Global Electric Insulator Market Size Anticipated to Reach USD 21.3 Billion by 2033 - IMARC Group

Global Electric Insulator Market Statistics, Outlook and Regional Analysis 2025-2033

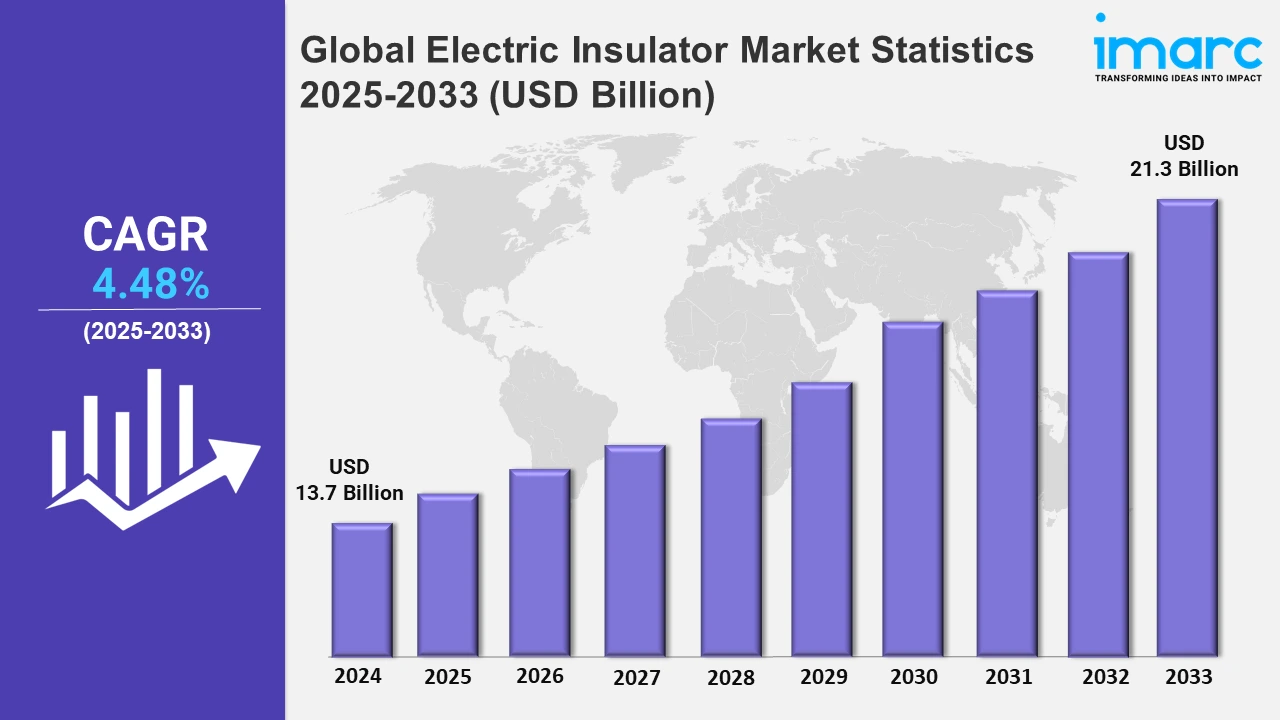

The global electric insulator market size was valued at USD 13.7 Billion in 2024, and it is expected to reach USD 21.3 Billion by 2033, exhibiting a growth rate (CAGR) of 4.48% from 2025 to 2033.

To get more information on this market, Request Sample

The market is driven by the increasing power generation and distribution needs and the push for energy efficiency and grid reliability. As the global electricity demand rises, especially in emerging economies, there is a significant expansion of power generation and distribution networks. For instance, in November 2024, six new countries, El Salvador, Kazakhstan, Kenya, Kosovo, Nigeria, and Turkey, signed a pledge to triple global nuclear generation capacity by 2050 at the UN's Climate Change Conference, COP29, in Baku, Azerbaijan. Industrial growth, urbanization, and an increase in renewable energy projects require robust electrical infrastructure, which directly boosts the demand for electric insulators. Similarly, in September 2024, state-operated hydroelectric power generation company SJVN announced that India is launching a tender for 6GW of electricity from renewable energy projects with storage to ensure supply during peak hours. Insulators are critical for safely managing high-voltage transmission and minimizing power losses. Investments in new transmission lines, as well as the upgrading of aging infrastructure in developed regions, further contribute to this growing demand.

