Europe Ice Cream Market Expected to Reach USD 32.43 Billion by 2033 - IMARC Group

Europe Ice Cream Market Statistics, Outlook and Regional Analysis 2025-2033

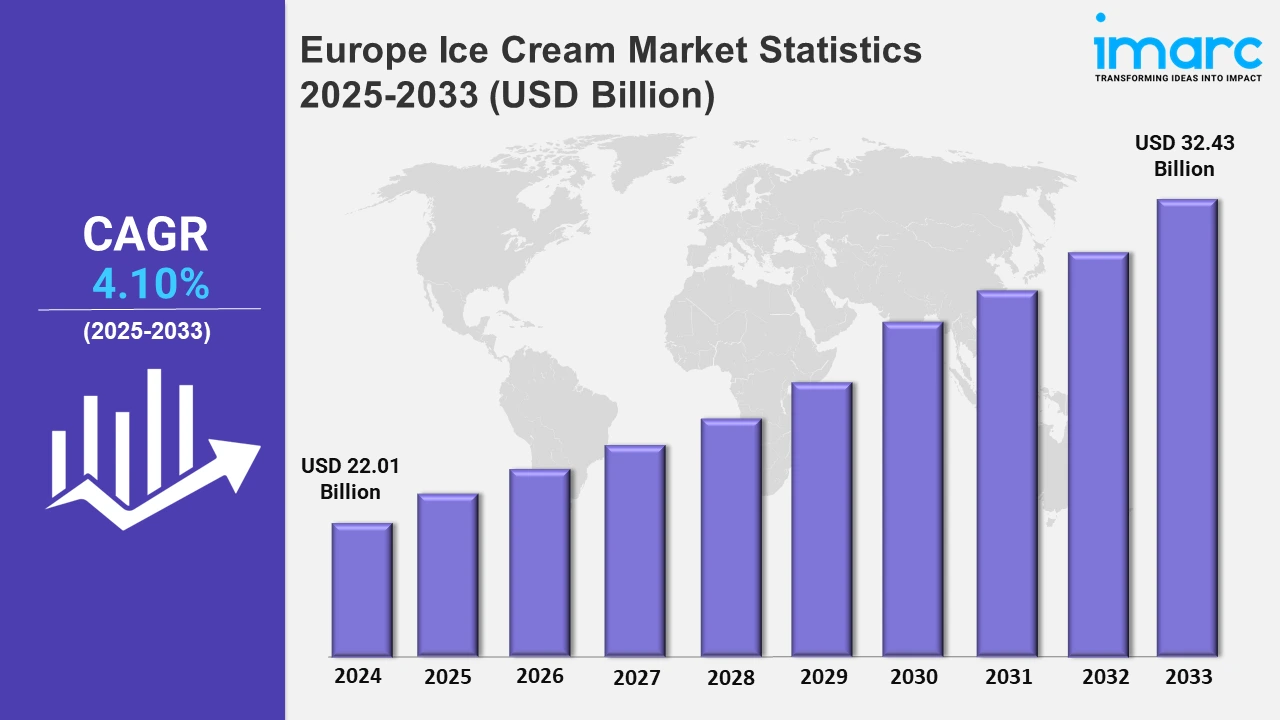

The Europe ice cream market size was valued at USD 22.01 Billion in 2024, and it is expected to reach USD 32.43 Billion by 2033, exhibiting a growth rate (CAGR) of 4.10% from 2025 to 2033.

To get more information on this market, Request Sample

Various companies across the region are introducing confectionery into their ice cream products, which is further propelling the market demand. This further promotes the development of products that combine textures like creamy inside and crispy outside. In 2024, Ferrero UK launched Kinder Bueno Ice Cream Cones in Classic flavors. The company offered single cones or multipacks at € 4.95. Besides this, the growing product innovation attracts adventurous consumers seeking unique flavors.

Additionally, consumers are looking for dairy-free alternatives made from almond or coconut milk. The growing veganism trend is encouraging companies to develop plant-based options that maintain a rich taste and provide the traditional ice cream experience. Besides this, the rising penetration of clean-label products is acting as another growth-inducing factor. In 2024, Pink Albatross, based in Spain, introduced a new plant-based ice cream bar in mango and passion fruit flavors. Furthermore, the surging innovation in the manufacturing process is also boosting the industry demand. Advanced freezing technologies extend the shelf life of ice creams. Also, the introduction of a user-friendly ice cream maker that enables consumers to enjoy fresh frozen treats is acting as another growth-inducing factor. In November 2024, Cuisinart introduced a new Solo Scoops Ice Cream Maker priced at € 39.99. This equipment helps to create homemade ice cream. Also, this equipment has a small freezer-friendly churning bowl that can be easily stored in the freezer, further boosting the market demand.

