Global E. Coli Testing Market to Grow at 6.4% During 2025-2033, Reaching USD 4.0 Billion by 2033 – IMARC Group

Global E. Coli Testing Market Statistics, Outlook and Regional Analysis 2025-2033

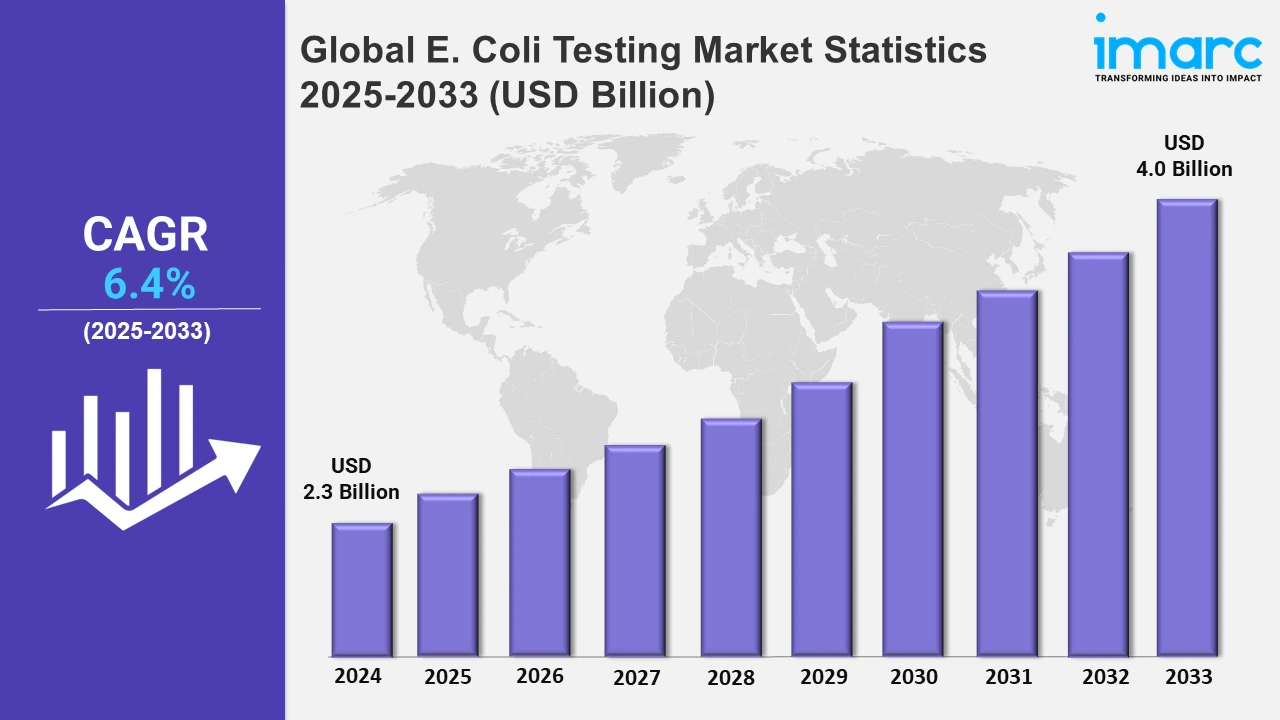

The global E. coli testing market size was valued at USD 2.3 Billion in 2024, and it is expected to reach USD 4.0 Billion by 2033, exhibiting a growth rate (CAGR) of 6.4% from 2025 to 2033.

To get more information on this market, Request Sample

Advancements in technology and heightened awareness regarding food and water safety are driving the market growth. Testing methods using rapid testing technologies such as Polymerase Chain Reaction (PCR) or enzyme immunoassay (EIA) are rapidly becoming popular because of speed, accuracy, and even detection of trace-level contamination. Automating laboratory processes creates a substantial impact on throughput testing for various industries like food and beverage, water treatment, and healthcare.

The increased focus on environmental sustainability and public health is boosting the demand for E. coli testing across different sectors. Industries are stepping up detection and prevention efforts against contamination of water sources in line with international initiatives to reduce water scarcity and provide access to safe drinking water. Emerging economies play a critical role in boosting the E. coli testing market demand. Developing regions continue advancing their healthcare and diagnostic structures to facilitate the control of the rising cases of waterborne and foodborne diseases. Unlike the developing world, North America and Europe have stricter regulatory mandates on food and water quality, compelling industries, especially the food and beverages sector, to adopt advanced testing solutions toward compliance. Other emerging trends include rapid growth in point-of-care testing, which includes portable and fast diagnostics solutions.

