Global Elevator Modernization Market Expected to Reach USD 14.1 Billion by 2033 - IMARC Group

Global Elevator Modernization Market Statistics, Outlook and Regional Analysis 2025-2033

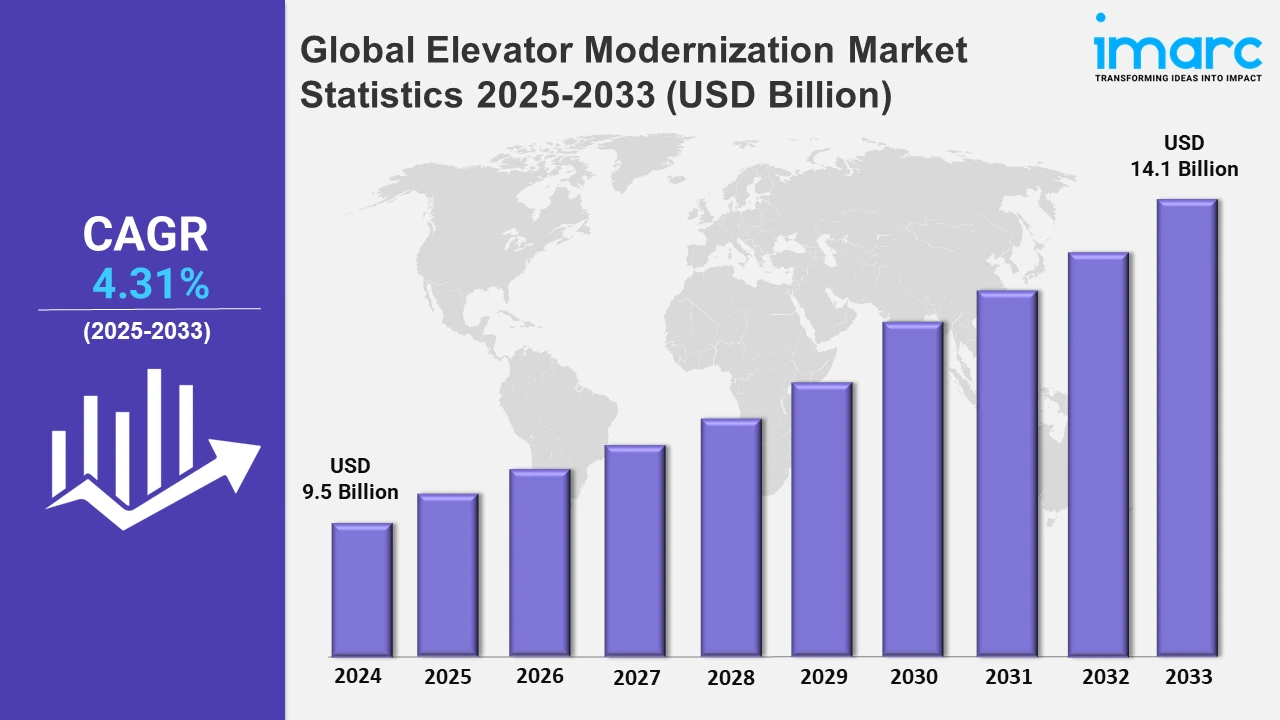

The global elevator modernization market size was valued at USD 9.5 Billion in 2024, and it is expected to reach USD 14.1 Billion by 2033, exhibiting a growth rate (CAGR) of 4.31% from 2025 to 2033.

To get more information on this market, Request Sample

The rising urbanization is propelling the market growth. For instance, according to Statista, in 2023, nearly one-third of India's total population resided in cities. The trend showcased about 4% of growth in urbanization levels over the last decade, suggesting that individuals have moved from rural areas to find work and make a livelihood in cities. This global trend toward urbanization is leading to the development of densely populated urban centers and high-rise buildings. As cities expand vertically, aging elevator systems in existing buildings require modernization to handle increased passenger traffic efficiently. Growing urban migration, particularly in Asia-Pacific and Middle Eastern regions, is accelerating the adoption of advanced elevator technologies, including energy-efficient systems and smart controls, to accommodate the needs of modern infrastructures.

Moreover, many buildings, particularly in developed economies, are equipped with outdated elevator systems that no longer comply with modern safety standards or operate efficiently. For instance, according to the Pacific Asia Lift and Escalator Association (PALEA) at the October 2023 conference in Hanoi, Asia Pacific countries represented for over 16% of the total number of elevators and elevators currently in use. The rising need to upgrade these systems to enhance performance, ensure passenger safety, and meet evolving regulations is driving demand for elevator modernization. Additionally, technological advancements, such as IoT and predictive maintenance, further incentivize property owners to invest in modernization rather than full replacements, thereby reducing costs and improving reliability. Besides this, the integration of smart technologies such as IoT, artificial intelligence, and predictive maintenance solutions is revolutionizing elevator systems. Modernization programs now focus on improving energy efficiency, reducing downtime, and enhancing user experience through real-time monitoring and automation. For instance, in September 2022, Johnson elevators launched its IoT-based wireless software gadget Watch, which senses, monitors, and alarms. This is wireless software that links your lifts to the data center via an IoT device in each lift. This new technology will allow for real-time monitoring of lifts, detecting and alerting a team of highly qualified experts to provide rapid help to clients while also maintaining a trouble-free functioning of the lift, boosting its reliability.

