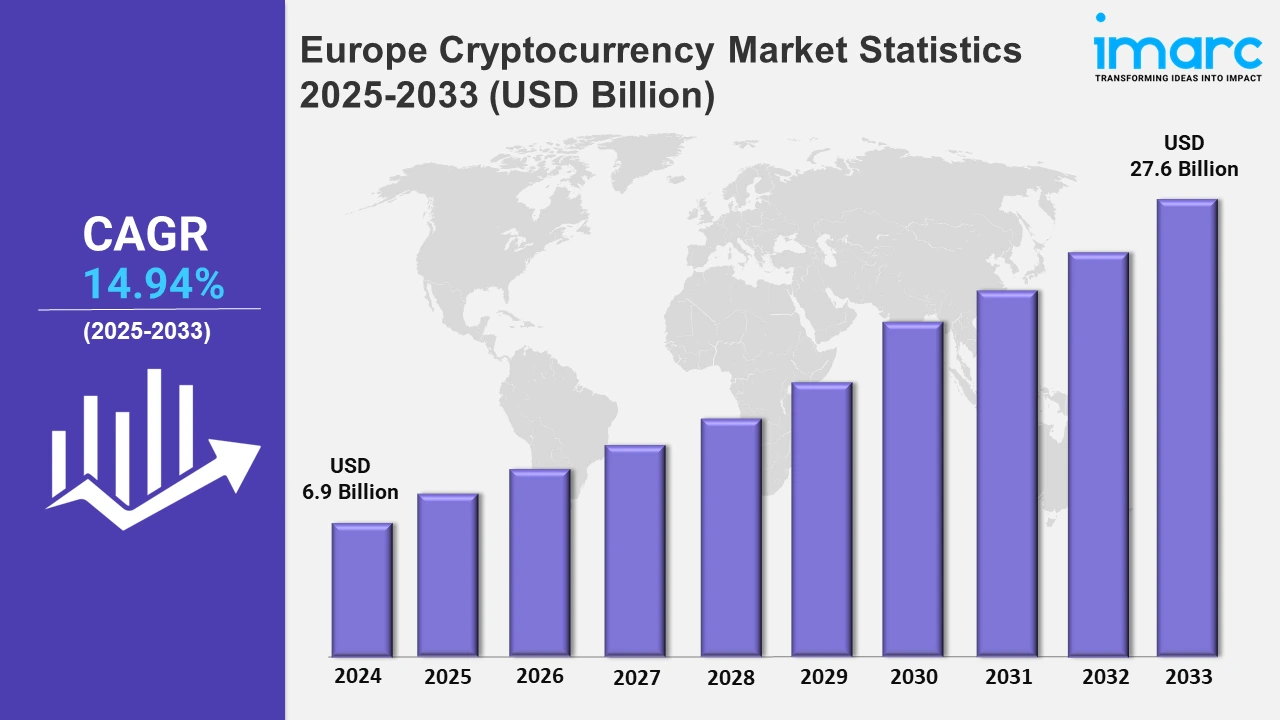

Europe Cryptocurrency Market Expected to Reach USD 27.6 Billion by 2033 - IMARC Group

Europe Cryptocurrency Market Statistics, Outlook and Regional Analysis 2025-2033

The Europe cryptocurrency market size was valued at USD 6.9 Billion in 2024, and it is expected to reach USD 27.6 Billion by 2033, exhibiting a growth rate (CAGR) of 14.94% from 2025 to 2033.

To get more information on this market, Request Sample

Institutional interest in cryptocurrencies is surging across Europe, marking a transformative trend in the market. Financial institutions, hedge funds, and asset managers are increasingly integrating digital assets into their portfolios, driven by regulatory clarity and growing recognition of cryptocurrencies as a legitimate asset. For example, in September 2024, CME Group launched Bitcoin Friday Futures (BFF), achieving a record-breaking debut with 31,498 contracts traded across two contract weeks on the first day.

Moreover, the rise of decentralized finance (DeFi) platforms is reshaping Europe’s cryptocurrency market by offering innovative financial services outside traditional banking systems. DeFi platforms, built on blockchain technology, provide lending, borrowing, and trading services with enhanced transparency and accessibility. For instance, in December 2024, Ethena, creator of USDe, partnered with Derive to integrate USDe as collateral. The latter received 5% DRV tokens, supported by Ethena’s multi-million-dollar grant to the Lyra Foundation. Furthermore, the Europe cryptocurrency industry is developing as government authorities and businesses use blockchain technology to improve transaction efficiency and transparency. Vendors are investing in scalable blockchain infrastructures and decentralized finance (DeFi) apps to satisfy regulatory requirements and increase financial accessibility. Additionally, stablecoins and creative tokens provide new options for cross-border commerce and payments, lowering transaction costs and delays. For example, the use of blockchain-based payment systems in Europe has increased substantially, with major companies such as Santander and Société Générale including crypto solutions for international payments. These banks are using blockchain to streamline operations, reduce costs, and improve security in financial transactions. Besides, blockchain technology is being used in fields such as supply chain management and energy, demonstrating its adaptability. This expansion underscores Europe's commitment to creating a cryptocurrency-friendly ecosystem that promotes economic innovation and stability.

