Europe Mobile Payment Market Expected to Reach USD 3,080.9 Billion by 2033 - IMARC Group

Europe Mobile Payment Market Statistics, Outlook and Regional Analysis 2025-2033

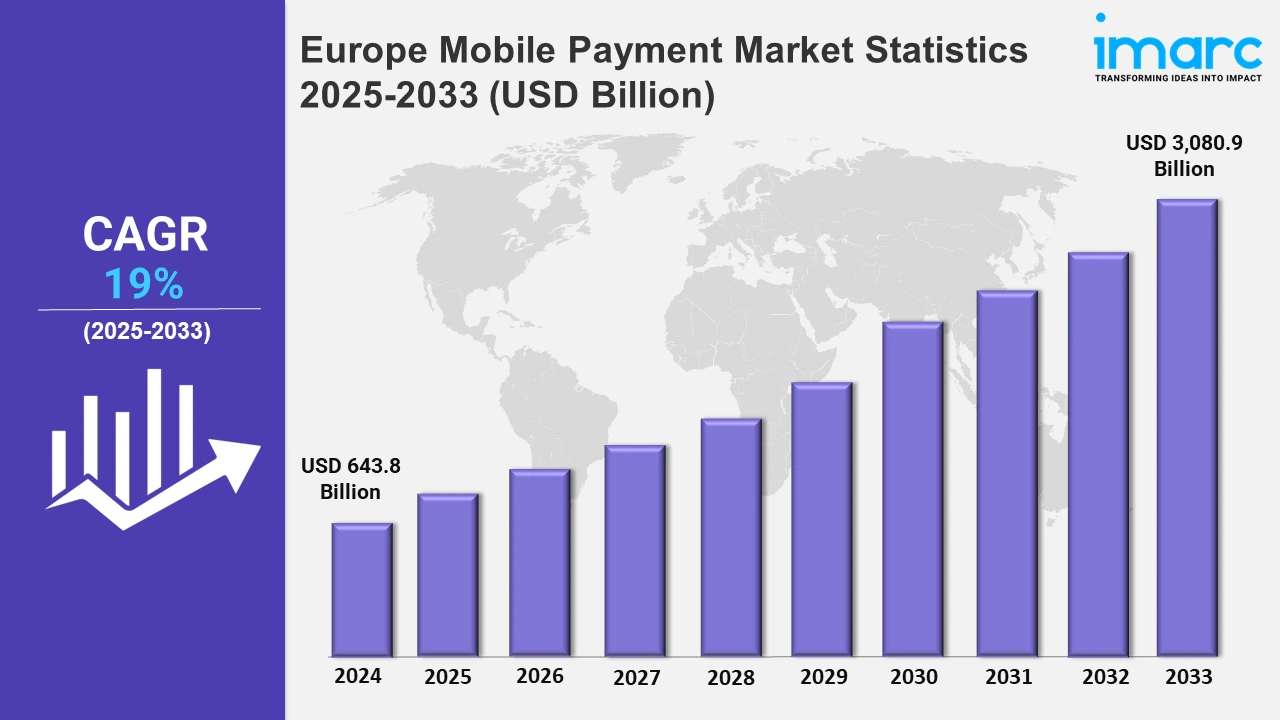

The Europe mobile payment market size was valued at USD 643.8 Billion in 2024, and it is expected to reach USD 3,080.9 Billion by 2033, exhibiting a growth rate (CAGR) of 19% from 2025 to 2033.

To get more information on this market, Request Sample

In Europe, factors such as advances in instant payment technologies, the rising adoption of smartphones, and a move toward digital transactions are the factors that contributed to the mobile payment market growth. Concurrently, major companies are investing in strong digital payment infrastructures in response to the need for streamlined and consistent cross-border payment experiences. The region's payment landscape has changed significantly as a result of the focus on speeding up transactions, guaranteeing secure payments, and providing user-friendly interfaces. Supporting this trend, Wero was introduced in Belgium by the European Payments Initiative (EPI) in November 2024, following its successful deployment in Germany and France. This unified mobile payment solution aims to simplify cross-border payments while providing a sovereign European alternative to payment systems. At the same time, in August 2024, Switzerland implemented quick payments, which now account for 94.6% of retail transactions. These advancements increase transaction speed, reduce settlement risks, and promote economic growth by promoting quicker financial transactions between companies and individuals.

