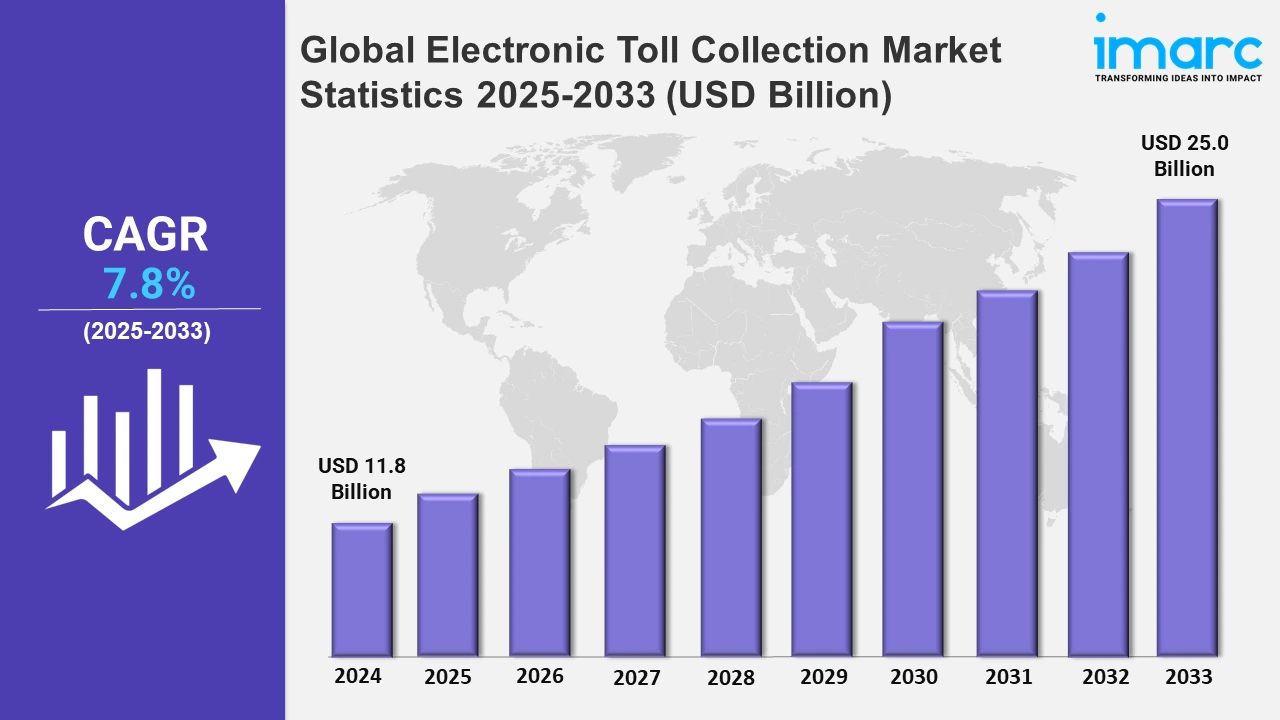

Global Electronic Toll Collection Market Expected to Reach USD 25.0 Billion by 2033 - IMARC Group

Global Electronic Toll Collection Market Statistics, Outlook and Regional Analysis 2025-2033

The global electronic toll collection market size was valued at USD 11.8 Billion in 2024, and it is expected to reach USD 25.0 Billion by 2033, exhibiting a growth rate (CAGR) of 7.8% from 2025 to 2033.

To get more information on this market, Request Sample

The global electronic toll collection (ETC) market is experiencing robust growth, driven by the increasing need for efficient traffic management and the rising adoption of smart transportation solutions. Governments and transportation authorities worldwide are focusing on reducing congestion on highways and urban road networks, which are leading to the broad implementation of ETC systems. For instance, in 2024, the National Highways Authority of India (NHAI) introduced the 'One Vehicle, One FASTag' initiative to enhance toll plaza efficiency in India. With a penetration rate of approximately 98% and over 80 million users, FASTag has significantly transformed the ETC system in the country. Furthermore, these systems eliminate the need for physical toll booths which are allowing vehicles to pass seamlessly without stopping, improving traffic flow, and reducing delays. The growing number of vehicles on the road and the subsequent rise in traffic congestion have further boosted the importance of automated tolling systems. Additionally, ETC systems contribute to reduced fuel consumption and emissions, aligning with the global encouragement towards sustainable practices and environmental conservation. The integration of advanced technologies, such as radio-frequency identification (RFID), global positioning system (GPS), and dedicated short-range communication (DSRC) into toll collection processes has also made these systems highly accurate and efficient, which has further propelled their adoption. The governments prioritize smart city initiatives with the deployment of ETC systems which has become a crucial element in modernizing urban infrastructure and meeting the demands of growing urban populations.

