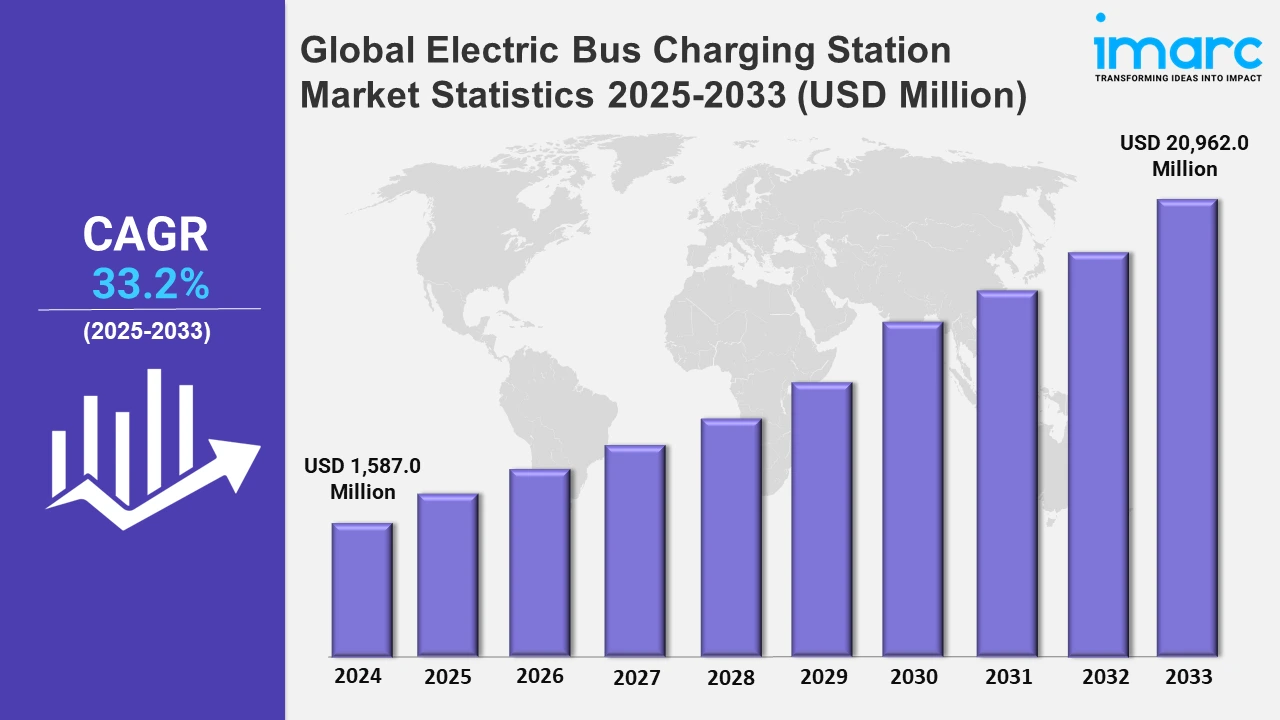

Global Electric Bus Charging Station Market Expected to Reach USD 20,962.0 Million by 2033 - IMARC Group

Global Electric Bus Charging Station Market Statistics, Outlook and Regional Analysis 2025-2033

The global electric bus charging station market size was valued at USD 1,587.0 Million in 2024, and it is expected to reach USD 20,962.0 Million by 2033, exhibiting a growth rate (CAGR) of 33.2% from 2025 to 2033.

