Europe Esports Market Expected to Reach USD 4.3 Billion by 2033 - IMARC Group

Europe Esports Market Statistics, Outlook and Regional Analysis 2025-2033

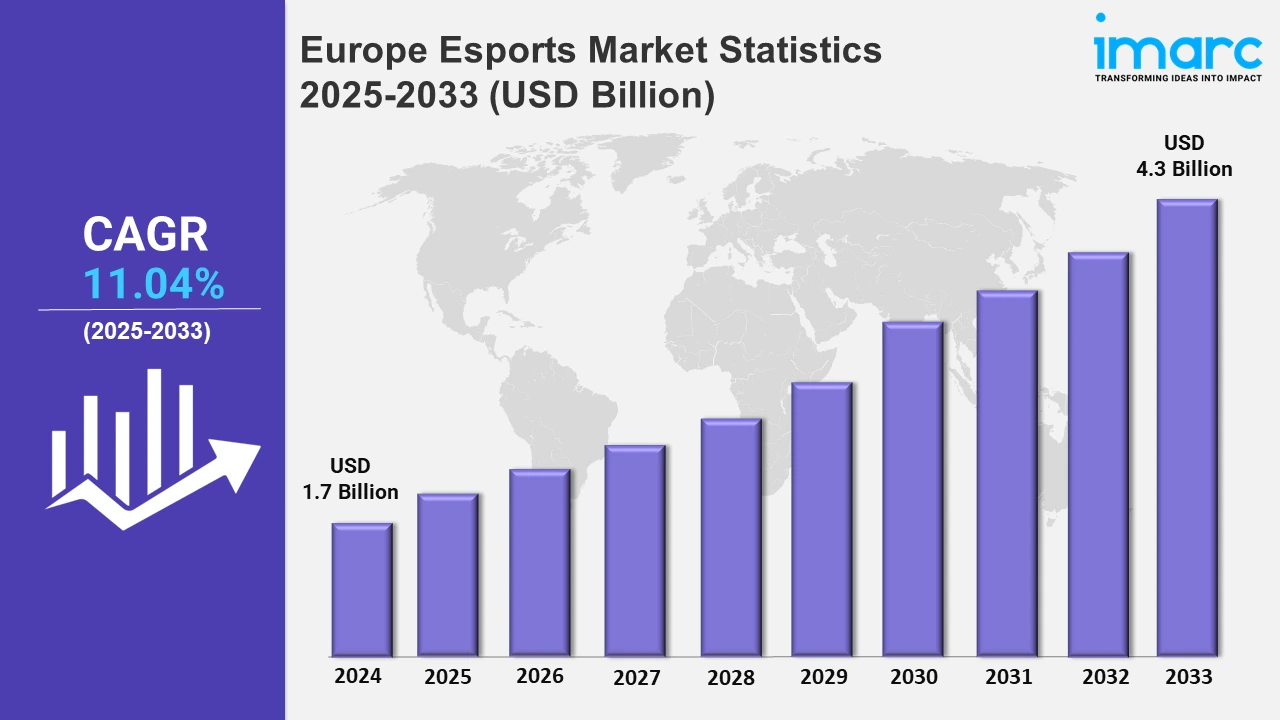

The Europe esports market size was valued at USD 1.7 Billion in 2024, and it is expected to reach USD 4.3 Billion by 2033, exhibiting a growth rate (CAGR) of 11.04% from 2025 to 2033.

To get more information on this market, Request Sample

The increasing popularity of mobile-friendly games that attract players from a diverse variety of demographics is expanding the market share. Mobile esports events are also widely organized owing to substantial prize pools and support from tech companies and game publishers. For example, in September 2024, British Esports launched a new student esports event in the UK featuring 16 teams. This tendency democratizes esports, allowing for greater accessibility and involvement than traditional PC or console gaming. Mobile esports provide advertisers and businesses with new ways to reach a growing and engaged audience.

Moreover, the esports ecosystem is increasingly incorporating virtual reality (VR) and augmented reality (AR) technology, which are transforming spectator experiences and gaming. These technologies, which provide immersive and interactive environments, enable new gaming forms and enhance spectator involvement. For example, Active Reality and GLL, one of the UK's leading municipal leisure center operators, launched VR-based physical esports experiences across the country. This program combines VR and motion capture to develop interactive gaming platforms in GLL-operated institutions such as Cardiff, Swindon, and Henley. In addition, hybrid events that combine live-action and virtual aspects are gaining popularity, providing a futuristic experience that improves esports' appeal beyond traditional gaming enthusiasts. This development indicates the rising use of cutting-edge technologies to remain competitive and attract investments. Besides this, European academic institutions are progressively offering esports-related courses and degree programs, with an emphasis on game creation, event management, and broadcasting. For example, the National Federation of British esports and learning provider Pearson Partnership announced to provide level 2 and level 3 BTECs in esports to more than 1,000 students worldwide. These programs provide a steady supply of competent professionals to support the growth of esports. Universities and esports organizations are working together to develop talent and prepare students for careers in team management, marketing, and game design.

