Global Dosing Pump Market Expected to Reach USD 11.8 Billion by 2033 - IMARC Group

Global Dosing Pump Market Statistics, Outlook and Regional Analysis 2025-2033

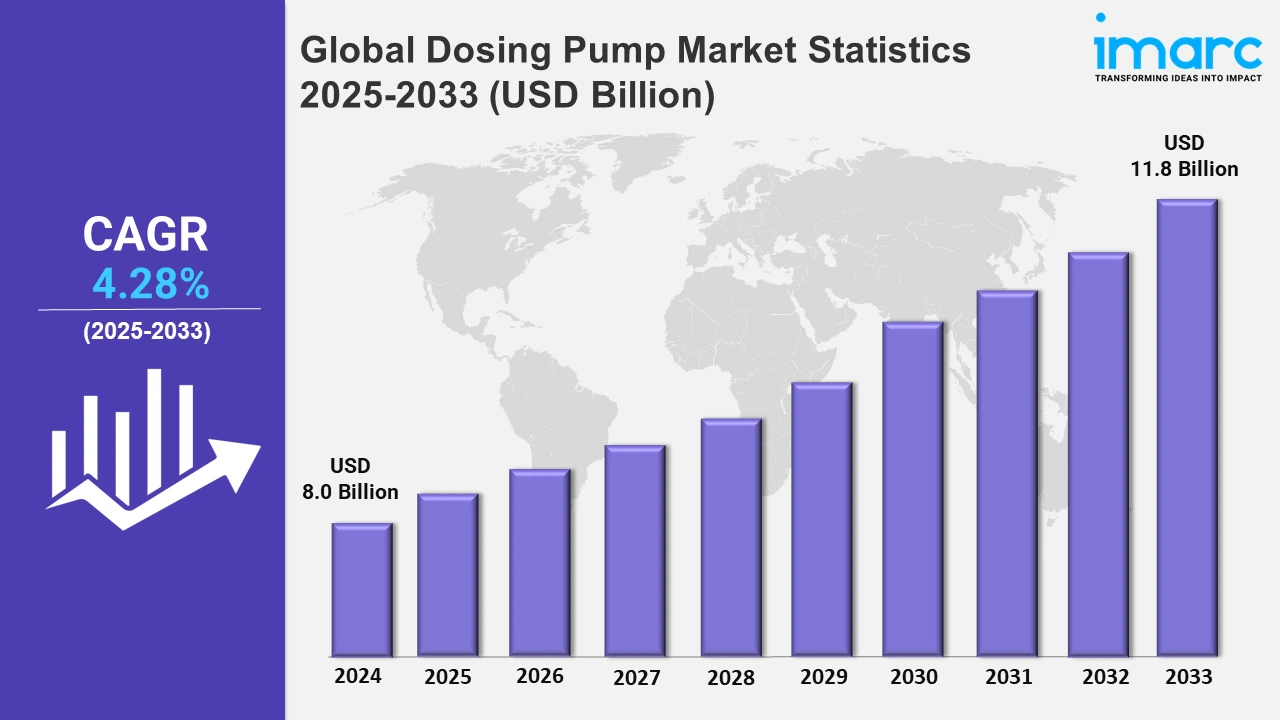

The global dosing pump market size was valued at USD 8.0 Billion in 2024, and it is expected to reach USD 11.8 Billion by 2033, exhibiting a growth rate (CAGR) of 4.28% from 2025 to 2033.

To get more information on this market, Request Sample

Water purification is one of dosing pumps' most common applications. Municipalities and industries are concentrating increasingly on cutting-edge water treatment technology as the world continues to deal with growing water scarcity and pollution problems. Currently, more than 3.6 billion people suffer from water scarcity globally, and that figure is expected to rise above 5 billion by 2050. In this regard, dosing pumps are required in order for the water to be dosed with the right chemicals, such as chlorine or coagulants, in the right quantities. Furthermore, several sectors are promoting water treatment practices due to increased environmental regulations and expanding clean water concerns. It is believed that three billion people would lack properly managed sanitation by 2030, and two billion people will still lack securely managed drinking water. Dosing pumps are therefore becoming necessary and as a result major expenditures are being made in water treatment facilities by both the public and commercial sectors.

The chemical, pharmaceutical, and oil & gas industries' growth are causing a major impact in the market. These industries need to include precise catalysts, additives, or other chemicals into their processes at the appropriate times. Dosing pumps assist in accomplishing this since they provide regulated amounts of substances into reactors, pipelines, or tanks that helps ensure the quality and efficiency of processes. Thus, the expansion of these industries leads to an increased use of these pumps. For instance, the adoption rates of these pumps grew as a result of the oil and gas industry's investment in infrastructure that jumped by over 53% between 2021 and 2024, while net profit scaled by nearly 16% during the same period. In order to produce medications and vaccines, which require precisely manufactured active components, the pharmaceutical sector also depends on dosing pumps for the right dosage. According to recent data, the world's pharmaceutical consumption increased by 14% between the years 2020 and 2024 and is set to rise by another 12% through 2028, reaching 3.8 trillion specified daily doses annually. As businesses grow and aim for better automation, efficiency, and quality control, there is an increasing need for dependable dosing solutions.

Global Dosing Pump Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific had the largest market share due to growing industrialization and urbanization, as well as major expenditures in water treatment and infrastructure.