The shift toward renewable energy sources like wind and solar has introduced variable power loads, which makes grid stability essential. For instance, in May 2024, The White House launched a Federal-State Modern Grid Deployment Initiative, with commitments from 21 states. The initiative aims to bring together states, federal entities, and power sector stakeholders to help drive grid adaptation quickly and cost-effectively. Participating states have committed to prioritize efforts that support the adoption of modern grid solutions to expand grid capacity and build modern grid capabilities on both new and existing transmission and distribution lines. Electric insulators play a crucial role in maintaining the integrity of the grid, protecting it from power surges, leakage, and environmental factors. Modern insulator technologies, including composite insulators, are increasingly popular due to their lightweight, durability, and resistance to weathering, which enhances the overall reliability of the grid. With a focus on sustainable energy and minimizing transmission losses, insulators are essential for achieving higher energy efficiency standards in power systems.

Global Electric Insulator Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of rapid industrialization, urbanization, the rising energy demand, and investments in renewable energy and grid infrastructure development.

North America Electric Insulator Market Trends:

In North America, the market is driven by infrastructure upgrades, aging power grids, and the transition to renewable energy sources. Increased investments in grid modernization, along with the demand for energy efficiency, reliability, and the adoption of advanced insulator technologies, further fuel market growth in the region.

Asia-Pacific Electric Insulator Market Trends:

In the Asia Pacific region, the electric insulator market is driven by rapid urbanization, industrial growth, increasing energy demand, and expanding power infrastructure. Additionally, investments in renewable energy projects and grid modernization initiatives contribute to heightened demand for reliable, durable insulator solutions. For instance, in August 2024, China's state planner launched details of a three-year plan to upgrade the power system as the country seeks to ramp up renewables and ease the strain of rising power demand on the national grid. The 2024-2027 plan launched by the National Reform and Development Commission aims to help China meet its goal of reaching a peak in carbon emissions before 2030 and includes guidance on the upgrading of transmission and distribution systems.

Europe Electric Insulator Market Trends:

In Europe, the market is driven by the growing demand for renewable energy, grid modernization, and the expansion of high-voltage transmission networks. Additionally, strict environmental regulations, the push for energy efficiency, and investments in smart grid technologies are further accelerating the demand for advanced insulator solutions in the region.

Latin America Electric Insulator Market Trends:

In Latin America, the market is driven by infrastructure development, increasing electricity demand, and the expansion of renewable energy projects. Investments in upgrading aging power grids, improving grid reliability, and the adoption of modern insulator technologies to enhance energy efficiency and reduce transmission losses also contribute to market growth.

Middle East and Africa Electric Insulator Market Trends:

In the Middle East and Africa, the market is driven by rapid urbanization, infrastructure development, and increasing demand for electricity. Investments in renewable energy projects, grid expansion, and modernization efforts, along with the need for reliable, durable insulator solutions in harsh climates, further fuel market growth in the region.

Top Companies Leading in the Electric Insulator Industry

Some of the leading electric insulator market companies include ABB, NGK Insulators Ltd, Aditya Birla Nuvo, Siemens AG, General Electric, Hubbell Incorporated, Bharat Heavy Electricals Limited, Toshiba, Krempel, MacLean-Fogg, PFISTERER, Seves Group, and WT Henley, among others.

In September 2024, Krempel announced the acquisition of all shares of Mexican EIC Insulation Company (EIC) as part of a share deal. The acquisition includes both the business of commercializing electrical insulation materials (EIC Insulation Company) and the further processing of these materials into customer-specific components and kits (ECC Conversion Center).