Europe Cryptocurrency Market Statistics, By Country

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Germany, France, the United Kingdom, Italy, Spain, and others. These countries focus on financial investments and digital asset proposals, thereby encouraging technological advancements throughout the country.

Germany Cryptocurrency Market Trends:

Germany is a pioneer in cryptocurrency legislation, giving legal certainty while encouraging usage. Bitcoin has been recognized as legal cash, and banks are incorporating cryptocurrency services. For example, Deutsche Bank's 2023 commitment to provide crypto custody services demonstrated the country's emphasis on safe digital transactions. Germany's clear rules continue to attract institutional and retail investors, cementing the country's position as a leader.

France Cryptocurrency Market Trends:

France has emerged as a hub for bitcoin entrepreneurs owing to its pro-innovation legislation. Paris is home to blockchain activities that get government financing. For example, Sorare, a blockchain gaming business, raised USD 680 Million in 2023, demonstrating France's importance in supporting cryptocurrency entrepreneurship. These efforts highlight France's ambition to be Europe's leader in blockchain technology and cryptocurrency development.

United Kingdom Cryptocurrency Market Trends:

The U.K. is experiencing increasing institutional interest in cryptocurrencies, driven by its financial prominence. London-based asset managers are incorporating crypto assets into portfolios. In 2023, HSBC expanded its digital asset services to include cryptocurrency investments, reflecting growing confidence. As a financial hub, the U.K.’s alignment with crypto markets strengthens its appeal to investors seeking innovative and diverse financial instruments.

Italy Cryptocurrency Market Trends:

Italy is using stablecoins for international transactions because of their low volatility. Businesses utilize stablecoins such as USDT to facilitate cross-border payments. For example, Italian exporters claimed lower transaction costs in 2023 after choosing stablecoins over traditional methods. This move highlights how Italy uses blockchain technology to improve financial efficiency and avoid currency swings in commerce.

Spain Cryptocurrency Market Trends:

Spain has integrated blockchain into real estate, allowing bitcoins for property transactions. In 2023, a villa in Marbella was sold exclusively with Bitcoin, indicating a change in traditional markets. The expanding usage of digital currencies in real estate demonstrates Spain's willingness to embrace blockchain technology and its potential to disrupt sectors by enabling faster, more secure, and transparent processes for high-value transactions.

Other Cryptocurrency Market Trends:

Eastern Europe has emerged as a center for cryptocurrency mining owing to low energy costs and supporting legislation. In 2023, Ukraine established legislation to regulate mining activities, inviting international investments. Countries such as Kazakhstan have emerged as mining centers, contributing considerably to cryptocurrency output. This emphasis on mining establishes the area as a vital player in the larger crypto ecosystem, providing prospects for economic development and innovation.

Top Companies Leading in the Europe Cryptocurrency Industry

Some of the leading Europe cryptocurrency market companies have been provided in the report. Financial institutions are entering the space with custody and trading services, while blockchain startups drive innovation in decentralized finance (DeFi) and tokenization.

Europe Cryptocurrency Market Segmentation Coverage

- Based on the type, the market has been classified into bitcoin, ethereum, bitcoin cash, ripple, litecoin, dashcoin, and others. Bitcoin provides decentralized and secure digital assets for trading and investing. Ethereum is a blockchain-based platform for decentralized apps and smart contracts. Bitcoin cash is a cryptocurrency that, unlike Bitcoin, is meant for quicker and cheaper transactions. Ripple is a blockchain-based digital payment platform that enables smooth and low-cost cross-border transactions. Litecoin is a peer-to-peer cryptocurrency that has been designed to be quick, low-cost, and highly scalable. Dashcoin is a digital money designed for rapid, safe, and low-cost transactions.

- Based on the component, the market has been categorized into hardware and software. Hardware includes physical devices like cryptocurrency mining rigs, wallets, and nodes essential for blockchain operations. The software comprises cryptocurrency wallet and exchange software and blockchain software.

- Based on the process, the market has been divided into mining and transaction. Mining is the validation of cryptocurrency transactions and the addition to the blockchain via computational power. Transaction describes the transfer of cryptocurrencies from one user on the blockchain network to another user.

- Based on the application, the market is segmented into trading, remittance, payment, and others. Trading is the practice of purchasing, selling, and exchanging cryptocurrencies over digital platforms. Remittance is the process of sending funds across borders utilizing cryptocurrency. Cryptocurrencies are used as payment for products and services.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 6.9 Billion |

| Market Forecast in 2033 | USD 27.6 Billion |

| Market Growth Rate 2025-2033 | 14.94% |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dashcoin, Others |

| Components Covered | Hardware, Software |

| Processes Covered | Mining, Transaction |

| Applications Covered | Trading, Remittance, Payment, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Cryptocurrency Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)