Global Feed Additives Market Expected to Reach USD 62.3 Billion by 2033 - IMARC Group

Global Feed Additives Market Statistics, Outlook and Regional Analysis 2025-2033

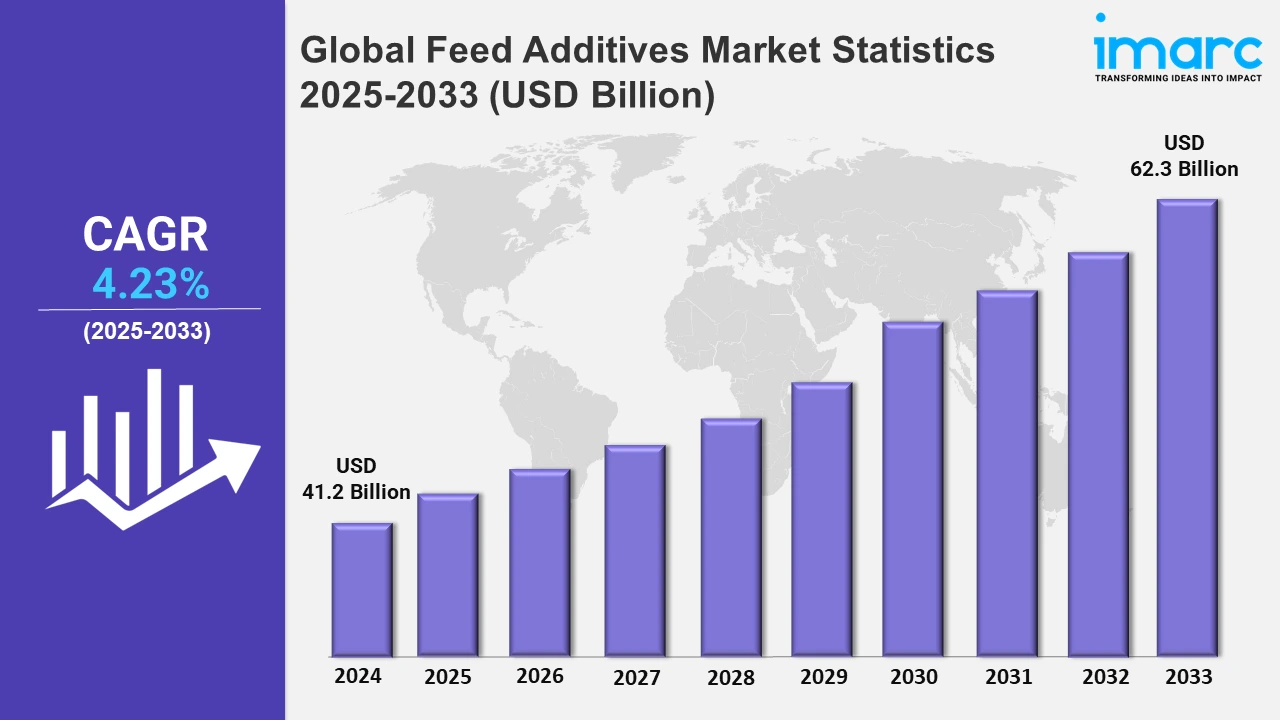

The global feed additives market size was valued at USD 41.2 Billion in 2024, and it is expected to reach USD 62.3 Billion by 2033, exhibiting a growth rate (CAGR) of 4.23% from 2025 to 2033.

To get more information on this market, Request Sample

The growing emphasis on sustainability and efficiency in livestock production is driving significant advancements in the feed additives market. This surge is supported by a focus on environmentally friendly solutions that align with global climate goals. Companies are increasingly investing in research to create innovative products that not only boost productivity but also meet stringent environmental regulations. For instance, in August 2024, Volac launched a new feed additives website showcasing its robust range of scientifically supported products and services. These offerings focus on enhancing livestock production efficiency while promoting sustainability. Volac’s platform highlights expertise in microbiology, biochemistry, enzymology, and immunology, playing a key role in supporting mycotoxin management and promoting phytogenic and nutraceutical solutions. Also, the introduction of regulatory-approved additives that reduce environmental impact further underscores this trend. In May 2024, the FDA approved Bovaer (3-NOP), a methane-reducing feed additive developed by Elanco, specifically for lactating dairy cows. This product aligns with global sustainability targets and supports dairy farmers in accessing voluntary carbon markets proven to cut methane emissions by 30%, creating an additional revenue stream. These developments reflect the sector's commitment to reducing greenhouse gas emissions while maintaining high production standards. Companies are focusing on integrating eco-friendly products that enhance farm profitability and align with the changing landscape of agricultural sustainability.

Moreover, the global feed additives market is witnessing expansion driven by innovative regional initiatives aimed at catering to local market needs. A notable example of this is the entry of European feed additives company Nuqo into the Indian market. In May 2024, Nuqo launched Nuqo Animal Nutrition India Pvt Ltd, leveraging its specialization in plant and seaweed-based micro-encapsulation technologies. This move aims to strengthen Nuqo’s presence and meet the growing demands in India, a region with expanding livestock production. The combination of global technological innovation and regional market strategies is fostering growth, creating a competitive and environmentally conscious market landscape.

Global Feed Additives Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, North America, Europe, the Middle East and Africa, and Latin America. According to the report, Asia Pacific dominates the feed additives market, rapid urbanization, increasing livestock production, and rising demand for high-quality animal protein.