Global Electric Insulator Market Segmentation Coverage

- On the basis of the material, the market has been categorized into ceramic/porcelain, glass, composites, and others, wherein ceramic/porcelain represent the leading segment. Ceramic and porcelain insulators hold the largest share in the market due to their excellent dielectric properties, high mechanical strength, and resistance to harsh environmental conditions. They offer durability, reliability, and long service life, making them ideal for high-voltage applications in power transmission and distribution systems.

- Based on the voltage, the market is classified into low, medium, and high, amongst which low dominates the market. Low voltage insulators hold the largest share of the market due to their widespread use in residential, commercial, and industrial applications. They are essential for low-voltage power distribution networks, which are more prevalent and serve a larger customer base, driving consistent demand for cost-effective, reliable insulator solutions.

- On the basis of the category, the market has been divided into bushings and other insulators. Among these, bushings accounts for the majority of the market share. Bushings hold the largest share in the market due to their critical role in providing insulation and support for electrical conductors in transformers, switchgear, and other high-voltage equipment. Their ability to withstand high electrical stress, combined with their durability and versatility, makes them essential in power transmission and distribution systems.

- Based on the installation, the market is segregated into distribution networks, transmission lines, substations, railways, and others, amongst which distribution networks dominates the market. Distribution networks hold the largest share of the market due to their widespread presence in urban and rural power systems. These networks require insulators for reliable power delivery to homes and businesses. With ongoing infrastructure expansion and upgrades, the demand for insulators in distribution systems remains high and consistent.

- On the basis of the product, the market has been categorized into pin insulator, suspension insulator, shackle insulator, and others, wherein pin insulator, represent the leading segment. Pin insulators hold the largest share of the market due to their cost-effectiveness, simple design, and reliable performance in low to medium-voltage applications. They are widely used in power distribution systems, particularly in overhead lines, offering durability and ease of installation, which contributes to their widespread adoption.

- Based on the rating, the market is classified into <11 kV, 11 kV, 22 kV, 33 kV, 72.5 kV, 145 kV, and others, amongst which 22 kV dominates the market. 22 kV insulators hold the largest share in the electric insulator market due to their widespread use in medium voltage distribution networks. These insulators are crucial for power transmission across urban and rural areas, offering a balance of cost, reliability, and performance for various industrial, residential, and commercial applications.

- On the basis of the application, the market has been divided into transformer, cable, switchgear, busbar, surge protection devices, and others. Among these, cable accounts for the majority of the market share. Cable insulators hold the largest share in the market due to their critical role in preventing electrical leakage and ensuring safety in power cables. Used extensively in power distribution and transmission, they offer reliable insulation, protection from environmental factors, and support for high voltage, making them essential for grid infrastructure.

- Based on the end use industry, the market is segregated into utilities, industries, and others. Utilities are expected to drive the largest share of the market due to their need for reliable, high-performance insulators in power generation, transmission, and distribution networks. Industries require robust insulators to support their high-voltage electrical equipment and maintain grid stability, especially in the manufacturing, chemical, and energy sectors.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 13.7 Billion |

| Market Forecast in 2033 | USD 21.3 Billion |

| Market Growth Rate 2025-2033 | 4.48% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Materials Covered | Ceramic/Porcelain, Glass, Composites, Others |

| Voltages Covered | Low, Medium, High |

| Categories Covered | Bushings, Other Insulators |

| Installations Covered | Distribution Networks, Transmission Lines, Substations, Railways, Others |

| Products Covered | Pin Insulator, Suspension Insulator, Shackle Insulator, Others |

| Ratings Covered | <11 kV, 11 kV, 22 kV, 33 kV, 72.5 kV, 145 kV, Others |

| Applications Covered | Transformer, Cable, Switchgear, Busbar, Surge Protection Device, Others |

| End Use Industries Covered | Utilities, Industries, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | ABB, NGK Insulators Ltd, Aditya Birla Nuvo, Siemens AG, General Electric, Hubbell Incorporated, Bharat Heavy Electricals Limited, Toshiba, Krempel, MacLean-Fogg, PFISTERER, Seves Group, WT Henley, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Electric Insulator Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)