Asia-Pacific Dosing Pump Market Trends:

Asia Pacific dominates the dosing pump market, which is expanding fast as a result of rapid urbanization, population hike, and industrial growth. With a sharp rise in chemical production, industrial manufacturing, and water and wastewater treatment projects, nations like China, India, Japan, and South Korea are causing this expansion. For example, with a market value of over $11 billion, India's water and wastewater treatment industry ranks sixth globally. Additionally, by the year 2026, this industry is expected to be valued at over $18 billion. Furthermore, the need for dosing pumps is also driven by the region's expanding industrial sectors, especially in the areas of chemicals, pharmaceuticals, food and beverage (F&B), and oil and gas.

North America Dosing Pump Market Trends:

Dosing pump demand is highest in the US and Canada, making North America a mature market. Strict health and safety regulations, industrial automation, and environmental sustainability are all factors that significantly influence the growth of the dosing pump market in the area. Water treatment, oil and gas, chemical processing, and food and beverage (F&B) production are among the few of the many industrial uses in the United States which require precise and dependable dosing systems.

Europe Dosing Pump Market Trends:

With robust demand from a range of industrial applications, including water treatment, chemical processing, and pharmaceuticals, Europe is another important region in the dosing pump market. The primary driver of dosing pump adoption in this region is the strict water and wastewater treatment standards enforced by the European Union (EU). Furthermore, due to their significant investments in wastewater treatment and clean water technology, nations like Germany, France, the UK, and Italy are also driving the need for accurate dosing systems.

Latin America Dosing Pump Market Trends:

Due to increased urbanization, dosing pumps are becoming more necessary throughout the Latin American region, especially in Brazil, Mexico, and Argentina. Growth in the industrial sector related to food and beverage, chemicals, and pharmaceutical industries have also caused an increased demand for dosing pumps in this region. Additionally, population growth coupled with hiked industrial activity is contributing to the wastewater management and water treatment solutions' need in Latin America.

Middle East and Africa Dosing Pump Market Trends:

In the dosing pump market, the Middle East and Africa (MEA) region accounts for a small but continuously expanding portion. Because of the region's limited freshwater supplies and growing population, nations including Saudi Arabia, the United Arab Emirates, South Africa, and Egypt are concentrating on enhancing their water and wastewater treatment systems. Dosing pumps are primarily driven by the region's strong reliance on desalination technology as well as the expanding industrial base in industries like food processing, chemicals, and oil and gas.

Top Companies Leading in the Dosing Pump Industry

Some of the leading dosing pump market companies include Aqua Industrial Group, Blue-White Industries Ltd, Diener Precision Pumps, Emec S.r.l., Etatron D.S. Spa, Grundfos Holding A/S, KNAUER Wissenschaftliche Geräte GmbH, Longer Precision Pump Co. Ltd. (The Halma Group), NETZSCH Pumps & Systems, Nikkiso Co Ltd, ProMinent Group, SEKO S.p.A., SPX Flow, and Verder Liquid B.V., among many others.

In November 2024, NETZSCH Pumps & Systems is expanding its product portfolio by adding PERIPRO tube pump has been added to their lineup of products. This peristaltic pump is used for demanding dosing operations and gives a strong yet affordable solution for a broad range of industrial operations. Its high performance construction combined with its sturdy design makes this pump ideal for applications which require dependable and long-time operation. It is believed to provide accurate dosage and little upkeep, and it is hermetically sealed.

Global Dosing Pump Market Segmentation Coverage

- On the basis of the type, the market has been categorized into diaphragm pump, peristaltic pump, solenoid pump, plunger pump, hydraulic pump, and others, wherein diaphragm pump represent the leading segment. Because of their accurate dose and remarkable chemical resistance, these pumps are suitable for chemical and water treatment uses. Additionally, they are known to give excellent dosing precision while working with viscous fluids and slurries.

- Based on the flow rate, the market is classified into upto 50 (L/min), 51 to 100 (L/min), and more than 100 (L/min), amongst which upto 50 (L/min) dominates the market. Water treatment, F&B processing, and chemical processing are just a few of the industries that benefit from flow rates of upto 50 L/min. These pumps are versatile for small to medium-sized businesses that require precise dosing at a regulated flow rate.

- On the basis of the end user, the market has been divided into oil and gas, water and wastewater, pharmaceuticals, chemicals, and others. Water and wastewater make up the largest portion of the market among them. This industry's dominance arises from the vast global need for clean water and effective solutions for wastewater treatment. Moreover, since it includes dosing specific chemicals for the disinfection, water purification, and treatment of industrial effluents, the industry is said to be the largest user of dosing pumps.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 8.0 Billion |

| Market Forecast in 2033 | USD 11.8 Billion |

| Market Growth Rate 2025-2033 | 4.28% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Diaphragm Pump, Peristaltic Pump, Solenoid Pump, Plunger Pump, Hydraulic Pump, Others |

| Flow Rates Covered | Upto 50 (L/Min), 51 To 100 (L/Min), More Than 100 (L/Min) |

| End Users Covered | Oil and Gas, Water and Wastewater, Pharmaceuticals, Chemicals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aqua Industrial Group, Blue-White Industries Ltd, Diener Precision Pumps, Emec S.r.l., Etatron D.S. Spa, Grundfos Holding A/S, KNAUER Wissenschaftliche Geräte GmbH, Longer Precision Pump Co. Ltd. (The Halma Group), NETZSCH Pumps & Systems, Nikkiso Co Ltd, ProMinent Group, SEKO S.p.A., SPX Flow, Verder Liquid B.V., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)