Global Edible Packaging Market Expected to Reach USD 1670.2 Million by 2033 - IMARC Group

Global Edible Packaging Market Statistics, Outlook and Regional Analysis 2025-2033

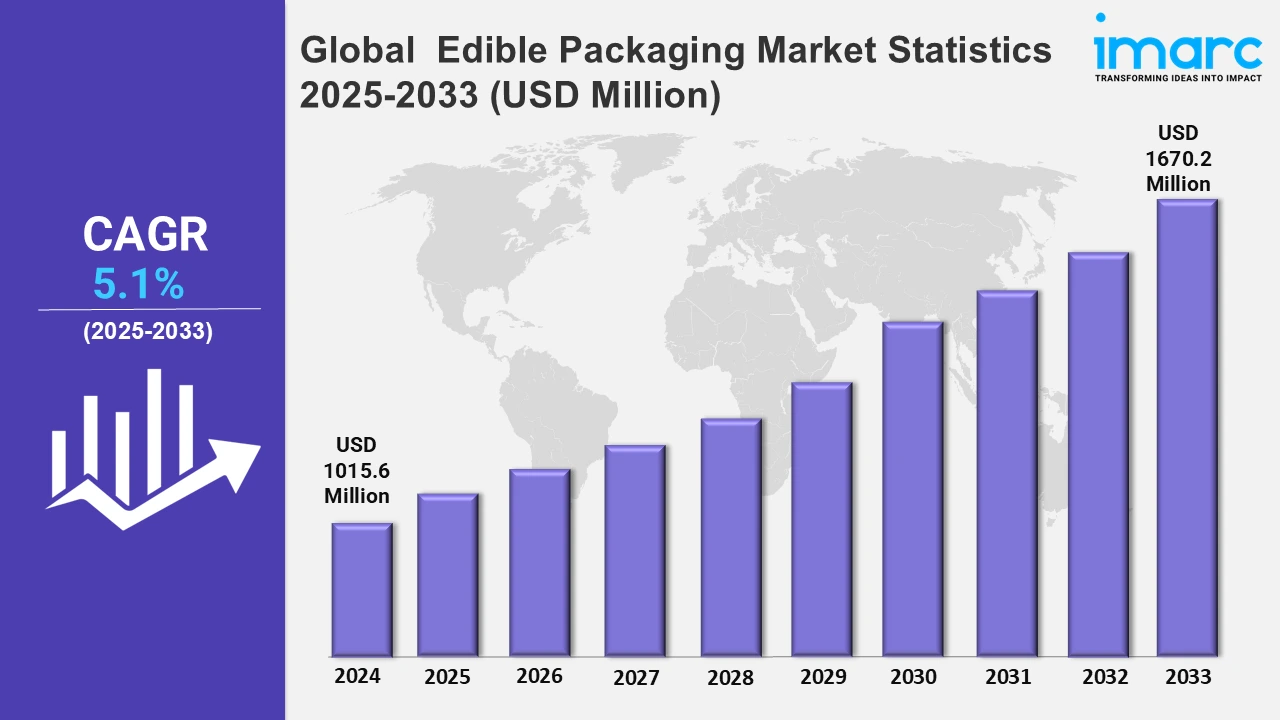

The global edible packaging market size was valued at USD 1015.6 Million in 2024, and it is expected to reach USD 1670.2 Million by 2033, exhibiting a growth rate (CAGR) of 5.1% from 2025 to 2033.

To get more information on this market,Request Sample

The growing adoption of sustainability and eco-friendly practices is stimulating innovation in the packaging industry. Also, increasing awareness about the environmental impact of traditional plastic packaging and strict regulatory measures are prompting businesses to seek sustainable solutions. Furthermore, these advancements include edible and biodegradable packaging options, as companies aim to reduce their carbon footprints and appeal to environmentally conscious consumers. For instance, in September 2023, Xampla, a startup from the University of Cambridge, introduced its consumer brand, Morro, showcasing bio-based and edible packaging as a practical alternative to plastic. This milestone, resulting from 15 years of research, positions Morro as a pioneer in the packaging industry. Supermarket products marked with the Morro brand assure customers that these items use bio-based materials, highlighting the industry’s shift toward natural, biodegradable packaging solutions. Also, major players in the food industry are incorporating eco-friendly practices. For instance, in June 2024, Nestlé launched a limited-edition plant-based edible fork for its Maggi cup noodles in India. This edible fork was developed using wheat flour and salt, which is a collaborative effort with a local startup and demonstrated Nestlé’s commitment to reducing plastic usage and investing in sustainable alternatives. These steps from established corporations signal a larger trend where traditional packaging practices are being reevaluated to prioritize sustainability.