Another significant driver of the ETC market is the heightening focus on revenue optimization and fraud prevention in toll collection. Traditional tolling systems are prone to human error and revenue leakage, which can significantly impact the financial sustainability of road projects. ETC systems address these challenges by ensuring precise and automated toll collection, minimizing discrepancies and improving revenue assurance. As per the sources, in August 2022, the Ministry of Transport mandated the implementation of ETC systems across all expressways nationwide, transitioning to fully automatic toll collection to enhance traffic flow and operational efficiency. Moreover, this has encouraged governments and private road operators to invest in these systems to secure steady income from toll revenues. The expansion of public-private partnerships (PPPs) in infrastructure development has also contributed to the market growth, as such collaborations often mandate the use of advanced tolling technologies. Additionally, growing consumer demand for convenience and the ability to pay tolls electronically without cash transactions have further accelerated the adoption of ETC systems. The accelerating penetration of smartphones and mobile payment platforms has made it easier for users to interact with these systems, enhancing their overall experience and fostering market expansion.

Global Electronic Toll Collection Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of advanced infrastructure, widespread adoption, and government support initiatives.

North America Electronic Toll Collection Market Trends:

The North America electronic toll collection (ETC) market holds the largest share due to the region's advanced transportation infrastructure and early adoption of smart tolling technologies. Governments in the United States and Canada have heavily invested in upgrading road networks with automated systems to reduce congestion and enhance traffic management efficiency. According to the sources, efforts to unify tolling systems have amplified interoperability, with Georgia's Peach Pass becoming fully compatible with the E-ZPass network in January 2024, allowing seamless multi-state travel without multiple transponders. Moreover, the extensive implementation of RFID and GPS-based tolling solutions, supported by strict environmental regulations aimed at reducing vehicle emissions, has further driven growth. Additionally, PPP for infrastructure projects have encouraged the adoption of ETC systems, ensuring efficient toll collection and revenue optimization. The high penetration of mobile payment platforms and the growing consumer preference for seamless, cashless transactions have solidified North America’s leadership in the global ETC market.

Asia-Pacific Electronic Toll Collection Market Trends:

The Asia-Pacific market benefits from rapid urbanization, growing vehicle ownership, and significant government investments in smart transportation infrastructure. Countries such as China, India, and Japan are deploying ETC systems to reduce traffic congestion and improve toll collection. PPP further support infrastructure advancements, boosting the adoption of automated tolling technologies across the region.

Europe Electronic Toll Collection Market Trends:

Europe’s market growth is supported by strict environmental regulations and the adoption of advanced technologies like DSRC and ANPR. The focus on seamless cross-border travel and uniform electronic tolling standards enhances implementation. Countries such as Germany, France, and the UK are at the forefront of deploying sustainable, automated tolling solutions across their road networks.

Latin America Electronic Toll Collection Market Trends:

Latin America’s market is driven by amplified investments in road infrastructure and rising demand for efficient traffic management. Countries like Brazil and Mexico are adopting ETC systems to modernize tolling processes and enhance revenue collection. Growing awareness of automated tolling’s benefits, including reduced congestion and operational efficiency, supports further market expansion in the region.

Middle East and Africa Electronic Toll Collection Market Trends:

The Middle East and Africa are embracing ETC systems as part of extensive infrastructure development and smart city initiatives, particularly in GCC countries. These systems address regional traffic management challenges, improving toll revenue collection, and align with sustainable development goals. Increased adoption supports the modernization of transportation networks across key markets.

