Global E-Commerce Logistics Market Expected to Reach USD 1,489.2 Billion by 2033 - IMARC Group

Global E-Commerce Logistics Market Statistics, Outlook and Regional Analysis 2025-2033

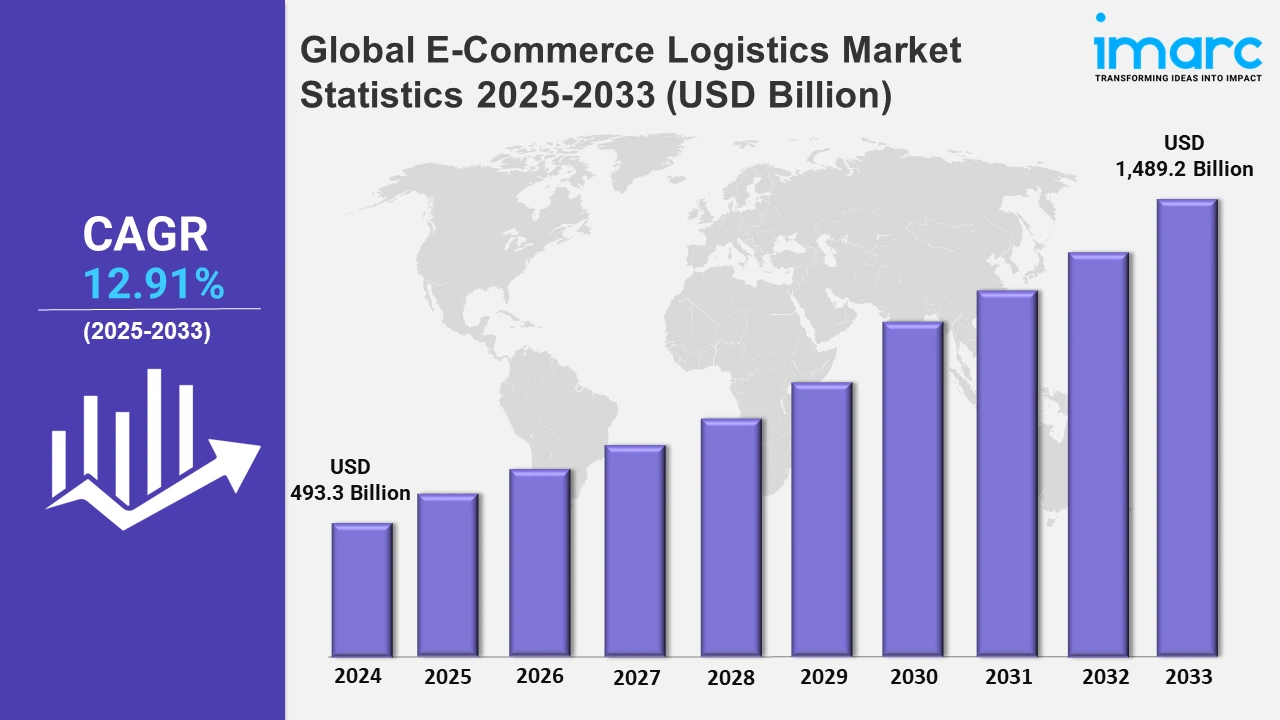

The global e-commerce logistics market size was valued at USD 493.3 Billion in 2024, and it is expected to reach USD 1,489.2 Billion by 2033, exhibiting a growth rate (CAGR) of 12.91% from 2025 to 2033.

To get more information on the this market, Request Sample

The exponential growth of online shopping is propelling the global e-commerce logistics market. Consumers' preference for the convenience of shopping from home has surged due to improved internet access and smartphone penetration worldwide. As per Datareportal, there are 5.35 billion people with internet access in 2024, which is 66.2% of the world’s total population. E-commerce platforms are diversifying their product offerings, extending to groceries, pharmaceuticals, and large-scale appliances. This broader product range requires efficient logistics solutions to handle different types of deliveries, from small packages to larger items requiring special handling. Logistics providers are enhancing their services to cater to these demands, implementing innovations like automated warehouses and AI-driven route optimization. The increasing volume of orders and expectations for faster delivery have pushed logistics companies to expand their infrastructure and invest in technology, reinforcing the market's growth trajectory.

The growth in cross-border e-commerce is also a notable driver of the global e-commerce logistics market. Consumers are increasingly purchasing products from international online retailers, facilitated by improved payment gateways, translation services, and global shipping options. This trend has compelled logistics providers to develop robust international shipping networks and partnerships to manage customs clearance, taxes, and different regulatory frameworks. Companies are investing in technologies that streamline cross-border supply chains and ensure compliance with various regional requirements. The growing emphasis on efficient and transparent customs procedures, coupled with improved tracking solutions, enhances the customer experience and boosts trust in international transactions, thus driving the overall logistics market growth.

Global E-Commerce Logistics Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of robust technological advances, rapid urbanization and rising disposable income.

Asia Pacific E-Commerce Logistics Market Trends:

Asia Pacific's e-commerce logistics market is propelled by a booming online retail sector, driven by increasing internet penetration and smartphone usage. Countries like China, India, and Southeast Asian nations witness high demand for diverse goods, supporting the rapid expansion of logistics infrastructure. As per the State Council and the People’s Republic of China, China's e-commerce business expanded rapidly in the first half of 2024, boosting momentum for consumption recovery in the world's second-largest economy. Online retail sales increased 9.8% year on year to 7.1 Trillion Yuan (approximately 996 Billion US Dollars), with retail sales of commodities reaching 5.96 Trillion Yuan, an 8.8% gain, according to figures provided by the Ministry of Commerce (MOC). Local and international logistics providers are enhancing capabilities to meet the fast-paced growth, including investments in warehouse automation and advanced delivery solutions. The rise of cross-border e-commerce within the region further boosts logistics services. Additionally, government initiatives to improve digital infrastructure and promote seamless cross-border trade contribute to the thriving logistics landscape.