Global Elevator Modernization Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe currently dominates the global market owing to ongoing technological innovations and infrastructure modernization.

North America Elevator Modernization Market Trends:

In North America, elevator modernization emphasizes smart technologies such as IoT-based predictive maintenance and destination control systems. For example, the adoption of Otis’ CompassPlus system in office buildings enhances traffic flow efficiency. The region’s focus on sustainability and energy efficiency drives upgrades, aligning with green building certifications like LEED. Aging infrastructure, particularly in cities like New York and Chicago, further accelerates demand for modernized systems.

Europe Elevator Modernization Market Trends:

Europe dominates the overall market driven by energy efficiency and compliance with strict regulations like EN 81 standards. For example, the adoption of regenerative drives and LED lighting systems aligns with the EU’s sustainability goals. Countries such as Germany and the UK prioritize eco-friendly retrofits to reduce operational costs and meet carbon reduction targets. This focus supports Europe’s commitment to achieving net-zero emissions by 2050.

Asia Pacific Elevator Modernization Market Trends:

The Asia Pacific region witnesses surging demand for elevator modernization due to rapid urbanization and the construction of high-rise buildings. Countries like China and India are experiencing infrastructure expansion, driving upgrades to accommodate increased elevator usage. For example, Schindler’s modernization projects in China’s high-density cities ensure elevators meet modern performance and safety standards, supporting the vertical growth trend in emerging economies.

Latin America Elevator Modernization Market Trends:

In Latin America, the modernization market is fueled by aging infrastructure in older residential and commercial buildings. Countries like Brazil and Mexico see growing demand for upgrades to meet new safety standards and improve reliability. For example, modernizing elevators in older high-rises in São Paulo helps reduce energy consumption and downtime.

Middle East and Africa Elevator Modernization Market Trends:

In the Middle East and Africa, demand is driven by massive infrastructure expansion and smart city projects. For instance, in March 2024, Emaar Properties selected Otis Worldwide Corporation to upgrade 34 of the 57 elevators and all eight escalators in the world's tallest building, the Burj Khalifa. Additionally, high investments in mega-projects such as NEOM City in Saudi Arabia are creating opportunities for modernization, ensuring compliance with global safety standards and advanced user experience.

Top Companies Leading in the Elevator Modernization Industry

Some of the leading elevator modernization market companies include Champion Elevator, Fujitec Co. Ltd, Hitachi, Ltd, Hyundai Elevator Co., Ltd., KONE Corporation, Liberty Elevator, Mid-American Elevator, Mitsubishi Electric US, Inc., Otis Elevator Company Ltd., Pincus Elevator Company, Schindler Group, Stanley Elevator Company Inc, TK Elevator and Toshiba Corporation, among many others. For instance, in May 2024, Mitsubishi Electric Building Solutions Corporation introduced NEXIEZ-Fit, an elevator that combines exceptional cost performance with carefully selected specifications, for low-rise residential structures.

Global Elevator Modernization Market Segmentation Coverage

- On the basis of the elevator type, the market has been bifurcated into traction elevator and hydraulic elevator, wherein traction elevator dominates the overall market share as they are ideal for high-rise and mid-rise buildings.

- Based on the modernization type, the market is categorized into partial modernization and full modernization. Partial modernization includes modernizing specific components of the elevator system while keeping some functioning elements of the present equipment. Furthermore, full modernization includes a thorough overhaul of the elevator system, replacing all essential components while leaving only the hoistway and framework.

- On the basis of the components, the market has been divided into controllers, door equipment, cabin enclosures, signaling fixtures, power units, and others. The controller handles functions such as starting, stopping, acceleration, deceleration, and leveling. Furthermore, door equipment controls the opening and closing of elevator doors to ensure safety and efficiency. Also, cabin enclosures improve the aesthetics, comfort, and functionality of the elevator car.

- Based on the end user, the market is categorized into residential, commercial, and industrial. Among these, the residential exhibits a clear dominance in the market. Older residential structures, particularly in developed markets, require upgrading to assure their safety, dependability, and compliance with new standards.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 14.1 Billion |

| Market Growth Rate 2025-2033 | 4.31% |

| Units | Billion USD |

| Segment Coverage | Elevator Type, Modernization Type, Components, End User, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Champion Elevator, Fujitec Co. Ltd, Hitachi, Ltd, Hyundai Elevator Co., Ltd., KONE Corporation, Liberty Elevator, Mid-American Elevator, Mitsubishi Electric US, Inc., Otis Elevator Company Ltd., Pincus Elevator Company, Schindler Group, Stanley Elevator Company Inc, TK Elevator, Toshiba Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)