Global Electric Truck Market Expected to Reach USD 6,652.6 Million by 2033 - IMARC Group

Global Electric Truck Market Statistics, Outlook and Regional Analysis 2025-2033

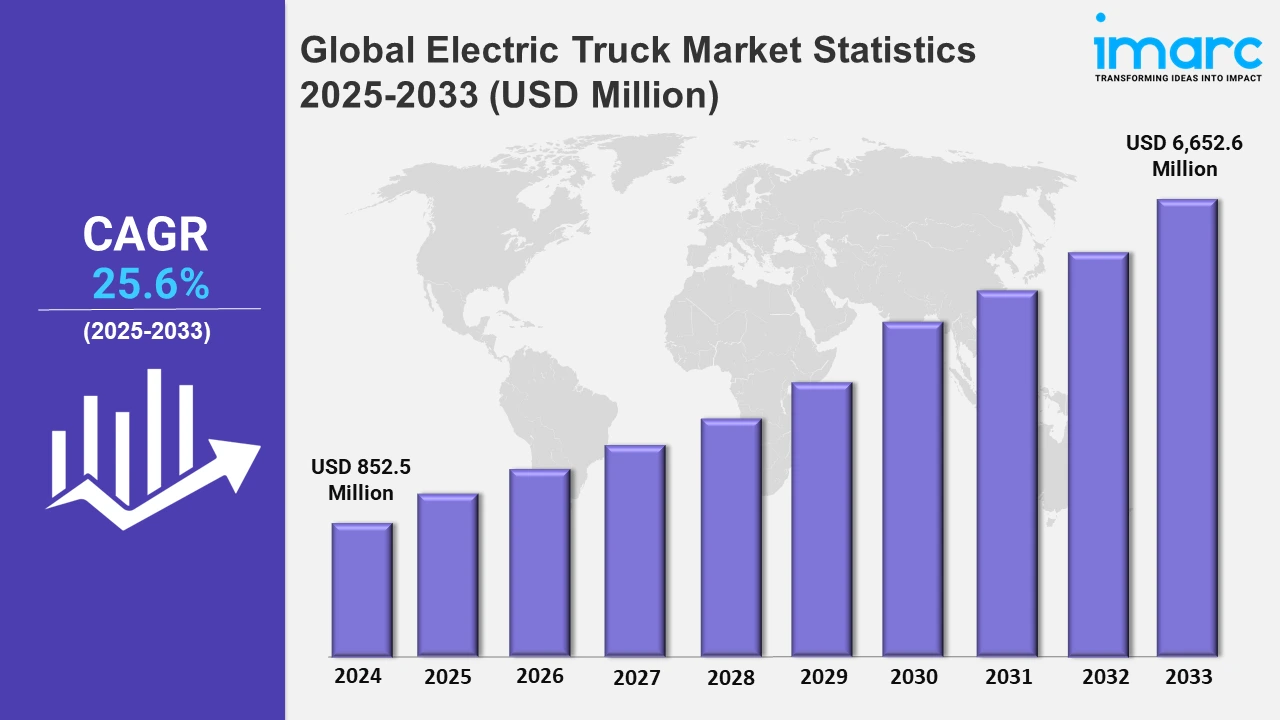

The global electric truck market size was valued at USD 852.5 Million in 2024, and it is expected to reach USD 6,652.6 Million by 2033, exhibiting a growth rate (CAGR) of 25.6% from 2025 to 2033.

To get more information on this market, Request Sample

Electric medium-duty trucks are transforming urban logistics with longer ranges, faster charging, and improved safety features. These changes respond to the increased need for efficient and zero-emission solutions in municipal transportation and distribution. For example, in November 2023, VolvoGroup introduced updated electric medium-duty trucks designed for zero-emission city transports. In addition, these trucks have an electric range of up to 450 km, 50% shorter charging time, and new active safety features to meet all the needs for city transport and logistics.

Moreover, fully electric medium-duty trucks are revolutionizing fleet operations with zero-emission capabilities, improving safety and dependability while lowering the total cost of ownership. These improvements benefit organizations looking for sustainable transportation solutions and increased operational efficiency in urban and regional logistics. For instance, in August 2021, Navistar Inc. launched the new fully electric International eMV series trucks. The International eMV is the result of the commitment of Navistar to safe, reliable, and zero emissions solutions that improve consumer total cost of ownership (TCO) and deliver on value-added business objectives. Furthermore, electric truck manufacturers are concentrating on increasing range and efficiency in order to fulfill tough pollution objectives and environmental goals. In addition to this, they are investing in innovative battery technology and lightweight materials to boost performance while lowering energy usage. Additionally, the aftermarket for electric vehicle parts, such as battery modules and charging components, offers significant income potential. Fleet operators are increasingly preferring high-performance electric vehicles over traditional diesel ones due to lower operating costs and compliance with green standards. For example, the need for high-performance electric trucks in North America is increasing as a result of collaborations among OEMs, such as Rivian, Tesla, and Ford. These organizations are establishing models for logistics and long-haul freight, demonstrating new versions that meet environmental goals while providing improved cost-effectiveness and dependability to businesses around the region.

