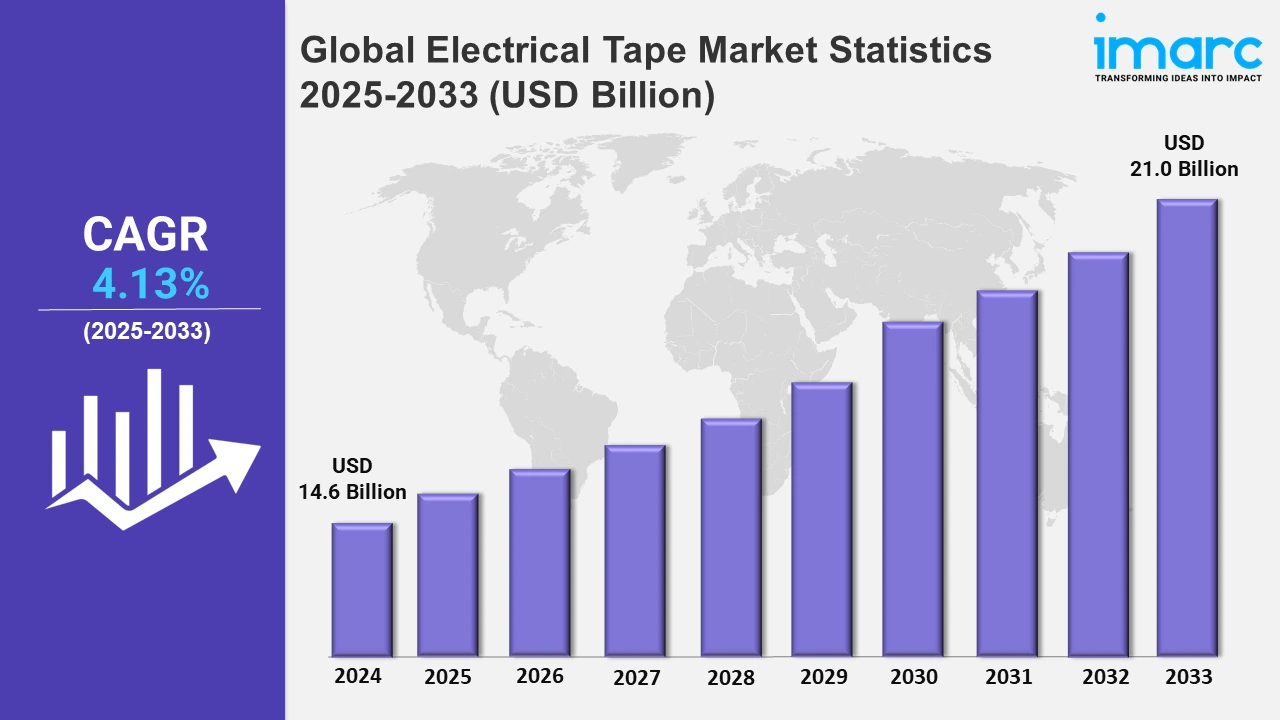

Global Electrical Tape Market Size Anticipated to Reach USD 21.0 Billion by 2033 | IMARC Group | Rising Focus on Electrical Safety and Expansion of Renewable Energy Projects Propelling Market Growth

Global Electrical Tape Market Statistics, Outlook and Regional Analysis 2025-2033

The global electrical tape market size was valued at USD 14.6 Billion in 2024, and it is expected to reach USD 21.0 Billion by 2033, exhibiting a growth rate (CAGR) of 4.13% from 2025 to 2033.

To get more information on this market, Request Sample

There is a rise in the demand for electrical tapes in residential, commercial, and industrial spaces. Electrical tapes are vital in ensuring electrical safety and efficient energy management. Commercial spaces like office spaces, retail complexes, and public infrastructure require complex electrical systems for lighting, heating, ventilation, and air conditioning (HVAC), security, and communication. Electrical tapes are essential for bundling, insulating, and protecting these wires, which reduces the risk of electrical faults and ensures reliable operation. In addition, they are crucial for household wiring, securing electrical connections, and insulation tasks to ensure the safety and longevity of electrical systems. Additionally, upgrades to existing homes usually involve updating electrical systems for catering to modern safety codes, which involves the use of electrical tapes for insulation and securing new wiring. As per the research report of the IMARC Group, the global real estate market is projected to reach USD 8,690.7 Billion by 2033.

The rising utilization of electrical tapes in electric vehicles (EVs) due to their critical role in ensuring the safety and functionality of complex automotive electrical systems is contributing to the market growth. These vehicles rely on intricate wiring harnesses for power distribution, communication, and control systems. Electrical tapes are required for these wiring harnesses as to bundle, arrange, and shield the wires, guaranteeing effective space management and averting damage or short circuits. To prevent current leakage and improve passenger safety, EVs' high-voltage batteries and electrical systems require superior insulation. Additionally, automotive manufacturers are seeking to improve vehicle efficiency and reduce weight. By the end of 2024, approximately 17 million EVs are anticipated to be sold, as per the International Energy Agency (IEA).

