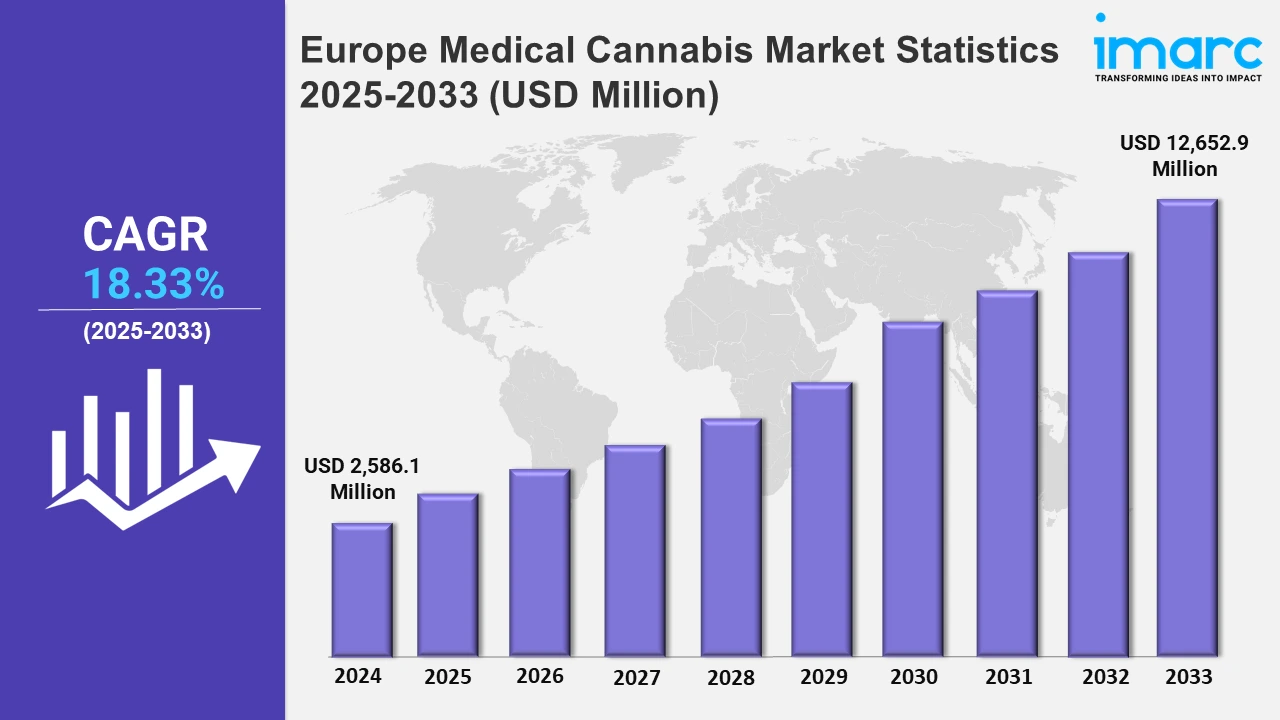

Europe Medical Cannabis Market Expected to Reach USD 12,652.9 Million by 2033 - IMARC Group

Europe Medical Cannabis Market Statistics, Outlook and Regional Analysis 2025-2033

The Europe medical cannabis market size was valued at USD 2,586.1 Million in 2024, and it is expected to reach USD 12,652.9 Million by 2033, exhibiting a growth rate (CAGR) of 18.33% from 2025 to 2033.

To get more information on this market, Request Sample

The market in Europe has shifted significantly due to its increased legalization. Additionally, more countries in the region are passing legislation to allow its use, resulting in a regulatory development that provides strict quality control, safety requirements, and patient accessibility. Nations such as Germany, the United Kingdom, and Italy have established complete frameworks that include license systems for cultivation, production, and distribution. In April 2024, Germany authorized restricted adult cannabis use, allowing home cultivation of up to three plants per household and personal possession of up to 25 grams. The new law also simplifies access to medical cannabis and establishes "cultivation social clubs" for recreational usage. Besides this, Germany will investigate commercial supply networks via pilot projects before the 2025 elections.

Additionally, technological improvements are transforming the market by enhancing cultivation, extraction, and product composition. Precision agriculture, hydroponics, and advanced greenhouse technology have improved the quality and productivity of cannabis plants. In extraction techniques, supercritical CO2 and other cutting-edge methods boost cannabinoids' purity and potency, resulting in reliable and effective products. These technological breakthroughs in cultivation and extraction are expanding the market by improving product quality and variety. In July 2024, Cannatrol announced a partnership with Paralab Green to bring its unique Vaportrol® Technology to Europe. This collaboration introduced Cannatrol's innovative dry, cure, and storage solution to cannabis producers, promising improved product quality, higher yields, and GMP regulatory compliance. Paralab Green, a well-known distributor in the region, helped with distribution. Besides this, the growing demand for cannabidiol (CBD) products is driven by their medicinal benefits, which are free of the euphoric effects of THC, resulting in wider acceptability and use. CBD’s legal status in some European countries contributes to regional market expansion. As consumers become more aware of the health advantages of CBD, they are adopting CBD-infused products into their daily routines. This trend is encouraging market innovation and expansion as a wider range of CBD products becomes available. For example, in February 2024, Zerion Pharma A/S collaborated with dsm-firmenich to improve cannabis bioavailability for medical and nutritional applications.

Europe Medical Cannabis Market Statistics, By Country

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Germany, France, the United Kingdom, Italy, Spain, and others. According to the report, Germany acquired the largest market share owing to its strong healthcare infrastructure and regulatory frameworks.

