Europe Beer Market Expected to Reach USD 181.6 Billion by 2033 - IMARC Group

Europe Beer Market Statistics, Outlook and Regional Analysis 2025-2033

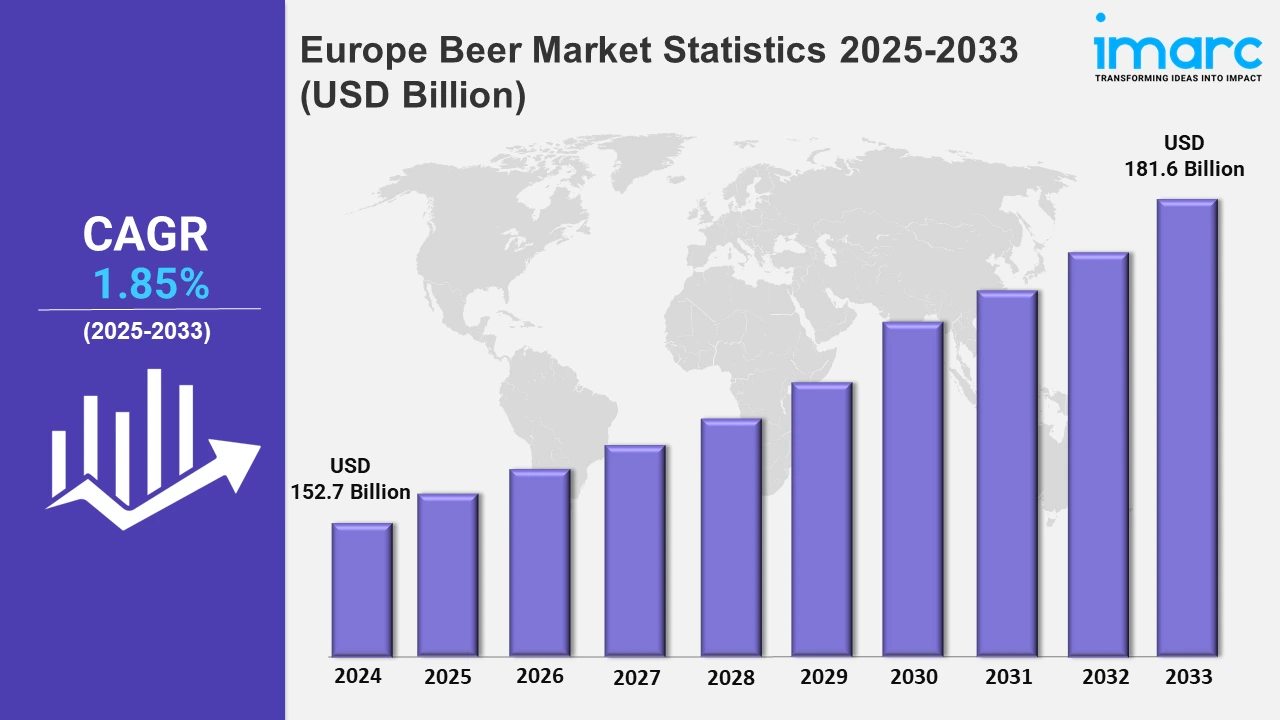

The Europe beer market size was valued at USD 152.7 Billion in 2024, and it is expected to reach USD 181.6 Billion by 2033, exhibiting a growth rate (CAGR) of 1.85% from 2025 to 2033.

To get more information on this market, Request Sample

The rising demand for high-end and inventive beer products in Europe is fueled by changing customer preferences toward distinctive flavors, premium ingredients, and craft-style products. Market expansion is also aided by collaborations between established breweries to scale operations and the growing appeal of traditional regional beers, particularly Bavarian lagers. Concurrently, Europe’s thriving culture of consuming beer, amplified during major events like the European Football Championship and Oktoberfest, creates noteworthy opportunities for breweries to introduce new product variants. Supporting this trend, the traditional Bavarian beer, 4.8% alcohol by volume, was brought to European markets in March 2024 in France, Italy, the UK, Southeast Europe, etc., by the Starnberger Brewery. Aligning this launch with key events maximized its visibility and appeal among diverse consumers.

Apart from this, health-conscious customers and the growing awareness towards the importance of moderation in alcohol usage are other major factors accelerating the market growth. Moreover, major players in this sector have made significant investments. Aligned with this trend, Corona Cero was introduced by AB InBev in ten European territories, including the UK, Germany, France, etc. This move represented Corona’s most extensive European launch to date and underscored AB InBev’s commitment to capturing the growing market for non-alcoholic options. The emergence of health-oriented alternatives demonstrates the market's changing consumer demands, while the premium beer segment continues to thrive on its authenticity and regional appeal. These developments reflect broader shifts in consumer preferences and industry focus on the European beer industry. As breweries continue to innovate and align their launches with cultural and sporting events, the regional market is poised for sustained growth driven by diversification, health-consciousness, and traditions.

Europe Beer Market Statistics, By Country

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Germany, France, the United Kingdom, Italy, Spain, and others. According to the report, Germany leads the majority of total market share due to its extensive brewing history, adherence to quality requirements such as the German Purity Law, and a wide variety of beer styles.