Global Electrical Tape Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of the thriving automotive sector, rising preferences for eco-friendly products, and advancements in tape technology.

Asia-Pacific Electrical Tape Market Trends:

The trend of eco-friendly and non-toxic materials in electrical tapes is driven by environmental regulations and consumer awareness about sustainable products. Additionally, industry participants are creating electrical tapes with better adhesive qualities, increased dielectric strength, and greater thermal resistance. This is assisting in meeting the demands of high-voltage systems and specific applications in electronics. Furthermore, the rising production of EVs is catalyzing the demand for electric tapes for enhanced safety. The India EV market is projected to reach US$ 102,610.8 Million by 2032, as per the research findings of the IMARC Group.

North America Electrical Tape Market Trends:

The need for premium electrical tapes that provide safe and long-lasting insulation for electrical wiring and components is being propelled by the growing emphasis on renewable energy projects, such as wind and solar farms. Stricter safety rules are catalyzing the demand for electrical tapes that meet Underwriters Laboratories (UL) and Canadian Standards Association (CSA) standards.

Europe Electrical Tape Market Trends:

The market for eco-friendly electrical tapes composed of recyclable, biodegradable, or non-toxic materials is growing. Manufacturers are coming up with new ways to make tapes that satisfy these sustainability standards. Specialty tapes, such as halogen-free or flame-retardant tapes, are widely used in high-risk settings and applications.

Latin America Electrical Tape Market Trends:

There is an increase in the need for electrical tapes, especially for wiring and insulation, due to the expansion of the automotive and construction industries in Latin America. The need for specialist electrical tapes with high durability and safety standards is also being fueled by rising investments in infrastructure development and renewable energy.

Middle East and Africa Electrical Tape Market Trends:

The expansion of infrastructure, especially in the construction and oil and gas industries, is driving up demand for electrical tapes across the Middle East and Africa. Furthermore, the region's market is expanding due to the growing need for sophisticated and heat-resistant tapes.

Top Companies Leading in the Electrical Tape Industry

Some of the leading electrical tape market companies include 3M Company, A&G Manufacturing Co. Inc., Denka Company Limited, Electro Tape Specialties Inc., HellermannTyton (Aptiv PLC), Intertape Polymer Group Inc., Nitto Denko Corporation, Parafix Tapes & Conversions Ltd., Plymouth Rubber Europa S.A., PPM Industries UK Ltd. (PPM Industries SpA), ProTapes & Specialties Inc. (Shurtape Technologies LLC), Scapa Industrial, and tesa SE (Beiersdorf AG), among many others. Leading companies in the industry are concentrating on sustainability projects, mergers and acquisitions (M&As), and increasing production capacity. For example, on October 1, 2024, tesa, a global producer of cutting-edge adhesive tapes and self-adhesive product solutions, unveiled a new, cutting-edge user solution center and office space in Bangkok, Thailand. The company is taking a big move to increase its market share and clientele in Southeast Asia.

Global Electrical Tape Market Segmentation Coverage

- On the basis of the material, the market has been categorized into PVC tapes, glass cloth tapes, PET tapes, and others, wherein PVC tapes represent the leading segment. These tapes are the most widely used electrical tapes, valued for their insulation properties, durability, and resistance to moisture and chemicals. They are commonly used in electrical wiring, maintenance, and construction on account of their excellent electrical insulation and ease of use.

- Based on the application, the market is classified into electrical and electronics, aerospace, industrial, and others, amongst which electrical and electronics dominate the market. The rising employment of electrical tapes in wiring insulation, cable harnessing, and circuit board protection is impelling the market growth. Electrical and electronics applications benefit from electrical tapes’ insulating properties, durability, and ease of application in both consumer and industrial electronic devices.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 14.6 Billion |

| Market Forecast in 2033 | USD 21.0 Billion |

| Market Growth Rate 2025-2033 | 4.13% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | PVC Tapes, Glass Cloth Tapes, PET Tapes, Others |

| Applications Covered | Electrical and Electronics, Aerospace, Industrial, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, A&G Manufacturing Co. Inc., Denka Company Limited, Electro Tape Specialties Inc., HellermannTyton (Aptiv PLC), Intertape Polymer Group Inc., Nitto Denko Corporation, Parafix Tapes & Conversions Ltd., Plymouth Rubber Europa S.A., PPM Industries UK Ltd. (PPM Industries SpA), ProTapes & Specialties Inc. (Shurtape Technologies LLC), Scapa Industrial, tesa SE (Beiersdorf AG), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)