Germany Medical Cannabis Market Trends:

The dominance of Germany across the market is pushed by an optimal insurance reimbursement system, which allows for widespread patient access. More than 128,000 people undergo cannabis therapies, with statutory health insurance covering the costs. This policy increases demand and encourages physician prescriptions. Companies such as Aurora and Tilray have expanded operations to meet Germany's demands.

France Medical Cannabis Market Trends:

The government's support drives the growth of medical cannabis in France. In January 2025, the healthcare officials in France extended the experimental program until July 2025. The extension reflects the government’s commitment to thoroughly evaluate the potential of cannabis-based treatments for conditions like chronic pain and epilepsy.

United Kingdom Medical Cannabis Market Trends:

The rise of private clinics, which avoid NHS prescription problems, is driving growth in the United Kingdom. Clinics such as Sapphire Medical provide streamlined access for chronic pain and anxiety patients, garnering over 15,000 active users. Furthermore, pharmaceutical innovation from companies, including GW Pharmaceuticals, drives the demand for cannabis in the UK.

Italy Medical Cannabis Market Trends:

The rising government-coordinated imports across Italy are escalating the demand for cannabis. To accommodate patient demand, the Ministry of Defense cultivates domestically. The government intends to expand farming to alleviate chronic supply shortages which is further stimulating the market demand.

Spain Medical Cannabis Market Trends:

Regulatory changes support the demand for medical cannabis in Spain. For example, the Health and Consumer Affairs Commission advocated medical cannabis regulation to fill therapeutic gaps for patients who do not respond to traditional medicines. Building on this, the Ministry of Health issued a draft royal decree for public consultation in late 2023, with the goal of ensuring access to standardized cannabis treatments.

Other Medical Cannabis Market Trends:

Portugal, Denmark, and Poland drive growth through export-oriented cultivation. Portugal leads with companies like Tilray exporting to Germany and beyond, leveraging its favorable climate. Denmark’s pharmaceutical-grade cannabis cultivation attracts investors, further escalating the market growth.

Top Companies Leading in the Europe Medical Cannabis Industry

The competitive landscape of the Europe medical cannabis market is marked by prominent organizations that dominate the region. The Europe medical cannabis market is extremely competitive, with several prominent companies dominating the market landscape. They nowadays rely on strong research and development (R&D) capabilities, strategic collaborations, and robust distribution networks to sustain market leadership. Emerging local firms are gaining traction by focusing on particular markets and following strict European laws.

Europe Medical Cannabis Market Segmentation Coverage

- On the basis of the species, the market has been bifurcated into indica, sativa, and hybrid. Among these, indica represented the largest segment. Indica is a plant species indigenous to the Hindu Kush highlands of Southern Asia. It belongs to the Cannabaceae family and grows as an annual plant. It can be widely used in treating various medical conditions.

- Based on the derivative, the market is categorized into cannabidiol (CBD), tetrahydrocannabinol (THC), and others, amongst which tetrahydrocannabinol (THC) accounted for the most prominent share. Tetrahydrocannabinol (THC) is a colorless and oily chemical found in cannabis. It is the psychoactive component of cannabis. Moreover, it is known for its analgesic and anti-inflammatory properties, making it an important tool for treating chronic pain, nausea, appetite loss, and some neurological conditions.

- On the basis of the application, the market has been divided into cancer, arthritis, migraine, epilepsy, and others. Among these, cancer represented the largest segment. The increasing prevalence of cancer across Europe is stimulating the segment's growth. Medical cannabis, particularly THC and CBD-rich strains, is extensively used to treat cancer-related symptoms like chronic pain and loss of appetite.

- On the basis of the end use, the market has been bifurcated into the pharmaceutical industry, research and development centers, and others. Among these, the pharmaceutical industry acquired the most prominent share. Leading pharmaceutical firms are producing cannabis-based drugs, ensuring high-quality goods. Also, partnerships and collaborations with biotech enterprises and research organizations are escalating the segment's growth.

- Based on the route of administration, the market is categorized into oral solutions and capsules, smoking, vaporizers, topicals, and others, amongst which oral solutions and capsules represent the largest segment. The oral solutions and capsules are especially popular among patients suffering from chronic illnesses, including pain and epilepsy, who require controlled and continuous cannabinoid release.

- The competitive landscape of the market has also been examined, with some of the key players being Canopy Growth Corporation, Aurora Cannabis Inc., Tilray, Inc., Demecan GmbH, Panaxia Pharmaceutical Industries Ltd, Little Green Pharma, Cannamedical Pharma GmbH, Sapphire Medical, Althea Group, Bedrocan International, etc.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 2,586.1 Million |

| Market Forecast in 2033 | USD 12,652.9 Million |

| Market Growth Rate 2025-2033 | 18.33% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Species Covered | Indica, Sativa, Hybrid |

| Derivatives Covered | Cannabidiol (CBD), Tetrahydrocannabinol (THC), Others |

| Applications Covered | Cancer, Arthritis, Migraine, Epilepsy, Others |

| End Uses Covered | Pharmaceutical Industry, Research and Development Centers, Others |

| Route of Administration Covered | Oral Solutions and Capsules, Smoking, Vaporizers, Topicals, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Companies Covered | Canopy Growth Corporation, Aurora Cannabis Inc., Tilray, Inc., Demecan GmbH, Panaxia Pharmaceutical Industries Ltd, Little Green Pharma, Cannamedical Pharma GmbH, Sapphire Medical, Althea Group, Bedrocan International, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Medical Cannabis Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)