Europe Esports Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Germany, France, the United Kingdom, Italy, Spain, and others. These countries foster innovative gaming culture.

Germany Esports Market Trends:

The German esports market is experiencing robust growth, with organizations and events playing a crucial role in shaping its future. Major organizations are focusing on fostering local talent and expanding their competitive reach. For instance, in June 2024, Berlin International Gaming (BIG), an esports organization based in Germany, introduced a new talent promotion program known as BIG SELECTA. Through a variety of initiatives, such as frequent professional coaching sessions, workshops, rigorous training, and individualized development plans, BIG SELECTA seeks to assist young gamers in improving their abilities.

France Esports Market Trends:

In France, esports are increasingly integrated with traditional sports, particularly football. Major football clubs like Paris Saint-Germain (PSG) have established esports teams, competing in games like FIFA and League of Legends. PSG's esports division, founded in 2016, has helped fuel the country’s esports market growth.

United Kingdom Esports Market Trends:

The opening of venues such as the Gfinity Esports Arena in London and The National Esports Performance Centre in Nottingham has provided a physical space for esports events, competitions, and training in the United Kingdom. These arenas host popular tournaments like DreamHack and Esports Pro League events, which attract large crowds and high sponsorship interest.

Italy Esports Market Trends:

In Italy, mobile esports is rapidly growing, particularly with games like Clash Royale and PUBG Mobile. These games are appealing due to Italy’s large mobile-first gamer base. Mobile esports tournaments, such as the PMCO Italy, are gaining traction, with growing sponsorships from brands like Red Bull.

Spain Esports Market Trends:

In Spain, government and institutional support play a pivotal role in the esports market. The Spanish government officially recognized esports as a sport, leading to funding opportunities and the establishment of formal esports training programs in schools and universities. Madrid and Barcelona host major international esports events, such as the ESL Pro League.

Top Companies Leading in the Europe Esports Industry

The competitive landscape of the Europe esports market is marked by prominent organizations that dominate the region. They collaborate among sponsors, event organizers, and teams to foster intense competition, optimize sponsorship strategies, enhance streaming metrics, etc. Furthermore, partnerships with brands will continue to elevate the regional market.

Europe Esports Market Segmentation Coverage

- On the basis of the revenue model, the market has been bifurcated into media rights, advertising and sponsorships, merchandise and tickets, and others. Media rights include broadcasting for esports tournaments and events and licensing of streaming rights. Furthermore, advertising and sponsorships in the revenue model comprise collaborations between esports organizations and businesses to target audiences through digital campaigns, in-game advertising, and event sponsorships. Aside from this, products and tickets in the revenue model include sales of branded apparel, accessories, and event entry. This segment plays an important role in the European esports business, expanding revenue streams, and enhancing fan interaction.

- Based on the platform, the market is categorized into PC-based esports, consoles-based esports, and mobile and tablets. PC-based platform provides excellent graphics, compatibility and processing power famous games. Console-based esports offer accessibility and usability. Moreover, the easy availability of high-speed internet is also driving the use of mobile and tablets.

- On the basis of the games, the market has been divided into multiplayer online battle arena (MOBA), player vs players (PvP), first person shooters (FPS), and real time strategy (RTS). The multiplayer online battle arena (MOBA) genre consists of team-based gameplay in which players plan to defeat rivals in real time. Furthermore, the player vs. player (PvP) genre in the games segment focuses on direct rivalry between people or teams in a regulated environment. Aside from that, first-person shooters (FPS) in the games section focus on combat scenes seen via the protagonist's eyes, emphasizing precision, strategy, and collaboration. Furthermore, real-time strategy (RTS) games in the esports segment place a premium on tactical decision-making, resource management, and strategic planning in an ever-changing environment.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1.7 Billion |

| Market Forecast in 2033 | USD 4.3 Billion |

| Market Growth Rate 2025-2033 | 11.04% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Revenue Models Covered | Media Rights, Advertising and Sponsorships, Merchandise and Tickets, Others |

| Platforms Covered | PC-based Esports, Consoles-based Esports, Mobile and Tablets |

| Games Covered | Multiplayer Online Battle Arena (MOBA), Player vs Players (PvP), First Person Shooters (FPS), Real Time Strategy (RTS) |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Esports Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)