Top Companies Leading in the Electronic Toll Collection Industry

Some of the leading global electronic toll collection market companies include Conduent Incorporated, EFKON GmbH, International Road Dynamics Inc., Kapsch Trafficcom AG, Mitsubishi Heavy Industries, Ltd., Q-Free, Skytoll, Thales Group, The Revenue Markets Inc., Trans Core, among many others.

- In March 2024, Cubic Transportation Systems (CTS) launched the Umo Handheld Reader, combining CTS software with Samsung’s rugged XCover6 Pro. This affordable device offers transit agencies seamless fare collection with tap-to-pay and 5G LTE connectivity, enhancing efficiency for operators and convenience for riders across evolving transit networks.

Global Electronic Toll Collection Market Segmentation Coverage

- On the basis of the technology, the market has been categorized into RFID, DSRC, and others, wherein RFID represent the leading segment RFID technology dominates the market due to its ability to facilitate seamless, contactless toll collection and reduce congestion. This technology enables quick and accurate vehicle identification, significantly enhancing the efficiency of toll operations. Its integration with ETC systems ensures compatibility and scalability, making it a preferred choice across transportation networks. RFID's cost-effectiveness and adaptability to various tolling environments have further boosted its adoption, solidifying its leadership in the technology segment.

- Based on the system, the market is classified into transponder - or tag-based toll collection systems and other toll collection systems, amongst which transponder - or tag-based toll collection systems dominates the market. Transponder-based toll collection systems lead the market by delivering superior accuracy and reliability in vehicle identification and toll processing. These systems reduce operational delays and streamline toll collection, improving overall traffic management. Their ability to integrate with advanced tolling technologies and accommodate high vehicle volumes ensures their dominance.

- On the basis of the subsystem, the market has been divided into automated vehicle identification, automated vehicle classification, violation enforcement system, and transaction processing. Among these, automated vehicle identification accounts for the majority of the market share. Automated vehicle identification commands the largest market share due to its unparalleled accuracy in detecting and processing vehicle data. This subsystem minimizes manual errors and accelerates toll operations, ensuring smooth traffic flow. Moreover, its integration with other tolling technologies enables comprehensive system functionality, amplifying its demand.

- Based on the offering, the market is segregated into hardware and back office and other services, wherein hardware represents the leading segment. Hardware is the leading segment in the offerings category, driven by the necessity for robust, high-performance components in toll collection systems. Cameras, sensors, and related devices ensure reliable system operation, meeting the demands of high-traffic environments. Continuous innovations in hardware technology, such as enhanced durability and accuracy, further strengthen its market position.

- On the basis of the toll charging, the market has been categorized into distance based, point based, time based, and perimeter based, wherein distance based represent the leading segment. Distance-based toll charging dominates the market owing to its equitable pricing model, where users are charged based on the distance traveled. This method promotes fairness and transparency, making it highly popular among toll operators and commuters alike. Its widespread implementation across regional and national highways demonstrates its efficiency in revenue generation.

- Based on the application, the market is classified into highways and urban areas, amongst which highways dominates the market. Highways are the leading application segment due to the extensive deployment of toll systems on these critical road networks. Toll collection on highways ensures efficient traffic management which supports infrastructure funding and facilitates seamless long-distance travel. Their significant role in economic connectivity and freight transportation bolsters their importance.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 11.8 Billion |

| Market Forecast in 2033 | USD 25.0 Billion |

| Market Growth Rate 2025-2033 | 7.8% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | RFID, DSRC, Others |

| Systems Covered | Transponder - or Tag-Based Toll Collection Systems, Other Toll Collection Systems |

| Subsystems Covered | Automated Vehicle Identification, Automated Vehicle Classification, Violation Enforcement System, Transaction Processing |

| Offerings Covered | Hardware, Back Office and Other Services |

| Toll Charging Covered | Distance Based, Point Based, Time Based, Perimeter Based |

| Applications Covered | Highways, Urban Areas |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Conduent Incorporated, EFKON GmbH, International Road Dynamics Inc., Kapsch Trafficcom AG, Mitsubishi Heavy Industries, Ltd., Q-Free, Skytoll, Thales Group, The Revenue Markets Inc., Trans Core, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Electronic Toll Collection Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)