Europe Seaweed Market Expected to Reach USD 1,169.8 Million by 2033 - IMARC Group

Europe Seaweed Market Statistics, Outlook and Regional Analysis 2025-2033

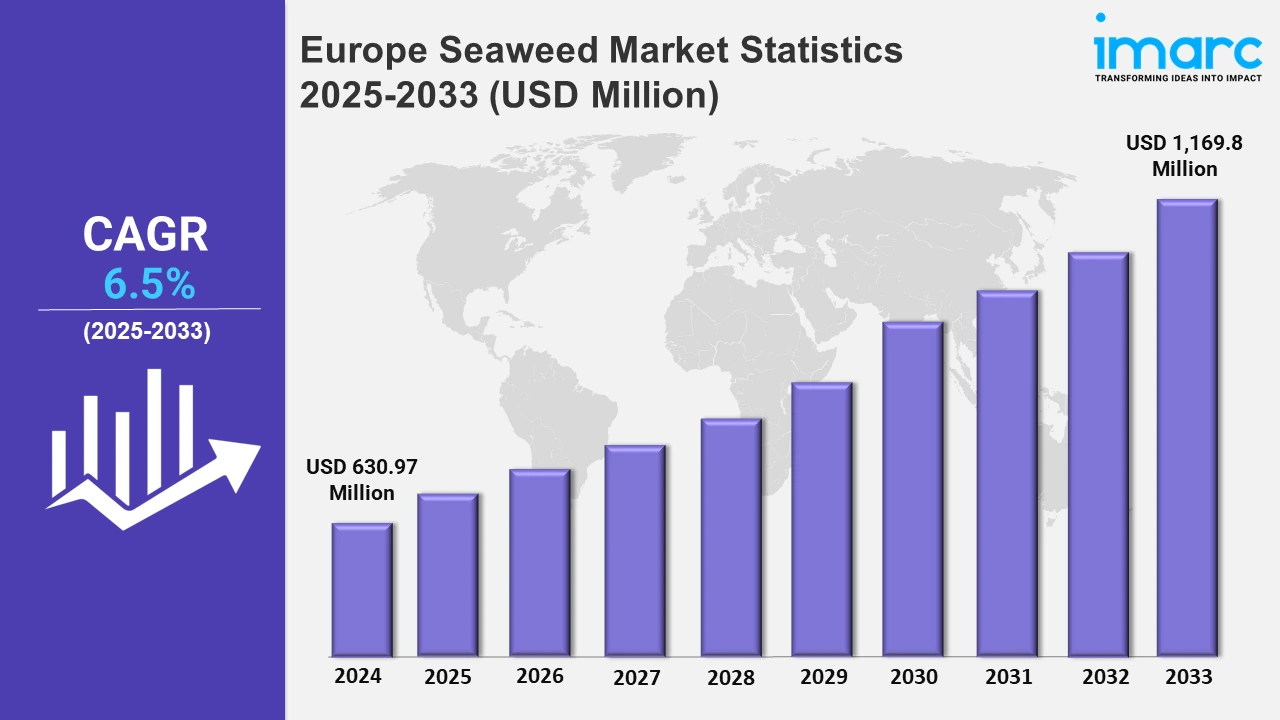

The Europe seaweed market size was valued at USD 630.97 Million in 2024, and it is expected to reach USD 1,169.8 Million by 2033, exhibiting a growth rate (CAGR) of 6.5% from 2025 to 2033.

To get more information on this market, Request Sample

Europe supports the seaweed industry by investing in innovation and collaboration across other regions. With dedicated funding, partnerships aim to boost sustainable practices, improve production methods, and create eco-friendly solutions for industries like food, healthcare, and bioeconomy. For example, in November 2024, Europe announced its plan to fund a EUR 9 million initiative for facilitating innovation and interregional collaboration with the region’s seaweed industry.

Moreover, a new seaweed-focused brand has been introduced, aiming to become a key trade and processing hub in the U.K., Scotland, and other countries. This marks an important step forward for growth and innovation in the seaweed industry in Europe. For instance, in July 2024, Seaweed Enterprises Limited declared its new brand, House of Seaweed, taking a major step in the brand’s journey to emerge as a leading trade processing hub in the U.K., Scotland, and various other locations. Furthermore, the Europe seaweed industry is seeing substantial growth as producers focus on sustainable and environmentally friendly production techniques to fulfill rising demand. Following this, legislative frameworks such as the European Green Deal stress carbon footprint reduction, which drives innovation in seaweed cultivation and processing technology. Additionally, the expanding use of seaweed in industries such as food, medicines, and biofuels provide profitable prospects for market participants to diversify their income streams. For example, the growing use of seaweed-based bioplastics in Europe has gained traction, with businesses, including Seaweed & Co. and Oceanium, leading the way. These organizations work with European governments and academic institutes to implement sustainable seaweed farming techniques. Their efforts adhere to EU legislation encouraging biodegradable materials, catering to industries moving from synthetic plastics to ecologically friendly alternatives.

Europe Seaweed Market Statistics, By Country

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Germany, the United Kingdom, France, Italy, Russia, Spain, Netherlands, Switzerland, Poland, and others. These countries are focusing on using organic and sustainable source strategies that can create a favorable environment for the adoption of seaweed.