Global Electric Truck Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest electric truck market share, on account of the governing authorities investing in charging networks, including high-power charging stations.

North America Electric Truck Market Trends:

North America is the leader in electric truck adoption for last-mile deliveries. Companies, such as Rivian and Amazon, have collaborated to deploy electric delivery vehicles, reflecting the region's commitment to reduce carbon emissions and achieve sustainability targets in e-commerce operations.

Europe Electric Truck Market Trends:

The market in Europe concentrates on long-distance heavy-duty vehicles. For example, Volvo Trucks is delivering electric semi-trucks in Germany, aided by EU pollution restrictions and incentives targeted at decarbonizing the freight transportation industry.

Asia Pacific Electric Truck Market Trends:

In Asia Pacific, electric vehicles are rapidly being adopted for urban waste management. China is installing hundreds of electric garbage trucks in cities, such as Shenzhen, with the official objective of promoting clean-energy urbanization.

Latin America Electric Truck Market Trends:

Latin America is implementing electric vehicles into agriculture. For example, Brazil's agribusinesses employ electric vehicles to carry crops, showcasing attempts to modernize farming operations while reducing environmental effects in one of the region's main sectors.

Middle East and Africa Electric Truck Market Trends:

The Middle East and Africa region is focusing on incorporating electric vehicles into mining operations. South African miners are testing electric vehicles as part of measures to reduce reliance on fuel and lower operating costs in resource-intensive industries.

Top Companies Leading in the Electric Truck Industry

Some of the leading electric truck market companies include VolvoGroup, BYD Company Ltd., Mercedes-Benz Group AG, China FAW Group Co. Ltd., Isuzu Motors Ltd, Navistar Inc., PACCAR Inc., Rivian Automotive Inc., Volkswagen AG, Tata Motors Limited, Tesla Inc., and Tevva Motors Limited, among many others. For example, in August 2021, BYD Company Ltd. unveiled two revolutionary battery-electric heavy-duty trucks, the Gen3 8TT and 6F, vehicles that combine performance, reliability, and driver comfort with stylish designs. The Gen 3 8TT and 6F feature cabs that offer improved aerodynamics and energy efficiency. These trucks have advanced driver-assistance systems (ADAS), making driving easier and safer.

Global Electric Truck Market Segmentation Coverage

- On the basis of the vehicle type, the market has been bifurcated into light-duty truck, medium-duty truck, and heavy-duty truck, wherein light-duty truck represents the most preferred segment. Light-duty trucks are intended for modest freight and passenger loads. It is often utilized for urban and suburban deliveries, last-mile logistics, and plumbing or electrical services.

- Based on the propulsion, the market is categorized into battery electric truck, hybrid electric truck, plug-in hybrid electric truck, and fuel cell electric truck, amongst which hybrid electric truck dominates the market. It uses electric motors for low-speed and stop-and-go driving, which reduces fuel consumption and pollutants in urban or congested traffic.

- On the basis of the range, the market has been divided into 0-150 miles, 151-300 miles, and above 300 miles. Among these, 0-150 miles exhibit a clear dominance in the market. The 0-150 mile range category is often aimed at shorter, intra-city, and regional applications. It is ideal for urban deliveries, short-haul transportation, and services requiring numerous stops and starts.

- Based on the application, the market is bifurcated into logistics, municipal, construction, mining, and others, wherein logistics dominate the market. The increased use of electric vehicles in the logistics sector is driving market expansion. These vehicles are ideal for urban and suburban deliveries, including last-mile logistics.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 852.5 Million |

| Market Forecast in 2033 | USD 6,652.6 Million |

| Market Growth Rate 2025-2033 | 25.6% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Light-Duty Truck, Medium-Duty Truck, Heavy-Duty Truck |

| Propulsions Covered | Battery Electric Truck, Hybrid Electric Truck, Plug-In Hybrid Electric Truck, Fuel Cell Electric Truck |

| Ranges Covered | 0-150 Miles, 151-300 Miles, Above 300 Miles |

| Applications Covered | Logistics, Municipal, Construction, Mining, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | VolvoGroup, BYD Company Ltd., Mercedes-Benz Group AG, China FAW Group Co. Ltd., Isuzu Motors Ltd, Navistar Inc., PACCAR Inc., Rivian Automotive Inc., Volkswagen AG, Tata Motors Limited, Tesla Inc., Tevva Motors Limited., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Electric Truck Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)