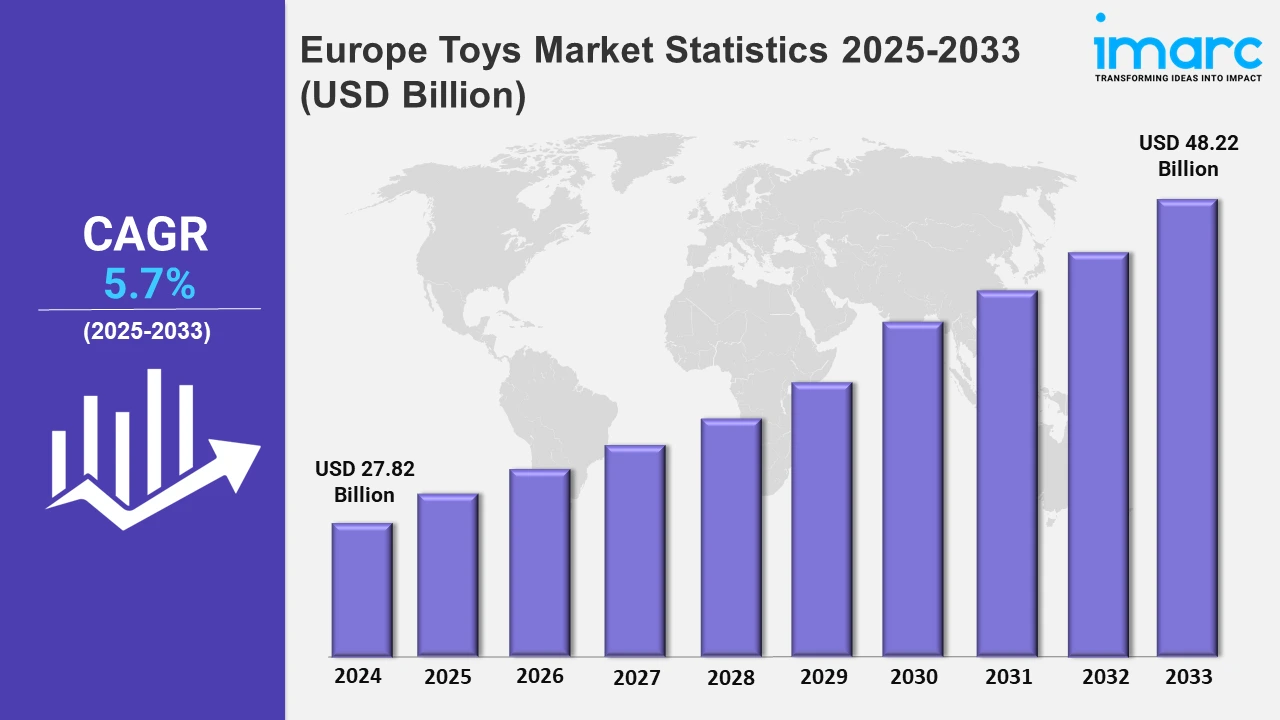

Europe Toys Market Expected to Reach USD 48.22 Billion by 2033 - IMARC Group

Europe Toys Market Statistics, Outlook and Regional Analysis 2025-2033

The Europe toys market size was valued at USD 27.82 Billion in 2024, and it is expected to reach USD 48.22 Billion by 2033, exhibiting a growth rate (CAGR) of 5.7% from 2025 to 2033.

To get more information on this market, Request Sample

The growing need for higher-quality toys driven by evolving consumer preferences is catalyzing the market growth in Europe. Sustainable and educational toys are becoming popular among parents as they support creativity and child development. Reflecting on this, in September 2024 at Brand Licensing Europe, Hasbro, one of the major market players in the toys industry, showcased several projects that focused on growth. Key launches included Peppa Pig baking accessories in collaboration with Zenker, role-play toys by HTI, Transformers puzzles by Trefl, and a partnership with MDM Deutsche Münze for collectible Transformers coins. These initiatives are part of broader movements that use popular franchises to accommodate diverse consumer choices while incorporating creative play patterns. Beyond that, the growing emphasis on childhood education with the rising disposable income of guardians is also represented as a notable growth factor. Further, complemented by robust investments in research and development to make toys that combine modern technology with traditional ways of playing. Influenced by these trends, Hasbro's partnerships cater to the needs of tech-savvy kids and nostalgic adults, thereby meeting the consumer demands for products that promote intergenerational relationships.

In addition, as businesses embrace eco-friendly practices, sustainability continues to influence market dynamics. The use of recyclable materials and integration of certified woods in the production of toys highlights the industry's commitment to environmentally conscious production, which resonates with sustainability-focused consumers in Europe. Additionally, to further support growth, businesses are expanding their regional presence. MGA Entertainment created four subsidiaries in the European Union: MGA Toys France, MGA Entertainment Italy, MGA Toys Iberia (Spain), and MGA Entertainment Greece in November 2023. This strategic move seeks to expedite sales and marketing activities, facilitating rapid development in these fundamental regions. The commitment of MGA to localize and innovate highlights the expanding significance of Europe as a dynamic market for toys. Furthermore, these changes underscore the company's capitalization and regional opportunities while addressing the demand of European consumers for high-quality, sustainable, and inventive toys.