In accordance with this, the mobile payment sector is also driven by government regulations and alliances between financial institutions and digital firms. Consumer demand for flexible and integrated payment choices is shown in the increased popularity of mobile wallets, contactless payments, and embedded payment solutions. The growing significance of digital platforms in Europe, which allow companies to incorporate financial services straight into their ecosystems, supports these developments. For instance, Worldline and OPP introduced an Embedded Payments solution for European platforms and markets in October 2024. This turnkey solution guarantees regulatory compliance, supports a large number of currencies, integrates numerous payment methods with ease, and improves user engagement. This invention highlights the market's commitment to providing comprehensive payment capabilities targeted to a variety of consumer and company requirements by expanding its reach throughout the EU, UK, and Switzerland. Overall, these advancements underscore the ongoing transformation in the European mobile payment industry, with technology and innovation driving greater efficiency, accessibility, and security in financial transactions.

Europe Mobile Payment Market Statistics, By Country

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Germany, France, the United Kingdom, Italy, Spain, and others. These countries are emphasizing using biometric identification features to offer a more secure experience to customers.

Germany Mobile Payment Market Trends:

In Germany, PayPal, Apple Pay, and Google Pay are the leading companies contributing to the market growth of the mobile payment sector. Besides this, more than 59.9% of people have adopted contactless payment methods with the help of cities like Berlin. Furthermore, NFC-based payments are frequently accepted at supermarkets like Lidl and Aldi. The proliferation of safe digital wallets, which provide smooth payment experiences in retail and e-commerce, is changing the country's historically cash-reliant culture.

France Mobile Payment Market Trends:

France has seen a surge in mobile payment usage, particularly with services like Lydia and Apple Pay gaining traction. In Paris, contactless payment systems integrated into public transport boosted adoption. For instance, nearly 41% of the population used mobile wallets regularly by 2023. Furthermore, local banks, including BNP Paribas, collaborate with fintech companies to enhance usability, thereby making mobile payments a popular choice for both in-store and online shopping.

United Kingdom Mobile Payment Market Trends:

The United Kingdom is one of the prominent leaders in mobile payment adoption, with apps like Google Pay and Revolut playing a significant role. In cities such as London, over 50% of consumers used digital wallets by 2023. Retailers like Tesco integrate contactless payment technology, offering faster transactions. The Open Banking framework fosters secure and competitive digital payment solutions, making mobile wallets indispensable for urban residents seeking efficient payment options.

Italy Mobile Payment Market Trends:

Italy is transitioning from cash to digital payments, supported by government initiatives to promote mobile wallets. Also, small firms in Milan make extensive use of platforms such as Satispay. Additionally, the adoption of mobile payments is fueled by tax advantages for non-cash payments, especially among younger customers. Retailers and transport systems integrate mobile payment technologies, aligning with national efforts to modernize Italy’s financial ecosystem.

Spain Mobile Payment Market Trends:

The market for mobile payments in Spain is thriving, especially among younger populations in places like Barcelona. Most of the consumers use mobile apps from CaixaBank and platforms like Bizum for retail payments and peer-to-peer transfers. In order to improve client convenience, the hospitality industry, particularly restaurants, has embraced QR code-based transactions. Across the country, banks and fintech partnerships provide safe and convenient mobile payment experiences.

Other Countries Mobile Payment Market Trends:

In other countries, such as the Netherlands, iDEAL dominates mobile payments, with more than 65% of online transactions involving this platform. Amsterdam showcases strong adoption, where public transit and retail stores accept payments via banking apps. Partnerships between banks and merchants foster a cohesive ecosystem. The Dutch preference for secure and efficient payment systems makes mobile wallets a central element in both online and offline financial activities.

Top Companies Leading in the Europe Mobile Payment Industry

Leading companies in Europe’s mobile payment market are expanding their offerings to include advanced payment apps, cross-border payment solutions, and secure digital wallets. Investments focus on enhancing accessibility across online and in-store platforms. Brands drive growth by collaborating with banks, employing influencer campaigns, and introducing user-friendly features to attract diverse demographics.

Europe Mobile Payment Market Segmentation Coverage

- On the basis of the mode of transaction, the market has been bifurcated into WAP, NFC, SMS, USSD, and others. Players in Europe utilize these technologies for seamless mobile payments, ensuring accessibility, security, and convenience across diverse user demographics and transaction scenarios.

- Based on the application, the market is divided into entertainment, energy and utilities, healthcare, retail, hospitality and transportation, and others. Mobile payments in Europe support these industries, enabling streamlined transactions, enhanced customer experiences, and operational efficiency across various sectors.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 643.8 Billion |

| Market Forecast in 2033 | USD 3,080.9 Billion |

| Market Growth Rate 2025-2033 | 19% |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Mode of Transactions Covered | WAP, NFC, SMS, USSD, Others |

| Applications Covered | Entertainment, Energy and Utilities, Healthcare, Retail, Hospitality and Transportation, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Mobile Payment Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)