Germany Seaweed Market Trends:

Germany has been making efforts in sustainable innovation, especially in bioplastics derived from seaweed. Companies like Notpla are collaborating with local manufacturers to produce biodegradable packaging solutions. The demand for these alternatives has surged due to Germany's strict environmental policies and consumer preference for eco-friendly products. This trend showcases its commitment to reducing plastic waste and promoting circular economies.

United Kingdom Seaweed Market Trends:

In the United Kingdom, seaweed is gaining traction as a sustainable protein source. Startups such as Seaweed & Co. are creating innovative seaweed protein powders for health-conscious consumers. This aligns with the U.K.'s increasing demand for plant-based and vegan-friendly food options. Public awareness campaigns emphasizing the health benefits of seaweed further fuel its popularity in the alternative protein segment across the country.

France Seaweed Market Trends:

France, renowned for its culinary expertise, is introducing seaweed into high-end cuisine. Renowned chefs are adopting seaweed for its distinct umami flavor, which is included in dishes at Michelin-starred restaurants. Brittany, a coastal location, is the center of seaweed cultivation, generating high-quality algae for culinary inventions. This shows France's commitment to enhancing traditional cuisine with sustainable and marine-sourced products.

Italy Seaweed Market Trends:

Italy is experiencing an increase in functional meals fortified with seaweed, notably pasta and bread. Seaweed-infused pasta, such as AlgaVia, is becoming a popular health-conscious option among Italians who prioritize nutrient-dense meals. This trend reflects Italy's tradition of high-quality food manufacturing while also catering to current desires for wellness-focused foods.

Russia Seaweed Market Trends:

Russia is using its extensive Arctic coastline resources to create seaweed-based cosmetics. Seaweed extracts are becoming increasingly popular because of their anti-aging and moisturizing effects, due to brands like Kamchatka Nature. The trend shows Russia's expanding natural cosmetics sector, with customers looking for organic and sustainable skincare products drawn from native marine biodiversity.

Spain Seaweed Market Trends:

The strong aquaculture sector in Spain is incorporating seaweed as a feed additive to improve fish health and environmental sustainability. Companies like AlgaEnergy are producing seaweed-based supplements for livestock and aquaculture. This aligns with Spain’s commitment to sustainable fishing practices and optimizing agricultural outputs with innovative marine-derived solutions.

Netherlands Seaweed Market Trends:

The Netherlands is pioneering the use of seaweed in biofuel production as part of its renewable energy strategy. Projects like Seaweed for Fuel are increasing attempts to turn seaweed into bioethanol, which reduces dependency on fossil fuels. This supports the country's efforts to mitigate climate change and explore new energy sources.

Switzerland Seaweed Market Trends:

Switzerland, with its focus on accuracy and quality, is incorporating seaweed into premium health products. Companies such as Algomed manufacture algae-based pills advertised for detoxification and immunity. This increase corresponds to Switzerland's reputation for high-quality health goods and the rising interest in wellness among its affluent population.

Poland Seaweed Market Trends:

Researchers in Poland have been studying the use of seaweed as a natural food preservative, with an emphasis on its antibacterial qualities. For example, Blirt Biochemistry works with scientists to produce seaweed-based bioactive chemicals that can improve the shelf life of dairy and meat products. This trend indicates Poland's commitment to harmonizing traditional culinary traditions with current advancements in food safety and quality, therefore meeting customer demand for natural ingredients.

Other Countries Seaweed Market Trends:

Countries outside Europe are looking at seaweed for carbon sequestration to tackle climate change. For example, Norway is investing in large-scale seaweed farming initiatives to absorb CO2 from the atmosphere. This exemplifies a trend of harnessing marine resources for environmental restoration while also creating economic possibilities in underutilized areas.

Top Companies Leading in the Europe Seaweed Industry

Some of the leading Europe seaweed market companies have been provided in the report. Key players in Europe are launching innovative products tailored to various industries, including food, cosmetics, pharmaceuticals, and biofuels. Seaweed Enterprises in July 2024 launched a new brand to expand its presence across other regions.

Europe Seaweed Market Segmentation Coverage

- Based on the environment, the market has been classified into aquaculture and wild harvest, wherein aquaculture represents the most preferred segment. Aquaculture offers a viable and scalable solution as it ensures regular supply, quality control, and reduction of environmental impacts.

- Based on the product, the market has been categorized into red, brown, and green. Red seaweed is frequently utilized in food products because of its strong nutritional profile, especially its high protein, vitamin, and mineral content. Brown seaweed offers wide applications in the industrial, agricultural, and food industries. Green seaweed is increasingly used in health foods, dietary supplements, and culinary applications because of its high chlorophyll, vitamin C, and protein content.

- Based on the application, the market has been divided into processed foods, direct human consumption, hydrocolloids, fertilizers, animal feed additives, and others. Among these, processed foods exhibit a clear dominance in the market on account of the high demand for seaweed-derived ingredients such as carrageenan, alginates, and agar in the food and beverage industry.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 630.97 Million |

| Market Forecast in 2033 | USD 1,169.8 Million |

| Market Growth Rate 2025-2033 | 6.5% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Environments Covered | Aquaculture, Wild Harvest |

| Products Covered | Red, Brown, Green |

| Applications Covered | Processed Foods, Direct Human Consumption, Hydrocolloids, Fertilizers, Animal Feed Additives, Others |

| Regions Covered | Germany, United Kingdom, France, Italy, Russia, Spain, Netherlands, Switzerland, Poland, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Seaweed Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)