Global Ethnic Foods Market Expected to Reach USD 113.8 Billion by 2033 - IMARC Group

Global Ethnic Foods Market Statistics, Outlook and Regional Analysis 2025-2033

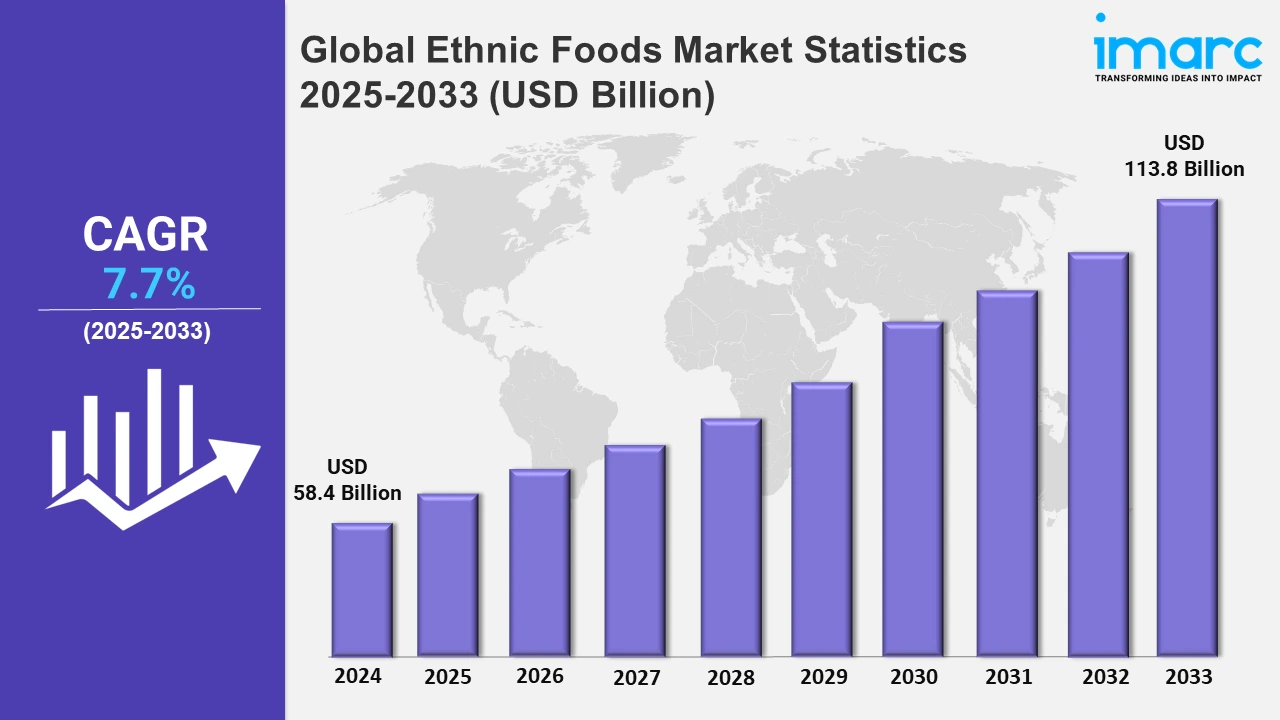

The global ethnic foods market size was valued at USD 58.4 Billion in 2024, and it is expected to reach USD 113.8 Billion by 2033, exhibiting a growth rate (CAGR) of 7.7% from 2025 to 2033.

To get more information on this market, Request Sample

The growing consumer interest in and acceptance of foreign cuisines has fueled the rapid expansion of the global ethnic food market. Authentic ethnic products and recipes are in high demand as people of diverse cultural backgrounds travel and live in new countries, bringing their culinary traditions with them. The United States Census Bureau revealed that the share of foreign-born people in the population will rise to about 17% from 14% in 2020. Furthermore, 83% of the population remained native-born, including immigrant children, and varied cultural during this period. These dietary preferences are reinforced in the local market by the fact that immigrant children and the communities frequently value and protect their ancestral cuisines. As a result, cultural blending improves the local culinary scene while also allowing ethnic cuisines to remain commercially viable in the marketplace, increasing demand for ethnic meals.

Moreover, global demographic trends toward metropolitan regions have had an impact on ethnic food consumption. According to statistics from the U.S. Census Bureau, the multiracial population in the United States increased significantly from 9 million in 2010 to 33.8 million by 2020, a remarkable 276% rise. This is indicative of the country's rising diversity and its impact on dietary choices. Furthermore, metropolitan areas usually provide more exposure to ethnic experiences due to the diversity of the people and the concentration of restaurants serving a diverse spectrum of clients. Thus, this urban transition facilitates the expanding availability of ethnic cuisines, while also encouraging the industry's continuous expansion due to persistent customer demand driven by demographic diversification, resulting in a favorable ethnic food market outlook. Besides this, technological advancements in food production are boosting the popularity of ethnic cuisines. Modern processing methods have altered ethnic food production, emphasizing safety, flavor, and nutritional features while ensuring batch-to-batch uniformity. Furthermore, the use of cutting-edge logistics and preservation technologies ensures that these delicacies remain pure. As a result, ethnic cuisines become more widely available and meet increasing market demand, becoming a staple of the global diet and inspiring a lifelong interest in cultural gastronomy. For example, in October 2023, Paulig introduced a new 3D snack production line in Spain, expanding its product line and promoting innovation, sustainability, and personalized snack options by investing more than €2 Million in a new line of pellet snacks. This new line includes a wide assortment of gluten-free 3D snacks in various forms, ingredients, and textures. With a daily production capacity of about 20,000 kg, the new line greatly expands Paulig's main factory in Spain's capacity to make pellets.