Germany Beer Market Trends:

Germany dominates the overall market because of its long-standing reputation for producing high-quality beer, which is supported by its local specialties that are becoming more and more well-known abroad. Reflecting this trend, Krombacher Brewery launched an authentic Bavarian lager in European countries, including France, Italy, and the UK. These advancements reinforce Germany's dominance in the European beer industry by its extensive brewing infrastructure and export network, solidifying its position as a leader in this sector.

France Beer Market Trends:

Craft beer and alcohol-free beers are becoming more popular in France due to health-conscious consumer preferences, while micro-breweries like La Parisienne are emphasizing on distinctive flavors and organic possibilities. The Alsace region remains central to production, leveraging its historic brewing heritage. Larger players, such as Kronenbourg 1664, are responding with innovative variants to compete in this evolving landscape, particularly among younger urban consumers.

United Kingdom Beer Market Trends:

The United Kingdom beer market emphasizes traditional ales and craft innovation. Pubs remain integral, with breweries like Fuller's crafting regionally beloved classics. The popularity of alcohol-free beers, like BrewDog's Nanny State, is rising as consumers choose healthier choices. Also, post-pandemic e-commerce growth enables wider access to niche products. Seasonal brews and eco-friendly packaging are also trending, aligning with sustainability goals and consumer demand for authenticity in their beer experiences.

Italy Beer Market Trends:

In Italy, the beer market blends tradition and creativity, with brands like Birra Baladin driving the craft revolution. The Lombardy region excels in pairing artisanal beers with regional cuisine, fostering a gourmet culture around beer. Alcohol-free and low-alcohol options are expanding, addressing a younger demographic. International exposure from events like Expo Milano prompted domestic interest in diverse beer styles, from hoppy IPAs to Belgian-inspired ales.

Spain Beer Market Trends:

In Spain, beer is deeply intertwined with social traditions, with light lagers dominating consumption. Concurrently, brands such as Estrella Galicia are innovating with premium options to appeal to a younger and urban audience. The popularity of alcohol-free beers, such as those from San Miguel, satisfies customer demand for healthier options. Summertime demand for cooling beverages is higher in coastal areas like Andalusia, and environmentally friendly packaging projects are becoming more and more popular.

Other Countries Beer Market Trends:

Other countries like Belgium and the Czech Republic showcase strong beer traditions. Belgium excels in artisanal brews, with brands like Chimay producing Trappist beers known internationally. Moreover, the Czech Republic leads in per capita beer consumption, driven by Pilsner-style lagers from breweries like Pilsner Urquell. In the Baltics, Latvia’s craft beer scene is thriving, with breweries like Labietis offering unique flavors, thereby emphasizing a regional trend toward innovation and quality.

Top Companies Leading in the Europe Beer Industry

Major breweries in Europe are actively adapting to evolving consumer preferences to sustain growth. Leading companies are concentrating on creating beers with fewer calories and alcohol. Portfolios are growing as a result of strategic collaborations and acquisitions, especially in the craft and premium beer industries. In January 2024, Carlsberg acquired a 20% stake in Danish brewer Mikkeller. This partnership allowed Carlsberg to distribute Mikkeller’s beers in Denmark, reflecting strategic efforts within Europe’s beer sector to expand portfolios, enhance distribution, and tap into the growing demand for craft beers.

Europe Beer Market Segmentation Coverage

- On the basis of the product type, the market has been bifurcated into standard lager, premium lager, specialty beer, and others, wherein standard lager represents the most preferred segment. Standard lager is considered a staple for most social gatherings. Its mellow taste and ability to complement a variety of food products are the reasons for its popularity at various times.

- Based on the packaging, the market is categorized into glass, PET bottle, metal can, and others, amongst which glass dominates the market. Glass bottles are preferred for maintaining the carbonation of the beer, protecting it from UV light, and providing a longer shelf life, which results in a better drinking experience.

- On the basis of production, the market has been divided into macro-brewery, micro-brewery, and others. Among these, macro-brewery exhibits a clear dominance in the market as it can produce beer on a large scale, thereby generating considerable economies of scale.

- Based on the alcohol content, the market is bifurcated into high, low, and alcohol-free, wherein high dominates the market. Beers with high alcohol content, including stouts, IPAs, and Belgian-style ales, will generally be consumed by those who have an affinity for bolder, more complex taste profiles.

- On the basis of the flavor, the market is segmented into flavored and unflavored. Currently, unflavored accounts for the majority of the total market share. People like classic, unflavored beers such as lagers and pilsners because they taste familiar and versatile, which goes well with a long list of foods.

- On the basis of the distribution channel, the market is bifurcated into supermarkets and hypermarkets, on-trade, specialty stores, convenience stores, and others, wherein supermarkets and hypermarkets dominate the market. The advantage of such retail formats for consumers is a one-stop shop for various brands and types of beer within one outlet, thus facilitating an easy comparison of products and the final selection of items.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 152.7 Billion |

| Market Forecast in 2033 | USD 181.6 Billion |

| Market Growth Rate 2025-2033 | 1.85% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Standard Lager, Premium Lager, Specialty Beer, Others |

| Packagings Covered | Glass, PET Bottle, Metal Can, Others |

| Productions Covered | Macro-Brewery, Micro-Brewery, Others |

| Alcohol Contents Covered | High, Low, Alcohol-Free |

| Flavors Covered | Flavored, Unflavored |

| Distribution Channels Covered | Supermarkets and Hypermarkets, On-Trades, Specialty Stores, Convenience Stores, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Beer Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)