Europe Toys Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Germany, France, United Kingdom, Italy, Spain, and others.

Germany Toys Market Trends:

The toy industry in Germany concentrates on educational and eco-friendly products. The country's emphasis on environmental sustainability and cognitive development is reflected in the growing demand for wooden toys, such as those made by HABA. For instance, Ravensburger, a company in Bavaria, leads the puzzle board games sector, serving both children as well as adults. Also, Germany leads the segments of green toys due to its good quality and durable toys, which align with the consumer's environmentally sustainable values.

France Toys Market Trends:

The French market shows a strong preference for storytelling toys that inspire creativity and role-play. Additionally, high-end plush toys from the market in France are witnessing substantial growth in the licensed character-based toys segment, which is driven by famous franchises. In addition, brands such as Smoby Toys, which has its headquarters in Jura, are creating products that are associated with well-known characters like Spider-Man and Peppa Pig. Also, toys that inspire creativity and role-play are highly preferred in the market in France. High-end plush toys from brands like Moulin Roty are gaining traction due to their aesthetic appeal, which is liked by French families.

United Kingdom Toys Market Trends:

The UK toy market thrives on tech-driven and STEM-related toys. For instance, London-based Tech Will Save Us creates educational kits that teach coding and robotics. The growing interest in electronic and interactive toys reflects the country’s focus on preparing children for future technological advancements. Brands like Lego, which maintain a strong presence, also lead in promoting creativity through building sets that integrate with digital platforms, catering to tech-savvy British consumers.

Italy Toys Market Trends:

Italy’s toy market values traditional craftsmanship alongside modern trends. Clementoni, based in Recanati, exemplifies this with educational toys that blend technology and heritage. Puzzle sets and arts-and-crafts kits are particularly popular, reflecting Italian families’ emphasis on creativity. Additionally, the rise of toy stores like Giochi Preziosi showcases demand for collectible action figures inspired by Italian animations, combining nostalgia with modern play trends.

Spain Toys Market Trends:

Spain’s toy market leans toward outdoor and active play products due to its warm climate. Valencia-based Famosa’s toys, like Pinypon and Nenuco dolls, dominate the region with a focus on imaginative and social play. Additionally, the demand for sports-related toys, such as Nerf blasters and soccer equipment, continues to rise. This trend underscores Spanish families’ preference for toys that encourage physical activity and group interactions.

Other Countries Toys Market Trends:

Others include countries such as Sweden, Denmark, and Poland, where certain trends influence the toy market. Additionally, with companies like Bajo making wooden toys, Poland is seeing an increased demand. Also, Sweden focuses on gender-neutral designs, thereby promoting equality through companies like Micki Leksaker. Meanwhile, Denmark, the birthplace of LEGO, is a leader in the development of modular toys that promote imagination and problem-solving skills. These diverse patterns show how changing tastes are influencing the toy sector in Europe.

Top Companies Leading in the Toys Industry

Some of the top companies are diversifying their product lines to incorporate tech-driven devices, educational toys, and eco-friendly solutions, appealing to a broad spectrum of age groups and tastes. Significant investments are being made to increase accessibility and reach in online and retail sales platforms. Companies are leveraging digital marketing, partnering with influencers, and launching targeted seasonal promotions to boost brand recognition and strengthen customer interaction. Manufacturers are using environmentally friendly materials and adopting sustainable packaging practices, with the growing importance of sustainability. Partnerships with entertainment franchises remain a key strategy, driving consistent demand for licensed products and collectible items. Additionally, companies are opening new stores to boost sales and offer a broader selection. For example, in 2024, Ducklings Toy Shop launched a new outlet at Five Valleys in Stroud, enhancing its range of toys and games for customers in the area.

Europe Toys Market Segmentation Coverage

- On the basis of the product type, the market has been bifurcated into action figures, building sets, dolls, games and puzzles, sports and outdoor toys, plush, and others. These categories of products serve a range of interests and encourage children's creative play, active engagement, and emotional bonding for children.

- Based on the age group, the market is categorized into up to 5 years, 5 to 10 years, and above 10 years. Toys for up to 5 years emphasize learning and sensory development and for ages 5 to 10 focus on creativity and skill-building. Meanwhile, those for above 10 years include innovative and tech-driven options to match evolving preferences.

- On the basis of the sales channel, the market has been divided into supermarkets and hypermarkets, specialty stores, department stores, online stores, and others. Supermarkets, hypermarkets, specialty shops, department stores, and online platforms shape toy distribution. Online channels grow rapidly, offering convenience, while specialty stores appeal to consumers seeking unique and high-quality products.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 27.82 Billion |

| Market Forecast in 2033 | USD 48.22 Billion |

| Market Growth Rate 2025-2033 | 5.7% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Action Figures, Building Sets, Dolls, Games and Puzzles, Sports and Outdoor Toys, Plush, Others |

| Age Groups Covered | 5 Years, 5 To 10 Years, Above 10 years |

| Sales Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Department Stores, Online Stores, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)