Europe Sports Betting Market Expected to Reach USD 83.2 Billion by 2033 - IMARC Group

Europe Sports Betting Market Statistics, Outlook and Regional Analysis 2025-2033

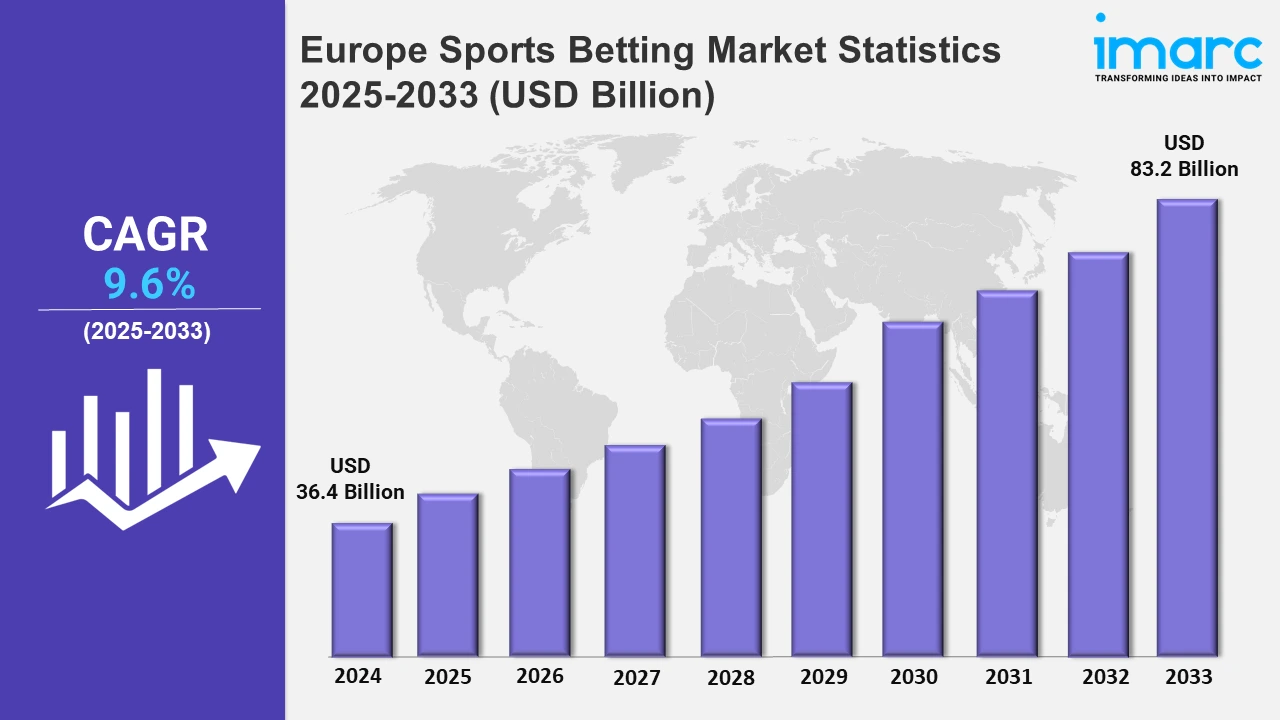

The Europe sports betting market size was valued at USD 36.4 Billion in 2024, and it is expected to reach USD 83.2 Billion by 2033, exhibiting a growth rate (CAGR) of 9.6% from 2025 to 2033.

To get more information on this market, Request Sample

The growing number of smartphone users across the region is accelerating the market demand. For example, according to Statista, in 2023, there were more than 450 million people using smartphones in the Western region. Moreover, German had the highest number of individuals using them, i.e., more than 70 million. However, the UK had the highest percentage of smartphone penetration in 2023, at over 90%. This surge in smartphone users enables consumers to make bets at any time and from any location. This convenience attracts many users who prefer the flexibility of mobile betting over other traditional methods, further positively influencing the industry growth.

Additionally, the growing popularity of esports is also significantly contributing to the market demand. For example, according to IMARC, the Europe esports market size is projected to exhibit a growth rate (CAGR) of 11.39% during 2024-2032. From traditional match-winner bets to more intricate in-game betting markets like first blood and map wins, e-sports events offer a wide variety of betting options. Also, both seasoned gamblers and novices are attracted to this variety, further supporting the industry growth. Besides this, ongoing technological innovations have made it easy for users to place bets on events in real time through advanced odds calculation algorithms. For example, in June 2024, GameOn, a mobile-first, next-generation fantasy sports gaming firm, launched GameOn Live Fantasy for the UEFA European Football Championship (Euro 2024). Apart from this, the expanding online payment options, which have improved transaction security, efficiency, and use, are also accelerating the demand for sports betting in the region. E-wallets, cryptocurrencies, and digital payment platforms like PayPal and Skrill are gaining popularity among betters. These payment methods provide speedy deposits and withdrawals, which reduces friction in the betting process. The emergence of cryptocurrency-based betting attracts technologically savvy, and privacy-conscious population.

