Europe Textile Market Expected to Reach USD 409.4 Billion by 2033 - IMARC Group

Europe Textile Market Statistics, Outlook and Regional Analysis 2025-2033

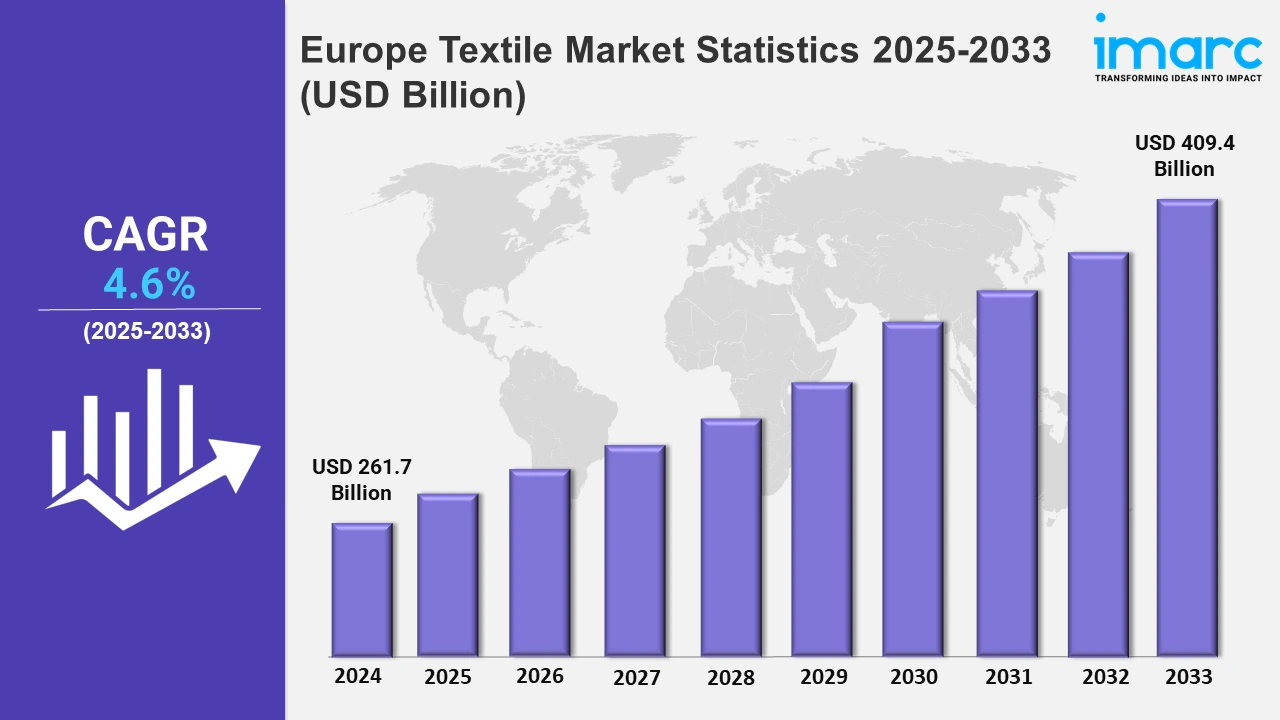

The Europe textile market size was valued at USD 261.7 Billion in 2024, and it is expected to reach USD 409.4 Billion by 2033, exhibiting a growth rate (CAGR) of 4.6% from 2025 to 2033.

To get more information on this market, Request Sample

The growing environmental concerns among individuals are leading to the development of eco-friendly textiles. Consumers are increasingly looking for sustainable options, which is further encouraging brands to introduce bio-degradable and tree-free textiles. In July 2024, Soft N Dry Diapers introduced eco-friendly disposable diapers in Germany, France, and the UK. Moreover, various regulations across the region, like the EU Green Deal, are also fostering innovations. This shift is propelling the market growth in Europe.

The ongoing technological advancements and innovations in textiles like fabrics with moisture-wicking are escalating the market demand in the region. These fabrics, made to keep the body dry, are becoming popular, especially in sportswear and activewear. Besides this, consumers are increasingly looking for comfort, which is further driving the demand for quick-drying textiles in Europe. In June 2024, Puma introduced CLOUDSPUN in Germany. This line offers comfort, softness, and moisture-wicking technology. Furthermore, the rapid expansion of e-commerce is also adding to the market demand. The increasing penetration towards smartphones offers easy access to a wide range of textile products. The convenience of online shopping, coupled with massive discounts, is bolstering the demand for textiles across the region. In July 2024, Shein, one of the online fashion companies, invested more than USD 260 Million in the UK and EU. Shein also planned to get into off-take agreements with established companies that already have textile recycling manufacturing capacity or are working with the new ones.

