestock population are primary factors fueling the need for high quality feed premixes. Technological advancements such as precision nutrition and improved formulation techniques are enhancing feed efficiency and animal health. Regional integration and investment in supply chain infrastructure are also strengthening market dynamics. The adoption of digital solutions for better management and traceability is shaping the future of the feed premix industry in these regions.

Top Companies Leading in the Feed Premix Industry

Some of the leading feed premix market companies include ADM, Alltech, Avitech Nutrition Pvt. Ltd, Cargill, Incorporated, De Heus Animal Nutrition, dsm-firmenich, Kemin Industries, Inc, Land O'Lakes, Inc., Novus International, Inc., Nutreco, among many others. In March 2024, De Heus inaugurated its new shrimp feed mill in will Vinh Long, Vietnam. The facility spanning across 29,300 square meters with capacity of 50,000 metric tons aims to enhance local aquaculture and support sustainable practices.

Global Feed Premix Market Segmentation Coverage

- On the basis of the ingredient type the market has been categorized into amino acids, vitamins, minerals, antibiotics, antioxidants and others wherein amino acids represent the leading segment. Amino acids dominate the feed premix market due to their essential role in optimizing animal growth development and productivity. These compounds are crucial in enhancing protein synthesis, improving feed efficiency and supporting overall health in livestock. The demand for amino acid based premixes is driven by increasing awareness of their benefits in reducing feed costs and enhancing meat quality. Their application spans various livestock categories ensuring consistent performance improvement. This leadership is bolstered by advancements in manufacturing processes ensuring high quality and cost effective solutions.

- Based on the form, the market is classified into dry and liquid amongst which dry dominates the market. The dry form leads the feed premix market owing to its ease of handling, transportation and storage. Dry feed premixes hold the largest share in the market attributed to their longer shelf life, easy handling and compatibility with diverse feed formulations. These premixes are preferred for their cost effectiveness and convenience in transportation and storage. Dry formulations enable precise blending with other feed ingredients ensuring uniform nutrient distribution. Their versatility makes them suitable for various livestock enhancing their appeal across feed producers.

- On the basis of the livestock, the market has been divided into poultry, ruminants, swine, aquatic animals, equine and pets. Among these poultry accounts for the majority of the market share. Poultry represents the largest market segment in feed premixes driven by the rising demand for poultry products such as meat and eggs. The segment benefits from efficient feed conversion ratios in poultry necessitating precise nutritional formulations to enhance productivity and health. Feed premixes are essential in supporting growth, immune function and egg quality aligning with consumer demand for high quality poultry products.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 21.7 Billion |

| Market Forecast in 2033 | USD 31.6 Billion |

| Market Growth Rate 2025-2033 | 4.22% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Ingredient Types Covered | Amino Acids, Vitamins, Minerals, Antibiotics, Antioxidants, Others |

| Forms Covered | Dry, Liquid |

| Livestocks Covered | Poultry, Ruminants, Swine, Aquatic Animals, Equine, Pets |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ADM, Alltech, Avitech Nutrition Pvt. Ltd, Cargill, Incorporated, De Heus Animal Nutrition, dsm-firmenich, Kemin Industries, Inc, Land O'Lakes, Inc., Novus International, Inc., Nutreco, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Feed Premix Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)