North America Feed Additives Market Trends:

North America is seeing a surge in demand for natural feed additives driven by consumer preference for organic meat. The U.S. is leading in adopting additives like probiotics to enhance animal health and production. The focus is on sustainability and reducing antibiotic use, with farmers opting for plant-based supplements to maintain livestock well-being while meeting regulatory standards.

Europe Feed Additives Market Trends:

Europe prioritizes stringent regulations for livestock health, boosting the demand for advanced, eco-friendly feed additives. Germany is at the forefront, using enzymes and prebiotics to enhance digestion and nutrient absorption. The market emphasizes non-antibiotic growth promoters, aligning with consumer interest in high-quality, safe meat products while supporting environmental conservation and adhering to strict EU policies.

Asia Pacific Feed Additives Market Trends:

Asia Pacific is the dominating region in the market, driven by rapid urbanization, and rising demand for high-quality animal protein. In addition, countries like China and India are leading contributors, driven by expanding agricultural activities and improvements in animal husbandry practices. In October 2024, Phibro Animal Health Corporation’s acquisition of Zoetis’ medicated feed additive portfolio, including water-soluble products and manufacturing sites in China, underscores the region's strategic importance. This development enhances Phibro’s product offerings and boosts profitability, reinforcing the growing focus on animal health solution.

Latin America Feed Additives Market Trends:

In Latin America, the market is expanding due to the growing livestock sector. Brazil, as a major meat producer, focuses on fortified feed additives to improve weight gain and overall animal health. The use of amino acids and vitamins to boost productivity and reduce production costs is common, catering to export demands and enhancing the region’s competitive agricultural market.

Middle East and Africa Feed Additives Market Trends:

The Middle East and Africa is witnessing increased adoption of feed additives to combat harsh climate conditions and improve livestock health. South Africa, for instance, uses mineral additives and enzymes to optimize feed efficiency and support dairy and poultry production. The focus on balancing cost-effectiveness and nutritional enhancement is essential for meeting the rising demand for quality meat products.

Top Companies Leading in the Feed Additives Industry

Some of the leading feed additives market companies include Adisseo, ADM, Ajinomoto Co., Inc, Alltech, BASF SE, Bentoli, Cargill, Incorporated, Evonik Industries AG, Kemin Industries, Inc., Lallemand Inc., Novonesis Group, Novus International, Inc., and Solvay S.A., among many others. In September 2023, Cargill and Solidaridad announced a strategic global partnership across five countries to improve farmer livelihoods, increase the use of climate-friendly farming practices, and improve conservation and responsible land use. Also, in September 2023, Archer Daniels Midland (ADM) Company and Syngenta Group announced that they had signed a memorandum of understanding (MoU) to collaborate in scaling research and commercialization of low carbon-intensity next-generation oilseeds and improved varieties to help meet skyrocketing demand for biofuels and other sustainably sourced products.

Global Feed Additives Market Segmentation Coverage

- On the basis of the source, the market has been bifurcated into synthetic and natural, wherein synthetic represents the most preferred segment. Synthetic feed additives are often more concentrated, leading to lower inclusion rates in animal feeds. They are easier and cheaper to produce as compared to natural sources.

- Based on the product type, the market is categorized into amino acids (lysine, methionine, threonine, and tryptophan); phosphates (monocalcium phosphate, dicalcium phosphate, mono-dicalcium phosphate, defulorinated phosphate, tricalcium phosphate, and others); vitamins (fat-soluble and water-soluble); acidifiers (propionic acid, formic acid, citric acid, lactic acid, sorbic acid, malic acid, acetic acid, and others); carotenoids (astaxanthin, canthaxanthin, lutein, and beta-carotene); enzymes (phytase, protease, and others); mycotoxin detoxifiers (binders and modifiers); flavors and sweeteners (flavors and sweeteners); antibiotic (tetracycline, penicillin, and others); minerals (potassium, calcium, phosphorus, magnesium, sodium, iron, zinc, copper, manganese, and others); antioxidants (BHA, Bht, ethoxyquin, and others); non-protein nitrogen (urea, ammonia, and others); preservatives (mold inhibitors and anticaking agents); phytogenics (essential oils, herbs and spices, oleoresin, and others); probiotics (lactobacilli, stretococcus thermophilus, bifidobacterial, and yeast), amongst which amino acids (lysine, methionine, threonine, and tryptophan) dominates the market. The need for protein-rich diets for livestock necessitates the inclusion of essential amino acids in animal feeds. Furthermore, the deficiency of amino acids can lead to stunted growth and health issues in animals, making their addition to feed crucial.

- On the basis of the livestock, the market has been divided into ruminants (calves, dairy cattle, beef cattle, and others), poultry (broilers, layers, and breeders), swine (starters, growers, and sows), aquatic animal, and others. These additives ensure optimal health, productivity, and feed efficiency, supporting sustainable and profitable livestock farming.

- Based on the form, the market is categorized into dry and liquid, amongst which dry dominates the market. This form is more stable, ensuring a longer shelf life, which is essential for bulk purchases.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 41.2 Billion |

| Market Forecast in 2033 | USD 62.3 Billion |

| Market Growth Rate 2025-2033 | 4.23% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Sources Covered | Synthetic, Natural |

| Product Types Covered |

|

| Livestocks Covered |

|

| Forms Covered | Dry, Liquid |

| Regions Covered | Asia Pacific, North America, Europe, Middle East and Africa, Latin America |

| Companies Covered | Adisseo, ADM, Ajinomoto Co., Inc, Alltech, BASF SE, Bentoli, Cargill, Incorporated, Evonik Industries AG, Kemin Industries, Inc., Lallemand Inc., Novonesis Group, Novus International, Inc., Solvay S.A., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Feed Additives Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)