Global Empty Capsules Market Expected to Reach USD 5.7 Billion by 2033 - IMARC Group

Global Empty Capsules Market Statistics, Outlook and Regional Analysis 2025-2033

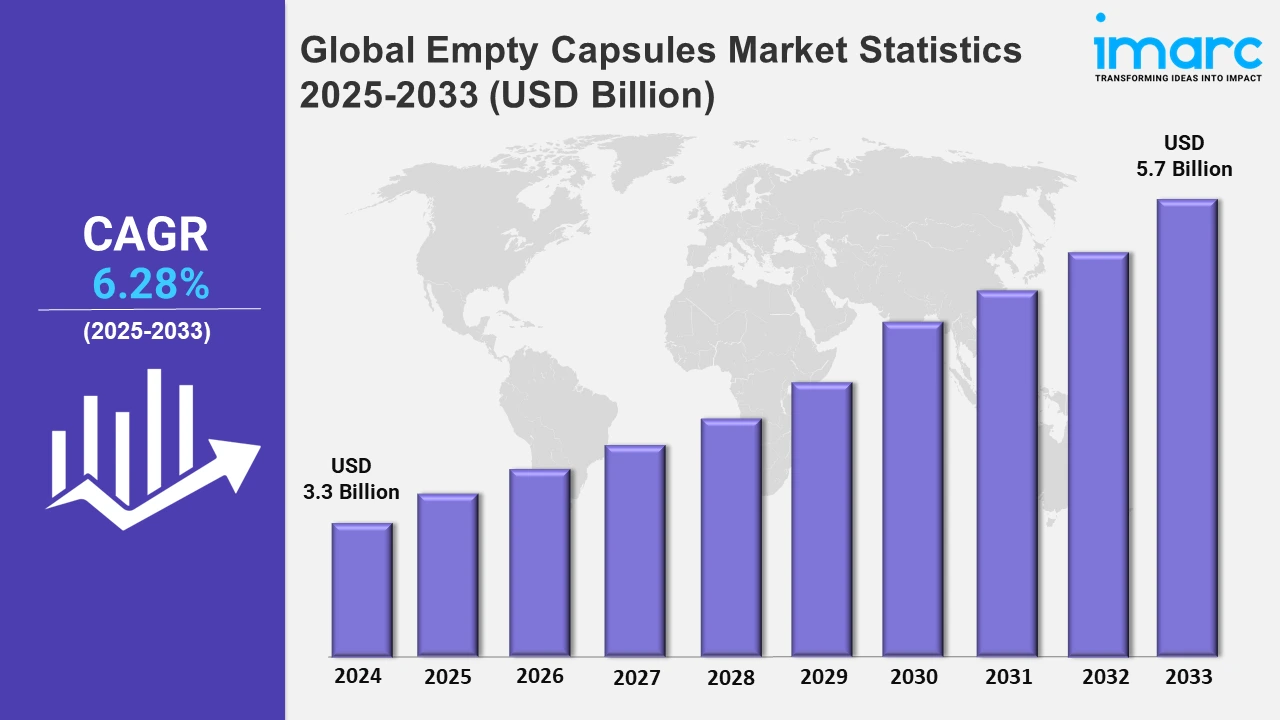

The global empty capsules market size was valued at USD 3.3 Billion in 2024, and it is expected to reach USD 5.7 Billion by 2033, exhibiting a growth rate (CAGR) of 6.28% from 2025 to 2033.

To get more information on this market, Request Sample

The introduction of innovative excipients, such as hydroxypropyl pea starch premixes, shows ongoing advances in soft gel capsule manufacturing. These solutions improve functionality, meet a wide range of pharmaceutical and nutraceutical applications, and promote sustainability. The emphasis on plant-based materials is consistent with growing customer demand for natural, efficient, and high-quality healthcare products. For example, in May 2024, Roquette, one of the global leaders in pharmaceutical and nutraceutical excipients, developed its LYCAGEL Flex hydroxypropyl pea starch premix for nutraceutical and pharmaceutical soft gel capsules.

Moreover, the recent arrival of generic doxycycline capsules reflects the growing emphasis on making affordable drugs broadly available. FDA-approved generics help to make healthcare more affordable by providing alternatives to brand-name pharmaceuticals while preserving quality and fulfilling the rising need for effective treatments. For instance, in April 2024, Lupin Ltd launched the first generic version of doxycycline capsules, Oracea, after receiving approval from the U.S. FDA. Empty capsule manufacturers continue to focus on finding new approaches to meet the increased need for high-quality medication delivery methods. They are using breakthroughs in biopolymers to improve capsule performance and meet regulatory standards, particularly for nutraceuticals and medicines. Additionally, the empty capsules industry offers several options for producers to increase their income streams. Consumers are increasingly turning to gelatin-free and plant-based capsules due to dietary constraints and ethical concerns. For example, the rising preference for vegetarian capsules in North America is being driven by a growing health-conscious population and strict FDA restrictions. Major manufacturers such as Capsugel, ACG Worldwide, and Qualicaps are investing in R&D activities to provide environmentally friendly and allergen-free alternatives that match customer expectations. These developments position them as market leaders while also meeting the pharmaceutical industry's demand for sustainable and adaptable capsule solutions.

Global Empty Capsules Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest empty capsules market share on account of the growing prevalence of chronic illnesses and the aging demographic in the U.S.