Global Ethnic Foods Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-Pacific was the largest regional market for ethnic foods, owing to the growing inclination among individuals towards varied cuisines.

North America Ethnic Foods Market Trends:

The increasing diversity in countries like the United States and Canada has driven demand for ethnic foods reflecting immigrant communities. For instance, the U.S. Census shows rapid growth in Hispanic and Asian populations. According to an article published by the Pew Research Center, in 2022, there were approximately 63.7 million Hispanics in the United States, boosting the popularity of Mexican and Chinese cuisines.

Europe Ethnic Foods Market Trends:

The region’s growth is driven by growing multicultural populations and the increasing curiosity for global cuisines. For example, the UK has seen a surge in demand for Indian and Chinese foods due to its diverse communities and colonial culinary influence. Similarly, Germany’s growing Turkish population fuels the popularity of kebabs and Mediterranean dishes, further escalating the market growth.

Asia-Pacific Ethnic Foods Market Trends:

Asia-Pacific dominates the overall market, owing to the growing appreciation for intra-regional ethnic foods. Countries like Japan and China are seeing increasing demand for Southeast Asian cuisines like Thai and Vietnamese dishes, including pho and green curry. Retail chains, such as AEON, stock diverse ethnic products, while international brands, including instant noodle manufacturers, expand offerings with localized flavors, further propelling the market’s growth.

Latin America Ethnic Foods Market Trends:

In Latin America, there’s an emerging market for packaged ethnic foods targeting convenience-oriented consumers. For instance, frozen empanadas, pre-made mole sauces, and taco kits are popular in urban areas like São Paulo and Mexico City. Local culinary traditions inspire product innovations, blending traditional flavors with modern convenience, as increasing urbanization drives demand for ready-to-cook ethnic meal solutions.

Middle East and Africa Ethnic Foods Market Trends:

The Middle East and Africa see rising interest in international ethnic cuisines, particularly Asian and European foods. Sushi and Italian pasta dishes, for instance, gain popularity in metropolitan areas like Dubai and Johannesburg. Restaurants and retail spaces reflect this trend, with chains, such as SushiArt and Carrefour, featuring diverse ethnic offerings. This shift stems from increased global exposure, tourism, and the influx of expatriates driving cross-cultural food adoption.

Top Companies Leading in the Ethnic Foods Industry

Some of the leading ethnic foods market companies include Ajinomoto Co. Inc., Asli Fine Foods, McCormick & Company Inc., MTR Foods Pvt. Ltd. (Orkla ASA), Natco Foods Ltd., Old El Paso (General Mills), Santa Maria UK Ltd. (Paulig Group), TRS Ltd., among many others. For instance, in January 2024, McCormick brand launched its latest offering, flavor maker seasonings, a new line aimed to provide inspiration and taste to meals from preparation to serving. It has 15 different blends, and each seasoning provides a simple approach to enhance the flavor of diverse foods, appealing to cooks of all skill levels with no effort.

Global Ethnic Foods Market Segmentation Coverage

- On the basis of the cuisine type, the market has been bifurcated into American, Chinese, Japanese, Mexican, Italian, and others, wherein Chinese represented the largest segment driven by its widespread popularity across the globe.

- Based on the food type, the market is categorized into vegetarian and non-vegetarian, amongst which non-vegetarian accounted for the largest market share, driven by the growing consumer interest in exploring new and traditional cuisines from around the world.

- On the basis of the distribution channel, the market has been divided into food services and retail stores. Among these, retail stores represented the largest segment, owing to their ability to offer consumers tangible shopping experiences where they can physically assess product quality and authenticity.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 58.4 Billion |

| Market Forecast in 2033 | USD 113.8 Billion |

| Market Growth Rate 2025-2033 | 7.7% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cuisine Types Covered | American, Chinese, Japanese, Mexican, Italian, Others |

| Food Types Covered | Vegetarian, Non-vegetarian |

| Distribution Channels Covered | Food Services, Retail Stores |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ajinomoto Co. Inc., Asli Fine Foods, McCormick & Company Inc., MTR Foods Pvt. Ltd. (Orkla ASA), Natco Foods Ltd., Old El Paso (General Mills), Santa Maria UK Ltd. (Paulig Group), TRS Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Ethnic Foods Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)