Europe Ice Cream Market Statistics, By Country

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Germany, France, the United Kingdom, Italy, Spain, and others. These countries are expanding their presence across several sales and food service channels. In addition, they are also adding new categories catering to the lactose-intolerant demographics.

Germany Ice Cream Market Trends:

The increasing preference for consuming organic products among consumers is acting as a growth-inducing factor in Germany. Various companies like Ben & Jerry's and Peters are focusing on launching organic options. Besides this, according to a survey, more than 50% of the ice cream consumers in Germany are interested in non-dairy options, further escalating the growth of the market across the country.

France Ice Cream Market Trends:

The demand for ice cream in France is driven by the surging popularity of gourmet products. In addition, consumers are looking for high-quality ice creams made from traditional methods. Various key companies like Berthillon in Paris focus on creating unique flavors like champagne sorbet, which is further propelling the industry demand.

United Kingdom Ice Cream Market Trends:

The rising penetration of innovative and creative flavors in the United Kingdom is escalating the market demand. Additionally, various key companies like Cornetto are launching premium flavored ice creams in order to attract more consumers. Besides this, traditional packaging and re-introducing old classic ice cream is encouraging consumers across the country to purchase new variants.

Italy Ice Cream Market Trends:

The growing popularity of gelato among consumers is one of the key factors adding to the market demand in Italy. Various companies across the country are introducing unique gelato flavors. In March 2023, Valsoia introduced plant-based gelato. This gelato comes in Expresso cones with chocolate chips and is 100% dairy-free, perfect for lactose-intolerant individuals.

Spain Ice Cream Market Trends:

The surging demand for tropical flavors in Spain is driving the market growth. Moreover, flavors like mango and passionfruit are gaining momentum. In June 2024, Pink Albatross, one of the companies based in Spain, launched a new category in mango and passionfruit flavor, further escalating the growth of the market in the country.

Other Countries Ice Cream Market Trends:

In other regions like Scandinavia and Eastern Europe, individuals are rapidly adopting plant-based alternatives. Companies like Oatly and Naturli' have produced oat and nut-based ice creams that appeal to vegans and lactose-intolerant people. This trend is fueled by younger demographics looking for sustainable options.

Top Companies Leading in the Europe Ice Cream Industry

Key market players are concentrating on product innovation to include consumer preferences, healthier options, and unusual flavor combinations. They are investing in sustainable sourcing and eco-friendly packaging to address environmental concerns. Strategic alliances, acquisitions, and expansions are bolstering their market position. Additionally, using digital platforms and e-commerce channels improves buyer accessibility and interaction. These companies are also stressing premiumization to appeal to higher-income segments, as well as developing tailored and seasonal goods to boost sales. Consistent investment in marketing campaigns and brand-building initiatives strengthens their competitive position in this changing market.

Europe Ice Cream Market Segmentation Coverage

- On the basis of the flavor, the market has been bifurcated into chocolate, fruit, vanilla, and others. The growing demand for chocolate among all age groups is supporting the segment's growth. Moreover, fruit is gaining traction as consumers look for natural flavors. Besides this, vanilla is a classic flavor made with cream and vanilla essence.

- Based on the category, the market is segregated into impulse ice cream, take-home ice cream, and artisanal ice cream. Impulse ice cream is available in cones and bars and is convenient for on-the-go consumption. Moreover, take-home ice cream is a preferred option for families as it offers large packaging formats like tubs and bricks. Besides this, artisanal ice creams include high-quality ingredients and are popular among people seeking authentic flavors.

- On the basis of the product, the market has been divided into cup, stick, cone, brick, tub, and others. Cups are generally chosen for on-the-go consumption, and it is widely available in retail stores. Moreover, the stick is popular for its ease of handling, especially among the younger population. Besides this, the cone remains an all-time favorite option as it combines with creamy filling.

- Based on the distribution channel, the market is categorized into supermarkets and hypermarkets, convenience stores, ice cream parlors, online stores, and others. Supermarkets and hypermarkets comprise numerous flavors and brands under one roof. They attract bulk purchasers owing to ongoing promotions. Moreover, convenience stores are the perfect solution for people seeking on-the-go options. Besides this, ice cream parlors offer freshly made ice creams and customizable options.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 22.01 Billion |

| Market Forecast in 2033 | USD 32.43 Billion |

| Market Growth Rate 2025-2033 | 4.10% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Flavors Covered | Chocolate, Fruit, Vanilla, Others |

| Categories Covered | Impulse Ice Cream, Take-Home Ice Cream, Artisanal Ice Cream |

| Products Covered | Cup, Stick, Cone, Brick, Tub, Others |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Online Stores, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Ice Cream Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)