To get more information on this market, Request Sample

The global electric bus charging station market is significantly influenced by technological advancements in charging infrastructure and stringent environmental regulations. Governments worldwide are implementing policies to curb greenhouse gas emissions and promote the adoption of electric vehicles (EVs), particularly in public transportation. According to research published by the U.S. Energy Information Administration, U.S. sales of electric and hybrid vehicles increased to 18.7% of total light-duty vehicle sales in the 2nd quarter of 2024, from 17.8% registered in the 1st quarter of 2024. Year-over-year, hybrid electric vehicle sales increased 30.7%, climbing from 8.6% of the LDV market in the 1st quarter of 2024 to 9.6% in the 2nd quarter of 2024. Plug-in hybrid electric vehicle sales increased from 1.7% to 2.0%, while battery electric vehicles (BEVs) remained stable at 7.1%, holding their 2nd quarter of 23 market share. With electric buses becoming the core of sustainable urban mobility, the demands for efficient and reliable charging stations have increased. The rapid innovation in fast-charging technologies, wireless charging systems, and integration with smart grids enhances operational efficiency in charging infrastructure. These technologies reduce charging time, optimize energy use, and make electric bus fleets more feasible. Therefore, this has a positive influence on the market. The increasing accessibility of subsidies and incentives to set up EV infrastructure is further propelling the market's growth while hastening a shift toward green transport. The trend of growing urbanization and resultant surge in urban transportation requirements are also fueling the market. As cities expand, the governments and municipalities are concentrating on sustainable mobility solutions for the reduction of congestion and air pollution which is aiding the market. Electric buses, together with strategic deployment of charging stations, represent a very practical way of addressing the problem. Growing public concern for the environment is also improving public acceptance of clean energy transportation programs. Moving to renewable energy sources for charging stations is further making the market converge towards the world's decarbonization goal. On 12th September 2024, Tata Power EV Charging Solutions, a subsidiary of Tata Power Renewable Energy, agreed to establish 200 fast-charging stations for electric commercial vehicles in metropolitan cities. The cities mentioned include Mumbai, Delhi, Chennai, Bengaluru, and Kolkata. These stations will cater to convenient charging for small electric commercial vehicles, enhancing sustainable mobility. Furthermore, investments in smart cities and smart transportation networks also contribute to market expansion, as integrated and digitalized charging systems become essential for seamless electric bus operations in densely populated urban areas.

Global Electric Bus Charging Station Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of its extensive adoption of electric buses, strong government support, and rapid urbanization.

Asia-Pacific Electric Bus Charging Station Market Trends:

Asia Pacific dominates the global electric bus charging station market due to its high adoption of electric buses, robust government initiatives, and expanding urbanization. Countries such as China and India are at the forefront, driven by their massive public transportation networks and efforts to combat air pollution. On 18th October 2024, EKA Mobility, a subsidiary of Pinnacle Mobility Solutions, India secured a contract to supply 250 electric buses to Nagpur Municipal Corporation (NMC) to improve eco-friendly public transport. The buses can carry 41 seated and 24 standing passengers. They will run on important city routes, saving the environment and money. The company will also offer maintenance services during the term of the contract. China, as the largest producer and consumer of electric buses, offers extensive charging infrastructure supported by substantial government funding and favorable policies. India is rapidly following suit, with ambitious plans to electrify its public transport system. Moreover, rising investments in smart city projects and renewable energy integration further strengthen the region’s market position. The presence of major manufacturers and the increasing affordability of EV technology strengthens Asia Pacific's leadership in this growing sector.

Europe Electric Bus Charging Station Market Trends:

Europe is one of the key regions in the electric bus charging station market, largely due to stringent emission norms and aggressive climate goals. Germany, France, and the Netherlands are at the forefront of this change toward sustainable urban mobility, through fleets of electric buses and advanced charging infrastructure. Funding for EV adoption under the European Union's Green Deal also propels market growth. Additionally, technological innovation in fast and wireless charging solutions enhances the region’s capabilities to meet increasing public transportation needs.

North America Electric Bus Charging Station Market Trends:

Increasing adoption of EVs in North America and supporting policies by the government are propelling the demand for electric bus charging stations. Heavy investment is being undertaken by both the United States and Canada to make their public transport emissions-free and lessen dependence on fossil fuels. Federal incentives, grants, and partnerships between private firms and municipalities are spurring the development of charging infrastructure. Increasing awareness of climate change and urban air quality issues is also driving the expansion of electric bus networks, especially in metropolitan areas.