North America Empty Capsules Market Trends:

North America has the largest share of the market, owing to an increase in demand for vegetarian capsules as more individuals choose products made from plants. Consumers with dietary limitations and ethical concerns are driving this trend. For example, key manufacturers in the U.S., such as Lonza, offer plant-based capsules suited for vegan and clean-label products in response to the nutraceutical sector's rapid expansion.

Europe Empty Capsules Market Trends:

The industry is driven by strict regulations that encourage the use of pharmaceutical-grade capsules in Europe. The European Medicines Agency's emphasis on quality standards has fueled innovation in hydroxypropyl methylcellulose (HPMC) capsules. For example, Germany leads the region in Qualicaps' efforts in allergen-free capsule production, which aligns with customer demand for safe and non-gelatin products in nutritional supplements and clinical medicine formulations.

Asia-Pacific Empty Capsules Market Trends:

Asia-Pacific is witnessing increased pharmaceutical manufacturing and healthcare spending. India and China are significant markets for low-cost capsule production. For example, India's ACG Worldwide has created advanced manufacturing facilities, taking advantage of the region's reduced manufacturing costs and rising demand for low-cost capsule-based pharmaceuticals in emerging nations.

Latin America Empty Capsules Market Trends:

The market is expanding in Latin America as herbal and nutritional supplements become more popular. Brazil stands out for its thriving wellness business, in which plant-based capsules are chosen for herbal compositions. For example, local producers are cooperating with multinational companies, such as Capsugel, to develop eco-friendly capsule solutions aimed at health-conscious consumers.

Middle East and Africa Empty Capsules Market Trends:

The market in the Middle East and Africa is growing due to improved healthcare infrastructure and dietary supplement consumption. For example, in South Africa, demand for gelatin capsules is increasing as attempts to alleviate malnutrition continue. Multinational corporations such as Lonza are targeting the region by providing cost-effective solutions for enriched capsule-based supplements to boost public health.

Top Companies Leading in the Empty Capsules Industry

Some of the leading empty capsules market companies include ACG, Bright Pharma Caps Inc., Farmacápsulas, HealthCaps India, Hunan ErKang Pharmaceutical Co., Ltd, Lonza, Medicaps Limited, Nectar Lifesciences Ltd., Qualicaps, Roxlor, Sirio Pharma Co., Ltd., Suheung Co. Ltd, and Sunil Healthcare Limited, among many others. For example, in March 2024, Lonza, a global manufacturing partner for the pharmaceutical, biotech, and nutraceutical markets, announced that it had signed an agreement to acquire the Genentech large-scale biologics manufacturing site in Vacaville, California from Roche for USD 1.2 Billion.

Global Empty Capsules Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into gelatin capsule and non-gelatin capsule, wherein gelatin capsule represents the most preferred segment. Gelatin capsules, also known as gel caps, are a common oral dosage form in the nutraceutical and pharmaceutical sectors due to their ease of use, adaptability, and ability to conceal disagreeable tastes and smells of the included ingredients.

- Based on the raw material, the market is categorized into pig meat, bovine meat, bone, hydroxypropyl methylcellulose (HPMC), and others, amongst which pig meat dominates the market due to its widespread availability and strong gelling qualities, which are critical for capsule manufacturing.

- On the basis of the functionality, the market has been divided into immediate-release capsules, sustained-release capsules, and delayed-release capsules. Among these, immediate-release capsules exhibit a clear dominance in the market. Immediate-release capsules dissolve rapidly in the stomach, releasing their contents immediately for prompt therapeutic effects, making them appropriate for a wide range of pharmaceutical and nutraceutical products.

- Based on the therapeutic application, the market is bifurcated into antibiotic and antibacterial drugs, vitamins and dietary supplements, antacid and antiflatulent preparations, cardiovascular therapy drugs, and others. Antibiotic and antibacterial drugs use empty capsules for targeted infection control and enhanced patient adherence. Capsules are useful for delivering vitamins and dietary supplements in a convenient and consistent manner. Capsules are used to deliver excellent digestive comfort in antacid and antiflatulent preparations. Cardiovascular therapy drugs use capsules for precise dosing, which improves compliance in controlling heart health and drives demand in the pharmaceutical and nutraceutical sectors.

- On the basis of the end user, the market is segmented into the pharmaceutical industry, nutraceutical industry, cosmetics industry, and others. Currently, the pharmaceutical industry accounts for the majority of the total market share. Empty capsules are used by key companies in the pharmaceutical industry to create controlled-release formulations, which improve therapeutic efficacy and patient compliance.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 3.3 Billion |

| Market Forecast in 2033 | USD 5.7 Billion |

| Market Growth Rate 2025-2033 | 6.28% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Gelatin Capsule, Non-gelatin Capsule |

| Raw Materials Covered | Pig Meat, Bovine Meat, Bone, Hydroxypropyl Methylcellulose (HPMC), Others |

| Functionalities Covered | Immediate-release Capsules, Sustained-release Capsules, Delayed-release Capsules |

| Therapeutic Applications Covered | Antibiotic and Antibacterial Drugs, Vitamins and Dietary Supplements, Antacid and Antiflatulent Preparations, Cardiovascular Therapy Drugs, Others |

| End Users Covered | Pharmaceutical Industry, Nutraceutical Industry, Cosmetics Industry, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ACG, Bright Pharma Caps Inc., Farmacápsulas, HealthCaps India, Hunan ErKang Pharmaceutical Co., Ltd, Lonza, Medicaps Limited, Nectar Lifesciences Ltd., Qualicaps, Roxlor, Sirio Pharma Co., Ltd., Suheung Co. Ltd, Sunil Healthcare Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Empty Capsules Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)