North America E-Commerce Logistics Market Trends:

The e-commerce logistics market in North America is driven by robust digital infrastructure and a tech-savvy population. High consumer expectations for fast, reliable delivery services have pushed logistics companies to innovate with advanced technologies like automation, robotics, and AI-driven route optimization. Additionally, the proliferation of omnichannel retail strategies has amplified demand for integrated logistics solutions. Major e-commerce giants are investing heavily in expanding their distribution networks and enhancing last-mile delivery capabilities.

Europe E-Commerce Logistics Market Trends:

Europe's e-commerce logistics market benefits from a well-established transportation network and the adoption of advanced logistics technologies. The region's emphasis on sustainability has also led logistics providers to integrate eco-friendly solutions such as electric delivery vehicles and optimized routes to reduce carbon footprints. Cross-border e-commerce within the EU is facilitated by uniform regulations, streamlining logistics operations. The high demand for omnichannel retail and personalized delivery options encourages investments in automation and AI to improve efficiency.

Latin America E-Commerce Logistics Market Trends:

In Latin America, the e-commerce logistics market is driven by an expanding online retail landscape and growing internet penetration. Countries like Brazil and Mexico are leading the surge in digital adoption, creating demand for more efficient logistics solutions. Challenges such as fragmented infrastructure and diverse geographic conditions are being addressed through strategic investments and partnerships among logistics providers. Additionally, initiatives to simplify customs and regulatory processes enhance cross-border trade.

Middle East and Africa E-Commerce Logistics Market Trends:

The Middle East and Africa's e-commerce logistics market is expanding due to a rising number of online shoppers and improving digital connectivity. E-commerce growth is supported by increasing urbanization and younger demographics who are more inclined towards online shopping. Logistics companies are investing in modern infrastructure to address challenges related to vast geographical distances and varied terrain.

Top Companies Leading in the E-Commerce Logistics Industry

Some of the leading e-commerce logistics market companies include Agility, AllcargoGATI, Aramex, CEVA Logistics, DHL eCommerce, FedEx, Kenco Group, Kuehne+Nagel, Rhenus Group, and United Parcel Service of America, Inc, among many others.

- In March 2024, Kuehne+Nagel entered into an agreement to acquire City Zone Express, which is a subsidiary of Chasen Holdings Ltd., a Singapore Exchange Mainboard-listed company. City Zone Express when combined with Kuehne+Nagel’s own network, logistics expertise, and its eTrucknow visibility platform, consumers from expanding local industries like e-commerce and high-tech will benefit from a highly dependable extended offering.

Global E-Commerce Logistics Market Segmentation Coverage

- On the basis of the product, the market has been categorized into baby products, personal care products, books, home furnishing products, apparel products, electronics products, automotive products, and others, wherein apparel products represent the leading segment. Apparel products have a strong hold in the e-commerce logistics market as the growth of online fashion retail is booming. This category has multiple items like clothing, footwear, and accessories and it appeals to a vast number of consumers across different tastes and preferences. Fast fashion-trendy and cheap, speedy dress escalates the demand for latest styles and boosts social media trends that define purchasing behavior. Advanced logistics technologies such as automated warehouses and AI-based inventory management support effective supply chain management through quick restocking and adaptation to the fast-changing requirements of the fashion industry.

- Based on the service type, the market is classified into transportation and warehousing, amongst which transportation dominates the market. Transportation holds the largest share in the e-commerce logistics market as it caters to efficient fast online retailing. It contains a variety of important activities including transport from suppliers to customers, and the first and last mile, and expedited shipping services. With more orders coming with increased volumes and frequencies, logistics operators are upgrading and expanding their transport capacities. Companies are investing heavily in high-grade technologies like route optimization software, lowering delivery times and, electric vehicles and drones that are more efficient and environmentally friendly to align with the eco-friendly goals of sustainability and market requirements.

- On the basis of the operational area, the market has been divided into international and domestic. Among these, domestic accounts for the majority of the market share. Domestic logistics ensures the transportation and distribution of goods inside one country to fulfill the demand of consumers in that country. The rise in local e-commerce is fueled by the ease and convenience online shopping has provided, the ever-growing home-grown online platforms, and the rise of DTC brands that avoid the conventional structures of traditional channels. To keep up with ever-growing expectations for same-day or next-day delivery, domestic logistics providers are turning to network improvements and operational changes.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 493.3 Billion |

| Market Forecast in 2033 | USD 1,489.2 Billion |

| Market Growth Rate 2025-2033 | 12.91% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Baby Products, Personal Care Products, Books, Home Furnishing Products, Apparel Products, Electronics Products, Automotive Products, Others |

| Service Types Covered | Transportation, Warehousing |

| Operational Areas Covered | International, Domestic |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Agility, AllcargoGATI, Aramex, CEVA Logistics, DHL eCommerce, FedEx, Kenco Group, Kuehne+Nagel, Rhenus Group, United Parcel Service of America, Inc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on E-Commerce Logistics Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)