Latin America Electric Bus Charging Station Market Trends:

The Latin America market for electric bus charging stations is growing due to rising urbanization and the effort to reduce severe air pollution. Electric buses are being adopted in countries such as Brazil, Chile, and Colombia, as part of sustainable public transport initiatives. Government incentives and partnerships with foreign agencies assist in the formation of charging infrastructure. Although the industry is still facing several challenges, high installation costs, high interest in integrating renewable energy resources, and sustainable mobility are fueling future regional growth.

Middle East and Africa Electric Bus Charging Station Market Trends:

The Middle East and Africa are emerging markets for electric bus charging stations driven mainly by urban expansion and an urgent need to diversify energy sources. Some of the countries include the United Arab Emirates and South Africa, which have adopted the use of electric buses with emission reduction and improved air quality in mind. This supports market growth, along with government-led renewable energy programs and partnerships with global EV infrastructure providers. Despite infrastructure development still being in its nascent stage, the sustainable urban transportation focus lays a strong framework for the future expansion of this region.

Top Companies Leading in the Electric Bus Charging Station Industry

Some of the leading electric bus charging station market companies include ABB Ltd., Ekoenergetyka - Polska S.A., Electreon Wireless Ltd., Furrer+Frey AG, Heliox Energy, JEMA Energy SA, and Siemens AG, among others. On 6th December 2024, Electreon Wireless Ltd. launched the world's first commercial wireless charging terminal for buses in Rosh HaAyin, Israel. The site applies stationary wireless charging to parked urban electric buses operated by Electra Afikim. This allows the buses to be charged at night and during the day as they are parked in bays in the public bus terminal.

Global Electric Bus Charging Station Market Segmentation Coverage

- On the basis of the type, the market has been categorized into depot charging, opportunity charging, and inductive charging, wherein depot charging represents the leading segment due to its operational efficiency and cost-effectiveness for large bus fleets. This charging type allows buses to recharge overnight or during non-operational hours at dedicated facilities, minimizing downtime and maximizing utilization. Its compatibility with high-power charging systems supports fast and efficient energy transfer, meeting the demands of growing public transportation networks. Depot charging’s scalability and ease of integration with renewable energy sources, such as solar or wind, further enhance its appeal, solidifying its position as the market's leading segment.

- Based on the charger, the market is classified into off-board and onboard, amongst which onboard dominates the market due to their versatility and efficiency in supporting vehicle mobility. Integrated directly within buses, these chargers eliminate dependency on external infrastructure, making them ideal for routes without established charging networks. Onboard systems provide flexibility, allowing buses to recharge during stops or at depots, enhancing operational reliability. Advances in compact and high-capacity charging technology are further promoting adoption, ensuring seamless energy replenishment while optimizing space. Their convenience and adaptability make onboard chargers the preferred choice for expanding electric bus fleets.

- On the basis of the power, the market has been divided into less than 50 kw, 50–150 kw, 151–450 kw, more than 450 kw. Among these, less than 50 kW accounts for the majority of the market share due to its suitability for overnight and depot charging applications. This power range offers a cost-effective solution for operators, reducing infrastructure expenses while providing sufficient energy for daily operations. It aligns well with buses operating on fixed routes, where extended charging time is feasible during off-peak hours. The segment's energy efficiency and lower grid load requirements make it a preferred choice for regions with limited electricity capacity, driving its widespread adoption in the market.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1,587.0 Million |

| Market Forecast in 2033 | USD 20,962.0 Million |

| Market Growth Rate 2025-2033 | 33.2% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Depot Charging, Opportunity Charging, Inductive Charging |

| Chargers Covered | Off-Board, Onboard |

| Powers Covered | Less than 50 Kw, 50–150 kW, 151–450 kW, More than 450 kW |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Ekoenergetyka - Polska S.A., Electreon Wireless Ltd., Furrer+Frey AG, Heliox Energy, JEMA Energy SA, Siemens AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)