Europe LED Lighting Market Expected to Reach USD 55.1 Billion by 2033 - IMARC Group

Europe LED Lighting Market Statistics, Outlook and Regional Analysis 2025-2033

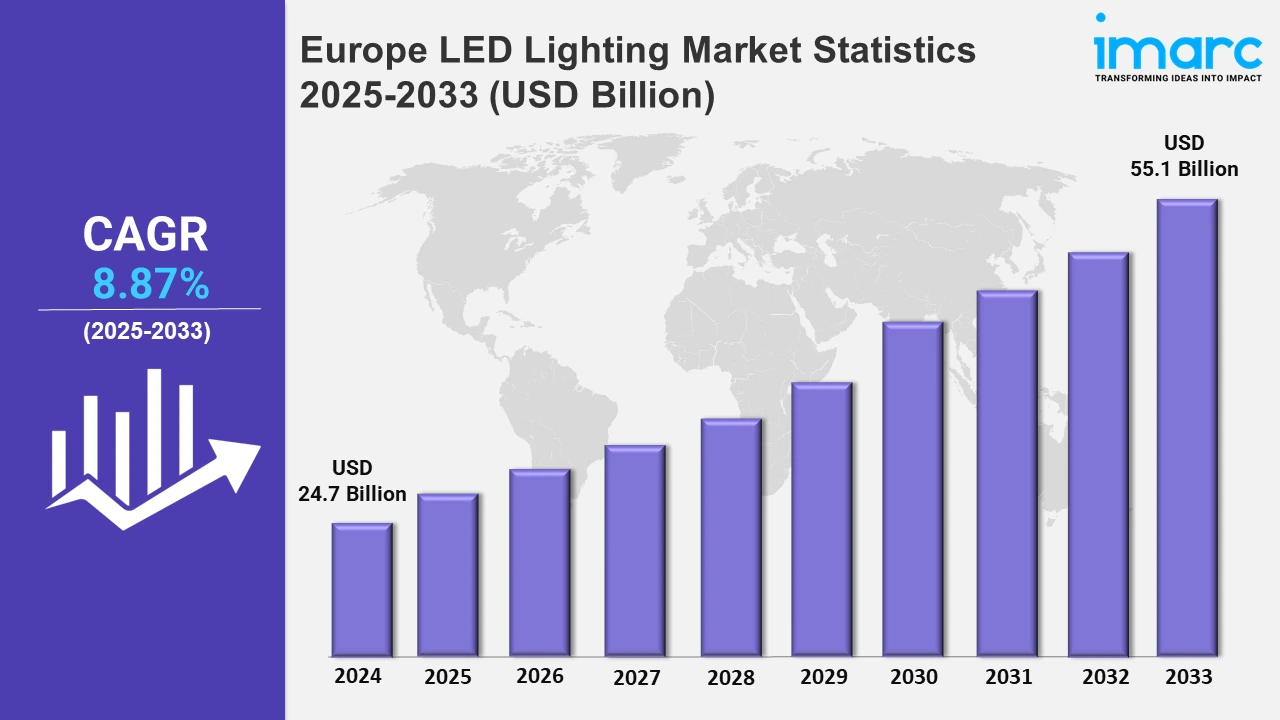

The Europe LED lighting market size was valued at USD 24.7 Billion in 2024, and it is expected to reach USD 55.1 Billion by 2033, exhibiting a growth rate (CAGR) of 8.87% from 2025 to 2033.

To get more information on this market, Request Sample

Smart house lighting in Europe is growing with revolutionary LED solutions that provide remote dimming and multi-color possibilities. Advanced control systems, including app-based and platform-compatible solutions, improve user ease and customization, making connected lighting a top priority for modern families. For example, in April 2024, IKEA introduced the JETSTRÖM LED wall light panel in Europe. The new smart light may be dimmed remotely and comes in white and colorful illumination options. The device features several control choices, such as a remote control and the IKEA Home smart app, which supports a variety of smart home platforms.

Moreover, the market in Europe is experiencing an upsurge in smart lighting systems aimed at convenience and energy saving. New LED bulbs, dimmers, and light switches enable customers to personalize their lighting and easily integrate it with smart home systems, indicating an increasing need for linked and flexible lighting solutions. For instance, in September 2024, Aqara launched a variety of smart lighting solutions. These products include the LED Bulb T2, Light Switch H2 EU, Dimmer Switch H2 EU, and Shutter Switch H2 EU. Furthermore, LED lighting producers in Europe are focusing on energy efficiency and advanced innovation to comply with environmental requirements and achieve sustainability goals. They intend to focus on developing smart LED solutions for homes, companies, and public areas to improve user experience and energy efficiency. In addition, the need for linked LED lighting systems in urban projects represents a significant income opportunity. Also, customers are increasingly choosing new LED lighting solutions with longer lifespans and configurable capabilities for a variety of applications. For example, in the U.K., the city of London implemented a large-scale upgrade of its streetlights with smart LEDs, lowering energy expenditures by 40%. Similarly, in Spain, Valencia installed solar-powered LED lighting in public places to promote sustainability and minimize reliance on the grid. These projects demonstrate how European countries are embracing cutting-edge LED technology to address environmental and energy concerns while boosting usefulness and aesthetics.