Global E. Coli Testing Market Statistics, By Region

The market research report provides a comprehensive analysis of all the major regions, including North America (the United States and Canada), Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others), Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others), Latin America (Brazil, Mexico, and others), and the Middle East and Africa. North America is reported to hold a major portion of the revenue share in the market. Stringent regulatory standards, advanced healthcare infrastructure, and growing investments in food and water safety measures are driving the market growth in the region.

North America E. Coli Testing Market Trends:

North America is the front-runner in the E. coli testing market owing to stringent regulatory frameworks and advanced healthcare infrastructure. Several areas in North America emphasize compliance in food and water safety and thus create a niche for innovative testing technologies, including PCR and enzyme-based assays. Another factor for the increasing demand for health diagnostic tests is high incidences of foodborne illnesses. Additionally, a well-established diagnostic laboratory system is driving the market demand.

Asia Pacific E. Coli Testing Market Trends:

Increasing cases of waterborne diseases and growth in awareness of food and water safety concerns are driving the Asia Pacific market growth. Furthermore, the number of people afflicted with waterborne diseases is on the rise. Urbanization, industrialization, and increased investments in the healthcare infrastructure propel demand for testing solutions in countries such as China and India. Another emerging trend in the region is point-of-care testing adoption.

Europe E. Coli Testing Market Trends:

Strong regulations regarding food safety and environmental monitoring are driving the European market. Countries like Germany, the UK, and France, with their cutting-edge diagnostic capabilities and greater reliance on compliance with safety standards, emerge at the forefront. The region is further experiencing increased adoption of rapid testing technologies within both clinical and environmental sector applications.

Latin America E. Coli Testing Market Trends:

Latin America is rapidly growing due to prevention efforts against food and waterborne diseases. Countries like Brazil and Mexico are currently developing infrastructure and employing innovative testing to ensure the public health of their citizens. This improvement is further propelled by government efforts at improving water quality and food safety standards within the countries.

Middle East and Africa E. Coli Testing Market Trends:

In the Middle East and Africa, E. coli testing market is growing modestly due to the growing awareness of diseases caused by water. However, limited healthcare infrastructure and funding are among the obstacles to be addressed for outbreak prevention in urban areas. Demand in such areas is further fueled by portable and point-of-care solutions.

Top Companies Leading in the E. Coli Testing Industry

Some of the key companies in the global E. coli testing market include Accugen Laboratories Inc., Alere Inc. (Abbott Laboratories), BD (Becton Dickinson and Company), bioMérieux (INSTITUT MERIEUX), Bio-RAD Laboratories Inc., Enzo Life Sciences Inc. (Enzo Biochem Inc.), Idexx Laboratories Inc., Johnson & Johnson, Meridian Bioscience Inc., Nanologix Inc., Pro-Lab Diagnostics, Qiagen N.V. and Thermo Fisher Scientific Inc. Leading players in the market are engaging in strategic partnerships and product innovation to enhance their offerings and expand their market presence. For instance, in November 2024, McMaster researchers announced the development of a biogel test that detects E. coli bacteria in liquids including lake water, urine, and milk, with the help of bacteriophages. The test provides quick and precise results within hours. Such developments are transforming the medical diagnostics and food safety sectors.

Global E. Coli Testing Market Segmentation Coverage

- On the basis of product, the market has been segregated into consumables and instruments . The consumables segment holds the largest market share owing to frequent usage and a high rate of replacement.

- Based on test type, the market has been categorized into environmental test (Membrane Filtration (MF), Multiple Tube Fermentation (MTF), and enzyme substrate methods) and clinical test (Polymerase Chain Reaction (PCR) Tests, Enzyme Immunoassays (EIA), and others). Environmental test (enzyme substrate methods) represents the largest market segment. Factors driving this growth include ease of use and reliability offered by these tests.

- On the basis of end user, the market has been classified into hospitals and clinics, diagnostic laboratories, and others. The diagnostic laboratories segment holds the largest market share owing to advanced testing capabilities.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 2.3 Billion |

| Market Forecast in 2033 | USD 4.0 Billion |

| Market Growth Rate 2025-2033 | 6.4% |

| Units | Billion USD |

| Segment Coverage | Product, Test Type, End User, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accugen Laboratories Inc., Alere Inc. (Abbott Laboratories), BD (Becton Dickinson and Company), bioMérieux (INSTITUT MERIEUX), Bio-RAD Laboratories Inc., Enzo Life Sciences Inc. (Enzo Biochem Inc.), Idexx Laboratories Inc., Johnson & Johnson, Meridian Bioscience Inc., Nanologix Inc., Pro-Lab Diagnostics, Qiagen N.V. and Thermo Fisher Scientific Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)