Moreover, region-specific growth continues to underscore these trends, with companies leveraging unique technologies to advance edible packaging solutions. For example, in November 2023, U.S.-based Foodberry introduced innovative edible coatings named "Foodberries," inspired by the protective qualities of fruit peels. These plant-based coatings provide a nutrient-rich barrier and serve as a sustainable, plastic-free alternative. Therefore, such biomimicry-driven innovation supports extended food shelf life and sustainable snacking, underscoring the progress in edible packaging and highlighting its future growth potential in the U.S. and beyond.

Global Edible Packaging Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America dominates the edible packaging market due to a strong emphasis on sustainability and innovation.

North America Edible Packaging Market Trends:

North America is the dominating region in the market due to its progressive regulatory landscape and consumer demand for eco-friendly alternatives, which has driven companies to adopt biodegradable and edible packaging solutions. For instance, in January 2024, Wyld, a prominent player in the North American edibles market, declared a new alliance with TIPA, a leader in biodegradable packaging solutions. The partnership aims to solve the environmental problems associated with single-use, non-recyclable flexible plastics and bring sustainable, alternative-plastic packaging to the North America edible packaging market.

Europe Edible Packaging Market Trends:

In Europe, the edible packaging market is driven by strict environmental regulations. On the contrary, companies in France and Germany are leading with plant-based and biodegradable packaging innovations. For instance, Xampla’s Morro brand from the UK emphasizes bio-based materials, highlighting the region’s dedication to reducing plastic waste and promoting eco-friendly alternatives that align with stringent EU sustainability goals.

Asia Pacific Edible Packaging Market Trends:

The Asia Pacific region is experiencing rapid growth in edible packaging due to government initiatives. In India, Nestlé’s plant-based edible fork for Maggi noodles showcases how local startups and multinational companies collaborate for innovative solutions. The increasing focus on eco-conscious products and reducing plastic reliance further strengthens the market's development across countries like Japan and China.

Latin America Edible Packaging Market Trends:

In Latin America, the edible packaging market is fueled by eco-friendly consumer habits. Brazil leads with startups focusing on biodegradable and compostable packaging derived from natural resources. Initiatives like these are aimed at addressing waste management issues while meeting growing consumer demand for sustainable alternatives, thereby fostering growth in the regional market for eco-conscious packaging solutions.

Middle East and Africa Edible Packaging Market Trends:

The Middle East and Africa is seeing emerging trends in edible packaging market driven by a need for sustainable practices amidst limited recycling infrastructure. South Africa is notable for pioneering projects that focus on biodegradable packaging made from locally sourced agricultural byproducts. This region's market growth reflects an effort to integrate eco-friendly solutions into food packaging, enhancing sustainability efforts despite logistical challenges.

Top Companies Leading in the Edible Packaging Industry

Some of the leading edible packaging market companies include Devro plc, Glanbia plc, Ingredion Incorporated, JRF Technology LLC, MonoSol LLC (Kuraray Co. Ltd.), Nagase & Co. Ltd., Notpla Limited, Safetraces Inc., Tate & Lyle Plc, and TIPA Corp Ltd., among many others. In December 2023, Nelson Mullins represented Ecopol S.p.A., an innovator in biodegradable films and delivery systems, in securing a strategic investment with JRF Technology LLC, a leader in water-soluble polymer and edible film technologies. This partnership will establish JRF as Ecopol’s U.S. R&D Center of Excellence, enhancing its existing research and development operations in Italy.

Global Edible Packaging Market Segmentation Coverage

- On the basis of the material type, the market has been bifurcated into lipids, polysaccharides, proteins, surfactants, and others, wherein lipids represent the most preferred segment. Lipids are known for their barrier qualities that efficiently stop tastes, carbon dioxide, and oxygen from migrating, which is essential for preserving product integrity and extending shelf life.

- Based on the source, the market is categorized into plant and animal, amongst which plant dominates the market. The versatility of plant materials allows for numerous applications in packaging everything from fresh produce to ready-to-eat (RTE) meals. As consumers seek eco-friendly products, the demand for plant-based packaging solutions continues to influence market growth.

- On the basis of the end user, the market has been divided into food and beverages, pharmaceuticals, and others. Among these, food and beverages exhibit a clear dominance in the market. The food and beverages sector are primarily driven by the growing consumer demand for sustainable and innovative packaging solutions within the food industry.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1,015.6 Million |

| Market Forecast in 2033 | USD 1,670.2 Million |

| Market Growth Rate (2025-2033) | 5.1% |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered |

Lipids, Polysaccharides, Proteins, Surfactants, Others

|

| Sources Covered | Plant, Animal |

| End Users Covered | Food and Beverages, Pharmaceuticals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Devro plc, Glanbia plc, Ingredion Incorporated, JRF Technology LLC, MonoSol LLC (Kuraray Co. Ltd.), Nagase & Co. Ltd., Notpla Limited, Safetraces Inc., Tate & Lyle Plc, TIPA Corp Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)