Europe Sports Betting Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Germany, France, the United Kingdom, Italy, Spain, and others. These regions emphasize on organizing online events and providing legal frameworks to protect customers from fraud.

Germany Sports Betting Market Trends:

The growth of the region is driven by regulatory changes and ongoing technological advancements. For instance, in September 2023, DAZN Bet, a gaming and sports betting division, launched in Germany in partnership with online casino service provider Pragmatic Solutions. DAZN Bet utilizes Pragmatic's player account management platform, which has tools for identifying fraudulent activity.

France Sports Betting Market Trends:

In France, there is a growing focus on responsible gambling and player protection. The government of France, through now ANJ, has imposed stringent regulations like self-exclusion programs and advertising restrictions. As a result, operators such as Winamax and Parions Sport have implemented features to promote responsible betting.

United Kingdom Sports Betting Market Trends:

A strong regulatory framework and a diverse range of options are significantly driving the industry demand. In August 2023, MGM Resorts International launched BetMGM, an online sports betting and i-gaming brand, in the United Kingdom. This online platform offers consumers exciting new features which include loyalty awards, big and frequent jackpots, sports promos, and exclusive slot machines.

Italy Sports Betting Market Trends:

The government of Italy implemented a more stringent regulatory framework for online sports betting as part of a significant improvement of its gaming legislation in 2018. Following these regulation changes, there was a notable increase in the number of licensed betting operators and betting shops in important cities such as Rome and Milan, which are centers of culture and the economy.

Spain Sports Betting Market Trends:

Football is one of the most commonly played sports in Spain, with a strong culture and fan base that drives a prominent share of the market. La Liga, one of the most competitive football leagues in the world, is a significant source of betting activity. Also, Madrid and Barcelona are the two most popular football betting markets in Spain.

Others Sports Betting Market Trends:

Other regions in the European market are bolstering as the football clubs are increasingly becoming popular. Some of the prominent examples include Liverpool, Manchester, Barcelona, etc. Furthermore, the inflating focus on making sports betting platforms more accessible will continue to fuel the market in the coming years.

Top Companies Leading in the Europe Sports Betting Industry

The report has also provided a comprehensive analysis of the competitive landscape in the market. Some of the players across Europe provide live-streaming services, in-play betting options, a user-friendly interface, etc. Bet365 is a prominent example, which is gaining prominence in the European market.

Europe Sports Betting Market Segmentation Coverage

- On the basis of the platform, the market has been bifurcated into offline and online. Due to the rising internet penetration, online sports betting has gained momentum. However, offline sports betting is still a popular choice in places that have limited internet connectivity.

- Based on the betting type, the market is categorized into fixed odds wagering, exchange betting, live/in play betting, pari-mutuel, esports betting, and others. Fixed odds wagering is one of the most traditional forms of betting, where bettors place bets on a specific outcome of an event, and the odds remain the same throughout the betting process. Moreover, exchange betting allows bettors to bet against each other. Furthermore, live or in-play betting allows bettors to place wagers during the course of an event, rather than only before it begins.

- On the basis of the sports type, the market has been divided into football, basketball, baseball, horse racing, cricket, hockey, and others. Football, or soccer, is one of the most popular sports for betting in the region, attracting millions of bettors across various markets. Moreover, sports betting options for basketball include traditional bets like point spreads, moneylines, and totals (over/under), along with prop bets such as individual player performances or quarter-specific results. Furthermore, horse racing has a long tradition in Europe, with significant betting interest in countries like the UK, and France.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 36.4 Billion |

| Market Forecast in 2033 | USD 83.2 Billion |

| Market Growth Rate 2025-2033 | 9.6% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Platforms Covered | Offline, Online |

| Betting Types Covered | Fixed Odds Wagering, Exchange Betting, Live/In Play Betting, Pari-Mutuel, eSports Betting, Others |

| Sports Types Covered | Football, Basketball, Baseball, Horse Racing, Cricket, Hockey, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)