Europe LED Lighting Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Germany, the United Kingdom, France, Italy, Spain, and others. According to the report, Germany accounted for the largest market share due to its proactive approach to addressing climate change and reducing energy consumption.

Germany LED Lighting Market Trends:

Germany holds the largest share of the market. It continues to encourage energy efficiency in lighting by replacing old lighting systems with LEDs in public areas. The Berlin Smart City program demonstrates this with LED lamps, which reduce energy usage and improve urban safety. These initiatives highlight Germany's commitment to sustainability, with local governments and companies spending extensively on green lighting solutions to fulfill stringent environmental regulations and help the country achieve its energy transition goals.

United Kingdom LED Lighting Market Trends:

The U.K. focuses on smart LED lighting usage in homes and companies, which is fueled by IoT breakthroughs. Signify's Interact platform, which is extensively used throughout the U.K., aids in energy efficiency and lighting management. These systems are especially popular in office spaces and urban projects, where energy-saving and customization options are in high demand. This demonstrates the U.K.'s rising emphasis on innovative and connected lighting solutions for everyday use.

France LED Lighting Market Trends:

France employs LED lighting to combine sustainability and cultural preservation. Iconic landmarks such as the Eiffel Tower have received LED retrofits, thereby decreasing energy use while preserving their magnificence. Municipalities around France are using LEDs for streetlights and public places, reflecting the country's commitment to balancing aesthetic enhancement, historical preservation, and environmental responsibility through modern lighting solutions.

Italy LED Lighting Market Trends:

Italy has integrated LED lighting into its rich cultural and architectural legacy. The Colosseum's LED upgrade enhanced visibility and lowered energy use, setting the standard for other ancient landmarks. Italian cities are using LEDs for public lighting to save money and decrease environmental effects while retaining the artistic flare and charm, which make up the country's distinct personality.

Spain LED Lighting Market Trends:

Spain prioritizes sustainability by including solar-powered LED lighting in both urban and rural areas. Valencia has installed solar-powered LED streetlights in underprivileged regions, which provide energy-efficient and cost-effective lighting. This innovative method demonstrates Spain's commitment to renewable energy and smart lighting solutions that satisfy both environmental concerns and the practical demands of its people.

Others LED Lighting Market Trends:

Other European countries are investigating innovative uses of LED lighting. Sweden pushes modular LED designs for recycling and sustainability, whilst the Netherlands creates smart city systems such as Amsterdam's intelligent LED lamps. These efforts illustrate Europe's overall dedication to environmentally friendly and advanced lighting, as well as boosting energy efficiency and public safety in a variety of locations.

Top Companies Leading in the Europe LED Lighting Industry

Some of the leading Europe LED lighting market companies include Cree Inc., Dialight PLC, Eaton Corporation Inc. (Cooper Industries LLC), Osram Licht AG, Panasonic Corporation, Seoul Semiconductor Co., Ltd., Signify N.V. (Philips Inc.), TRILUX GmbH & Co. KG, Zumtobel Group AG, among many others. For example, in November 2024, the TRILUX Group, a leading provider of innovative lighting solutions, announced the acquisition of Ansorg GmbH. Through this, TRILUX expanded its product and service portfolio in the retail sector, strengthening its position in the lighting segment.

Europe LED Lighting Market Segmentation Coverage

- Based on the product type, the market has been classified into LED lamps and modules and LED fixtures, wherein LED lamps and modules lead the market. Their exceptional energy efficiency, long shelf life, and versatility are significant growth-inducing factors.

- Based on the installation, the market has been categorized into new installation and replacement, amongst which new installation dominates the market. This is primarily driven by the growing acceptance of LED lighting's multiple benefits, from its energy-saving potential to its longer lifespan and lower maintenance needs.

- Based on the application, the market has been divided into residential, outdoor, retail and hospitality, offices, industrial, architectural, and others. Among these, the residential segment shows a clear dominance in the market on account of LED lighting’s capability to reduce electricity bills and minimize environmental impacts.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 24.7 Billion |

| Market Forecast in 2033 | USD 55.1 Billion |

| Market Growth Rate 2025-2033 | 8.87% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | LED Lamps and Modules, LED Fixtures |

| Installations Covered | New Installation, Replacement |

| Applications Covered | Residential, Outdoor, Retail and Hospitality, Offices, Industrial, Architectural, Others |

| Countries Covered | Germany, United Kingdom, France, Italy, Spain, Others |

| Companies Covered | Cree Inc., Dialight PLC, Eaton Corporation Inc. (Cooper Industries LLC), Osram Licht AG, Panasonic Corporation, Seoul Semiconductor Co., Ltd., Signify N.V. (Philips Inc.), TRILUX GmbH & Co. KG, Zumtobel Group AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)