Europe Textile Market Statistics, By Country

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Germany, France, the United Kingdom, Italy, Spain, and others. Extensive trade agreements with the European Union, along with stringent environmental regulations by authorities, are stimulating the market.

Germany Textile Market Trends:

The growing sustainability innovations are propelling the demand for textiles in Germany. Various key companies like Sympatex are focusing on producing sustainable fabrics. Besides this, the government's commitment to promoting the use of renewable energy sources and sustainable textile production further acts as another growth-inducing factor. Also, Germany is developing technical textiles like smart fabrics for the medical industry.

France Textile Market Trends:

The elevating demand for luxury fashion in France is escalating the market growth. Additionally, brands like Dior and Chanel use premium textiles from well-known mills like Hurel. Companies in France focus on embroidery and lace, catering to high-end fashion. Moreover, Paris Fashion Week also acts as another growth-inducing factor.

United Kingdom Textile Market Trends:

There has been a significant demand for heritage textiles in the United Kingdom. Countries like Scotland produce high quality tweeds, which is further contributing to the market growth. Besides this, British wool is also gaining immense popularity as it is a symbol of quality. Furthermore, the growing demand for high-quality and durable fabrics is bolstering the growth of the market.

Italy Textile Market Trends:

Italy is known for its premium fabrics. The growing fine wool production in Biella is positively contributing to the growth of the market in the country. Additionally, various brands in the country, like Zegna and Lord Piana, focus on high-quality fabrics, which is creating a favorable outlook in the market. Also, fashion houses in Italy like Gucci elevate the demand for locally sourced fabrics.

Spain Textile Market Trends:

The textile industry in Spain is driven by innovations and the inflating focus on sustainability. The country's strong fashion heritage, with brands like Zara and Mango, fuels robust domestic and international sales. Innovations in technology, including digital printing and automation, enhance efficiency and product diversity. Sustainability is a key driver, with companies like Ecoalf producing eco-friendly textiles from recycled materials.

Other Countries Textile Market Trends:

In regions like Scandinavia and Eastern Europe, functional textiles are gaining momentum. Scandinavia focuses on weather-resistant and performance fabrics, with brands like Fjällräven excelling in outdoor wear. Eastern Europe focuses on the cost-effective production of industrial textiles. Moreover, both regions are capitalizing on their niches, offering specialized materials for European markets, such as protective clothing and durable fabrics for construction and automotive uses.

Top Companies Leading in the Europe Textile Industry

The report has also provided a comprehensive analysis of the competitive landscape in the market. Various major companies in Europe are focusing on premium and high-quality textiles for affluent consumers. Moreover, sustainability is a growing competitive factor, with brands pioneering eco-friendly textiles.

Europe Textile Market Segmentation Coverage

- On the basis of the raw material, the market has been bifurcated into cotton, chemical, wool, silk, and others. Cotton is a breathable, durable, and soft fabric. It is the best choice for people with sensitive skin. Moreover, wool comes from the fleece of sheep and is majorly worn in winter weather. Besides this, silk is a natural fiber protein that consists of fibroin.

- Based on the product, the market is categorized into natural fibers, polyesters, nylon, and others. Natural fibers are produced from plants or animals. These fibers are majorly popular among people seeking eco-friendly materials. Moreover, polyester is becoming popular due to its strength and affordability. Besides this, nylon is essential for outdoor activities as it can be used in sportswear due to its lightweight nature.

- On the basis of the application, the market has been divided into household, technical, fashion and clothing, and others. The growing demand for home furnishing products like bed sheets and curtains is driving the demand for textiles in households. Moreover, the expanding construction and healthcare industry is propelling the demand for technical textiles. Besides this, the quick turnover of clothing styles is a major driver for fashion textiles.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 261.7 Billion |

| Market Forecast in 2033 | USD 409.4 Billion |

| Market Growth Rate 2025-2033 | 4.6% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Cotton, Chemical, Wool, Silk, Others |

| Products Covered | Natural Fibers, Polyesters, Nylon, Others |

| Applications Covered | Household, Technical, Fashion and Clothing, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Textile Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)